Ch.3: The Demand for Labor

advertisement

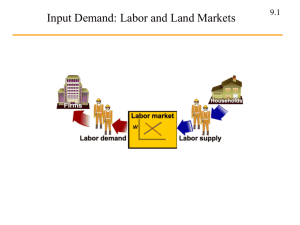

Chapter 3 The Demand for Labor Short Run Labor Demand • Short run – short enough period of time that capital is fixed • Marginal Product of Labor (MPL ) – increase in output (Q) from adding one unit of labor (L), holding other inputs constant. • Law of Diminishing Marginal Returns – Holding other inputs constant, as the amount of a single input increases, its marginal product will eventually decrease. • Marginal Revenue (MR) – increase in total revenue (TR) from producing one more unit of output. Short Run Labor Demand • MR for a firm – identical to price if firm sells its product in a perfectly competitive industry. – MR=P(1-1/e) where e=elasticity of product demand if firm faces a downward sloping product demand curve. [e expressed as positive number.] – If firm sells product in a perfectly competitive industry, e is infinite and MR=P. – As a firm increases the sales of its product, MR generally falls. The steeper the product demand curve is, the steeper the MR curve. Short Run Labor Demand Relationship between product demand and MR Perfectly competitive product market Monopolistic product market D D=MR MR Short Run Labor Demand • Marginal Revenue Product of Labor (MRPL) – increase in total revenue from adding one more unit of labor, ceteris paribus. – MPL* MR • MRPL will fall as L increases for 2 reasons: – MPL decreases as L increases due to Law of diminishing marginal returns – MR falls as L (and output) increases unless the firm is in a competitive product market. Short Run Labor Demand • Marginal Expense of Labor (MEL ) increase in total cost (TC) from adding one more unit of labor DTC / DL • If a firm is in a competitive labor market, MEL=W • If firm is in a monoposonistic labor market MEL>W. Short Run Labor Demand Competitive labor market Market Firm W=ME L W* units of labor units of labor Short Run Labor Demand Monopsonistic Labor Market ME L Labor supply units of labor Short Run Labor Demand • Profit maximization: L where MRPL = MEL ME L MRP L* L UNITS OF LABOR Short Run Labor Demand Assume competitive product and labor markets • Analyze the effect of an increase in product demand on – employment in market, at firm. – firm profits (change in area between MRPL and MEL) – labor’s rents (area between W& LS) • Analyze the effect of an increase in labor supply on – employment in market, at firm. – firm profits Short Run Labor Demand • Use short run supply/demand model to discuss winners/losers from: – More open immigration laws – NAFTA/CAFTA – Increase in minimum wage Long Run Labor Demand • In the LR, all inputs can be varied. • Assume two inputs: L and K. • In the LR, the profit maximizing condition MRPL = MEL MRPK = MEK • If the firms purchase their labor and capital in competitive markets, MEL = W MEK = C. where W=wage rate C =cost per period of a unit of K. Long Run Labor Demand • If the firms sell their products in competitive product markets, MRPL=P*MPL MRPK=P*MPK • Using these facts, the profit maximizing conditions can be rewritten as: P*MPL = W P*MPK = C • Which can be rewritten as: W/MPL = C/MPK = P Long Run Labor Demand • Long run effect of an increase in price of capital on labor. – substitution effect: for every given level of output, use more labor and less capital. – scale effect: an increase in price of capital reduces product supply, reduces equilibrium quantity produced, and reduces amount of labor employed. • L & K are – gross substitutes if subst effect > scale effect – gross complements if subst effect < scale effect Long Run Labor Demand • When there are more than two inputs, any pair can be classified as gross substitutes or complements depending on whether the scale or substitution effect dominates. Long Run Labor Demand Other Applications of Labor Demand Models. • Minimum wages and monopsony. • Effect of a payroll tax. – does it matter whether tax is levied on employer or employee? – how does the elasticity of labor supply affect incidence of tax? – how does the elasticity of labor demand affect incidence of tax? • Effects of employment subsidies. – given to employers. – given to employees. • Financing medical payments for black lung disease. – tax on coal workers' wages (surface versus land) – tax on coal (unions versus management)