Fiscal Impact Tool Webinar

advertisement

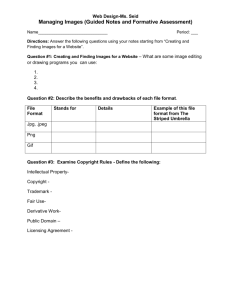

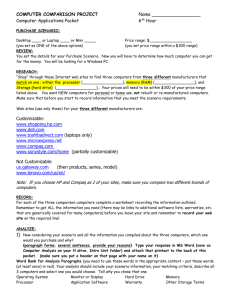

Envision Tomorrow + Fiscal Impact Tool (ET+FIT) July 16th, 2013 FIT Discussion Topics • • • • ET+FIT Overview Revenue Projections Expenditure Projections Output and Summary Model Overview • • • Method based on the Federal Reserve Fiscal Impact Tool (FIT) – County-level analysis – Aggregates all sub-county jurisdictions – Provides a standardized method for conducting planning-based fiscal assessments Revenues & Cost based on the Census of Gov’t finance data (2010) – Provides user override for all assumptions User inputs: – County / Municipal population – Annual taxable sales (County total & City) – Property & Sales tax rates (weighted average) – Property assessment ratios (weighted average) – Added population & employment (from ET+) – Added project value by land-use (from ET+) What drives the model? ANNUAL EXPENDITURE ANNUAL REVENUE FIT MODEL NET BENEFIT Existing Conditions What is the current fiscal outlook? • Census of Governments (2010) - County-level data Annual revenue, capital outlays, operations & maintenance • Local data (2011) - Taxable sales - Tax rates - Assessment Ratios Local Data Sources More recent data (2011) gathered for each city, village and township and aggregated to the county level: • • • • State Auditor of Ohio - Summarized 2011 Annual Financial Data for all jurisdictions Ohio Department of Taxation – Sales tax and property tax rates for all jurisdictions Assessor’s Data– Assessed land and building valuation at the parcel level as an input to property tax calculations Longitudinal Employer-Household Dynamics Data (Census)– Counts of employment by location as an input to municipal income tax calculations FIT Data Sheet FIT MODEL Scenario Impact FIT MODEL • • • • Population change Employment change Private investment (value of new construction) Infrastructure costs Sample of ET+ Output What is Envision Tomorrow? • Suite of planning tools: • Prototype Builder • Return on Investment (ROI) model • Scenario Builder • Extension for ArcGIS A Linked System of Spreadsheets and GIS Buildings Development Types ROI Model Scenario Spreadsheet 5 Story Mixed Use Town Center 2 Story Mixed Use 3 Story Apartment Town Neighborhood Townhome Compact Single Family Conventional Single Family Residential Subdivision GIS Painting ArcGIS Evaluation Criteria Scenario Spreadsheet Density & Mix Travel Health Sustainability Investment Fiscal Impact Scenario Building Process Building Types Development Types Scenario Development Evaluation 1 Step 1: Model a library of building types that are financially feasible at the local level. Building Prototypes • • • • • • • Density and Design Rents, Sales Prices Market Value Employment Population Costs and Affordability Energy and Water Use Use Real-World Examples • Rents, sales prices calibrated to NEO region • Design and density modeled using local examples Scenario Building Process Building Types Development Types Scenario Development Evaluation 2 Step 2: Define the buildings, streets and amenities that make up all the “places” in which we live, work and play. Development Type Mix A Variety of Buildings, Streets and Amenities Create a “Place” Town Center Medium-Density Residential Single-Family Residential Development Types are Scalable from Parcels to Districts • Include one or many building types depending on scenario planning geography • Parcels, Census Blocks, uniform grid Place Types Composed of Regionally Calibrated Prototype Buildings Place Types Mix of Buildings Place Types Include Street Characteristics Place Type Example: Urban Center Housing Units per Acre Jobs per Acre Street Lane Miles per Acre Intersection Density per Sq Mi 40 DU/Gross Acre 50 Jobs/Gross Acre .07 204 Scenario Building Process Building Types Development Types Scenario Development 3 Step 3: Paint future land use scenarios to test the implications of different decisions or policies. Evaluation Hard Costs and Revenue From New Construction NEW CONSTRUCTION PRIVATE INVESTMENT + EMPLOYMENT CAPITAL OUTLAYS (INFRASTRUCTURE COSTS) TO FISCAL IMPACT TOOL Scenario Building Process Building Types Development Types Scenario Development Evaluation 4 Step 4: Compare the scenarios and monitor the impact of land use decisions in real-time. Questions? ET+FIT Overview • Up Next: Revenue Projections • Expenditure Projections • Output and Summary Projecting Future Revenue ET+ FIT applies user-defined tax rates to scenario-defined population, employment, and building values. • Revenue projections – – – – Property tax Sales tax Income tax Non-tax revenue • • • • Sewerage Solid waste Utility Intergovernmental USER-DEFINED TAX RATES FIT MODEL Sales Tax Revenue Projection • Annual sales tax revenue = [Total payroll in scenario] x [% consumer dollars spent subject to sales tax] • Payroll based on County Business Patterns (CBP) data and scenario employment by sector Property Tax Revenue Projection • Annual scenario property tax revenue = [market value of scenario construction] x [millage rate] x [assessment ratio] • Broken out by residential and commercial property types Income Tax Revenue Projection • [annual average wage by sector] x [scenario employment by sector] * [weighted average income tax rate] • Weighted average based on municipal population ratio – incorporated v.s. unincorporated population in county Proportional Ramp-up Projecting Future Sales Tax Revenue TAX REVENUE We assume that the scenario ramps up at a constant rate over the scenario period For example, over a period of 30 years – 3.3% per year TIME Non-Tax Revenue Projection NON-TAX REVENUE • Assume a constant per-capita revenue • [current non-tax revenue per person]*[new population in scenario] POPULATION Questions? ET+FIT Overview Revenue Projections • Up Next: Expenditure Projections • Output and Summary Projecting Future Expenditures • One-time expenditures (capital outlays) – New roadways, sewage treatment plant, school construction • On-going expenditures (operations & maintenance) – Public safety, housing and community development, roadway maintenance FIT MODEL Capital Outlay Projection • Envision Tomorrow + tracks capital outlay costs related to infrastructure: – Roads – lane miles of new roadway – Utilities – miles of overhead electric – Water/Sewerage – lineal feet of pipe Development Type Assumptions • Each development type has associated road lane miles per vacant acre assumptions • Less than 100% of these are publicly financed • City Architecture provided estimates of % publicly financed by development type • It is assumed that sewer, water, and utilities scale with miles of new roadway Sample of Development Type Street Assumptions Infrastructure Cost Assumptions New Infrastructure Costs (Capital Costs only) Unit Cost New Roadway Lane Mile $ Streetscape Lineal Foot $ - Sewerage Lineal Foot $ 100 Utilities - above-ground Mile $ 600,000 Water Lines Lineal Foot $ 227 Source: • Road – Arkansas DOT • Utilities - Western Mass. Electric Company • Sewerage – Dept. of Public Works, Ipswich, MA • Water Lines – Dept. of Public Works, Baltimore, MD 1,700,000 Operations and Maintenance (O&M) Projection • The following categories are tracked: – – – – – – – – – Education Hospitals Roads Police Fire Parks Sewerage Solid Waste Utility Operations and Maintenance (O&M) Projection • ET+FIT uses scenario capital outlay to “pivot” around existing annual per capita O&M • Future O&M is a factor of the change in average annual capital outlays • Future per capita O&M = [Baseline per capita O&M] x [% change in average annual capital outlay] • In estimating future O&M costs, it is assumed that all roads in a shared right of way will eventually be publicly maintained, even if privately constructed. Level of Service Assumption OPERATIONS AND MAINTENANCE Projecting Future O&M • We assume a fixed level of service. • Per capita O&M stays constant as population increases POPULATION Questions? ET+FIT Overview Revenue Projections Expenditure Projections • Up Next: Output and Summary Outputs • ET+FIT calculates the net present value of expenditure and revenue over the forecast horizon • Discount rate of 3.8% is same as the average federal funds rate over the last 30 years (1980-2010), less inflation (2%) User enters rate and forecast period: PROJECT ASSUMPTIONS Years from up front to on-going Discount Rate Period/Years Scenario 1 1 3.8% 30 FIT MODEL NET BENEFIT Outputs RampUp path: Discount rates are applied to costs and revenues over the forecast horizon. User can define when costs and revenues “ramp up” Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 Year 22 Year 23 Year 24 Year 25 Year 26 Year 27 Year 28 Year 29 Year 30 3% 6% 10% 13% 16% 20% 23% 26% 30% 33% 36% 40% 43% 46% 50% 53% 56% 60% 63% 66% 70% 73% 76% 80% 83% 86% 90% 93% 96% 100% Raw Inflated $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $43,465,920 $44,543,874 $45,648,562 $46,780,647 $47,940,807 $49,129,739 $50,348,156 $51,596,791 $52,876,391 $54,187,726 $55,531,581 $56,908,764 $58,320,102 $59,766,440 $61,248,648 $62,767,614 $64,324,251 $65,919,493 $67,554,296 $69,229,643 $70,946,538 $72,706,012 $74,509,121 $76,356,947 $78,250,600 $80,191,214 $82,179,957 $84,218,019 $86,306,626 $88,447,031 $90,640,517 Discounted $43,037,560 $42,613,422 $42,193,463 $41,777,644 $41,365,922 $40,958,258 $40,554,611 $40,154,942 $39,759,213 $39,367,383 $38,979,414 $38,595,269 $38,214,910 $37,838,299 $37,465,400 $37,096,176 $36,730,590 $36,368,608 $36,010,193 $35,655,310 $35,303,924 $34,956,001 $34,611,507 $34,270,408 $33,932,671 $33,598,262 $33,267,149 $32,939,299 $32,614,679 $32,293,259 Summary • The summary tab aggregates existing costs and revenues with 30 year cost and revenue streams to provide a revenue/cost ratio • If revenue/cost ratio is positive, revenue exceeds costs over the forecast horizon. • Net reduction tells us the direct impact of the scenario on the cost to revenue ratio. Positive means that there was a negative impact. • Scenario tells us the revenue/cost ratio of the scenario development by itself. Revenue/Cost Ratio 30 yr. 16.83% Net reduction -12.32% Scenario 65.25% Summary • Annual “full ramp-up” costs and revenues are broken out into categories SummaryOutput tab Scenario 1 Stream Value of chosen time horizon, in years: Total, One-Time and Ongoing One-time Ongoing Education Everything Else Revenue Source Taxes/Fees Intergovernmental Transfers Utilities/Services Revenue $783,436,635 $783,436,635 Cost $2,411,190,316 $3,314,830,336 $0 $62,071,065 $903,640,020 $101,852,568 $89,184,133 $6,655,054 $53,863,862 $1,946,688 30 yr. Net -$1,627,753,681 -$2,531,393,701 Questions? ET+FIT Overview Revenue Projections Expenditure Projections Output and Summary