Chapter 8 Review

advertisement

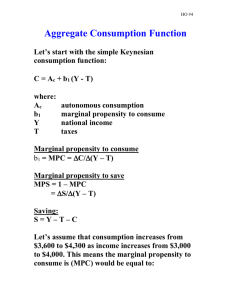

Chapter 8 Review Macroeconomic Measurement & Basic Concepts With an MPS of .5, the MPC will be: • 1.0 minus .5 The most important determinant of consumption and saving is: • level of income. As disposable income goes up the • APC falls Which fiscal policy actions would be most effective in combating a recession • Taxes decrease • Government Spending increase The consumption schedule relates: • consumption to the level of disposable income • The consumption schedule in the above diagram indicates that: up to a point consumption exceeds income, but then falls below income. APC + APS = • 1 The sector of the economy that is responsible for Consumption is: • the Household sector The relationship between consumption and disposable income is such that: • a direct and relatively stable relationship exists between consumption and income. If the Government increases Government Purchases by $800 billion dollars and increases taxes by $800 billion dollars the effect on GDP will be • positive. If the marginal propensity to consume is three quarters, then an increase in personal income taxes of $100 will most likely result in • a decrease in consumption of $75 and a decrease in savings of $25. The spending multiplier will have an effect on any new, additional spending in the component(s) of • Investment and Government Purchases • MPC is greater in A than in B. If X’s MPC is .0, this means that X will: • spend seven-tenths of any increase in its disposable income. Dissaving occurs where: • consumption exceeds income. The saving schedule is drawn on the assumption that as income increases: • saving will increase absolutely and as a percentage of income. If the marginal propensity to consume is .9, then the marginal propensity to save must be: • .1 The greater is the marginal propensity to consume, : • The smaller is the marginal propensity to save. In the late 1990s the U.S. stock market boomed, causing U.S. consumption to rise. • wealth effect. The wealth effect is shown graphically as a: • rightward shift of the consumption schedule. MPS/MPC Marginal propensity to save (MPS) Marginal propensity to consume (MPC) = = change in saving change in income change in consumption change in income The investment demand slopes downward and to the right because lower real interest rates: • enable more investment projects to be undertaken profitably. An increase in the real rate of interest will • reduce the level of investment. The investment demand curve suggests: • there is an inverse relationship between the real rate of interest and the level of investment spending. A decrease in corporate income taxes will: • shift the investment-demand curve to the right. Investment spending in the United States tends to be unstable because: • profits are highly variable. • Capital goods, because their purchases can be postponed like durable consumer goods, tend to contribute to instability in investment spending. The multiplier is: • 1/MPS Or • 1/(1 MPC) • Which economy has the highest marginal propensity to consume? • 4 • Which economy has the largest multiplier? • 4 The practical significance of the multiplier is that it: • magnifies initial changes in spending into larger changes in GDP. If the MPC is 0.75 and gross investment increases by $8 billion, GDP will increase by • $32 billion.