A framework for risk management - Governance Institute of Australia

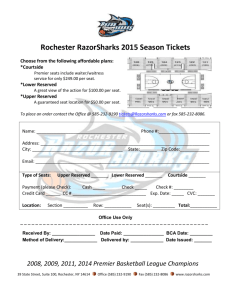

advertisement

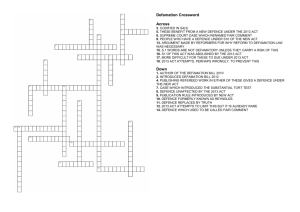

Risk Management, Culture & Governance Agenda What is risk management? A framework for risk management Establishing a good risk culture Getting risk a seat at the table Providing the right risk information to stakeholders ERM – what does the “E” stand for? What is a risk? “The effect of uncertainty on objectives”. ISO 31000: 2009 Risk Management “Those things that may stop you meeting your objectives”. Susan Crago What is risk management? Risk Management = Objectives and Outcomes Management What risk management is not! LIKELIHOOD (The probability of the risk materialising in the next 12 months) LEVEL PROBABILITY RANGE Almost Certain (Level 5) 80% - 100% Low Low Medium High High Likely (Level 4) 60% - 80% Low Low Medium High High Possible (Level 3) 40% - 60% Low Low Medium Medium High Unlikely (Level 2) 20% – 40% Low Low Medium Medium Medium Rare (Level 1) 0% – 20% Low Low Low Medium Medium (Level 3) (Level 4) (Level 5) (Level 1) (Level 2) CONSEQUENCE (assess as once off or accumulation of risks) A framework for risk management Escalate, Communicate and Consult Establish Context Identify Assess Monitor and Review Action A framework for risk management Establish Context Identify Assess •What is our strategy and objectives? •What issues have we experienced? •What risks are we currently managing? •What is going on in the external environment? •What are the risks that could stop us meet objectives? •What would cause those risks to occur? •What controls do we currently have in place? •How likely is it that this risk will occur? •If it does occur what will be the consequence? •How effective are the controls to manage this risk? A framework for risk management Action •Prioritisation •What will we do about the risk? Nothing or something? •If something what is the best action to take? Escalate, Communicate and Consult •Who needs to make the decision about this risk? •Who needs to take any actions on this risk? •Who needs to be aware of this risk? Monitor and Review •Are we on track with managing this risk? •Has something changed so we need to review this risk? The sales pitch Value Proposition…. 1. Making informed decisions •supports prioritisation and transparency of decision making 2. Meeting business unit objectives •alignment to the business strategy and objectives •highlights areas of potential focus 3. Preparing for the unexpected •identifying uncertainties •fewer shocks and unwelcome surprises Good risk culture ?? Impacts of poor risk culture Establishing a good risk culture Establishing a good risk culture ‘Values and culture drive people to do the right thing even when no one is looking … Although value and culture cannot always be measured quantitatively, they impact governance in powerful ways.’ John F Laker - APRA Chairman (27 February 2013) Getting risk a seat at the table Business Units (including Executive, Managers and All Staff) First Line of Defence Independent Risk Function Second Line of Defence Internal Audit Third Line of Defence • Own and manage risks • Risk management embedded in processes • Promote a strong risk culture 3 lines of defence • Independent advice, oversight and monitoring • Advocate a risk culture and raise awareness of Risk • Establishment of Risk Management Framework • Independent appraisal of the control infrastructure • Oversight of the Risk Management Framework Getting risk a seat at the table Getting risk a seat at the table Bendigo & Adelaide Bank Group’s Vision: “We aim to be Australia’s leading customerconnected banking group.” Providing the right risk information to stakeholders “... integral to the effectiveness of risk governance, concerns the flow of information to the board. The lack of timely, relevant and comprehensive risk information [is] often a critical weakness.” John F Laker - APRA Chairman (27 February 2013) Providing the right risk information to stakeholders Clear risk appetite and tolerances Escalation of new key risks Monitoring of actions for key risks Monitoring of testing of key controls Consistent across risk types Good risk governance ERM – what does the “E” stand for? Effective? Efficient? Engaging? Enterprise? Questions?