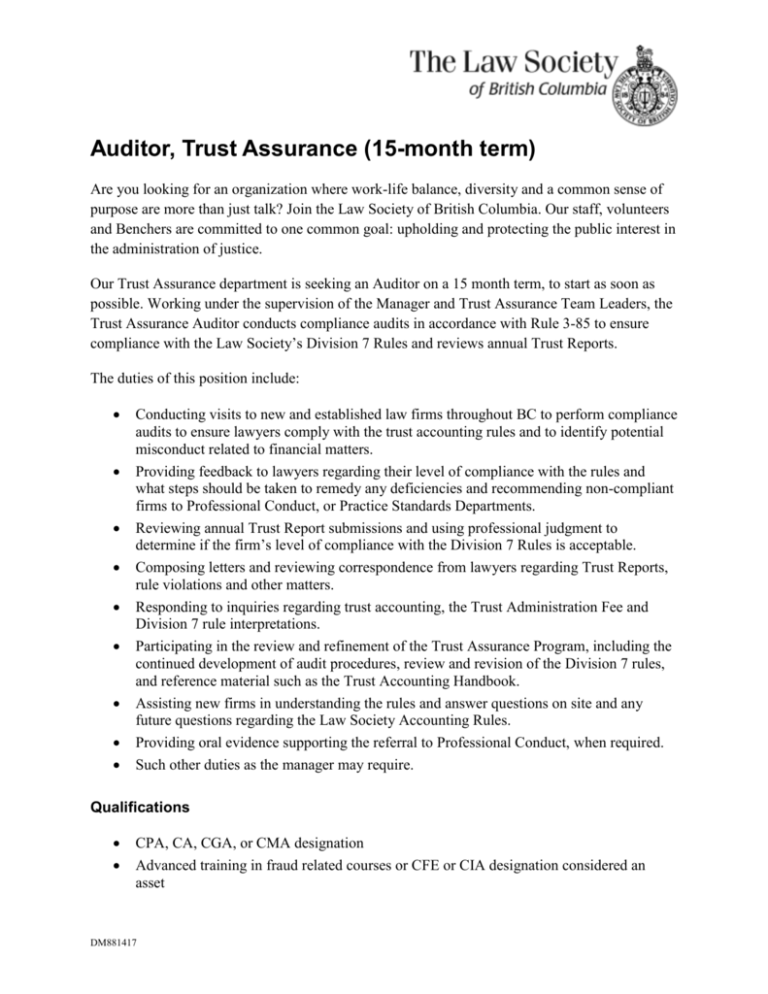

Auditor, Trust Assurance (15-month term)

advertisement

Auditor, Trust Assurance (15-month term) Are you looking for an organization where work-life balance, diversity and a common sense of purpose are more than just talk? Join the Law Society of British Columbia. Our staff, volunteers and Benchers are committed to one common goal: upholding and protecting the public interest in the administration of justice. Our Trust Assurance department is seeking an Auditor on a 15 month term, to start as soon as possible. Working under the supervision of the Manager and Trust Assurance Team Leaders, the Trust Assurance Auditor conducts compliance audits in accordance with Rule 3-85 to ensure compliance with the Law Society’s Division 7 Rules and reviews annual Trust Reports. The duties of this position include: Conducting visits to new and established law firms throughout BC to perform compliance audits to ensure lawyers comply with the trust accounting rules and to identify potential misconduct related to financial matters. Providing feedback to lawyers regarding their level of compliance with the rules and what steps should be taken to remedy any deficiencies and recommending non-compliant firms to Professional Conduct, or Practice Standards Departments. Reviewing annual Trust Report submissions and using professional judgment to determine if the firm’s level of compliance with the Division 7 Rules is acceptable. Composing letters and reviewing correspondence from lawyers regarding Trust Reports, rule violations and other matters. Responding to inquiries regarding trust accounting, the Trust Administration Fee and Division 7 rule interpretations. Participating in the review and refinement of the Trust Assurance Program, including the continued development of audit procedures, review and revision of the Division 7 rules, and reference material such as the Trust Accounting Handbook. Assisting new firms in understanding the rules and answer questions on site and any future questions regarding the Law Society Accounting Rules. Providing oral evidence supporting the referral to Professional Conduct, when required. Such other duties as the manager may require. Qualifications CPA, CA, CGA, or CMA designation Advanced training in fraud related courses or CFE or CIA designation considered an asset DM881417 Excellent organizational and problem solving skills A professional, mature, and confident disposition Excellent written and verbal communication skills Strong attention to detail and capable of performing autonomously while meeting strict deadlines Knowledge of the Law Society’s Division 7 Trust Accounting Rules in addition to general law firm accounting Travel within the Vancouver and surrounding areas will be required. The applicant must hold a valid BC driver’s license and have access to a vehicle. Limited travel outside of Vancouver but within BC will also be required. To apply, please email a resume and cover letter to personnel@lsbc.org. The closing date for this competition is October 2, 2015. We thank all applicants for their interest; however, only those candidates selected for an interview will be contacted. DM881417