Section 4.03 B Power Point

advertisement

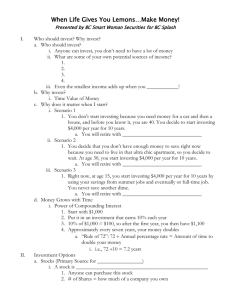

Saving and investing options 4.03B Essential Question What factors should be considered in evaluating saving and investing options? Saving Options Savings Plans Savings account Usually allows low or zero balance, deposit or withdrawals anytime and interest to be earned. Usually withdrawals are allowed without penalties. Wachovia Rates and Fees https://www.wachovia.com/savings/premiumsavings.html?intcid=PF_BNK_SAV_FP1_R_DPS_PSA_20667_46 5x000_01T#panel3 Bank of America Rates and Fees http://www.bankofamerica.com/deposits/checksave/index.cfm ?template=save_regular Saving Options Savings Accounts Certificates of deposit (CDs) Requires a minimum deposit, money to remain deposited for a period of time without penalties. Penalties may be assessed if money is withdrawn before specified time. Wachovia Rates and Fees https://www.wachovia.com/savings/featured-cd.html Bank of America Rates and Fees http://www.bankofamerica.com/deposits/checksave/index.cfm? template=save_overview Saving Options Savings Accounts Money market account Requires a minimum deposit and interest is earned based on government and corporate securities. Usually withdrawals are allowed without penalties. Wachovia Rates and Fees https://www.wachovia.com/savings/money-market.html Bank of America Rates and Fees http://www.bankofamerica.com/deposits/checksave/inde x.cfm?template=save_overview Main Categories of Investing Options Stocks Bonds Mutual Funds and Exchange-traded Funds Real Estate Commodities Collectibles Stock Investments Two main categories of stock: Preferred Pays dividends at a set rate. Common Represents general ownership in company and sharing of profits. Stock Investments cont. What are the major similarities and differences between preferred and common stocks? Major similarities between preferred and common stock are: Both have investment risks and pay dividends Major differences between preferred and common stock are: Preferred stock pays dividends before common stock is paid. Preferred stockholders do not have voting powers; but common stockholders are invited to annual corporate meetings and permitted to one vote per share of stock owned. Preferred stock is less risky than common stock. Stock Investments cont. What are stockbrokers? How do stockbrokers get paid? Stockbrokers buy and sell stock and bonds at a set price for a commission for stockholders. Commission and fees from the buying and selling of stocks and bonds. Stock exchange The stock exchange is where the trading of securities take place. NYSE: New York Stock Exchange www.nyse.com NASQAQ:National Association of Securities Dealers Automated Quotation System www.nasdaq.com Stock Investments cont. What is market value of stock? The market value of stock is the price for which a share of stock can be purchased. What effects the market value of stock? What might make the price of a stock increase? What might make the price of a stock decrease? At what market value do you want to purchase stock? Stock Table A B 52 Week Sales High Low C D E F G H I Vol 100s High Low Last Chg 6 1/2 -1/8 Stock Div Yld PE 12 1/8 8 AAR .44 6.2 15 6 6 3/4 6 5/8 49 1/2 31 1/4 ACF 1.76 7.4 7 477 36 1/4 37 5/8 AMF 1.36 6.7 7 133 17 1/2 17 1/2 8 10 33 7/8 33 7/8 26 1/2 6 1/8 16 3 1/8 ARA 2 7 37 17 1/2 33 +3/4 -3/8 -1 Stock Table Key A-Highest and lowest price of stock during the past 52 weeks B-Symbol used to represent the company and current dividend as dollars per share of stock C-Dividend yield based on current selling price D-Price-earning ratio E-Number of shares exchanged on trading day. The amount is listed in 100’s. F-Highest price of a share on trading day G-Lowest price of a share on trading day Selecting Stock Factors that could influence investors in selecting stock: Economic Inflation Interest rates The higher the rate the more an investor can make. Consumer spending The interest rate of the investment must be higher than the inflation rate to make money. If consumer’s are spending money the market value of the stock will rise. Employment Lower unemployment rates mean the economy is better and more people may invest. Types of Markets Bull Market A bull market is associated with increasing investor confidence, and increased investing in anticipation of future price increases. It is a transition from fear and pessimism to investor optimism. Bear market ( Positive ) ( Negative ) A bear market is a general decline in the stock market over a period of time. It is a transition from high investor optimism to widespread investor fear and pessimism. Investing Ratios Current Yield Ratio Earnings Per Share Ratio The Current Yield is calculated by dividing the amount an investment makes a year, in interest or dividends, by the market price. Earnings per share, (EPS), is calculated by dividing a company's earnings, net income, by the number of outstanding shares. Price-Earnings Ratio The Price Earnings Ratio is calculated by dividing the market price of a stock by the Earnings Per Share (EPS) Investing Ratios Current Yield Ratio A stock earned $25 last year and has a market value of $100 25/100 = .25 or 25% A stock earned $35 last year and had a market value of $100 35/100 = .35 or 35% A stock earned $45 last year and had a market value of $100 45/100 = .45 or 45% Investing Ratios Earnings Per Share Company 1 had a net profit of $10,000 and 1,000 shares of stock outstanding. 10,000/1,000 = 10 Company 2 had a net profit of $20,000 and 1,000 shares of stock outstanding. 20,000/1,000 = 20 Company 3 had a net profit of $30,000 and 1,000 shares of stock outstanding. 30,000/1000 = 30 Investing Ratios Price Earnings Ratio Company 1 had a market value of $50.00 per share and Earnings Per Share of 10. 50/10 = 5 Company 2 had a market value of $50.00 per share and Earnings Per Share of 20. 50/20 = 2.5 Company 3 had a market value of $50.00 per share and Earnings Per Share of 30. 50/30 = 2.5 Investing Ratios Lets look at some companies on the NYSE and check their financial information. Walmart Target McDonalds Wendy’s Coca Cola Pepsi www.google.com/finance Bond Investments What is a bond? A promissory note to pay back a specified amount of money at a stated rate on a specific date. Are issued to lend funds to the organization selling the bond. Main Categories of Bonds Government bonds Municipal bonds Issued by local and state governments for public service projects. Bond Investments cont. Main Categories of Bonds Government bonds U.S. savings bonds The federal government issues Series EE bonds, HH bonds, and I bonds. Also the federal government issues Treasury bills and notes. The EE bond interest is paid once the bond is cashed. The HH bond interest is paid twice a year, which may be considered income. Treasury bills and notes The treasury bills and notes differ by their maturity time frame. Treasury bills may reach maturity between 91 days to a year; where as treasury notes take one to ten years. Bond Investments cont. Main Categories of Bonds Corporate bonds Purchasing corporate bonds is a means of loaning money to a company. Lenders versus owners as it relates to investing in a company’s stocks and bonds Bond Investments cont. How does stated interest rate impact the value of a bond? The stated interest rate usually determines the price investors want to pay for a bond. If a bond’s stated interest rate is lower than similar ones, investors will most likely want to pay less for the bond. If the stated interest rate is higher than similar ones, the seller will most likely want to be paid more than its face value. Mutual Funds Definition A collection of stocks and/or bonds that brings together a group of people and invests their money in stocks, bonds, and other securities. Each investor owns shares, which represent a portion of the holdings of the fund. Companies’ major tasks in assisting investors of mutual funds Assist investors of mutual funds by studying companies stocks and bonds, and then buying a variety of stocks and bonds to sell. Mutual Funds Why invest in mutual funds? They are diverse, made up of different investments, and can help the investor during poor financial times by spreading out the risk If the stock market drops the bonds and other types of investments will protect the fund. If the bond market drops the stocks and other investments will protect the fund. Mutual Funds Some examples of mutual fund categories Aggressive-growth stock funds Look for quick growth, but also have an higher risk than other stock. Income funds Concentrate on stocks that pay regular dividends. Mutual Funds cont. Some examples of mutual fund categories cont. International funds Sector funds Purchase stocks of companies in the same industry. Bond funds Invest in a variety of company stock around the world. Concentrate in corporate bonds. Balanced funds Invest in both stocks and bonds. Other Investments Real Estate Includes land and anything attached to it. House, condominium, mobile home park, etc. Advantages tax benefits increased equity pride of ownership Disadvantages property taxes interest payments property insurance maintenance Other Investments cont. Commodities and futures Grain, livestock, and precious metals Commodity investors usually agree to buy and sell for an amount at a specified price in the future and these are known as futures Examples may include rice, cattle, and gold http://money.cnn.com/data/commodities/ Other Investments cont. Collectibles Collectibles are items collected over time that may increase in value Examples may include art work, antique furniture, and autographed items Evaluation factors for savings and investing options Evaluation Factors Safety and risk What’s the current and potential future cost? Guarantee of money invested to be returned Can the potential risk be afforded? Low tolerance risk High tolerance risk Diversity of investment options Potential yield How much is the investment going to make? Acceptable yield High yield Low yield Evaluation Factors cont. Liquidity How quickly can the investment be turned into cash without losing any value. High liquidity Low liquidity Taxes How much is Uncle Sam going to take? Taxed earnings Tax-exempt earnings