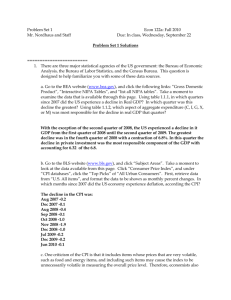

MACROECONOMICS

advertisement

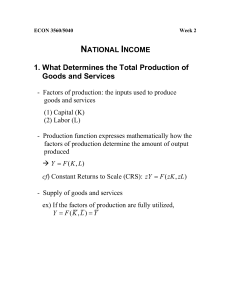

MACROECONOMICS Chapter 3 National Income: Where It Comes From and Where It Goes Sources and Uses of GDP How much GDP is produced by the firms in an economy? How the income is divided between labor and capital owners? Who buys the output of the economy? How does the demand for goods and services match the supply of goods and services? 2 How Much GDP? Think of the whole economy as a production function: Y=F(K,L) In the LONG RUN, markets clear. No unemployment in the factor markets. The amount of K and L are thus determined. The total amount of Y (GDP=Income) is thus determined. 3 Who Gets What? In perfectly competitive factor markets, the demand for an input is its marginal product. MPL = ΔY/ΔL MPK = ΔY/ΔK The supply of a factor was determined to be K-bar and L-bar. 4 Factor Shares R (MPK)P K W Q of K (MPL)P L Q of L The demand for capital is the value of the marginal product of capital: P(MPK) The demand for labor is the value of the marginal product of labor: P(MPL) Explain equilibrium. At equilibrium R = P(MPK) and W = P(MPL) WL is labor’s share in $; RK is capital’s share in $ 5 Shares of Factors If all the firms are operating in perfectly competitive markets, then P=AC=MC and economic profits (PQ-WL-RK) is zero. PQ = WL + RK Q = (W/P)L + (R/P)K Y = (MPL)L + (MPK)K Senator Paul Douglas noticed that (1920s) the share of labor in the national income remained constant through the years. 6 Shares of Factors What kind of a production function would pay each factor their marginal products and the marginal products would remain a constant share of the total income? MPL = α(Y/L) MPK = (1-α)(Y/K) Cobb-Douglas production function. 7 Cobb-Douglas Production Function It turns out that a function in the following form fulfils the required condition. Y AL K K L LK Y Y Y L L L AK 1 L 1 AK L Y L 1 L Y Y Y 1 K K K (1 ) AL K 1 1 1 ( 1 ) AL K (1 )Y K K 8 Properties of Cobb-Douglas Constant returns to scale: zY=F(zL,zK) Declining marginal products: negative 2nd derivative Y K Y Y=F(L,K) MPL 2b 2Y b Y a 2a L L L 9 Who Buys the GDP? Y C I G NX C C (Y T ) I I (r ) For simplicity, let’s assume that NX=0 If labor and capital are fixed, Y is fixed. So, the only variable that determines how demand will match supply is r. _ G G _ T T S S GOV S HH S T G Y C T S Y C G Y C T S HH S GOV T G I S HH S GOV But from Y = C + I + G I=Y–C–G 10 Circular Flow Identify the arrows. Domestic production (GDP) = Expenditures Income = Expenditures Savings = Investment All equalities imply market clearing. 11 Another View of Equilibrium Expenditures C+I+G C=c(Y-T) Y-bar Y 12 Equilibrium in the Financial Markets r GOV S HH S S What happens if government budget has a deficit? What happens if investment demand rises? What happens to investment demand during recessions? I 13