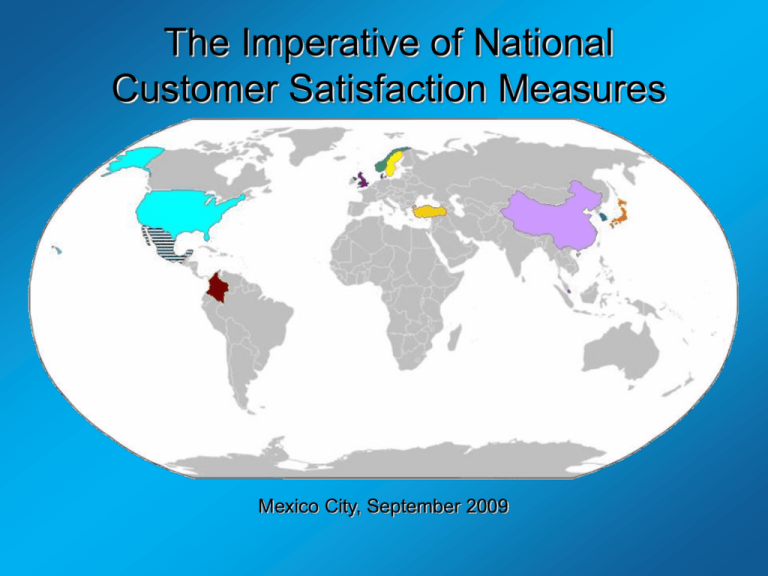

The Imperative of National

Customer Satisfaction Measures

By

Professor Claes Fornell

University of Michigan

Mexico City, September 2009

Sources of Economic Growth

Productivity

Quality

Sustainable Economic

Growth

© 2009 CFI Group. All rights reserved.

1

Benefits to the Economic

Decision Makers

Investors

Business Managers

Government

Consumers

© 2009 CFI Group. All rights reserved.

2

Investors Need to Know…

The relationship between a firm’s

current condition and its future

capacity to produce wealth

© 2009 CFI Group. All rights reserved.

3

Managers Need to Know…

How to improve the firm’s current

condition by allocating scarce

resources such that the strength of

the customer relationships are

maximized

© 2009 CFI Group. All rights reserved.

4

Government Needs to Know…

How to best encourage economic

growth and living standards for

its citizens

© 2009 CFI Group. All rights reserved.

5

Consumers Need to Have…

A voice in measures that reflect their

economic living standards

© 2009 CFI Group. All rights reserved.

6

Why Now?

The Economy is Changing

© 2009 CFI Group. All rights reserved.

7

Why Now? The Global Forces

Movement of:

Information

Capital

Work (not labor)

Shift in the balance of power in favor of the buyer –

at the expense of the seller

© 2009 CFI Group. All rights reserved.

8

Consumer utility is the true standard

for economic growth

Sellers compete for buyer satisfaction

© 2009 CFI Group. All rights reserved.

9

Implications

• The cost of poor service will be borne by the

seller

• When buyers are powerful, assets of supply

(balance sheet assets) have little predictive

power

• Productivity and quality of economic output must

be better balanced

• Capital follows power

© 2009 CFI Group. All rights reserved.

10

ACSI: A Growing Presence in the US

“The American Customer Satisfaction Index, the definitive benchmark of how

buyers feel about what business is selling them.”

- New York Times, August 8, 2004

© 2009 CFI Group. All rights reserved.

11

A Brief Introduction to ACSI: Data

280,000 telephone numbers

Sampled randomly

Screened: Recent experience as a

customer of the selected companies

80,000 telephone interviews

+ 4,000 internet interviews

© 2009 CFI Group. All rights reserved.

12

A Brief Introduction to ACSI: Analysis

The ACSI Equations

E[ η| η, ξ ] Βη Γξ

where = (1, 2, ..., m) and = (1, 2, ..., n) are

vectors of unobserved endogenous and exogenous variables,

respectively; B (m x m) is a matrix of coefficient parameters

for ; and G (m x n) is a matrix of coefficient parameters for

. The PLS estimation implies that E[0, 0,

and 0, where - |,.

© 2009 CFI Group. All rights reserved.

13

A Brief Introduction to ACSI: Analysis

The ACSI Equations

1 0

2 21

3 31

4 0

5 0

© 2009 CFI Group. All rights reserved.

0

0

0

0

0

0

32

0

0

0

43

53

0

0

54

14

0 1 11

1

0 2 21

2

0 3 31 3

0 4 0

4

5

0 5 0

A Brief Introduction to ACSI: Analysis

The ACSI Equations

y Λy η ε

x

Λ

x

ξ δ

where y = (y1, y2, ..., yp) and x = (x1, x2, ..., xq) are the

measured endogenous and exogenous variables,

respectively. Ly (p x m) and Lx (q x n) are the

corresponding regression coefficient matrices. By

implication from PLS estimation (Fornell and Bookstein,

1982), the noise or measurement error has the

properties E[e] = 0, E[d] = 0, E[e] = 0, and E[d] = 0.

© 2009 CFI Group. All rights reserved.

15

A Brief Introduction to ACSI: Analysis

The ACSI Equations

x 1 11

d 1

x d

2 21

2

x 3 31

d 3

y1 11 0

y

2 21 0

y3 31 0

y4 0 12

y5 0 22

0

y6 0

y 0

0

7

0

y8 0

y 0

0

9

y10 0

0

0

y11 0

© 2009 CFI Group. All rights reserved.

0

0

0

0

0

0

0

0

0

0

13

23

33

0

0

14

0

0

0

0

0

0

16

0

e1

e

0

2

e3

0

0 1 e 4

0 2 e 5

0 3 e 6

0 4 e 7

0 5 e 8

e

0

9

e 10

15

25

e11

ACSI Scores – National, Sector & Industry

Q3 2008 – Q2 2009

76.1

Utilities

73.7

E-Business

81.5

Transportation

72.6

Manufacturing/

Nondurable Goods

82.3

Information

70.2

Public Administration/

Government

67.9

Hospitals 77

Ambulatory Care 80

Health Care &

Social Assistance

78.5

Retail Trade

75.2

76

74

74

76

78

Supermarkets

Gasoline Stations

Department & Discount Stores

Specialty Retail Stores

Health & Personal Care Stores

Hotels 75

Full Service Restaurants 84

Limited Service Restaurants 78

Accommodation &

Food Services

78.9

Finance &

Insurance

76.0

75

84

73

78

81

Banks

Credit Unions

Health Insurance

Life Insurance

Property & Casualty Insurance

Manufacturing/

Durable Goods

81.6

E-Commerce

80.0

Energy Utilities 74

Airlines 64

U.S. Postal Service 74

Express Delivery 82

Newspapers 63

Motion Pictures 74

Computer Software 75

Fixed Line Telephone Service 72

Wireless Telephone Service 69

Cellular Telephones 72

Cable & Satellite TV 63

Network Cable TV News 71

Personal Computers

Electronics (TV/VCR/DVD)

Major Appliances

Automobiles & Light Vehicles

© 2009 CFI Group. All rights reserved.

75

83

81

84

17

74 Internet News & Information

83 Internet Portals/Search Engines

83

84

79

85

Food Manufacturing

Pet Food

Athletic Shoes

Personal Care &

Cleaning Products

83 Soft Drinks

83 Breweries

78 Cigarettes

80 Apparel

68.0 Local Government

67.8 Federal Government

82 Retail

74 Brokerage

75 Travel

A Brief introduction to ACSI:

Graphic Model

Perceived

Product Quality

Perceived

Service Quality

• Reliability

• Customization

• Overall

• Reliability

• Customization

• Overall

Customer

Complaints

Perceived

Overall Quality

• Overall

• Customization

• Reliability

Customer

Expectations

Customer

Satisfaction

(ACSI)

Perceived

Value

• Price Given Quality

• Quality Given Price

•

•

•

•

• Overall

• Customization

• Reliability

© 2009 CFI Group. All rights reserved.

Satisfaction

Comparison w/ Ideal

Confirm/Disconfirm

Expectations

• Complaint Behavior

Customer

Loyalty

• Repurchase Likelihood

• Price Tolerance

• (Reservation Price)

18

Growth in ACSI and Consumer Spending:

1995 – 2009 (Q2)

8%

7%

Annualized, Seasonally Adjusted Rate of Growth

6%

5%

6%

4%

3%

4%

2%

1%

2%

0%

-1%

0%

-2%

-3%

-2%

-4%

-5%

-4%

% Quarterly Change in Consumer Spending

% Quarterly Change in ACSI (lagged)

-6%

-7%

-8%

Source: Consumer Spending from U.S. Department of Commerce, Bureau of Economic Analysis

© 2009 CFI Group. All rights reserved.

-6%

19

The Global Context

Global Forces:

Information

Capital

Work (not labor)

How do they affect the buyer-seller relationship?

© 2009 CFI Group. All rights reserved.

20

The Buyer – Seller Relationship

Who Benefits Most?

• Who is getting more choice? The buyer

• Who is becoming more replaceable? The seller

© 2009 CFI Group. All rights reserved.

21

The Buyer – Seller Relationship

The Result:

The balance of power between buyers

and sellers is shifting in favor of the

buyer.

© 2009 CFI Group. All rights reserved.

22

The Effects

Punishment and Rewards

Corporate Balance Sheets

Capital Movements

Business Strategy

© 2009 CFI Group. All rights reserved.

23

For Investors:

Do customers

know something

investors don’t?

© 2009 CFI Group. All rights reserved.

24

The Conventional Answer:

No, because markets are

efficient and reflect all

available information

© 2009 CFI Group. All rights reserved.

25

But…

How does this

information reach

investors (satisfied

customers are not on

the balance sheet)?

© 2009 CFI Group. All rights reserved.

26

Is there another answer?

© 2009 CFI Group. All rights reserved.

27

Shift in Power Between Buyer

and Sellers

Capital Follows Power

© 2009 CFI Group. All rights reserved.

28

Rewards and Punishment

The Successful Seller

Product Markets

Seller

Equity Markets

© 2009 CFI Group. All rights reserved.

29

Rewards and Punishment

The Unsuccessful Seller

Punished by:

• Buyer defection in product markets

• Capital withdrawal from equity markets

© 2009 CFI Group. All rights reserved.

30

Can You Beat the Market?

Only if you know something

that others don’t

© 2009 CFI Group. All rights reserved.

31

10 Years of Annual Returns

CSAT Stock Portfolio 2000 - 2009*

50%

S&P 500

40%

36%

ACSI Stock Portfolio

31%

30%

26%

22%

22%

18%

Yearly Performance

20%

13%

11%

14%

16%

9%

10%

4%

3%

0%

-6%

-10%

-9%

-12%

-13%

-20%

-23%

-26%

-30%

-40%

-39%

-50%

2000

2001

2002

2003

2004

*2009 is YTD through September 18

© 2009 CFI Group. All rights reserved.

32

2005

2006

2007

2008

2009

Even Lower Risk – Market Neutral vs.

HFRX Equity Market Neutral Index

*2009 is YTD through July

© 2009 CFI Group. All rights reserved.

33

From Investment to Business

Management

Good Customer Asset Measurement Tells Us:

•

What the company has done to its customers

•

What customers will do to the company

•

What the company can do to affect the above in

the future

© 2009 CFI Group. All rights reserved.

34

For Management

What Losers Do

> Buy customer loyalty with price discounts

> Get short term profit at the expense of

weakening customer relationships

> Get too close to the customer

> Try to exceed customer expectations

© 2009 CFI Group. All rights reserved.

35

For Management

What Winners Do

> Manage customer relationships as true economic assets

> Balance productivity and service quality

> Maximize customer complaints

> Earn loyalty of customers by satisfying them

> Combine time and space

© 2009 CFI Group. All rights reserved.

36