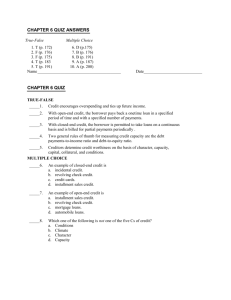

CARE-Presentation - Colorado Consumer Bankruptcy

advertisement

CARE

Credit Abuse Resistance

Education Program

provided by the United States

Bankruptcy Court for the

District of Colorado

Why CARE?

Teens surveyed reported

spending 98% of their money,

rather than saving it

It’s a marathon!

Your future, your financial well-being…

it's not a sprint,

it's a marathon

If you are training to be a long distance

runner, what would you do?

First few days you would probably just jog.

Or maybe even walk fast. You start with a

few blocks, and then half a mile, a mile,

then a couple of miles. And before you

know it, several months have passed and

you go from being out-of-shape to being

someone who could run a marathon.

Smart Runners v. Smart Investors

Smart runners don't go out and try to sprint

26 miles the very first day. They build it up.

Same thing with your savings. You don't

start from saving nothing to try to save

$2000 or $3000 a month. But you can start

small. With perseverance, you will finish

big!

Who thinks they can save $10 a day?

(That equals $3650 a year.)

How much would you have in the future?

(Interest-bearing account at 6% per year)

At 20 years = $153,319.28.

At 30 years = $329,043.34.

The “latte” factor

How much are you squandering every day?

How many people go to Starbucks every

day? If you go four times a week and at each

visit you order a venti frappacino. That's

$4.05 each visit. Let us just assume it's four

dollars to make the math easier.

How must is that venti frap costing you?

$4 x 4 times a week = $16 a week

$16 x 4.33 weeks = $69 a month

$69 x 12 months = $828 a year

But what is the REAL cost?

If you would put just your Starbucks money

into an interest-bearing account, after 20

years, you would have $32,040.32.

That’s some pretty expensive coffee and ice.

68% of teens report never

discussing responsible credit

card use with any family

member

Graduating college students

average $20,402 of debt with

$3,262 on credit cards

84% percent of undergraduates

indicated they needed more

education on financial

management topics. In fact,

64% would have liked to

receive information in high

school and 40% as college

freshmen.

What is credit?

Credit is the ability to borrow

money

Borrowing money creates debt

Debt is what you owe

It costs to borrow money

Types of Credit

1. Long Term Credit - payments made over several

months or years

Mortgages

Car Loans

Student Loans

2. Short Term Credit – single payments

Utility Bills

Cable/Satellite

Cellular phone bills

How would I start

using credit?

Use a checking account or debit card

Pay all bills on time

paying for your own cell phone

might be a great place to start!

Take out a small loan from a bank

and repay it timely

Debit cards are different

from Credit cards

A debit card works just like a check

The money for the purchase comes directly from

your bank account

You must have money in the bank account to use

the card

can’t spend what you don’t have

Many places prefer debit cards over checks or do

not accept checks at all

What is Interest?

Interest is the amount that a lender charges

to borrow money

The higher the interest rate, the more

money you pay

Interest rates vary from credit card

company to credit card company

Credit Card

Costs and Fees

Finance Charges

Balance Transfer

Fees

Cash Advance Fees

Universal Default

Rate

Annual Fees

Over-the-Limit Fees

Document and

Research Fees

Reissued Card Fees

Returned Check

Fees

Go to

www.cardratings.com

to find deals

What is a Credit Report?

A credit report is a history of how

well you have paid your bills

Also collects other financial

information about you

Filing for bankruptcy will remain

on your credit report for 10 years

Factors That

Negatively Affect

Your Credit

1.

History of late/past due payments

2.

Failure to make payments

3.

Having too much credit

4.

Having no credit

5.

Not leaving a forwarding address

6.

Judgments against you/Bankruptcy

Some Good Reasons to have

Credit Cards

Emergencies

Large Purchases

Internet Purchases

Establish a Credit History

Identification

Safety

Some Downsides

to Credit cards

It is very easy to lose track of your

purchases

You end up spending more than you think

The convenience of a credit card can

be overpowering

leads to unnecessary and even foolish

purchases.

Credit Card

Control

Reasons to reduce or eliminate the credit card

habit:

1.

Improve your credit rating

2.

Save more money and pay less interest

3.

Regain control over your life when you

control your spending

Saving for the

Future

Learning to live within your means

will help you get ahead (wants vs.

needs)

Budgeting creates financial security

Budgeting will keep you out of debt

SO, how do

you budget??

Keep track of what you make.

Keep track of what you spend.

Ask yourself, how close are they?

To make your budget work,

you must equalize what you

spend with what you make by:

1)

2)

Making more

Spending less

(Sounds easy, huh?)

Start making adjustments…

Earn more by working more hours

Reduce expenses by buying your

coffee at 7/11 instead of Starbucks

Be honest with yourself: Do I really

need this or do I simply want this?

Then, stick to your budget!

Sticking with a budget is a lifelong

process

Be flexible

your budget will change as your life

changes

Let’s give you an

example

{ What if you bought…

Laptop = $1,300.00

Scanner/printer/fax for $400

Software/wireless router for $300

TOTAL: $2,000

you used your credit card

you make monthly payments of $300

you never miss a payment

annual percentage rate on your card is

8%

What will the system end

up costing you?

{

(remember, it costs to borrow

money)

How long will it take to pay for

it?

Your total cost will be $2052

It will take you SEVEN

MONTHS to pay for it

Now, instead of an 8% rate, assume

that, because your credit rating is

poor, you must pay interest at a rate

of 24%.

Also assume that you pay the

MINIMUM MONTHLY PAYMENT

of only $50 per month.

It will take you

82 MONTHS

(almost SEVEN

YEARS) to pay

for it

Total payment:

$4,085!

There is a growing crisis in this

country with credit card abuse

Many banks and credit cards are

actively seeking younger customers

Understanding how credit works and

what kinds of things to avoid when

using credit cards is essential before

the damage is done

True or False

You pay no interest on a debit card

purchase.

TRUE!

A debit card

works just like

a check.

True or False

There is a credit report for everyone

over age 18.

FALSE

There is a credit

report only for

people who have

established a credit

history.

Having no credit

history can have

adverse

consequences.

True or False

If you are late in making a

few payments on your

credit card, the interest rate

you pay may increase

sharply.

TRUE

For example, on one

Platinum VISA card,

the interest rate

jumps from 4.9% to

30% if you pay late

or miss even one

payment. Late

charges also accrue.

True or False

If you miss just one or two

payments on your credit card, it

won’t hurt your credit rating.

FALSE

That negative

information

can legally

remain on

your report for

up to 7 years.

True or False

No one really looks at credit

reports.

FALSE

People who lend you money will almost

always review your credit report. Car,

home, credit cards.

More prospective employers also look at

credit reports.

You can receive free copies of your credit

report each year—worth reviewing!

How many of you plan to go to college?

How will you pay for it?

Assistance from family

Student loans

Personal savings

Student Loans

The majority of college students today

have to take out students loans to help

pay for their college education

Source:

Time

Magazine

What is the value of a college education?

Gain skills and knowledge for a career?

Gain a well-rounded education?

Increase earning power?

Become an informed citizen?

Learn to think critically?

Formulate goals and values?

What is cost of college?

The average debt load for college seniors

who took out loans and graduated in

2010 was…

$25,250

Is that too high?

Is that reasonable?

College is still a smart move!

Source:

Time

Magazine