Personal Finance Final Exam Review

advertisement

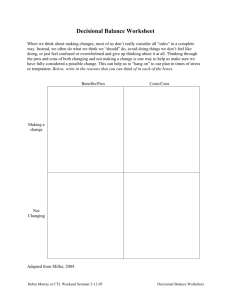

PERSONAL FINANCE FINAL EXAM REVIEW Name – class- date When it comes to managing money, there are three types of people.. People who just get by The big spenders People who “get it” Directions: summarize each one. What are the 5 steps to financial planning 1. 2. 3. 4. 5. Set SMART goals Analyze information Create a plan Implement the plan Monitor and modify the plan Directions: Summarize your overall understanding of the 5 steps Add the answer What is the difference between a need and a want? What is a “Smart” goal? What are the 6 steps to the decision making process? Identify your goal 2. Establish your criteria 3. Examine your options 4. Weigh the pros and cons 5. Make your decision 6. Evaluate results Directions: Summarize or give examples of the process (page 9) 1. Directions: answer the questions What is a budget? (page 16) What are items that are found on a budget? (chapter 2) Directions: answer the questions What is the difference between saving and investing? (page 28) What is time value of money? (page 30) What is inflation? (page 30) What is compound interest? (page 31) Directions: answer the questions What is rule 72? (page 32) What is the stock market? (page 33) What is a dividend? (page 34) Name the 6 income investments? (Pages 35-36) Directions: answer the questions What are the names of the growth investments?(page 36) What does diversification mean? (page 38) Directions: answer the questions What does credit mean? What does principal mean? What does interest mean? Page 42 –all of the above What are the 4 types of common credit. (page 43) Directions: answer the questions What are some factors that are tied to the cost of using credit? (page 44) What is the universal default clause? (page 45) What are the pro’s and con’s of using credit? (page46) PROS CONS Directions: answer the questions What are the 4 c’s of credit? (page 47) What is a credit report and why is it important? (page 49) Directions: answer the questions What is chapter 7? What is chapter 13? Page 55 Name some ways you can avoid the pitfalls of credit (page 53) Directions: answer the questions What is the difference between a bank and a credit union? (page 60) What is the difference between an credit card and a debit card? (chapter 5) Directions: answer the questions What is a PIN and why does someone need one? (page 65) What does EFT stand for and why is it used? (page 70) Directions: answer the questions What is identify theft and what are ways you can protect yourself from it happening to you? (page 72) What is phishing and spyware, and what does it have to do with identity theft? (page 73) Directions: answer the question What are the names of the three reporting bureaus? Directions: answer the questions What is insurance? (page 82) What are the steps of risk management? (page 81) Directions: answer the questions What do the terms below mean? (page 82) Premium Coverage limit deductible What are some ways you can drive down the cost of insurance (page 83) Directions: answer the questions What are some factors that can raise or lower your premium? (page 85) What are some items that are needed when you apply for insurance? (page 88) Directions: answer the questions What are some types of Insurance? (page 90) What is the difference between a job and a career (page 96) Directions: answer the questions What are transferable skills? (page 98) What are some of the parts of a resume? Directions: answer the questions What are the different education levels? What are some benefits that you may receive on the job How can you apply the decision making process (slide 5) to two of the following topics: Budgeting, Investing, Choosing a credit card, how to keep your money safe, or insurance? 1. 2. 3. 4. 5. 6. Identify the goal Establish your criteria Examine your options Weigh the pros and cons Make your decision Evaluate the resuls Vocabulary Terms Define 10 terms.