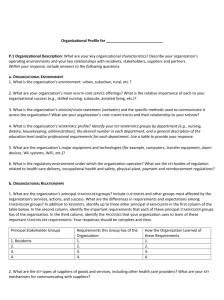

Sources of power for external stakeholders

advertisement

Strategic Management Purpose, shareholder value, and stakeholders Prof.Dr. E.Vatchkova Contents 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Identifying stakeholders The political power in the organization Sources of power Stakeholder mapping Power/dynamism matrix Power/interest matrix Conflicts of expectations Managerial values Ethical issues Cultural frames Freeman’s definition (1984) “Any group or individual who can affect or is affected by the performance of an organization” Stakeholders concept is valuable when: The organizational objectives are defined Specific strategic developments will take place The strategic choice is to be made Groups of stakeholders External stakeholders The state Customers Suppliers Financial institutions Shareholders Unions Media Internal stakeholders Managers Employees Power The ability of individuals or groups to persuade, induce or coerce others into following certain courses of action The organization is a political arena Source of power within the organization Hierarchy (formal) Influence (informal) Control of strategic resources Possession of knowledge and skills Control of the environment Involvement in strategy implementation Sources of power for external stakeholders Control of strategic resources Involvement in strategy implementation Possession of knowledge (skills) Through internal links Indicators of power Internal stakeholders External stakeholders 1. Status 2. Claim on resources 1. Status 2. Resource dependence 3. Negotiating arrangements 4. Symbols 3. Representation 4. Symbols Stakeholders mapping – assessing the importance of stakeholder expectations How likely each stakeholder is to impress its expectations on the company Whether they have the means to do so (assessment of power) The likely impact of stakeholder expectations on future strategies Power /dynamism matrix High A Low Few problems Predictability Low B Unpredictable but manageable Power High C Powerful but predictable D Greatest danger or opportunities Adapted from Mendelow, 1999 Power / interest matrix Level of interest Low Low High A Minimal effort B Keep informed C Keep satisfied D Key players Power High Adapted from Mendelow, 1999 Stakeholders expectations(1) Shareholders: Annual dividends Increasing the value of their investments in the company as the share price increases Stakeholders expectations(2) Managers salaries and bonuses proxy payments responsibility challenge working for a well known and prestigious company Stakeholders expectations(3) Employees wages holidays job satisfaction working conditions security Stakeholders expectations(4) Consumers desirable and quality products competitive prices new products at appropriate time Stakeholders expectations(5) Distributors on time and reliable deliveries Suppliers constant orders payment on time Financers interest payments loan repayments Stakeholders expectations(6) Government payment of taxes provision of employment contribution to the nation’s exports Society in general socially responsible actions Common conflicts of expectations Growth – profitability Cost efficiency – jobs Volume – quality Savings in one SBU –increased spending in elsewhere Division’s belonging to two organizational fields Definition Values are broad, general beliefs about some way of behaving or some end state is preferable to the individual The influence of values The way other individuals and groups are perceived, thereby influencing interpersonal relationships The decisions and problem solutions The perception of situations The criteria for ethical behavior The acceptation or resistance to organizational goals The ways to achieve the success Types of values Theoretical – order, system, logic Economic – usefulness and practicability Aesthetic – art and beauty Social – people and their welfare Political – power over people and things Religious – unity and harmony The political and cultural aspect of the organization 1.Whom the organization does actually serve? The concept of stakeholders 2. Which purposes an organization should fulfill? Ethical considerations 3. Which purposes are actually prioritized? The cultural concepts Some questions of CSR Internal aspects Employee welfare Working conditions Job design Intellectual property J&S,02 External aspects Green issues Products Markets and marketing Suppliers Employment Community activity The cultural web Stories Symbols Routines and rituals Paradigm Control Power Organizational structures Expectations and purposes model Corporate governance Business ethics Organizational Purposes •Mission •Objectives Stakeholders Cultural context Managing for shareholder value General consideration: How to make the business value-based? Objective: Maximizing shareholder value over time Strategy: Significant change in management Action tasks (initiatives) Key steps (initiatives) 1 (Cadbury-Schweppes plc,1966) 1. Preparing a multi-year blueprint for the many changes to make the business value-based 2. Identify sources of value creation and destruction, using financial and performance measures: Economic profit Return on total invested capital Earning growth Free cash flow 3. Set performance targets 4. Manage day-to day performance Key steps (initiatives) 2 (Cadbury-Schweppes plc,1966) 5. Focusing business strategies on the search for profitable growth 6. Creating short- and long term incentive plans for senior managers 7. Reviewing the value performance of all the businesses 8. Delivering awareness and training sessions on managing for value (top 300 executives worldwide) Key steps (initiatives) 3 (Cadbury-Schweppes plc,1966) 9. Carrying two pilot studies in core group businesses (produce “value champions”) 10. Establishing the first “rolling strategic management agenda” for the board: list of issues managers in charge value-maximizing decisions Funding strategies in different circumstances: the Growth/share matrix Growth (Stars) Business risk: High Financial risk needs to be: Low Funding by: Equity (growth investors) Dividends: Normal Maturity (Cash cow) Business risk: Medium Financial risk can be: Medium Funding by: Debt and equity (retaining earnings) Dividends: High Launch (Question marks) Business risk needs to be: Very high Financial risk: Very low Funding by: Equity (venture capital) Dividends: Zero Decline (dogs) Business risk: Low Financial risk can be: High Funding by: Debt Dividends: Total THANK YOU !