Price Indexes & Aggregate Price Level

advertisement

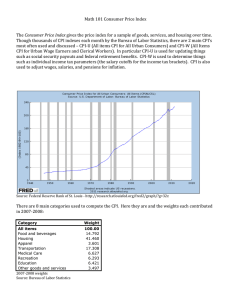

Price Indexes & Aggregate Price Level Chapter 7 Price Indexes To measure the aggregate price level, economists calculate the cost of purchasing a market basket. A price index is the ratio of the current cost of that market basket to the cost in a base year, multiplied by 100. A Simple Year-to-Year Market Basket Comparison Basket of Goods Prices 2003 2004 Expenditures 2003 2004 10 pairs of jeans $20.00/pr. $25.00/pr. $200 $200 12 flannel shirts 15.00/ea. 20.00/ea. 180 240 100 lbs. Apples 0.80/lb. 1.05/lb. 80 105 80 lbs. Oranges 1.00/lb. 1.00/lb. 80 80 $540 $675 Total Expenditures Price index in 2003 $675 X 100 125 $540 Calculating the Cost of a Market Basket Inflation Rate • The inflation rate is the yearly percentage change in a price index, typically based upon Consumer Price Index, or CPI, the most common measure of the aggregate price level. CPI The consumer price index, or CPI, measures the cost of the market basket of a typical urban American family. The Makeup of the Consumer Price Index in 2004 Some Questions to Ask? • Who is a typical consumer? • Do we all consume the same stuff? • Do different countries use different weights? – How about different regions of the same country? Price Effects • Two basic lessons: – Not all prices rise at the same rate during inflation. – Not everyone suffers equally from inflation. Price Changes in 2000 Prices That Rose (percent) Gasoline +28.5 Prices That Fell (percent) Coffee –0.5 Lettuce +9.5 Video rentals –1.5 Airfares +9.4 Women’s dresses –6.9 Textbooks +7.0 Oranges –14.7 Cable TV +4.8 Computers –23.2 College tuition +4.1 Average inflation rate: +3.4% Is the CPI Biased • The CPI is biased upward when new products whose prices are falling are left out of the market basket. Biased • The CPI is not a perfect measure of inflation because an increase in price may be caused by quality improvements. • There is no consensus on how large a Bias (if any)! The CPI, 1913–2004 Other Price Measures • A similar index to CPI for goods purchased by firms is the producer price index. • PPI responds to inflationary/deflationary pressures more quickly than the CPI Other Price Measures • Economists also use the GDP deflator, which measures the price level by calculating the ratio of nominal to real GDP. • The GDP deflator for a given year is 100 times the ratio of nominal GDP to real GDP in that year. The CPI, the PPI, and the GDP Deflator The three different measures of inflation usually move closely together. Each reveals a drastic acceleration in the inflation rate during the 1940s and the 1970s and a return to relative price stability in the 1990s. Political importance of CPI • CPI plays an important and direct role in most peoples lives so it is the most politically sensitive index