INVESTMENTS

advertisement

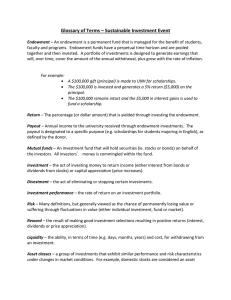

Chapter 13 Investments Investment Strategies Retirement Planning The Stock Market Other Investments Estate Planning Investment Characteristics Return – the income that an investment produces Liquidity: how easily it is turned into cash Volatility- the degree to which an investment’s return or value may change Risk- the possibility of variation in the return on your investment Simple Interest • Interest paid one time per year at the end of the year on the average balance on the account. Compounded Interest • Interest paid on the principle and also previously earned interest. Rule of 72 A quick way to evaluate an interest rate. Divide the interest rate into 72 and you get the number of years it takes for the money to double. ex. An account paying 6% will double in 72/6 = 12 years ex. An account paying 4% will double in 72/4 = 18 years STOCKS Why is a stock issued? When a company wants to raise money to start or expand its business What is a share of stock? A piece of the company When you purchase stock in a company you will receive a stock certificate. (This your proof of ownership.) WHERE CAN I BUY ONE? Stock Exchanges National Corporations are usually traded on the “floor” of the New York Stock Exchange (NYSE) or the American Stock Exchange (AMEX). The NASDAQ is not a physical space for trading. It is a telecommunications network done electronically. Where else? Over the Counter Stock OTC: A network of stock brokers who buy and sell the securities of corporations that are not listed on the securities exchange. Usually OTC stocks are small businesses not able to make it on the other lists they’re called unlisted stocks Common vs. Preferred Stock Preferred *Pays a fixed dividend *More conservative *Less risk *If the company goes bankrupt, the preferred stockholders get paid first Common *Dividends depend on profits earned and vary from year to year *Can vote for Board of Directors Bonds A bond is a written pledge that it will repay a specified amount of $ with interest InterestA % that is multiplied on the principle (base amount) Types of Bonds Corporate- issued by corporation to raise money to continue, or improve the business Municipal Bonds-State/local government: A security issued by the state or local government for major products such as airports, school, toll roads More Bonds Treasury Securities- Federal Government U.S. Savings BondsLoan to the government Tax Advantage CONSIDERED TO BE RISK FREE Stock Terminology Odd lot: Fewer than 100 shares of stock Round lot: 100 or multiples of 100 shares of stock Who regulates? Securities Exchange Commission (SEC): regulates laws concerning trading stocks and bonds. What are some conditions that may cause a stock’s price to rise or fall? Stock split Weak economy Buy-out or merge Lay-offs Low earnings New product * The market price of common stock is determined by the demand for the stock. Diversification A strategy of making a variety of investments in order to reduce your exposure to risk. How can I begin my portfolio? You have to learn and make intelligent decisions. Look at reliable media sources Take a course in financial planning Take part in an investment club- a group of people who meet regularly to learn and make investments together Listen to professional advisors Financial News Business Sections of local newspapers Evening news programs (Wall Street Week) CNN Wall Street Journal – most widely known financial newspaper Internet