Chapter 2

advertisement

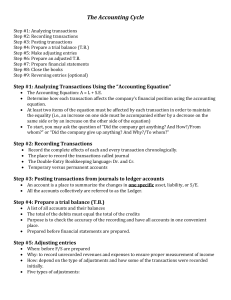

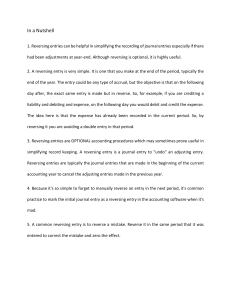

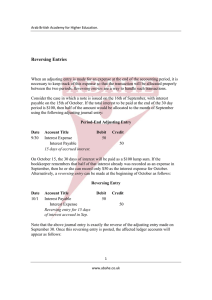

Chapter 3 The Accounting Information System ACCT-3030 1 1. Accounting Equation A = L + SE Expanded: A = L + SE + R + G - E - L Definitions of elements ACCT-3030 2 2. Financial Statements Balance Sheet Income Statement Statement of Stockholders’ Equity (or Retained Earnings Statement) Cash Flow Statement Articulation ACCT-3030 3 3. Accounts Definition Number needed T account General ledger ACCT-3030 4 4. Debits and Credits Definitions Increases and decreases Normal balance Balance of an account ACCT-3030 5 5. Journal Entries Journalizing Format Posting Special journals Analyzing transactions E 3-1 ACCT-3030 6 6. Trial Balance Definition Purpose When prepared? Order of accounts ACCT-3030 7 7. Adjusting Entries Purpose Types ◦ Deferrals – cash flow occurs before revenue/expense recognition Expense, Revenue ◦ Accruals – cash flow occurs after revenue/expense recognition Expense, Revenue ◦ Other Bad debts, Depreciation, Cost of goods sold ACCT-3030 8 8. Deferred Expense Adjustments On January 1 you paid $1,800 for three months’ rent in advance. ACCT-3030 9 9. Deferred Revenue Adjustments On May 1 your tenant pays you $3,600 for four months’ rent in advance. ACCT-3030 10 10. Accrued Expense Adjustments On December 31 your employees have earned wages of $10,000 but they will not be paid until January 5. ◦ Without reversing ◦ With reversing ACCT-3030 11 11. Accrued Revenue Adjustments As of December 31 another of your apartment building tenants has not paid his December rent of $700. ◦ Without reversing ◦ With reversing ACCT-3030 12 12. Reversing Entries Purpose If you choose to use reversing entries, what adjustments should be reversed? ◦ All accruals ◦ Deferrals initially recorded as a revenue or expense ACCT-3030 13 13. Other Adjusting Entries Bad Debts Adjustment Depreciation Expense Inventory and cost of good sold adjustments ◦ Perpetual inventory system ◦ Periodic inventory system ACCT-3030 14 14. Closing Entries Purpose Entries ◦ Using income summary account Close temporary accounts with Cr balances to income summary Close temporary accounts with Dr balances to income summary Close income summary to retained earnings Close dividends account to retained earnings ◦ Making one entry ACCT-3030 15 15. Cash Basis of Accounting Definition GAAP requirements Conversion to accrual basis ACCT-3030 16