View this speaker`s presentation

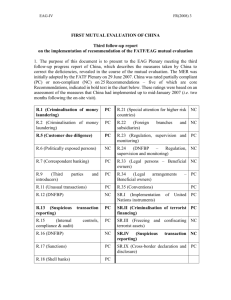

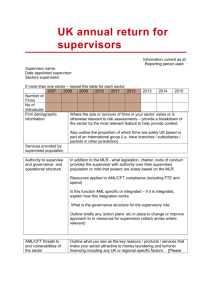

advertisement

David Nutman Regional Head of Compliance & Regional MLPO Prudential Corporation Asia Recent AML regulatory developments Asia-wide, key challenges and next steps Managing the 3 letter world in which we live Insurers in Asia AIA, ING, AXA, ACE, RSA (even Pru)…………… Even the Asian banks BOC, CCB, DBS, BEA, UOB, SCB, ANZ, UBS …….…………… The Asia financial regulators don’t want to miss out!! OCI, FSA, FSS, SFC, OIC, MAS, BNM, MoF, FSC, SEC……………… Money Laundering also gets in on the act AML, CFT, CDD, KYC, STR, FIU, APG…………………… No disrespect meant to HSBC or the HKMA who nearly made it !!!! Anyway keeping on the theme LMS and apologies for using abbreviations…. Recent regulatory developments Internationally FATF proposals to upgrade their 40+9 recommendations to bring up-to-date and make relevant for the new world. (October 2010) Third EU Directive on ML, IAIS Guidelines still being implemented Asia (largely in response to various evaluations by FATF and APG) - examples Hong Kong – draft bill to tighten AML laws including random border checks, bringing other industry sectors into regulatory scope and improving record retention. Recent enhancements to CDD requirements. Japan – strengthening CDD measures Taiwan – multiple amendments made to Money Laundering Control Act. CounterTerrorism Action Law still in proposal stage. India – updated STR legislation beyond financial trigger only Indonesia – upgraded their KYC requirements for non-banks and revised AML Law to allow KPK (Corruption Eradication Commission) to investigate cases of ML. Korea – regulatory lowering of threshold to report cash transactions to FIU 3 Key challenges At least 9 of the 31 worldwide jurisdictions deemed to have strategic AML/CFT deficiencies by FATF are in Asia – Prudential like many MNCs have operations in some (PHP/Indo/THL/VN). Emerging markets have cash-based businesses & economy, corruption remains a concern. AML remains largely invisible politically - not an election topic!!! Co-operation internationally still needs to develop further – crime is global The law remains weak in some areas particularly regarding CTF Sanctions adherence seen to be the biggest burden (Logica survey in 9/2010) – managing OFAC and the extra-territorial reach of US (and now UK) legislation UK FSA fine on RBS Group in August 2010 for failing to have adequate systems and controls in place to prevent breaches of UK financial sanctions. (watershed?) New Anti Bribery & Corruption Act in UK becomes law in 2011 Asian Cultural challenges Unwillingness to disclose information (banking, professional and personal secrecy). Cross-border issues – e.g. mainland Chinese cash into Hong Kong, Burmese nationals living in Singapore. Multi-jurisdictional crime with proceeds of ML often quickly & easily transferred to another territory. Illegal gambling now a prime source of dirty money alongside the usual suspects (vice, drugs, counterfeiting, financial crime etc.) Use of alternative remittance systems (ARS) Charitable connections and indigenous terrorist groups Low taxation environment can attract the dirty dollar Next steps Unquestionably further reform at a country level (FATF lead? – some jurisdictions need to complete implementation of action plans within timeframes proposed) Training and education for all (e-learning platforms for front-line teams and internationally accredited AML programmes for functional staff) Automation for sanctions checking (protecting at the gate) and increased use of sophisticated tools to flag & track transactions Improved industry engagement with local FIUs Globalisation – crime has no borders