Whole Foods - ChelseaMGT685

advertisement

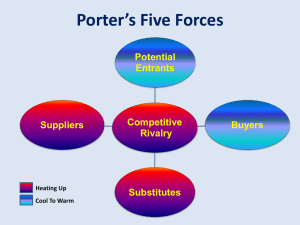

A niche product to a national competitor By: Tom Anderson Kyle McDaniel Dan McLindon Ray Moorman Jeremy Smiley Key Question Can Whole Foods remain competitive in the face of major changes in the external environment? Supporting Questions: What is the history of Whole Foods? What is changing in the external environment? What are the changes in demand? How is supply changing in the retail food industry? How is the competitive landscape changing? What is Whole Foods Strategy? Marketing Growth Operational Supporting Questions: What internal factors are affecting Whole Foods? What are the strengths, weaknesses, opportunities, and threats for Whole Foods? What are the future challenges of Whole Foods? How should Whole Foods proceed? Overview of Whole Foods Founded 1980 Vision Create an international brand , create a more healthy diet for consumers , pace setter in the industry, be the best in food retail Brand Values Natural & Organic Foods Competitive Position Premium Products at a Premium Price Source of Differentiation Best Quality, least processed, most flavorful, naturally preserved, zero hormones and pesticides Status in 2008 275 stores, 3 countries, $6.6bn in revenue Corporate Objective 400 stores, $12bn in revenue What is changing in the external environment? PEST Analysis for Whole Foods Category Issue Threats/Opport unities Ranking (1-5) Political 4 tier class system i.e. Organic Definitions Opportunity 1 or 2 Economic 2008 Economy Sours Threat 5 Social More health & Opportunity environmentally conscious population. Technological 4 or 5 What are the changes in demand? Overview of the Demand Total Food Retail $850bn Natural & Organic Retail $62bn (7.3%) – niche market Growth Rate Growth slowed since 2000 (7-9%) Organic $17bn (1/3 of natural foods) Key Items Purchased Fresh fruit &vegetables – 73% (largest category) Big growth is processed items 3 Key Barriers for Consumers Prices of organic foods – likely to decline as competition/supply increases Lack of availability – more supply in the future Brand loyalty to natural & organic foods How is supply changing in the food retailing industry? Porter’s Five Forces Potential Entrants Suppliers Heating Up Cool To Warm Competitive Rivalry Substitutes Buyers Porter’s Five Forces – Whole Foods Market Forces Description Conventional Retailers Threat of Substitute Products Easy switch to the conventional retailers. Specialty stores built right in to their strategies. High Bargaining Power of Suppliers Largest food processors acquiring organic food producers. Only 1% of farmland used for organics. Medium to High Bargaining Power of Buyers For the most part, conventional retailers determine what we pay. Low Intensity of Competition Degree of commitment by the conventional retailers will determine the intensity. High Threat of New Entrants Entrants are already there! Their intensity of their pursuit of the natural/organic market is the question. Low – Medium Whole Foods Answer Forces Whole Foods Answer to the Competition The Result Threat of Substitute Products Acquisitions, taking on debt, reducing available cash. Hoping to get into new markets. Plans for new stores, varied floor plans Slowing growth since 2000 Bargaining Power of Suppliers Use local suppliers. But only 1% of farmland being used as organic farms. The big retailers are in a better position to deal with suppliers. Struggling to find beef and chicken suppliers. Intensity of Competition Growing and marketing organic foods runs 25 to 75% higher than conventional. Conventional retailers setting the price and gaining market share. Spend less (%) than the competition. Bargaining Power of Buyers For the most part, conventional retailers determine what we pay. At will. Threat of New Entrants Entrants are already there! Their intensity of the pursuit of the natural/organic market is the question. Already there. How is the competitive landscape changing? Changes in the Competitive Landscape Should they really welcome competition? Local, regional, independent, national, and specialty stores are all competitors. CEO say it is a gateway for customers to try natural/organic foods or opportunity for the competition? Take a look at Store Sales Growth 2004 2005 2006 2007 2008 14.9% 12.8% 11.0% 7.1% ??? Sales growth has been cut in half since 2004! Changes in the Competitive Landscape We may be seeing a revolution in the food retailing business. Supercenters – Marketplaces – Wholesale Clubs 2006 US Grocery Sales # of Stores Revenue in Billions $ Conventional Retailers 25% 5812 $377 Whole Foods 0.7% 188 $5.6 Will the competition force Whole Foods to rethink their strategy? What is Whole Foods Strategy? Marketing Growth Operational Marketing Strategy Product High Quality Natural and Organic Food and nonfood items Offerings vary based on store size and tastes of local clientele Exotic offerings and product variety Ex) Japanese eggplant, 40 cheeses, 20 coffees Private label products Emphasis on perishables (fruits/veg., bakery goods, meat, seafood) – 67 % of sales Marketing Strategy Price Goal is competitive price at highest quality Organic foods are 25 – 75% more costly to grow and market Price and Quality are competing forces Whole Foods chooses to focus on Quality, therefore prices are higher than conventional grocers Marketing Strategy Place No standard store design. Layout customized for site and product mix. Colorful, inviting, fun Gathering place to learn, interact, eat, and grocery shop Presentation Highly regarded food displays, cleanliness, wide aisles Marketing Strategy Promotion Primarily rely on word-of-mouth recommendations 0.5% of revenue spent on advertising Most marketing spend is for in-store signage and events Store personnel is knowledgeable and personable Growth Strategy New stores and acquisitions of small owner-managed chains in desirable markets Ideal store size is 45,000 – 60,000 sq. ft. Operational Strategy Team-based management of store operations Many personnel, merchandising, and operating decisions made at store level Buying responsibility at the national and regional levels for volume discounts Own and operate many distribution centers: 2 for produce, 9 bake houses, 5 commissary kitchens for prepared food, and a central coffee roaster What internal factors are affecting Whole Foods? Internal Analysis Affordability is a key Weakness – WF must build value with every customer interaction. Email recipes, establish newsletter, personalized services once customer is in the store, free organic cooking classes, partner with local farmers in advertising Internal Analysis Value Chain Analysis Logistics seem to be streamlined Operations – opportunity to be more efficient, appeal to more customers/increase average spending Focus more on perishables (fruit and vegetables) – reduce waste and spoilage in biggest section of the store Eliminate non-essential services – valet parking, massages Develop budget that allows chefs to teach organic cooking classes to customers at no cost. Continue to invest in customer service associates. Their interactions can help build brand loyalty. Internal Analysis Value Chain Analysis (continued) Marketing – severely under-funded, develop new marketing campaign in current markets to reach more middle/upper income families. Focus on pesticide/hormone free and benefits to the earth – capitalize on green/healthy trends. Management/Administration – board should remove John Mackey and replace him with a leader with experience in grocery or organics. Proven inability to lead at this level. Doesn’t have the vision to make the changes necessary right now. What are the strengths, weaknesses, opportunities, and threats for Whole Foods? SWOT Analysis STRENGTHS Experience in the Industry Large, customized stores Huge selection/variety – over 30,000 items Nationally Known Organic/Natural Foods Seller OPPORTUNITIES Expand private label selection – lower price for customers Advertise more, create coupons and promotions to get people in the store Hype right now is to eat healthier and protect the environment Rewards program – frequent buyer cards (like Kroger cards) Back to Basics – buy more local products that people will pay more for WEAKNESSES Price – up to 75% higher Locations – only in affluent areas Advertising Budget very low (WOM approach) Promotional Offers – no coupons THREATS Conventional Supermarkets Bad Economy Local Farmers’ Markets/Independent Retail Chains What are the future challenges for Whole Foods? Future Challenges Conventional Grocery Stores over saturate Market & offer Organic & Natural Foods Convince new customers to shop at WF rather than more convenient stores Pricing – being able to compete against the conventional grocery chains Getting more people in the store Recommendations for Whole Foods Market Recommendations Lower Price to Compete with Grocery Stores Add a customer rewards program for frequent buyers Mail coupons to customers in a targeted marketing effort Expand Private Label Selection Lowers mfg costs, could offer discounts to customer for using WF brand products Recommendations Expand Private Label Selection Lowers manufacturing costs, offer discounts to customer for using WF brand products Recommendations Personalize Service at WF 3 days after purchase, email Thank You cards to customers after purchases 7 days after purchase, email 10% coupon to use on next purchase Email recipes Advertise, Advertise, Advertise Mail fliers to local zip codes – show locally grown foods, classes offered, items on sale, coupons Recommendations Catering Offer catering to local businesses & events Stop re-branding Wild Oats stores Halt expansion until WF builds up more cash Focus on profitable stores and use that philosophy to improve unprofitable stores Look at option of selling some underperforming Wild Oats stores Questions?