Investment Thesis

advertisement

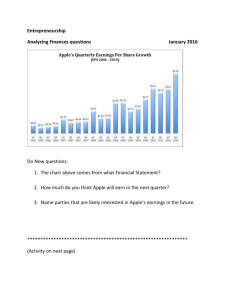

Green & Gold Fund Recommendation: Hold Apple (AAPL) Buy limit at $425 per share Investment Thesis We recommend a hold on AAPL and a buy limit at $400 per share. We believe Apple is a healthy company that will recover from its current short term downtrend through its expansion into China’s mobile market and upcoming product line innovations. Financial Information • Continuously increasing revenue, free cash flow, net income. Long term uptrend, Short term downtrend AAPL Investment Information Apple Inc. (AAPL) -NasdaqGS 452.67 61.34(11.93%) 1:58PM EST – Nasdaq Prev Close: 514.01 Open: 460.14 Bid: 454.15 x 100 Ask: 454.27 x 400 1y Target Est: 713.32 Beta: 0.93 Day's Range: 450.66 - 465.73 52wk Range: 443.14 - 705.07 Volume: 40,781,143 Avg Vol (3m): 21,523,100 Market Cap: 427.23B P/E (ttm): 10.29 EPS (ttm): 44.15 Div & Yield: 10.60 (2.10%) SWOT Analysis Strengths: • Well Diversified Product Mix • Robust Research & Development • Strong Brand Image Weaknesses: • Dependence on Network Providers • Unresolved Legal Proceedings • Limited iPhone/Mobile Phone Variants Opportunities: • Innovative Products & Designs • Scope in Retail Segment • Emerging Markets Providing Ladder for Growth Threats: • Intense Competition • Absence of Multiple Distribution Network • Theft of Digital Content Source: GlobalData AAPL Earnings and Estimates • Apple forecast sales of $41 billion to $43 billion for the second quarter. That compares with predictions by analysts for revenue of $45.5 billion. • Apple is also changing the way it provides financial outlooks to investors, after years of exceeding quarterly profit estimates by an average of 26 percent. Rather than providing “conservative” forecasts, Apple expects to report results within its predicted range. Product Sales Compared with Analyst expectations • 13-week fiscal 2013 first quarter ended December 29, 2012 below expectations but still setting record sales highs. Note that last year was a 14 week quarter. • Sales rose 18 percent to $54.5 billion, falling short of $54.9 billion, the average analyst estimate compiled by Bloomberg. The lack of profit growth reflects higher manufacturing costs due to a product lineup overhaul ahead of the holiday shopping season. The company introduced the iPhone 5, iPad mini and a restyled Mac. Additionally, the products that are selling the best happen to be the ones with the lowest profit margins. • These results compare to revenue of $46.3 billion and net profit of $13.1 billion, in the 14-week year-ago quarter. • Gross margin was 38.6 percent compared to 44.7 percent in the year-ago quarter. But is still higher than the estimated 36% in October. • International sales accounted for 61 percent of the quarter’s revenue. • Sold 4.1 million macs, estimates were 5.1 million (Cook said Apple couldn’t manufacture enough Macs to keep up with demand, holding back sales) • Sold 12.7 million iPods, estimates 11.4 million • Sold 47.8 million iPhones, estimated 47.8 million • Sold 22.9 million iPads, estimated 22.4 million Growth Opportunities • AAPL is just now beginning to expand into the Chinese market, which is the largest in the world. They opened 4 new stores there this past quarter. • Further revisions and expanding of the Apple TV product line. • Creating a product line of less expensive iPhones. iPhone 5 • The Wall Street Journal reported on January 14th that Apple was slashing orders for iPhone 5 parts by half. Apple notified suppliers last month that it was cutting orders of LCD screens and other components for the current quarter. Weaker-than-expected demand and lackluster sales for the iPhone 5 have been cited as the reasons behind the production changes. • According to Morningstar, Apple's forecast was for 65 million iPhone screens in the March quarter. • “If accurate, we suspect that such a forecast would have been unrealistically high to begin with and that some degree of order cuts should have been expected.” • “Apple could still be reasonably expected to sell at least 40 million iPhones, if not 50 million, in the March quarter, which we would consider to be a strong number.” CHINA • China Mobile, the largest mobile service provider in the world with over 700 million subscribers, currently does not offer the iPhone. China Mobile’s network system is incompatible with the technology used in iPhones. • CEO Tim Cook met with China Mobile executives earlier this month to discuss “matters of cooperation.” • "China is currently our second largest market. I believe it will become our first. I believe strongly that it will.” – CEO Tim Cook • “Our revenues were $7.3 billion in the quarter(In Greater China). So, this is incredibly high, it’s up over 60% year-on-year. And again, that’s comparing 13 to 14 weeks and so it’s really the underlying growth, it’s higher than that. We saw exceptional growth in iPhones into the triple digits. iPad, we shipped iPad very late in the quarter in December, and despite that, saw very nice growth. We are expanding in Apple retail there. In the year ago quarter, we had 6 stores we now have 11. We obviously have many more to open there. In our premium resellers, we went over 400, up from a little over 200 in the previous year. And we increased iPhone point of sales from 7,000 to over 17,000 there. And now this isn’t nearly what we need and it’s not the final by any means, we are not even close to that, but we are making, I feel that we are making great progress that was just over there recently. And I was talking to a lot of different people and I am very happy with how things are going.“ Tim Cook Recommendation Sector : ITT Current Holdings: IXP, IXN, EMC, ORCL, AAPL Target Sector Allocation: 11.52% Current Sector Allocation: 7.94%, Purchased 20 shares of AAPL on March 24, 2011 @354.64 per share. ($7,093) • Currently @ 503.02 per share. ($10,060) • $2,967 Gain • • • • • • HOLD 20 shares of AAPL. ($10,060, 2.54% of portfolio, 27.32% of sector) BUY LIMIT at $425. • year end target price: $713.32