PowerPoint - Regional Training Institute,Allahabad

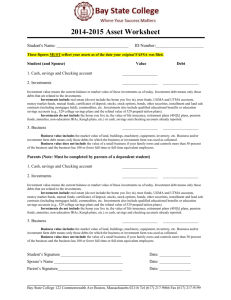

advertisement

Learning Objective: The trainees will be able to know about the Government investment in Equity, and about the Public Debt and other Liabilities of Governments ► Overview and Structure: ► The investments made by the Union and the State Governments in Statutory Corporations, Government Companies, other Joint Stock Companies, Co-operative Banks and Societies, and International Bodies by way of subscription to equity instruments of these entities The objective of the IGAS-10 is to lay down the principles for identification, measurement and disclosure of public debt and other obligation of Union and the State Governments including Union Territories with legislatures in their respective financial statements. It ensures consistency with international practices for accounting of public debt in order to ensure transparency and disclosure in the financial statements of Government for the benefit of various stake holders ► Indian Government Accounting Standard-9 GOVERNMENT INVESTMENTS IN EQUITY Introduction 1.1 Investments are made by the Union and the State Governments in Statutory Corporations, Government Companies, other Joint Stock Companies, Co-operative Banks and Societies, and International Bodies by way of subscription to equity instruments of these entities. ► 1.2 Investments by the governments constitute a portion of capital outlay of the Governments and dividends received are part of non tax revenue. ► 1.3 Government investments are primarily in the Public Sector wherein the focus is not only on generating adequate return on investments but also to ensure rapid economic growth, balanced regional development, employment generation, and meeting strategic and infrastructural requirements ► ► Objective ► The objective of the Standard is to lay down the norms for Recognition, Measurement and Reporting in respect of Investments made by the Union Government, the State Governments and Governments of Union Territories with Legislatures in their respective Financial Statements to ensure complete, accurate, realistic and uniform accounting practices, and to ensure adequate disclosure on investments made by the Governments consistent with best international practices. Scope ► This Standard applies to entities which keep a record of investments made by the Government for incorporation and presentation in the Annual Financial Statements of the Government. This standard will apply only to government accounts being maintained on a cash basis. This standard applies to only instruments that are in the nature of equity of the investee entities and not to debt instruments like debentures, bonds, preference shares etc. Financial Statements will not be considered as giving fair and complete picture of Investments unless they comply with these standards Definitions ► ► ► ► ► ► ► ► 4.1 The following terms used in the Standard have meanings as specified here under, unless the context otherwise requires: Accounting Authority is the authority which prepares the Financial Statements of the Governments. Accounting Period means the period covered by the Financial Statements. Bonus shares are shares issued free of cost to the shareholders of a company, by capitalizing a part of the company’s reserves. Cash Basis of accounting is that wherein accounting transactions of an entity represent the actual cash receipts and disbursements during a financial year as distinguished from the amount due to or by the entity during the same period. Consolidated Fund of India is the fund referred to in clause (1) Article 266 of the Constitution of India. Consolidated Fund of the State is the fund referred to in clause (1) Article 266 of the Constitution of India. Debentures are an instrument of debt executed by the company acknowledging its obligation to repay the sum at a specified rate and also carrying an interest. ► ► ► ► ► ► ► ► ► ► ► ► ► Equity is the residual interest in the assets of the enterprise after deducting all its liabilities. Equity Instrument is any contract that evidences a residual interest in the assets of an enterprise after deducting all of its liabilities. Equity shares are all shares which are not preference shares. Financial statements mean the Annual Finance Accounts of the respective Governments. Government means the Union Government or any State Government or Government of any Union Territory with Legislature. Historical Cost is the transaction value including incidental costs at the time of transaction Investee Entity is an entity in whom an investment is sanctioned by the Government. Investee Group consists of a group of investee entities of similar nature and characteristics. Investments are financial assets created by the Governments by providing money, goods or services directly or indirectly to the investee entities. These financial assets are in the nature of equity of the investee entities. Major Heads of account represent the functions of Government as per the ‘List of Major and Minor Heads of Account of Union and States’. Minor Heads of account represent various programmes undertaken by departments of Government to achieve the objectives of the function represented by the major head as per the ‘List of Major and Minor Heads of Account of Union and States’. Net worth is the total assets minus total outside liabilities Parliament means the Parliament of India. ► ► ► ► Planning Commission means the Central Planning Commission set up by the Government through a resolution in 1950. Preference shares are shares which have the following two characteristics; (a) that as respects dividends they carry or will carry a preferential right to be paid a fixed amount or an amount calculated at a fixed rate. (b) that as respect capital, it carries or will carry, on winding up or repayments of capital, a preferential right to be repaid the amount of the capital paid-up or deemed to have been paid up. Sector consists of a grouping of specific functions or services as per the ‘List of Major and Minor Heads of Account of Union and States’. Sub-Major Heads of account represent the subfunctions of Government and are under the Major Heads and are as per the ‘List of Major and Minor Heads of Account of Union and States’. Recognition ► 5.1 An investment shall be recognized by the disbursing entity as an asset from the date the money is actually disbursed and not from the date of sanction. ► 5.2 Loans converted into equity shall be treated as investments from the date of conversion in as much that they shall lead to an increase in the investment amount from the date of conversion. Measurement and Valuation ► ► ► ► 6.1 Historical Cost measurement shall be the basis for accounting and reporting on investments made by Governments 6.2 The total amount of investments on the last date of a accounting period shall be the investments at the beginning of the period with additions and disinvestment/ sale of investments during the period. 6.3 The method of initial measurement and valuation of investments in the Financial Statements of the Governments is to measure at historical cost of the investments. 6.4 Subsequent to initial valuation too, Investments will be reflected in the Financial Statements at Historical cost Disclosure 7.1 The Financial Statements of the Union and State Governments shall disclose the Amount of Investments at the beginning and end of the accounting period showing additional investments and disinvestments. The financial statements shall also disclose the dividend received. An additional column in the relevant Financial Statements shall also reflect the amount of dividend declared. This amount will not be accounted for but will only be in nature of an additional disclosure. ► 7.2 The Financial Statements of the Union and State Government shall disclose the following details under ‘Investments made by the Union/State Government’ in the Annual Finance Accounts of the Union Government: ► (a) Summary of Investments: Investee group-wise ► (b) Summary of Investments: Sector-wise. ► 7.3 The Financial Statements of the Union/State Government shall disclose the following details under ‘Detailed Statement of Investments made by the Union/State Government’ in the Annual Finance Accounts of the Union Government: ► ► ► ► ► (a) Detailed Statement of Investments showing the Major Head and Minor Head-wise Details. (b) Detailed Statement of Investments made: Entity wise 7.4 The Financial Statements of the Union and government shall disclose the following details under ‘Additional Disclosures’ in the Annual Finance Accounts of the Union/State Government: (a) Fresh Investments and deduction/ disinvestment made during the year. 7.5 The Financial Statements shall reflect the total amount of investments at the beginning and end of the accounting period along with the additions made during the year by way of fresh investments to the opening balance and deductions there from by way of disinvestments to arrive at the closing balance. Also the amount of dividend received will be reflected as revenue of the period. An additional column in the relevant Financial Statements shall also reflect the amount of dividend declared, though not necessarily received. This amount will only be by nature of an additional disclosure and not accounted for. 7.6 Financial Statements of both the Union and the State Governments shall disclose details of Investments made in various investees in their respective Annual Finance Accounts in three parts. For the Union Government these would be ‘Investments made by the Union Government’, ‘Detailed Statement of Investments made by the Union Government’ and ‘Additional Disclosures’ in the Annual Financial Accounts of the Union government. ► 7.7 The State Government will have a similar three tier presentation in Annual Finance Accounts of the State ‘Investments made by the State Government’, ‘Detailed Statement of Investments made by the State Government’ and ‘Additional Disclosures’ in the Annual Finance Accounts of the State Government. ► 7.8 The Detailed Statement of Investments made by the Government, on the other hand, shall disclose the major head-wise and minor head-wise details of the investments made by Governments as also detailed statements of entity wise investments. ► 7.9 Another Detailed Statement of Investments made: Entity wise in the Finance Accounts of the Governments shall report details including the full name of the entity, the number of shares and the total amount invested. While indicating the details, the shares purchased and those allotted as bonus shall be depicted separately along with year of allotment and then added together to give the total number of shares. It shall also disclose the total paid up capital of the entity and its current net worth. This would help indicate the extent of government control and whether the investment has appreciated or depreciated. Moreover, where the shares are traded in the market, the amount of investment in terms of market value shall also be disclosed as on the last date of the reporting period. ► 7.10 The amount of dividend received and credited to government revenue shall also be reported entity wise. In case the dividend received pertains to previous accounting periods the figure would be starred and the year to which the amount actually pertains disclosed in the footnote. In addition, the dividend declared, though not necessarily paid, shall be disclosed. The net profit or loss during the year of the entity shall also be disclosed and this would help indicate the appropriateness of the dividend amount. ► 7.11 The Third, Additional Disclosure, shall disclose the fresh investments and disinvestments made during the reporting period. In addition it would disclose as a note on investments made in entities which have made a loss in the accounting period along with reasons for making the investment. ► 7.12 All the figures in the Financial Statements are ‘in lakhs’ of rupees. ► 8 Effective date ► This Indian Government Accounting Standard becomes effective for the financial statements effective for the Financial Statements covering periods beginning 1 April of the year after the notification of the Standard by the Government. 9- Format for disclosure ► Financial Statement of Union / State Government Statement of Investment made by the Union / State Government Section 1: Summary Investments: Investee Group wise (Rs in Lakhs) Investee Group 1 Balance on April 1, 20X0 2 Investments made during the year 3 Disinvest ments during the year 4 Balance on March 31, 20X1 (2+3) - (4) 5 Net increase/ decrease during the year (2-5) 6 ► Section 2: Summary of Investments : Sector wise Sector 1 Balance on April 1, 20X0 2 Investments during the year 3 Disinvestments during the year 4 Balance on March 31, 20X1 (2+3) - (4) 5 Net increase/ decrease during the year (2-5) 6 ► Sl. 1 Section: 1 Detailed Statement of Investments made by the Union / State Governments Name of N the o con cer n 2 Details of investment Total am ou nt 3 4 5 6 Net paid up cap ital Net worth/ net asset Liabil ity positi on Market value of invest ment/ Fair Value Net 7 8 9 10 pro fit/ los s Amount of divid end receiv ed and credit ed to Gove rnment durin g the year Amount of Divid end Decla red 11 12 ► Section- 2 : Major and Minor Head wise Details of Investments Major Head Minor Heads Balance on April 1, 20X0 Invest-ments During the year Disinvestment during the year Balance on March 31, 20X1 Net Increase/ decreas e during the year (3-6) Divident Receiv ed 1 2 3 4 5 6 7 8 Additional Disclosures ► Fresh Investments made during the year ( In lakhs of rupees) Investee Entity 1 Investment disinvestment Type of units Number of units Total amount invested Type of units Number of units 2 3 4 5 6 Total amount of disinvestment 7 ► Fresh Investment made during the year in those entities which suffered a net loss during the last year Name of the Investee Entity 1 Investment made during the year 201011 Amount of Investment as on March 31, 2011 Type of Un it Number of units Total amo unt Type of uni ts Numbe r of uni ts Total am ou nt 2 3 4 5 6 7 Net loss du rin g 20 10 20 11 Resons for inves t ment durin g 2010 -11 8 9 Indian Government Accounting Standard-10 Public Debt and Other Liabilities of Governments: Disclosure Requirements Introduction 1. In terms of Article 292 of the Constitution, the executive power of the Union extends to borrowing upon the security of the Consolidated Fund of India within such limits, if any, as may from time to time be fixed by Parliament by Law. Article 293(1) of the Constitution provides a similar provision in respect of State Governments. Section 48A(1) of the Government of Union Territory Act 1963 and Section 47A(1) of Government of NCT of Delhi Act 1991, also provides for borrowing upon the security of the Consolidated Fund of the Union Territory concerned or Consolidated Fund of the Capital within such limits, if any, as may be fixed by Parliament by law and the stipulations indicated therein. ► ► ► ► Objective ► 2. The objective of the IGAS is to lay down the principles for identification, measurement and disclosure of public debt and other obligation of Union and the State Governments including Union Territories with legislatures in their respective financial statements. It ensures consistency with international practices for accounting of public debt in order to ensure transparency and disclosure in the financial statements of Government for the benefit of various stake holders. ► Scope ► 3. The proposed IGAS shall apply to the financial statements prepared by the Union and State Governments and Union Territories with legislature. The IGAS shall also cover “other obligations” as defined in paragraph 4 of this Standard relating to definitions. The IGAS shall not include in its ambit, guarantees and other contingent liabilities and non-binding assurances ► Definitions ► ► ► ► ► ► ► ► ► 4. The following terms used in this standard shall have the meaning as specified hereunder, unless the context otherwise requires:- Accounting Authority means the authority who prepares the Financial Statements of the Governments. Accounting Period means the period covered by the Financial Statements. Cash Basis of accounting is that wherein accounting transactions of the Union Government, State Government and Government of Union Territory with legislature represent the actual cash receipts and disbursement during a financial year as distinguished from the amounts due to or by the relevant Government, subject to the exceptions as may be authorized under the Government Accounting Rules 1990 or by any general or special orders issued by the Central Government on the advice of the Comptroller & Auditor General of India. Consolidated Fund of India is the fund referred to in Article 266(1) of the Constitution of India. Consolidated Fund of a State is the fund referred to in Article 266(1) of the Constitution of India. Consolidated Fund of Union Territories with Legislature is the fund referred to in Section 47(1) of the Union Territories Act, 1963 and Section 46(1) of the Government of National Capital Territory of Delhi Act, 1991. Public Account of India is the fund referred to in Article 266(2) of the Constitution of India. Public Account of a State is the fund referred to in Article 266(2) of the Constitution of India. ► ► ► ► ► ► Public Account of Union Territory is the Public Account referred to in Section 47A (1) and Section 46A (1) of the Government of Union Territories Act, 1963 and the Government of National Capital Territory of Delhi Act, 1991 respectively. Financial Statements means the Annual Finance Accounts of the Union Government, State Governments and Union Territories with legislature. It would also include appropriate statements, schedules and notes to the above statements. Government means the Union Government or any State Government or Government of any Union Territory with Legislature. Face Value is the contract value of the Public Debt or other obligations. Public Debt includes internal and external debts of the Central Government, State Governments and Government of the Union Territory with legislature, as applicable. “Other obligations” refers to the net outcome of the receipt and payment transactions arising in the public account. It does not include transactions categorized as Remittances, Suspense and Miscellaneous and Cash Balance ► Measurement & Valuation ► 5. The Public Debt and Other Obligations incurred by Governments shall be accounted and reported on the basis of Face Value. For the purpose of reporting external debt, changes in the Balance at the end of the Accounting Period arising from variations in the rate of exchange shall also be reported ► ► ► ► ► Disclosure 6. The financial statements of the Union Government, State Governments and the Union Territories with legislature shall disclose the following details concerning Public Debt and other obligations:(a) the opening balance, additions and discharges during the year, closing balanc3e and net change in rupee terms with respect to internal debt; (b) the opening balance, additions and discharges during the year, closing balance and net change in rupee terms with respect to external debt, wherever applicable; (c ) the opening balance, receipts and disbursements during the year, closing balance and net change in rupee terms with respect of other obligations. ► ► ► ► ► 7. The Financial Statements of the Union Government and the State governments shall disclose the following details regarding servicing of debt and related parameters for the current year, preceding year and net change in rupee terms with respect to – (a) Interest paid by the governments on public debt, small saving, provident funds, and reserve funds and on other obligations. (b) Interest received on loans to State and Union Territory Governments, departmental Commercial Undertakings, PSUs and other Undertaking including Railways, Post & Telegraph. (c ) Interest received on other Loans, from investments of cash balances and other items. 8. External debt of the Central Government shall be classified according to source indicating the currency of transaction. Measurement of face value shall be in respect of both the currency of agreement and Indian rupees. It should also disclose the outstanding in terms of exchange rate prevailing at the end of the accounting period. ► Effective date ► 9. This Indian Government Accounting Standard becomes effective for the Financial Statements covering periods beginning on 1st April of the year after the notification of the Standard by the Government. ► Format for disclosure 10. The formats for the disclosures in the form of Tabular Statements indicated in Annexure 1 are illustrative in nature. The purpose of these Statements is to illustrate the application of the Standard to assist in clarifying its meaning. The use of the formats in the same form in Finance Accounts is not envisaged. STATEMENT NO.1 SUMMARY OF DEBT POSITION ► (a) Statement of Public Debt and Other Liabilities ► Name of borrowings 1 PUBLIC DEBT Consolidated Fund Internal Debt Market Loans Treasury Bills Securities issued to International Fincnail Institutions Bonds Ways and Means Advances Special Central Government Specurisies againse Small Savings Others External Debt* Loans from Foreign countries Loans from Multilateral Agencies and other Institution Others OTHER LIABILITIES Publice Accounts Small Savings, Provident Funds, etc. Reserve Funds bearing interest Reserve Funds not bearing interest Deposits bearing interest Deposits not bearing interest Balance as 1st April 2011 Receipt during the year Repayments during the year Balance as 1st March 2012 2 3 4 5 Net Increase / Decrease (in Rs.) 6 ► Statement showing Servicing of Debit and related parameters (1) Interest paid by Government(a) On Public Debt and Small Savings, Provident Funds (b) Interest on Reserve Funds (c) On other Obligations GROSS INTEREST (B) Deduct (a) interest received on loans to save and Union Territory Governments. (b) Interest from Departmental Commercial Undertakings, Public Sector Undertakings and other undertakings including Railways and Posts and Telegraphs. (c) Interest received on other loans, from investment of cash balances and other items, NET INTEREST Percentage of gross interest to the total revenue receipts………………………. Percentage of net interest to the total revenue receipts…………………. 2011-12 2010-11 Net Increase Decrease (in Rs.) / STATEMENT NO.2 Statement showing details of Foreign Loans ► Sl.No Name of Country / Institutions (Foreign currency indicated in brackets) Outstanding balanc e on 01/04/ 2011 Additions during 201112 Repayment during 20112012 Outstanding balance as on 31/03/2 012 ( Donor Currency in thousands at Historical Value) 1- (Austria (Euro) etc TOTAL Outstanding balanc es as on 31.03. 2912 (In crores of rupees ) Oustaing balanc es as on 31.03. 2012 ( In crores of rupees ) (Expressed in terms of Histori cal Value) (Converted at Curren t Exchan ge Rate) Exchange Rates adopte d 31/03/ 2012 Major/Minor head of account PART I - CONSOLIDATED FUND Receipt Heads (Revenue Account)(A) Receipt Heads (Capital Account)(A) Expenditure Heads (Revenue Account)(A) Expenditure Heads (Capital Account)(A) TOTAL - E - Public Debt F — Loans and Advances G — Inter-State Settlement 7810 - Inter-State Settlement TOTAL — Consolidated Fund PART II — CONTINGENCY FUND 8000 - Contingency Fund III 1 Opening balance as on 1.4.20x1 Receipt Disbursement Closing balance as on 31.3.20x2 PART III — PUBLIC ACCOUNT I — Small Savings, Provident Funds etc., J — RESERVE FUNDS — (a) — Reserve funds bearing Interest — 8115 - Depreciation/Renewal Reserve Funds, etc. ► N — Reserve Funds Bearing Interest TOTAL (b) - Reserve Funds not Bearing Interest 8223 - Famine Relief Fund, etc. TOTAL — Reserve Funds Not Bearing Interest TOTAL — J — Reserve Funds K—DEPOSITS AND ADVANCES— (a) — Deposits bearing Interest— 8336 - Civil Deposits, etc. TOTAL — DEPOSITS BEARING INTEREST (b) - Deposits not bearing interest 8443 - Civil Deposits, etc. TOTAL — DEPOSITS NOT BEARING INTEREST (c) - Advances TOTAL — Advances TOTAL — K — DEPOSITS AND ADVANCES L — SUSPENSE AND MISCELLANEOUS (a) — Coinage Accounts 8656 - Coinage Accounts, etc. ► TOTAL —MCoinage Accounts (b) — Suspense 8658 - Suspense Accounts, etc. TOTAL — Suspense (c) — Other Accounts 8670 - Cheques and Bills, etc. TOTAL — Other Accounts (d) — Accounts with Governments 8679 - Accounts with Governments of other Countries, etc. TOTAL — Accounts with Governments of foreign countries (e) — Miscellaneous 8680 - Miscellaneous Government Account, etc. TOTAL — Miscellaneous TOTAL — L — SUSPENSE AND MISCELLANEOUS M — REMITTANCES (a) — Money Orders and other remittances 8781 - Money Orders, etc. TOTAL — Money Orders and Remittances (b) — Inter-Government Adjustment Account 8786 - Adjusting Account between Central and State Government (c) — Exchange Accounts 8797 - Exchange Accounts, etc. TOTAL - M - REMITTANCES TOTAL - Public Account N - CASH BALANCE 8999 - Cash Balance, etc. TOTAL - N - CASH BALANCE GRAND TOTAL ► STATEMENT NO-4 STATEMENT OF DEBTS AND OTHER INTEREST BEARING OBLIGATIONS OF GOVERNMENT Description of Loans Amount on 1st April, 20x1 Additions during the year Discharges during the year Amount on 31st March, 20x2 Interest paid on Public debt 1 2 3 4 5 6 E - PUBLIC DEBT 6001- Internal Debt of the Union Government 101 - Market Loans 1. Market loans bearing interest 2. Market loans not bearing interest 3. Market Loans Suspense Account 103 - Treasury Bills and connected Securities issued to R.B.I., etc. 6002- External Debt 202 - Loans from the Federal Austrian Government, etc. TOTAL - PUBLIC DEBT ► STATEMENT NO.5 DETAILS OF MARKET LOANS RAISED IN INDIA AND SECURITIES ISSUED TO INTERNATIONALFINANCIAL INSTITUTIONS Details Loans and Securities When raised Amount on 1st April, 20x1 Additions during the year Discharges during the year 1 2 3 4 5 E - PUBLIC DEBT A — Internal Debt of the Union Government 1. Market Loans (a) Market loans bearing interest etc. (i) Treasury Bills and Connected Securities issued to RBI — (ii) 364 days Treasury Bills 182 days Treasury Bills Securities issued to the International Financial Institutions (iii) Special Securities issued to RBI etc. Etc. TOTAL Amount on 31st March, 20x2 6