Towards building World Class Competencies 2. Supply Chain

advertisement

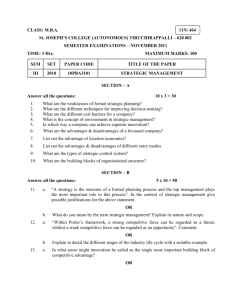

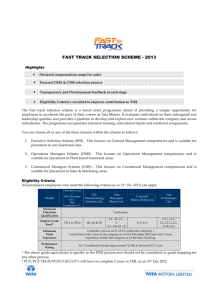

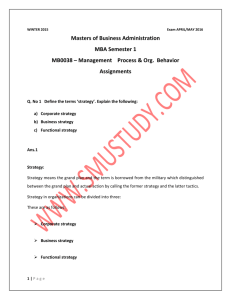

Building World Class Competence TATA Motors 21 April 2006 Contents 1. Overview 2. Building World Class Competence 3. Results TATA Motors India’s largest Automobile company • 2nd largest company in Private sector • Globally ranked as:•2nd largest Bus manufacturer •5th largest Bus & Truck manufacturer Strong Domestic Position • Market leader in Commercial Vehicles in domestic market with ~60% MS • 2nd largest player in Passenger Cars in domestic market with 16.5% MS Robust Financial performance • Sales 400,000 vehicles • Revenues USD 4.7 Bn • Profit (Post Tax) USD 0.3 Bn • Largest Indian Exporter of Automobiles • Largest portfolio of products by an Auto major:•Mini, Light & Heavy Trucks • Nation wide Sales, Service, Spare parts and Auto financing network with over 1,200 customer touch points •Range of Buses & Coaches •Passenger Cars & Utility Vehicles • Indigenously developed & India’s 1st •Light Commercial Vehicle (1986) •Sports Utility Vehicle (1998) •Passenger Car (1998) •Mini Truck – ACE (2005) • Largest R&D network in India with offshore centers in :•Korea (Gunsan) •Spain (Zaragoza) •UK (Midlands) • 1st Engineering company to be listed on NYSE (2004) (All figures are for FY 04-05) Evolution of TATA Motors: challenges Liberalization brings greater opportunity & Economy opening Liberalization USD Entry of MNC players Bn Developed suppliers 4.7 Product complexity 19400 Protected Economy Protected environment Less developed supplier base Limited domestic competition Collaboration with Daimler Benz 1st vehicle rolled out within 6 months of contract (1954) Stage 1 Vertical Integration Focused Vendor Dev Very little outsourcing Increase inOutsourcing Outsourcing Stage 2 Stage 3 Stage 4 14400 Stage 5 USD 2.3Bn L O C O M O T I V E S 9400 USD 0.7Bn USD 35.9Mn 4400 USD 0.05Bn USD 0.2Bn 0.3 PBT (Rs Cr) Turnover (Rs Cr) '03-04 04-05 '01-02 99-00 97-98 95-96 93-94 91-92 89-90 87-88 85-86 83-84 81-82 79-80 77-78 75-76 73-74 71-72 69-70 67-68 65-66 63-64 61-62 59-60 57-58 USD 1.8Mn 55-56 45-50 New Strategy Cyclical impact Self Reliance -600 -0.1 Cyclic nature of Commercial Vehicle Industry required de-risking of Company’s business model Domestic CV Industry Sales 350 CAGR: 6% 250 200 150 100 50 0 70 -7 1 72 -7 3 74 -7 5 76 -7 7 78 -7 9 80 -8 1 82 -8 3 84 -8 5 86 -8 7 88 -8 9 90 -9 1 92 -9 3 94 -9 5 96 19 -97 98 -9 9 00 -0 1 02 -0 3 04 -0 5 Nos in '000 300 Indian CV Industry Similar with Global CV Industry Dis-similar to Global CV Industry Characteristics • Cyclical • Low Volume (in ,000s) • Secular long term growth trend • Early stage of road development Increasing intensity of competition required building World Class competencies 40 36 28 Competition in LCV Market 15 All Models 4 6 Indian 1970s '1985 '1995 '00-01 '04-05 58 '05-06 59 52 48 37 Competition in Passenger Car Market 42 All Models 36 Foreign 12 22 Indian 24 00-01 '01-02 '02-03 '03-04 '04-05 '05-06 Contents 1. Overview 2. Building World Class Competence 3. Results Building World Class Competence 1. Offsetting cyclicality & de-risking business model 2. Increasing Competitiveness 1. Offsetting cyclicality & de-risking business model a. Entering new segments & increasing presence in less cyclical segments • Personal transportation - Passenger Car TML Passenger Car Market Share 16.9% 16.5% 04-05 05-06 14.7% • Size of Zen • Interior space of an Ambassador • Economy of a Maruti 800 10.7% 6.8% 98-99 00-01 02-03 Bus Industry growth 50,300 43,500 • Fully Built Buses & Coaches • Controlled market • Less fluctuation in sales • Explosive growth projected in demand due to improvement in road infrastructure 45,500 35,300 Small Buses 22,300 Large Buses '01-02 '02-03 '03-04 '04-05 '05-06 2. Increasing Competitiveness Being competitive with International competition in domestic & International markets International Players TATA Motors Technology & Quality Gap Maintain Reduce Cost Gap Reduce Maintain TATA Motors Competitive Advantage:Providing vehicles with Highest Life-cycle Profitability to customers Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 1. Product Development A. Passenger Car Indica + $0.55 Bn Generation 1 Marina Indigo Generation 2 TML Market Share In B & C segments $1.1Bn Indigo: 33% (#1) 17.1% Indica: 19.5%(#2) (behind Alto) 14.6% Our 1st generation cars (Indica & Indigo) are competing with competitions’ 5th or 6th generation cars & are helping Company to gain Market Share in Car segment 8.7% '00-01 '02-03 '05-06 Towards building World Class Competencies 1. Product Development B. Introduction of India’s first Mini Truck – TATA ACE for last mile distribution Beginning May’05, ACE sales have grown to 50,000 nos (annualised) Impact of ACE on 3 Wheeler Sales Pkups ACE L3W S3W '01-02 '04-05 '05-06 Towards building World Class Competencies 1. Product Development C. Moving from ‘Developing Products’ to ‘Managing Product Development’ Engg Research Centre Pune, Jsr, Lko Aggregate Suppliers In house Product Development Outsourcing Partners TATA Technologies INCAT, UK Management of Product Development needs of TML Bus Body Building ACGL - Goa TATA Daewoo Korea Hispano Carrocera Spain TML-European Tech Centre, UK • Product Life-cycle Management (PLM) system for effective product data management & analysis • Institutionalizing New Product Introduction (NPI) Process across the organization • Incorporating ‘Voice Of Customer’ – for meeting Customer expectations • Advanced Computer Aided Design (CAD) Environment for product design, virtual testing & validations for reducing development time and enhance effectiveness Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 2. Supply Chain A. Manufacturing – Lean manufacturing, improvement in Quality & Productivity Lean Manufacturing • Single Piece flow • Flexibility & Scalability • Centre of Excellence (CX) • SMED (Single Minute Exchange of Dies) • JIT supplies / KANBAN • KAIZEN / Poke-Yoke Increase in Productivity (Equivalent Veh /Man/yr) Improvement in Quality • Design Quality X 2.2 X • Build Quality • Special emphasis on Visual Quality & Performance parameters 00-01 Enhancing People Capability • Multi Skilling & Multi Tasking • Small Working Groups • Advanced & focused training • Modernization of facilities 05-06 Towards building World Class Competencies 2. Supply Chain B. Outsourcing & Global Sourcing 1950 - 1990 2000 & beyond • Controlled economy • Open economy • Protected environment • Entry of International players • Less developed supplier base • Developed supplier base • Limited domestic competition • Product complexity Outsourcing Highly Vertically integrated company Outsourcing content 1. 82% 75% 57% 60% 1990 2000 2005 M&HCVs 2. Global Sourcing : Steel, various aggregates & other components 2005 ACE Towards building World Class Competencies 2. Supply Chain C. Vendor Management 1. Source Selection 2. Development 3. Management 4. Partnering • Past performance • Process development • 2 way communication • Rating performance • Managerial capability • Quality • Change adoption • Improvement • Technology • Capacity rate • New Technology • Relationship building • Knowledge • Training • New business • Rationalization Features • Early involvement of Vendors in product design & development • Focus on ‘overall least cost’ • Self Certification of Vendors • e-Commerce/ e-auctions & other IT tools (PLM , SRM) Towards building World Class Competencies Leading to reduction in Break Even Point BEP was brought down to 1/3rd of capacity by:• Direct Material Cost Reduction 65% TML’s BEP as % of Capacity • Variable Conversion Cost Reduction 41% • e-Sourcing – Largest e-Sourcing company & 33% among Benchmark companies in Auto Industry • Alternate Sourcing / materials • Benchmarking, tear down & design changes '2000 2003 2005 • Negative working capital – Unique distinction for an Engineering Company Lowering of BEP has prepared the Company to withstand severe demand fluctuations Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 3. Marketing & Sales A. New Customer Segmentation approach - To develop products as per target customer requirements Example: Pickup Customer Segments A B C D India Today India Tomorrow Towards building World Class Competencies 3. Marketing & Sales B. New Sales Planning Process Inquiry Stage 1 Stage 2 Sale • Non uniform Sales processes at various dealerships • Sales process Benchmarking • Addressing gaps / modified Sales process / Standardization • Embedding Sales process in IT enabled CRM system • CRM data analysis for sales trends & sales process improvements • Largest deployment of CRM (Siebel) system world wide in Auto Industry covering all TATA Motors Dealerships & Workshops Towards building World Class Competencies 3. Marketing & Sales C. TATA Motors Corporate Identity Program Uniform TATA Motors identity Towards building World Class Competencies In FY 05-06, TATA Motors achieved all time high domestic sale of > 400,000 vehicles TATA Motors Sales CV Market Share ~ 60% (# 1 ) Car Market Share ~ 17% (# 2 ) 188,900 28,600 Cars* (17%) CV Market Share – 51% Car Market Share – 0% 42,900 85-86 Cars (47%) 214,900 CVs(53%) 136,800 CVs(83%) CVs (100%) 95-96 CV PV '05-06 * Sumo, Sierra, Estate, Pickup Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 4. International Business A. De-risking business from cyclicality of Domestic market Strategic importance of International Business 1. Products meeting Global Standards • Entry of Global Players in India • World Class Road network 350 Nos in '000 300 250 CAGR: 6% 200 150 100 50 • International Emission & Safety norms 2. To offset domestic cyclicality effect • Greater share of IB can dampen the effect of cyclicality in domestic market 70 -7 1 72 -7 3 74 -7 5 76 -7 7 78 -7 9 80 -8 1 82 -8 3 84 -8 5 86 -8 7 88 -8 9 90 -9 1 92 -9 3 94 -9 5 96 19 -97 98 -9 9 00 -0 1 02 -0 3 04 -0 5 0 3. Economies of Scale • For advanced products, IB markets provide economies of scale 4. Accelerate Growth • Growth opportunities in International markets Domestic leadership image to be leveraged effectively for building relationships in global markets Towards building World Class Competencies 4. International Business B. Organic Growth 1 Market Attractiveness & Potential High Low 2 Regulatory Environment Emission, Safety, Entry regulations 3 TML’s ability to address markets Based on Stage of Market development • Cyclicality of these markets was out of phase with the Indian market • Product offerings were developed/ customized as per market requirements e.g. South African market required vehicles with Higher Power to Weight ratio as roads are highly developed • South Africa • South Korea • Sri Lanka • UK • Italy • Bangladesh • Nepal • Saudi Arabia • Ukraine • Malaysia & others… Towards building World Class Competencies 4. International Business B. Organic Growth – TATA Motors I B Sales 50,500 35 30,500 40 9,500 45 No of countries '02-03 '04-05 '05-06 Today, entire range of automobiles from Mini Truck to Heavy Trucks to Buses to Passenger Cars under TATA Motors Brand is exported to 35 countries Towards building World Class Competencies 4. International Business C. Inorganic Growth – TML acquired Daewoo Korea in Mar’04 1. Addition to Topline 2. Enhanced Product portfolio 3. Growth in South Korea 4. Managing business in a developed country 5. Operating high quality manufacturing plant 6. Lead change in domestic market Complementary Product Range TATA Novus was launched in India in Dec’05 TML range a HP b HP Medium Truck was launched in Korea in Dec’05 Daewoo range b HP c HP Towards building World Class Competencies 4. International Business C. Inorganic Growth – Daewoo acquisition provided us with valuable learning to initiate Brand building in Korea (even before the acquisition happened) 1. Be prepared for being evaluated • Entire Daewoo team was closely monitoring TML team’s work practices & behavioral traits 2. Collect first hand knowledge from market & customers • Interactions with customers & local transport associations Customer reaction… “No existing Company management has bothered to ask me how I feel or what I want…and here you are doing so even before taking over the business…” 3. Focus on human integration & communication • Overcoming the language barrier • India considered low on technology TATA Motors Brand Building Towards building World Class Competencies 4. International Business C. Inorganic Growth – Evolution of Cross Cultural partnership with Daewoo Synergizing •Sharing of best practices Harmonization •Work Ethics •Corporate Governance •Fine tuning Familiarization •Music, movies, food, .. •Sister City Concept •Cultural familiarity Initiation •Basic understanding •Language familiarity •Country visits Towards building World Class Competencies 4. International Business C. Inorganic Growth – TATA Motors in Korea Synergy of key attributes for making a Global Company Good Corporate Governance Cost effectiveness Strong Engineering base Work Ethics Quality Productivity Tata Motors, India DWCV, Korea • Integrity • Understanding • Excellence • Unity • Responsibility • Big • Modern • Reliable Towards building World Class Competencies 4. International Business C. Inorganic Growth – TATA Daewoo brand received very well in Korean market Towards building World Class Competencies 4. International Business C. Inorganic Growth – Increase in TDCV Revenue & Market Share TML TDCV Revenue TDCV Market Share in Korea 1.5X 1.2X X 62.4% 54.1% 48.8% FY03-04 FY 04-05 FY 05-06 X 29.1% DWCV Acquisition TDCV Sales (Nos) TML Heavy Trucks 25.5% 13.5% 1.3X 21.5% X Introduced in Jan’06 Exports Mar'05 Mar'04 FY03-04 FY 04-05 FY 05-06 TATA Competitor X Mar'06 Medium Trucks Towards building World Class Competencies 4. International Business C. Inorganic Growth – Learning from Daewoo helped in our 2nd acquisition - Hispano Hispano buses Sales (Nos) 3.5X TML X Q1 Q1 Q2 Q3 Q4 4X Revenue X Q1 Q1 Q2 Q3 Q4 Towards building World Class Competencies 4. International Business TATA Motors International Business template To be seen as a local Company in the country of operation • As a South Korean Company in South Korea • As a South African Company in South Africa • As a Spanish Company in Spain • Brand ‘Japan’ - Electronics, High Tech, Innovative, Efficient, Trendy, Process oriented • Brand ‘Germany’ - Automobiles, Engineering excellence, robust design, heavy duty, meticulous • Brand ‘India’ -? Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 5. Human Resource Awarded India’s Best Employer 2004 1. Right People • • • • • Customer focus Quality focus Cost focus Innovation Agility 2. Challenging assignments / International exposure 3. Meritocracy 4. Changes in Organizational Structure Hierarchical Organizational Structure Cross Functional Team Cross Functional Team Cross Functional Team Building World Class Competence 1. Offsetting cyclicality & de-risking business model 1. Product Development 2. Supply Chain 3. Marketing & Sales 4. International Business 5. Human Resources 2. Increasing Competitiveness 6. Performance Systems Towards building World Class Competencies 6. World Class Performance Systems Tata Business Excellence Model (TBEM) Balanced Score Card • Financial & Business perspective 1. Leadership • Customer perspective 2. Strategic Planning 3. Customer & Market Focus • Process perspective • Learning & Growth perspective 4. Information, analysis & KM 5. Human resource focus 6. Process management 7. Business Results Awards & Recognitions • JRD QV TBEM Award for 2004-05 • ‘Hall of Fame’ for 2003 for effective deployment of BSC • CII-EXIM Bank Award for Business Excellence for 2004-05 • 2 Case studies published in ‘HBS Review’ on BSC deployment at Tata Motors Contents 1. Overview 2. Building World Class Competence 3. Results Business Results 1. Negative Net Working Capital 11 8 0 '00-01 '01-02 '02-03 '03-04 '04-05 -20 -26 (Days of Sale) 2. Low Debt/Equity Ratio 0.94 0.92 0.61 0.56 0.35 '00-01 '01-02 '02-03 '03-04 '04-05 Business Results 454,300 (’05-06) TML Sales TML Turnover (USD Bn) 400,000 220,000 170,000 4.7 1.9 '00-01 '02-03 '04-05 TML PBT (USD Bn) & EBIDTA Margin (%) '00-01 2.4 '02-03 TML Market Capitalization (USD Bn) TML 13.3% 12.7% '04-05 Ford GM TML 13.4 11.6 7.9 (NYSE 19 Apr’06) 0.3 TML Maruti M&M ALL 3.9 7.2% 8.1(#1) 5.7 3.3 1.1 (BSE 31 Mar’06) 0.1 0.9 '00-01 (0.1) '02-03 '04-05 Mar’02 Mar’04 Mar’06 EBIDTA (%) 1 USD = Rs 44 Thank You