Major functional accounts useful in marketing cost analysis

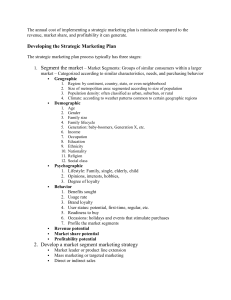

advertisement

MODULE 17 : COST ANALYSIS ACCOUNTING VERSUS MARKETING COSTS Accounting costs are computed to provide a historical record of the company’s operations. The marketing perspective is like an economist’s perspective because it is future-oriented. Although many costs reflect the result of some particular activity – such as production – marketing costs are directed at producing some benefit. Thus, in controlling production costs, management focuses on the effect of volume on costs. In controlling distribution costs, it looks at the effect of costs on volume. Moreover, there is less certainty about the effect marketing costs have on volume than about the effects volume changes have on production costs. FULL COST VERSUS CONTRIBUTION MARGIN (a) Direct Costs versus Indirect Costs A direct cost can be specifically identified with a product or a function. The cost is incurred because the product or function exists or is contemplated. An indirect cost is a shared cost because it is tied to several functions or products. Even if one of the products or functions were eliminated, the cost would not be. Cost versus Expenses The term costs is often restricted to the materials, labour, power, rent, and so on used in making the product. The cost of goods sold on the following conceptual net income statement reflects these costs. Sales – Cost of Goods Sold = Gross Profit Gross Profit – General administrative & selling expenses = Net Profit The expenses reflect the other costs incurred in operating the business, such as the cost of advertising and of maintaining branches. Expenses cannot be tied nearly as well as costs to specific products, since they are general expenses associated with doing business. In marketing cost analysis, the distinction between costs and expenses is not nearly so clear, and the terms are often used interchangeably. Specific versus General Expenses A specific expense is just like a direct cost – it can be identified with a specific product or function. The function would be eliminated if the product or function were eliminated. A general expense is like an indirect cost – it cannot be identified directly with a specific object of profit measurement such as territory, salesperson, or product. Thus, the expense would not be eliminated if the specific object were eliminated. Measurement objective affects classification A particular cost or expense may be direct for some measurement purposes and indirect for others. The object for measurement determines how the cost should be treated. Which to use – full cost or net profit approach or the contribution margin approach Proponents of the full-cost or net profit approach argue that all costs should be assigned and somehow accounted for in determining the profitability of any segment (eg. Territory, product, salesperson) of the business. Under this approach, each unit bears not only its own direct costs that can be traced to it, but also a share of the company’s costs of doing business, referred to as indirect costs. Full costing advocates argue that many of the indirect costs can be assigned to the unit being costed on the basis of a demonstrable cost relationship. If a strong relationship does not exist, the cost must be prorated on as reasonable a basis as possible. Under the full-costing approach, a net income for each marketing segment can be determined by matching the segment’s revenue with its direct and its share of indirect costs. Contribution margin advocates argue, on the other hand, that it is misleading to allocate costs arbitrarily. They suggest that only those costs that can be specifically identified with the segment of the business should be deducted from the revenue produced by the segment to determine how well the segment is doing. Any excess of revenues over these costs contributes to the common costs of the business and thereby to profits. The contribution margin approach does not distinguish where the costs are incurred, but rather simply whether they are variable or fixed. Thus, the difference between sales and all variable costs, whether they originate in manufacturing, selling or some administrative function, are subtracted from revenues or sales to produce the contribution margin of the segment. The net profit approach does attempt to determine where the costs were incurred. Not only is the segment net income derived differently in the two approaches, but also advocates of the contribution margin approach do not even focus on net income when evaluating the profitability of a segment of the business. Rather, they focus on the contribution produced by the segment after subtracting the costs directly traceable to it from its sales. Differences in perspective between full-cost and contribution margin approaches to marketing cost analysis Full Cost Approach Sales – Cost of Sales = Gross Profit Gross Profit – Operating expenses = Net Profit Contribution Margin Approach Sales – (Variable Manufacturing Costs + Other variable costs directly traceable to the segment) = Contribution Margin Contribution Margin – (Fixed costs directly traceable to the products + Fixed costs directly traceable to the market segment) = Net Profit The contribution margin approach is preferred to the full cost approach. This method advocates that if the costs associated with the segment are not removed with the elimination of that segment, why should they be arbitrarily allocated? The costs still have to be borne after the segment is eliminated, but they must be borne by other segments of the business. This can simply tax the ability of these other segments to remain profitable. A contribution margin approach versus a full-cost profitability analysis is also supported by the recognition that most marketing phenomenon are highly interrelated. They have interdependant effects. The contribution margin approach implicitly recognises this synergy through its emphasis on the contribution of each segment or part. In sum, allocation of indirect costs for segments performance allocation are generally inappropriate. That is, any measure of segment performance that includes allocated shares of indirect costs includes factors that do not really reflect performance in the segment as a separate entity. Hence, indirect costs allocations should not be made if the purpose is to measure true performance. PROCEDURE The general procedure followed in conducting a cost or profitability analysis first involves specifying the purpose for which the cost study is being done. This helps to determine the functional cost centres. The next step is to spread the natural account costs to these functional cost centres. Then the functional costs are allocated to appropriate segments using some reasonable basis. Finally, the allocated costs are summed, and the contribution of the segment is determined. Here, segment means a portion of the business, not in the normal sense of the market segment. Purpose It is necessary to determine the purpose of the marketing profitability analysis because the treatment of the various costs and expenses depends on the purpose. Ideally, the firm would want to break all its costs into small building blocks or modules. These elements would be as small as possible and yet still meaningful. This allows the firm to aggregate these building blocks as needed to produce profitability analysis for various segments of the business. Thus, good profitability analyses require that the various costs be partitioned into direct and indirect expenses so the proper aggregations can be made. Sales managers are typically concerned with the profitability of various regions, branches, salespeople, and customers; they are only remotely concerned with the profitability of various products. What is properly treated as direct and what should be treated as indirect or general depend on the study’s purpose. Natural Accounts versus Functional Accounts In the second step of a profitability analysis, natural account costs need to be spread to the functional cost centres. Natural Accounts are the categories of cost used in the normal accounting cycle. These costs include such things as salaries, wages, rent, heat, light, taxes, auto expenses, raw materials, and office supplies. They are called natural accounts because they bear the name of their expense categories. However, this is not the way of classifying costs. In manufacturing cost accounting, costs are often reclassified according to the purpose for which they were incurred. Thus, production wages might be broken into the cost categories, forging, turning, grinding, milling, polishing and assembling. These categories are functional account categories because they recognise the function performed, which is the purpose of incurring the cost. Marketing cost analysis recognises that costs are incurred for some purpose, and it recognises general selling and administrative expenses according to their purposes or functions. Allocate Functional Costs The third step in conducting a cost or profitabilty analysis is to allocate the functional costs to various segments of the business. One needs to recognize immediately that the bases for allocation are not fixed. Rather they depend on the discretion of the decision maker and what he or she feels are reasonable bases. One basis often used is to divide the expenses according to volume attained. This is often used because of simplicity. It is erroneous, however, in that it fails to recognise the purpose for which the costs were incurred, which is the reason for a functional cost analysis. Major functional accounts useful in marketing cost analysis direct selling advertising and sales promotion product and package design technical product services sales discounts and allowances credit extension warranty costs marketing research warehousing and handling inventory packaging, shipping and delivery order processing customer service billing and recording of accounts receivable returning merchandise Functional Cost Groups and Bases of Allocation Functional Cost Group Selling – direct costs Personal calls by salespeople and supervisors on accounts and prospects. Sales salaries, incentive compensation, travel, and other expenses. To Product Groups Selling time devoted to each product, as shown by special sales call reports or other special studies. Selling – Indirect Costs Field supervision, field sales-office expense, sales administration expenses, sales – personnel training, sales management. Market research, new product development, sales statistics, tabulating services, sales accounting. Advertising Media costs such as TV, radio, billboards, newspaper, magazine, etc. Advertising production costs, advertising department salaries. Sales Promotion Consumer promotions, such as coupons, patches, premiums, etc. Trade promotions such as price allowances, In proportion to direct selling time or time records by project Direct or analysis of space and time by media, other costs in proportion to media costs Direct; or analysis of source records To account size classes Number of sales calls times average time per call, as shown by special sales call reports or other special sales studies. In proportion to direct selling time or time records by project To sales territories Direct Equal charge to each account or number of ultimate consumers and prospects in each account’s trading area Direct; or analysis of source records Direct or analysis of media circulation records Equal charge for each sales rep Direct; or analysis of source records point-of0purchase displays, cooperative advertising, etc Transportation Railroad, truck, barge, etc, payments to carriers for delivery of finished goods from plants to warehouses and from warehouses to customers. Traffic department costs. Storage and Shipping Storage of finished goods inventories in warehouses. Rent (or equivalent costs), public warehouse charges, fire insurance and taxes on finished goods inventories, etc. Physical handling, assembling, and loading out of rail cars, trucks, barges for shipping finished products from warehouses and mills to customers. Labour, equipment, space and material costs. Order processing Checking and processing of orders from customers to mills for prices, weights and carload accumulation, shipping, dates, coordination with production planning, transfer to mills, etc. Pricing department. Preparation of customer invoices. Freight accounting. Credit and collection. Handling cash receipts. Provision for bad debts. Salary, supplies, space and equipment costs (teletypes, flexowriters, etc). Applicable rates times tonnages Analysis of sampling of bills of lading Applicable rates times tonnages Warehouse space occupied by average inventory. Number of shipping units. Number of shipping units Number of shipping units Number of order lines Number of order lines Number of order lines Activity-based costing which attempts to itemize all costs associated with producing and marketing a particular product for a particular market or even customer, represents a popular, natural extension of the allocation of functional costs to the various segments of the business. Activity-based costing can help managers see which products are profitable and where reducing costs can have the most impact. Sum allocated costs The fourth step in the process is to sum the costs allocated to the segment. Costs for which tehre is no direct casual relationship remain unallocated in determining the contribution of the segment. A comparison of the contributions of like segments then indicates the remedial action that might be taken, if any. THE PROCESS ILLUSTRATED SEE CASE STUDY IN THE TEXT PROSPECTS AND PROBLEMS The real benefit of a marketing cost analysis is the opportunity it provides managers to isolate segments of the business that are most profitable as well as those that generate losses. This information allows those involved to improve their planning and control of the firm’s activities. RETURNS ON ASSETS MANAGED Sales and cost analysis provide the sales manager with two important financial techniques for controlling the personal selling function. The first measures the results achieved and the second the cost of producing those results. The important financial ingredient left out of those analysis is the assets needed to produce those results. At a minimum, the company will be committing working capital in the form of accounts receivable and inventories to support the sales function. The return produced on the assets used in each segment of the business provides sales managers with a useful variation of more traditional cost analysis procedures for evaluating and controlling various elements of the personal selling function. Return on Assets Managed = Contribution as a percentage of sales X Asset Turnover Rate This formula indicates that the return to a segment of the business can be improved either by increasing the profit margin on sales or by maintaining the same profit margin and increasing the asset turnover rate. The formula can then be used to evaluate segments or to select the best alternative from strategies being considered. Contribution as a percentage of sales equals the ratio of net contribution divided by sales. Asset turnover rate equals sales divided by the assets needed to produce these sales. Assets managed adds another important dimension to the financial control picture. The investment required for a venture needs to be recognized because long run profits can be maximized only if the optimal level of investment in each asset is achieved.