Anti-Money Laundering Seminars

advertisement

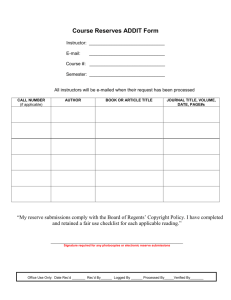

International Standards on Regulating DNFBPs & The way forward Narcotics Division, Security Bureau Mr Ping-Yiu MA Assistant Secretary for Security 4 March 2010 Agenda Financial Action Task Force (FATF) requirements on accountants Highlight of the FATF recommendations relevant to accountants Way Forward in regulating accountants 2 FATF The Financial Action Task Force (FATF) : an inter-governmental body created in 1989 by ‘G7’ sets standards, develops and promotes policies to combat money laundering and terrorist financing has published 40+9 Recommendations to achieve its purpose 3 Designated Non-Financial Businesses and Professions (DNFBPs) DNFBPs as defined by Financial Action Task Force (FATF) are: Lawyers Accountants Trust and Company Service Providers (TCSPs) Real Estate Agents Dealers in Precious Metals/ Stones Casinos 4 You Play an Important Role Casino Trust and Company Services Providers Banks Dealers in Precious Stones and Metals Securities House Insurance Firms Estate Agents Lawyers Accountants Designated Non-Financial Businesses and Professions (DNFBP) 5 6 Be a Gatekeeper for Hong Kong 7 FATF Requirements on Accountants Complex Transactions (Rec. 11) New Technology (Rec. 8) Special Attention (Rec. 21) CDD (Rec. 5 & 9) Accountants – operating individually or in a firm PEPs (Rec. 6) Record Keeping (Rec. 10) STRs (Rec. 13 & 14) Internal Control (Rec. 15) 8 FATF Requirements on the Accounting Profession Sanctions (Rec. 17) SRO (Rec. 24) The Accounting Profession Guidelines (Rec. 25) 9 FATF Requirements on Accountants Requirements to be specified in law: Customer Due Diligence (Rec. 5) Record Keeping (Rec. 10) Suspicious Transaction Reporting (STR) (Rec. 13) Risk-based Approach Guidance for Accountants 10 When to Conduct CDD? When accountants prepare for or carry out transactions in relation to: Buying and selling of real estates; Managing of client money, securities or other assets; Management of bank, savings or securities accounts; Organisation of contributions for the creation, operation or management of companies; Creation, operation or management of legal persons or arrangements, and buying and selling of business entities. 11 When to Conduct CDD? When accountants act as Trust and Company Service Providers and Acting as a formation agent of legal person; Acting as a director or secretary of a company; Providing a registered office, etc for a company; Acting as a trustee of an express trust; Acting as a nominee shareholder for another person. They have to comply with Rec. 5, 6, 8-11, 21. 12 FATF Requirements on Accountants Other selected requirements: Internal Controls (Rec. 15) Self Regulatory Organisation (SRO) (Rec. 24) 13 Internal Controls To establish / maintain internal policies / procedures to prevent ML / TF. Policies / procedures to cover CDD, record keeping and STR obligations. To communicate these to employees. To develop appropriate compliance management (e.g. AML/CFT Compliance Officer at management level). 14 Internal Controls On-going staff training. Independent audit function to test compliance with the policies and procedures. To put in place screening procedures to ensure high standards in hiring employees. The type and extent of measures to be taken should commensurate with: the level of ML / TF risk; and the size of the business. 15 SRO – Responsibilities & Sanctions Government authority or SRO to monitor and ensure compliance with AML / CFT requirements. Power to sanction in case of noncompliance. Effective, proportionate and dissuasive criminal, civil or administrative sanctions be available. 16 SRO - Sanctions Range of sanctions available should be broad and proportionate to severity of noncompliance. Sanctions should be available to legal persons, their directors and senior management. 17 SRO - Resources Adequate structuring, funding, staff with sufficient technical and other resources to fully and effectively perform their functions. Sufficient operational independence and autonomy to ensure freedom from interference. Staff be of high professional standard & integrity and adequately trained for AML / CFT. 18 SRO - Guidelines Government authority or SRO to establish guidelines to include the following: ML / FT techniques and methods; and any additional measures that accounting firms/accountants could take to ensure their AML / CFT measures are effective. 19 FATF Recommendations Relevant to DNFBPs 4 5 * 6 1 2 3 7 8 9 10 * 11 12 13 * 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 20 Results of HK Mutual Evaluation Rec. 12 (applying Rec. 5, 6 & 8-11) : NC Rec. 16 (applying Rec. 13-15 & 21) : NC Rec. 24 : NC 21 Post ME Development (1) Establishment of Central Co-ordinating Committee (CCC), chaired by Financial Secretary. To steer & co-ordinate the strategic development of HK’s AML/CFT regime in line with internationally recognised standards. 22 Post ME Development (2) Financial Services & the Treasury Bureau (FSTB) is the overall co-ordinator for AML / CFT matters and with specific responsibilities on financial sectors. Security Bureau (Narcotics Division) looks after DNFBPs and Non-profit Organisations. 23 Way Forward (1) Legislation on CDD & Record Keeping Phase I : Financial Sectors Phase II: DNFBPs 24 Way Forward (2) FSTB Consultation on Legislative Proposals Against Money Laundering ended on 6 February 2010. Proposes to allow continued reliance on unregulated Third Parties by Financial Institutions. To be introduced into LegCo – Q2 2010. 25 Way Forward (3) To prepare for Phase II, SB will step up outreaching activities to raise awareness on AML / CFT and work closely with professional bodies. CPD Seminars. Sector Specific Guidelines. Revised Interactive Training Kit. 26 Consultation with Non-Financial Sectors Issues Timeline Compliance costs Regulatory Authority 27 Timeline (1) 2010 2011 2015 2013 2012 2014 2016 28 Timeline (2) FATF 35 members 29 Compliance Costs (1) Internal Control Systems Staff Training Policies and Procedures Complianc e Officer Audit Function 30 Compliance Costs (2) Compliance Cost International Standards 31 Compliance Costs? (1) Business Costs and Legal Obligations Professional Status and Reputation 32 Compliance Costs? (2) 33 Open-minded 34 Partnership 35 Thank you! 36