Need for Alternative Investments in Today`s Pension Plans

advertisement

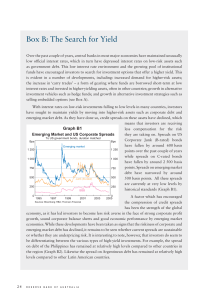

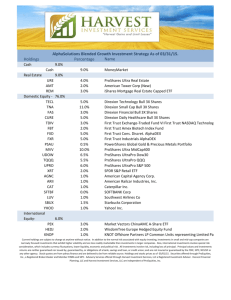

Need for Alternative Investments in Today’s Pension Plans Presented by Robert Longfield at Atlantic Connections July 9, 2014 Robert Longfield • Robert serves as the CEO of, Gavion, LLC and chairs the Gavion Research Advisory Board. This board directs the firm’s research process to which Robert brings his twentyfive years of experience. Robert also services clients with specific expertise to hospitals, foundations, insurance reserves, defined benefit plans, various types of defined contribution plans, as well as post retiree healthcare Trusts. In 1989 Robert began his career with an institutional consulting practice as a financial analyst. He transitioned into the consultant role in 1992 and became a senior consultant and owner in 1997. This prior experience led Robert to the founding of Gavion in 2013 with two veteran partners. Robert lectures periodically on topics ranging from alternative investing to market outlook at various conferences. He graduated magna cum laude with a bachelor’s degree in finance and a minor in economics from the University of Memphis. He has earned the right to use the CFA designation. Robert’s community involvement includes serving on various committees for Hope Presbyterian Church. Robert also serves on the Board of Directors for BioDlogics, LLC, a Memphis based biologics company • Gavion, LLC is a Tennessee based investment consulting firm with over $20 billion in assets under advisement as of first quarter 2014 representing approximately 35 client relationships. Gavion’s 23 employees focus on the institutional consulting needs of our clients. Current Sentiment U.S. Deleveraging Equity Risk Reduction • Historically - fixed income • Today – plethora of alternatives Market Declines Gavion Outlook Alternative Categories • • • • • • • • • Hedge Funds Timber Private Debt Real Estate Infrastructure Structured Notes Venture Capital Mezzanine Debt Distressed Debt Disclosures The information contained herein is for informational purposes only. This presentation does not represent an offer to buy or sell securities. Any investment involves risk including the potential loss of investment principal. All examples are hypothetical and for illustrative purposes only. The views expressed in this material and presented during this educational session are the views of the panelists and are subject to change based on market and other conditions. The presentations contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Certain of the information contained herein: (1) is proprietary to third party content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Third party content providers are not responsible for any damages or losses arising from any use of this information. When considering alternative investments, such as hedge funds and hedge funds of funds, you should consider various risks including the fact that some alternative investments use leverage and other speculative investment practices that may increase the risk of investment loss, can be illiquid, are not required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual funds, often charge high fees, and in many cases the underlying investments are not transparent and are known only to the investment manager.