Fiscal and Monetary Policy

advertisement

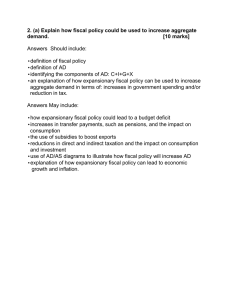

Fiscal Policy Krugman Section 4 Modules 20 and 21 Fiscal Policy Fiscal policy is done by CONGRESS—not the Federal Reserve Stabilization is done by G and Tax (T) collection Everything equal, what puts more money in the economy, G or a decrease in T? G! People can SAVE some of a tax break The Employment Act of 1946 Congress proclaimed gov’t role in promoting max. employment, production and purchasing power Keynesian Economics Created the Council of Econ. Advisors to advise the President Created the Joint Economic Committee of Congress to investigate econ. problems. Discretionary Fiscal Policy = changes to G or T are at the option of Congress Two types = expansionary and contractionary Expansionary Policy Used to combat recession Increase G Decrease T If budget is balanced, a budget deficit is created Goal is to shift AD to the right LRAS PL SRAS PL2 PL1 AD2 AD Y1 Y2 GDPr Contractionary Policy Used to lower inflation A decrease in G An increase in T Goal is to shift AD to the left by taking money out of the system PL LRAS SRAS PL1 PL2 AD2 Y2 YI AD GDPr Financing Deficit Spending 1. borrow from the public Sell bonds to the public: take out loans 2. Money Creation FED loans money directly to the gov’t Could increase inflation What to do with a Surplus 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus 2. stand idle Withholds purchasing power No chance of inflation Automatic Policy--Built In Stability 1. Income Tax As income increases, people pay more taxes. This limits the increase in DI and C. 2. Unemployment compensation The income of unemployed does not fall to zero. UC provides a base level of income. 3. Stocks and Bonds Dividends do not follow the swings of the business cycle. Bond payments are established at the time the bond is purchased