Lecture: Accounting Changes

advertisement

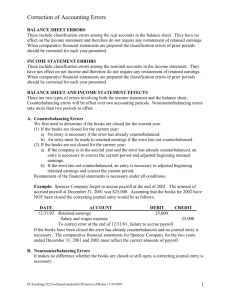

Accounting Changes and Error Analysis Chapter 22 Intermediate Accounting 12th & 13th Editions Kieso, Weygandt, and Warfield KWW slides Prepared by Coby Harmon, University of California, Santa Barbara as modified by Teresa Gordon, University of Idaho 1 Restatements are common! 4 Accounting Changes & Corrections ASC Topic 250 (SFAS No. 154) discusses 3 types of accounting changes plus correction of errors 1. Changes in Accounting Principle 2. Changes in Accounting Estimates 3. Changes in Reporting Entity 4. Errors in Financial Statements 5 Change in accounting principle A change from one generally accepted principle to another generally accepted accounting principle Only possible where GAAP permits more than one acceptable choice Definition includes a change in the method of applying an accounting principle Must be applied consistently after adopted IMPORTANT NOTE: The change must be justified on the basis that it is preferable to the principle previously 6 followed. Change in accounting principle A change in accounting principle does NOT include Initial adoption of an accounting principle for a new event or transaction Modification of an accounting principle made necessary by transactions clearly different in substance from those previously occurring A change to a generally accepted principle from an incorrect principle (This is considered the correction of an error) 7 Reporting a change in principle Retrospective application to all prior periods unless this is impracticable Cumulative DIRECT effect of the change on periods prior to those presented is reflected on the balance sheet in the amounts reported for assets and liabilities The offsetting adjustment (if any) is made to the beginning balance of retained earnings for the earliest period presented Financial statements will be re-stated as though the new principle had been in use Direct effects include income tax impact Indirect effects (if actually incurred) are recognized in the period during which the 8 accounting change is made Earliest Year Presented (or affected by change) Retained Earnings account is shown as follows: Balance at beginning of year Adjustment for the cumulative effect on prior years (net of tax) Balance at beginning (as adjusted) Net Income Less dividends declared Balance at end of year $ XXX $ XX $ XX $ XXX - XX $ XXX 9 When is a Change in Accounting Principle Appropriate? Changes are appropriate when the new principle is preferable to the existing accounting principle. The new principle should result in improved financial reporting. A change is considered preferable if a FASB standard: creates a new accounting principle, or expresses preference for a new principle, or rejects a specific accounting principle 10 Motivations for Change Managers and others may have a selfinterest in adopting principles or standards: Companies may want to be less politically visible to avoid regulation A company’s capital structure may affect its selection of accounting standards Managers may select accounting standards to maximize their performance-related bonuses Companies have an incentive to manage or smooth earnings 11 Changes in Accounting Principle Retrospective Accounting Change: Long-Term Contracts Illustration: Denson Company has accounted for its income from long-term construction contracts using the completedcontract method. In 2010 the company changed to the percentage-of-completion method. Management believes this approach provides a more appropriate measure of the income earned. For tax purposes, the company uses the completed- contract method and plans to continue doing so in the future. (We assume a 40 percent enacted tax rate.) LO 3 Understand how to account for retrospective accounting changes. Changes in Accounting Principle Income statements for 2008–2010 Illustration 22-1 LO 3 Changes in Accounting Principle Data for Retrospective Change Example Illustration 22-2 Journal entry to record change at beginning of 2010: Construction in Process Deferred Tax Liability Retained Earnings 220,000 88,000 132,000 LO 3 Understand how to account for retrospective accounting changes. Changes in Accounting Principle Reporting a Change in Principle Major disclosure requirements are as follows. 1. Nature and reason for the change in accounting principle. 2. The method of applying the change, and: a. A description of the prior-period information that has been retrospectively adjusted, if any. b. The effect of the change on income from continuing operations, net income, any other affected line items. c. The cumulative effect of the change on retained earnings or other components of equity or net assets as of the beginning of the earliest period presented. LO 3 Understand how to account for retrospective accounting changes. Changes in Accounting Principle Reporting a Change in Principle Illustration 22-3 LO 3 Understand how to account for retrospective accounting changes. Changes in Accounting Principle Retained Earnings Adjustment Assuming a retained earnings balance of $1,360,000 at the beginning of 2008. Illustration 22-4 Before Change LO 3 Understand how to account for retrospective accounting changes. Changes in Accounting Principle Retained Earnings Adjustment Illustration 22-5 After Change LO 3 Understand how to account for retrospective accounting changes. Changes in accounting estimates Current and prospective method 19 Many amounts on FS involve estimates, including: 1. Uncollectible receivables. 2. Inventory obsolescence. 3. Useful lives and salvage values of assets. 4. Periods benefited by deferred costs. 5. Liabilities for warranty costs and income taxes. 6. Recoverable mineral reserves. 7. Change in depreciation methods. 20 Change in Estimate Estimates that are later determined to be incorrect should be corrected as changes in estimates Result from availability of new or additional information Companies report prospectively changes in accounting estimates. 21 Change in Estimate Sometimes effected in the form of a change in accounting principle Bad debt accounting – change from percentage of sales method to aging of accounts receivable (allowance) method Fixed assets – change from sum-of-year’s-digits depreciation to straight-line depreciation 22 Changes in Accounting Estimates Are handled with what used to be called the current and prospective method This means that we do not go back and change previously reported numbers on the financial statements (no retroactive restatement) We make changes to current and future years only Two numeric examples Depreciation expense Depletion expense 23 Depreciation Example Consider these facts related to an asset acquired January 1, 2010: Asset cost Estimated residual value Estimated service life $240,000 $40,000 5 years The company uses straight-line depreciation Assume that after 2 years, it becomes obvious that the asset will be used for a total of 8 years At the end of 8 years, it will be worth $10,000 What depreciation expense should be recorded for 2012? 24 Solution $240,000 - 40,000 - 40,000 = $160,000 Carrying Value 160,000 -10,000 6 Year 2010 2011 2012 2013 2014 2015 2016 2017 = Depreciation $ $ $ $ $ $ $ $ 40,000 40,000 25,000 25,000 25,000 25,000 25,000 25,000 $240,000 Book value at end of year $200,000 $160,000 $135,000 $110,000 $85,000 $60,000 $35,000 $10,000 $ 25,000 25 Alternate treatment If we had originally known new facts: 240,000 -10,000 8 = $28,750 We would have had $57,500 in accumulated depreciation at end of 2011. Actually in acc’d depreciation = $80,000 Make adjusting JE and then continue with $28,750 depreciation for remaining useful life 26 Alternate treatment 240,000 -10,000 8 = $28,750 2012 Correcting JE: Acc’d Depr 22,500 Depr Exp 22,500 Record 2012 depreciation: Depr Exp 28,750 Acc’d Depr 28,750 Year 2010 2011 2012 2013 2014 2015 2016 2017 Depreciation $ $ $ $ $ $ $ $ 40,000 40,000 6,250 28,750 28,750 28,750 28,750 28,750 $240,000 Book value at end of year $200,000 $160,000 $153,750 $125,000 $96,250 $67,500 $38,750 $10,000 27 Example - Coal Mine Cost of property Cost to restore property Value after restoration Recoverable resources First year production Sold for Statutory depletion rate for tax purposes = 10% $9,000,000 $1,200,000* $1,000,000 4,000,000 tons 150,000 tons $30 per ton * Present value (asset retirement obligation measured in accordance with SFAS No. 143) 28 Coal mine example: Cost basis + cost to restore - residual value after restoration Total estimated recoverable units $9,000,000 + 1,200,000 - 1,000,000 4,000,000 tons = $2.30 per ton Sold 150,000 tons, therefore cost depletion = 150,000 * 2.30 = $345,000 29 Coal mine example, continued Assume that 250,000 tons of coal were produced and sold during the second year of operation However, new EPA regulations increased the projected restoration costs to $2,000,000 (asset retirement obligation) At the beginning of the second year of production, geologist estimate 4,050,000 tons remain We start over estimating the depletion rate per ton -- using the current BOOK VALUE instead of cost 30 Coal Mine Example Cost basis + cost to restore - residual value after restoration Remaining recoverable units (estimated) Cost basis is now $9,000,000 - $345,000 = $8,655,000 The cost to restore is now $2,000,000 The new estimate of recoverable units (including 2nd year’s production) is 4,050,000 tons (3,800K left + 250K mined this year) $8,655,000 + $2,000,000 - $1,000,000 = $2.38 per ton 4,050,000 250,000 tons * $2.38 = $595,000 depletion expense 31 Statutory Depletion Note that the tax deduction would be much higher using statutory depletion allowance (a permanent difference between accounting and tax return) Year 1 - 150,000 tons * $30 per ton = $4,500,000 revenue * 10% statutory rate = $450,000 on tax deduction vs. $345,000 on income statement Year 2 - 250,000 tons * $33 per ton = $8,250,000 Revenue * 10% statutory rate = $825,000 tax deduction vs. $595,000 on income statement 32 Disclosure of Changes in Estimate Not required for routine changes in estimate that happen every year Allowance for uncollectible accounts Inventory obsolescence Warranty obligations UNLESS material If material, the change in estimate should be discussed in footnotes to financial statements with per share disclosures 33 Other Changes & Corrections Change in Entity Correction of Error 34 Reporting a Change in Entity The reporting entity changes Financial statements are restated for all prior periods presented Examples of a change in reporting entity are: Consolidated statements in lieu of individual financials Loss in control of formerly consolidated subsidiary Acquisition or sale of subsidiaries 35 Reporting the Correction of an Error Corrections are treated as prior period adjustments to retained earnings for the earliest period being reported Examples of accounting errors include: A change from an accounting principle that is not generally accepted to one that is accepted Mathematical errors Changes in estimates that were not prepared in good faith A failure to properly accrue or defer expenses or revenues A misapplication or omission of relevant facts 36 Restatement Example ASC 250-10-55-2 (SFAS No. 154, Appendix A) Illustration 1 - detailed example of a change from LIFO to FIFO inventory method Shows extensive disclosures that would be needed to communicate impact on balance sheet, income statement, and statement of cash flows 37 Error Analysis in General Firms do not correct errors that are insignificant. Three questions must be answered in this regard: 1. What type of error is involved? 2. What correcting entries are needed? 3. How are financial statements to be restated? Error corrections are reported as prior period adjustments to the beginning retained earnings balance in the current year 38 Accounting Changes A. B. C. D. Change in Accounting Estimate (prospectively) Change in Accounting Principle (retroactively or disclosed) Change in Accounting Entity (retroactively) Correction of an Error (retroactively) 1. Change in a plant asset’s salvage value. 2. Change due to overstatement of inventory 3. Change from sum-of-years’-digits to straight-line depreciation method 4. Change from presenting unconsolidated financial statements to consolidated financial statements 5. Change from LIFO to FIFO inventory method 6. Change in rate used to compute warranty costs 39 Accounting Changes A. B. C. D. Change in Accounting Estimate (prospectively) Change in Accounting Principle (retroactively or disclosed) Change in Accounting Entity (retroactively) Correction of an Error (retroactively) 7. Change from an unacceptable to an acceptable accounting principle 8. Change in a patent’s amortization period 9. Change from completed contract to percentage of completion accounting for long-term contracts 10. Change from FIFO to LIFO inventory method 11. Change from allowance method to the percentage of sales method to account for bad debt expense 40