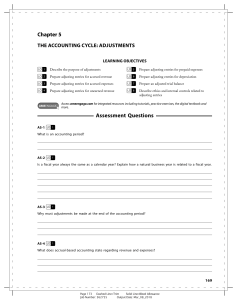

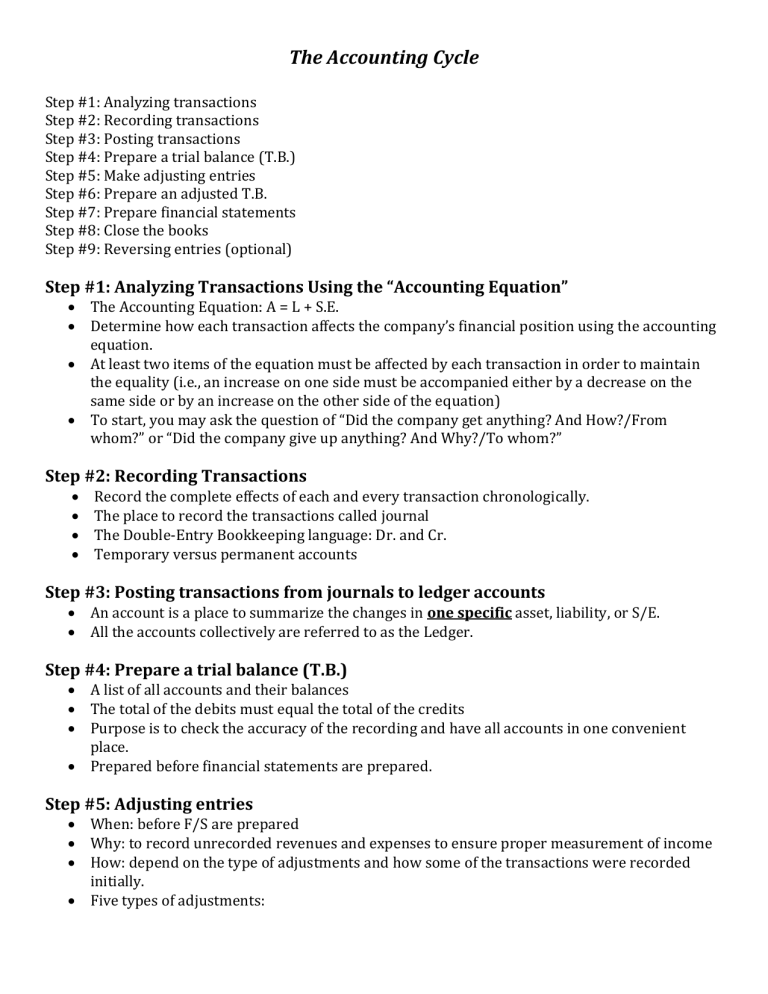

The Accounting Cycle Step #1: Analyzing transactions Step #2: Recording transactions Step #3: Posting transactions Step #4: Prepare a trial balance (T.B.) Step #5: Make adjusting entries Step #6: Prepare an adjusted T.B. Step #7: Prepare financial statements Step #8: Close the books Step #9: Reversing entries (optional) Step #1: Analyzing Transactions Using the “Accounting Equation” The Accounting Equation: A = L + S.E. Determine how each transaction affects the company’s financial position using the accounting equation. At least two items of the equation must be affected by each transaction in order to maintain the equality (i.e., an increase on one side must be accompanied either by a decrease on the same side or by an increase on the other side of the equation) To start, you may ask the question of “Did the company get anything? And How?/From whom?” or “Did the company give up anything? And Why?/To whom?” Step #2: Recording Transactions Record the complete effects of each and every transaction chronologically. The place to record the transactions called journal The Double-Entry Bookkeeping language: Dr. and Cr. Temporary versus permanent accounts Step #3: Posting transactions from journals to ledger accounts An account is a place to summarize the changes in one specific asset, liability, or S/E. All the accounts collectively are referred to as the Ledger. Step #4: Prepare a trial balance (T.B.) A list of all accounts and their balances The total of the debits must equal the total of the credits Purpose is to check the accuracy of the recording and have all accounts in one convenient place. Prepared before financial statements are prepared. Step #5: Adjusting entries When: before F/S are prepared Why: to record unrecorded revenues and expenses to ensure proper measurement of income How: depend on the type of adjustments and how some of the transactions were recorded initially. Five types of adjustments: (1) Prepaid expense: expenses that were paid for in advance and were unused are used/expired at the end of the period; (there are two ways to record the transactions initially and two ways to adjust them accordingly) (2) Unearned revenue: revenues that were collected in advance and were unearned are earned by the end of the period; (there are two ways to record the transactions initially and two ways to adjust them accordingly) (3) accrued expense: expenses already incurred, but have not been paid for and are not recorded; (4) accrued revenue: revenues already earned, but have not been collected and are not recorded; and (5) other adjustments: e.g., bad debt expense related to accounts receivables; cost of goods sold. Step #6: Prepare an adjusted T.B. An adjusted T.B. is the T.B. after adjusting entries are posted Use of worksheet Step #7: Prepare F/S Income Statement Statement of S/E or R/E Balance Sheet Statement of Cash Flows (will be dealt with later) Step#8: Close the books (closing entries) When: After F/S are prepared and only at the end of the fiscal year Purpose: to close all temporary accounts (all revenues, expenses, and dividends) to R/E account. Don’t close prepaid expense (which is an asset) and unearned revenue (which is a liability) accounts The four entries to close the books: o Close the revenues to income summary o Close the expenses (and contra revenue accounts) to income summary o Close income summary to R/E o Close dividends to R/E Step #9: Reversing entries (optional) When: after the closing entry What: reverse some adjusting entries, specifically, o Prepaid expense adjustment (only if the pre-payment was recorded as an expense initially) o Unearned revenue adjustments (only if advance collection was recorded as a revenue initially) o All accrued expense adjustments o All accrued revenue adjustments The reversing entries are dated the first day of the next period (therefore becomes part of next year’s accounting records).