Chapter 8 Review

advertisement

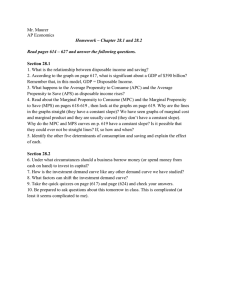

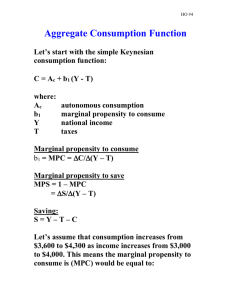

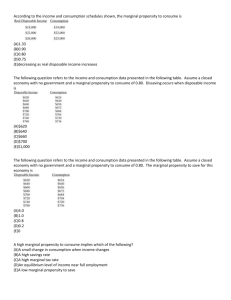

Chapter 8 Review Macroeconomic Measurement & Basic Concepts With an MPS of .5, the MPC will be: • 1.0 minus . The most important determinant of consumption and saving is: • level of . As disposable income goes up the • APC . Which fiscal policy actions would be most effective in combating a recession • Taxes . • Government Spending . The consumption schedule relates: • consumption to the level of . The consumption schedule in the diagram indicates that: • up to a point consumption but then falls below income. income, APC + APS = • . The sector of the economy that is responsible for Consumption is: • the sector The relationship between consumption and disposable income is such that: • a direct and relatively stable relationship exists between and . If the Government increases Government Purchases by $800 billion dollars and increases taxes by $800 billion dollars the effect on GDP will be • . If the marginal propensity to consume is three quarters, then an increase in personal income taxes of $100 will most likely result in • a decrease in consumption of decrease in savings of . and a The spending multiplier will have an effect on any new, additional spending in the component(s) of • and Purchases • MPC is greater in than in . If X’s MPC is .70, this means that X will: • spend of any increase in its disposable income. Dissaving occurs where: • consumption income. The saving schedule is drawn on the assumption that as income increases: • saving will increase percentage of and as a . If the marginal propensity to consume is .9, then the marginal propensity to save must be: • . The greater is the marginal propensity to consume, : • The save. is the marginal propensity to In the late 1990s the U.S. stock market boomed, causing U.S. consumption to rise. • effect. The wealth effect is shown graphically as a: • shift of the consumption schedule. ?/? Marginal propensity to save (MPS) Marginal propensity to consume (MPC) = = change in saving change in income change in consumption change in income The investment demand slopes downward and to the right because lower real interest rates: • enable more undertaken profitably. projects to be An increase in the real rate of interest will • the level of investment. The investment demand curve suggests: • there is an relationship between the real rate of interest and the level of investment spending. A decrease in corporate income taxes will: • shift the investment-demand curve to the . Investment spending in the United States tends to be unstable because: • profits are highly . • Capital goods, because their purchases can be postponed like consumer goods, tend to contribute to in investment spending. The multiplier is: • 1/ . Or • 1/(1 ) • Which economy has the highest marginal propensity to consume? • • Which economy has the largest multiplier? The practical significance of the multiplier is that it: • initial changes in spending into larger changes in . If the MPC is 0.75 and gross investment increases by $8 billion, GDP will increase by • $ billion.