Document

advertisement

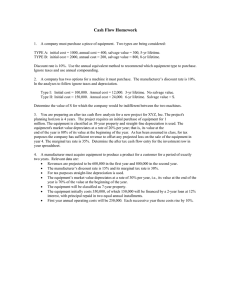

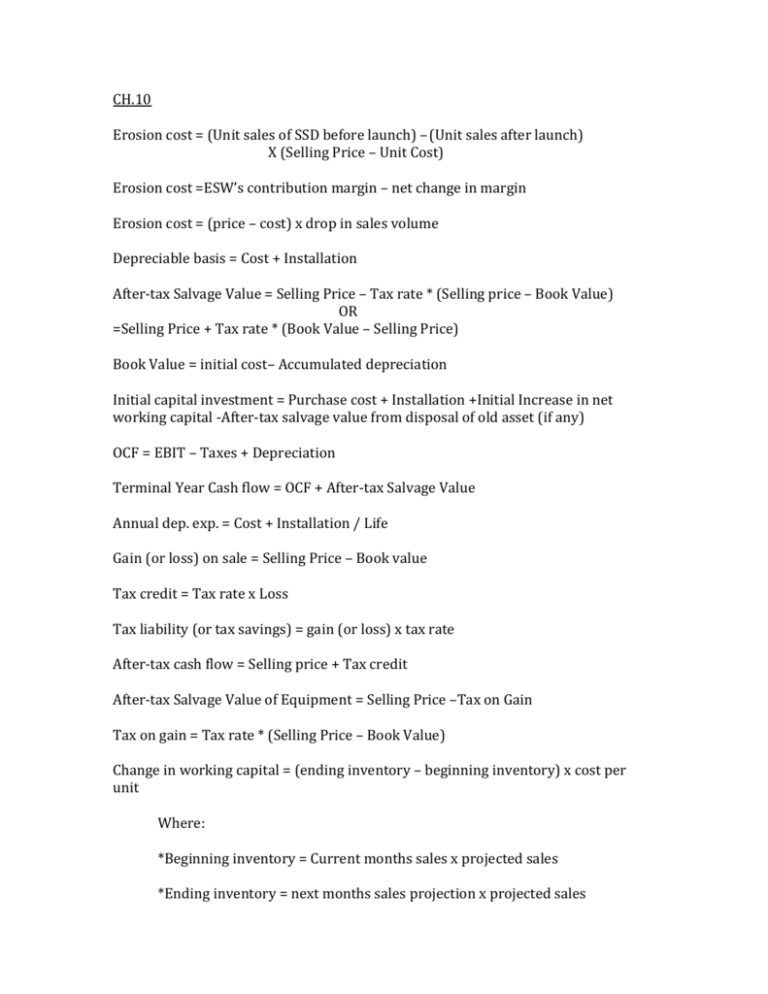

CH.10 Erosion cost = (Unit sales of SSD before launch) – (Unit sales after launch) X (Selling Price – Unit Cost) Erosion cost =ESW’s contribution margin – net change in margin Erosion cost = (price – cost) x drop in sales volume Depreciable basis = Cost + Installation After-tax Salvage Value = Selling Price – Tax rate * (Selling price – Book Value) OR =Selling Price + Tax rate * (Book Value – Selling Price) Book Value = initial cost– Accumulated depreciation Initial capital investment = Purchase cost + Installation +Initial Increase in net working capital -After-tax salvage value from disposal of old asset (if any) OCF = EBIT – Taxes + Depreciation Terminal Year Cash flow = OCF + After-tax Salvage Value Annual dep. exp. = Cost + Installation / Life Gain (or loss) on sale = Selling Price – Book value Tax credit = Tax rate x Loss Tax liability (or tax savings) = gain (or loss) x tax rate After-tax cash flow = Selling price + Tax credit After-tax Salvage Value of Equipment = Selling Price –Tax on Gain Tax on gain = Tax rate * (Selling Price – Book Value) Change in working capital = (ending inventory – beginning inventory) x cost per unit Where: *Beginning inventory = Current months sales x projected sales *Ending inventory = next months sales projection x projected sales CH.11WACC, Sequation risk free return g = (ending value / beginning value)1 / number of years – 1 Weighted average cost of borrowing = Proportion of each loan * Rate Net proceeds on each bond = Selling price –Commission Net price = Dividend/Rps Preferred Stock Component = Rp = Dp/Net price Security Market Line Approach/COST OF COMMON STOCK = Cost of Equity with SML equation = Re = rf + [E(rm)-rf]βi Constant growth in stock (dividend growth approach) = where Div0 = last paid dividend per share; Po = Current market price per share; and g = constant growth rate of dividend. Cost of Equity with Flotation Cost = After-tax cost of debt = Rd*(1-Tc) Adjusted Weighted Avg. cost of capital = Profitability index = (NPV + Cost)/Cost CH.12 Net Fixed Assets = Previous year + New Growth rate (g)= (ending value / beginning value)1 / number of years – 1 Sales forecast = previous years ales x (1 + sales growth rate)