2000 Credit Card Balance @ 24%APR Payment Number of Months

advertisement

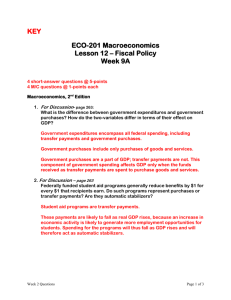

Credit Cards – More Than Plastic CARL JOHNSON FINANCIAL LITERACY JENKS HIGH SCHOOL Terms to Know Credit card – A card that authorizes the delivery of goods and services in exchange for future payment with interest, according to a specific schedule Revolving credit – A consumer line of credit that can be used up to a certain limit or paid down at any time How Did We Get In This Mess??? Bank of America in California issued the first bank credit card in the late 1950’s called the BankAmericard It was later renamed Visa in 1976 Other banks have followed BOA’s lead and the rest is history In 2013, the average U.S. citizen owes more than $10,000 in open ended credit, with most of it being credit card debt The Differences… Credit cards differ from debit cards and charge cards Debit cards remove money from your account at the time of purchase Charge cards must be paid in full at the end of each month Credit cards are revolving loans that must be repaid to the issuer, and if not paid in full, accumulate interest on the balance due When you use your card, the credit card company pays the merchant for your purchase The credit card company sends you a bill called a statement at the end of each month showing what purchases you made, any additional fees you owe and the total amount you owe…In addition, it also tells your minimum payment for the month Interest on Credit Cards If you pay the entire balance in full each month, you will not pay any interest If you do not pay off the entire balance, the credit card company will charge interest on the entire amount from the date of your purchase Credit card interest rates vary from 0% to 30% Low interest rates are incentives to encourage you to use your credit card and may be only temporary Before you use your card, be sure and carefully read and understand the credit terms Interest on Credit Cards Do not ever use credit cards for cash advances…You will end up paying very high interest on the money that you borrowed Credit cards are classified as revolving credit, which means that you can use the amount for which you are approved as long as you are continuing to make payments on it Revolving credit has more flexible terms than other forms of credit Before accepting and using any credit card, be sure and read all terms very carefully. They can vary greatly and can easily become a financial nightmare Parts of the Credit Card Statement Purchases or New Charges Interest Rate Payments and Credits Due Date Credit Limit Making Minimum Monthly Payments Let’s say you buy a new notebook computer for $2,000 and put it on your credit card How long would it take to pay off the balance if you only make the minimum monthly payments Interest Rate Number of Months Total Interest Paid 18% 222 $2,615.43 24% 403 $6,812.23 10% 145 $888.49 At 24% interest, the computer would cost you over $8,000 making minimum payments for more than 33 years Making Minimum Monthly Payments What happens if you increase your monthly payments??? $2,000 Credit Card Balance @ 24%APR Payment Number of Months Total Interest Paid Minimum monthly payment of $50 403 $6,812.23 Add $10 a month - $60 monthly payment 56 $1,328.23 Add $20 a month - $70 monthly payment 43 $995.22 Double the payment $100 monthly 26 $579.75