Economic Overview - Unbounded Possibilities

advertisement

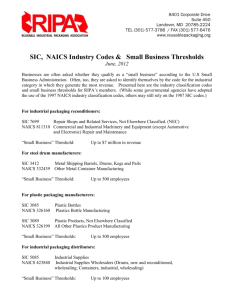

Indiana Economic Growth Region 7 Economic Overview October 2012 Prepared By: 1 Table of Contents Introduction Demographic Perspective Table 1: Population Change Table 2: Age Breakdown Table 3: Educational Attainment Table 4: High School Graduation Rates Table 5: Race/Ethnicity Breakdown Economic Overview Chart 1: Total Job History 2001-2011 Table 6: Unemployment Rates Table 7: Jobs by 2-Digit NAICS Codes Table 8: Growing Industries by 4-Digit NAICS Codes Table 9: Declining Industries by 4-Digit NAICS Codes Table 10: Occupations by SOC Codes 3 4 5 6 7 8 9 9 10 12 14 15 2 Introduction Indiana State University’s Strategic Plan, The Pathway to Success, envisions a culture where its graduates are productive citizens of the world in which they live. As a commitment for improving the communities in which its students and graduates reside, the University has a strong desire to address the needs of Indiana’s rural communities from which the majority of its students migrate. Leadership for this endeavor lies with the newly established Rural-Urban Entrepreneurship Development Institute (RUEDI). RUEDI will provide engagement and research as well as a learning and leadership platform to improve the economic health and stability of rural counties and small towns throughout Indiana. Collaboration with external businesses, industry, civic organizations, government and academic stakeholders will play a critical role in implementing projects to reach overarching goals of the Institute, the University and the communities in which ISU students and graduates live. RUEDI objectives include: supporting existing commercial activity, increasing new business starts, expanding job creation, creating, growing and attracting entrepreneurs, raising per capita incomes, and enhancing regional rural educational attainment by encouraging completion of high school and post-secondary education. An integral part of beginning any project is to ensure that reliable data is collected to first inform stakeholders of important issues that exist and for which decisions need to be made and then to provide a reliable and consistent resource to measure the effect of activities taken. Therefore, the Rural-Urban Entrepreneurship Development Institute has created a Data Center within the Institute to oversee the collection and analysis of data as part of its activities. The RUEDI Data Center will work in collaboration with the University’s Survey Research Lab to provide both quantitative and qualitative data throughout program initiatives. Because of the complex number of data resources available, RUEDI has enlisted the assistance of Economic Modeling Specialists, Inc. (EMSI) to collect and integrate the most current data available on industries, occupations, and demographics. EMSI is a webbased tool that has assisted community colleges, universities, workforce boards, economic development groups, and private industries throughout the United States to better understand all facets of employment and economic trends—industries, occupations, demographics, economic impacts, and even skills, job compatibility, educational attainment, and more—at various levels (zip code, county, state, nation) of geographic detail. The tables contained within this report have been created with the data from EMSI’s web-tools. For Indiana Economic Growth Region – 7, counties include Clay, Indiana (18021), Parke, Indiana (18121), Putnam, Indiana (18133), Sullivan, Indiana (18153), Vermillion, Indiana (18165), Vigo, Indiana (18167). 3 Demographic Perspective Economic Growth Region-7 consists of the urban county of Vigo and the rural counties of Clay, Parke, Putnam, Sullivan, and Vermillion. The total population of these 6 counties, 228,479, represented 3.5-percent of the State’s total population in 2011. EGR-7’s growth rate falls below that of the State and Nation over the past decade and has slowed even further in recent years. Percent Change from 2001 to 2006 was one-quarter of the Nation's rate of growth and one-fifth of the National rate for 2001 to 2011. Individually, only Putnam and Vigo Counties have shown growth in the last five years with Sullivan and Vermillion Counties showing an overall loss during the last decade. Table 1: Population Change Population Area Number Change Percent Change 2001 2006 2011 2001-06 2006-11 2001-11 2001-06 2006-11 2001-11 Clay County 26,623 27,112 26,915 489 (197) 292 1.8% -0.7% 1.1% Parke County 17,213 17,386 17,342 173 (44) 129 1.0% -0.3% 0.7% Putnam County 36,398 37,779 38,040 1,381 261 1,642 3.7% 0.7% 4.3% Sullivan County 21,785 21,552 21,487 (233) (65) (298) -1.1% -0.3% -1.4% Vermillion County 16,649 16,595 16,112 (54) (483) (537) -0.3% -2.9% -3.2% Vigo County 105,549 106,521 108,583 972 2,062 3,034 0.9% 1.9% 2.8% EGR - 7 224,176 226,945 228,479 2,769 1,534 4,303 1.2% 0.7% 1.9% 6,129,883 6,334,225 6,544,892 204,342 210,667 415,009 3.2% 3.3% 6.6% 284,968,955 298,379,912 312,447,985 13,410,957 14,068,073 27,479,030 4.5% 4.7% 9.2% State of Indiana United States 4 When looking at the population broken down by age it is not unusual to see strong gains in the population cohorts over the age of 50 as Baby-Boomers have now reached the half-century mark and more and more retirees make the decision to "age in place". While there were single digit gains in the 25-29 year olds and those over 85, the baby boomer age cohorts showed significant gains of 15 to 42 percent. One- third of the Region’s population is below the age of 25, with a little over 50-percent in the age groups associated with an active workforce, 25-64, and another 15-percent are at retirement age, 65 and above. Table 2: EGR-7 Age Breakdown Population 2001-2011 Change Percent of Total Demographic 2001 2006 2011 Number Percent 2001 2011 Under 5 years 13,048 12,891 12,545 (503) (3.9%) 5.8% 5.7% 5 to 9 years 14,226 13,392 13,185 (1,041) (7.3%) 6.3% 5.9% 10 to 14 years 14,954 14,594 13,913 (1,041) (7.0%) 6.7% 6.4% 15 to 19 years 18,104 17,658 17,119 (985) (5.4%) 8.1% 7.8% 20 to 24 years 18,802 19,917 18,771 (31) (0.2%) 8.4% 8.8% 25 to 29 years 13,227 13,588 14,499 1,272 9.6% 5.9% 6.0% 30 to 34 years 14,860 13,788 14,624 (236) (1.6%) 6.6% 6.1% 35 to 39 years 16,400 15,068 13,940 (2,460) (15.0%) 7.3% 6.6% 40 to 44 years 17,073 16,306 14,803 (2,270) (13.3%) 7.6% 7.2% 45 to 49 years 16,165 16,853 15,938 (227) (1.4%) 7.2% 7.4% 50 to 54 years 14,709 15,924 16,954 2,245 15.3% 6.6% 7.0% 55 to 59 years 11,398 14,523 15,619 4,221 37.0% 5.1% 6.4% 60 to 64 years 9,517 10,813 13,557 4,040 42.5% 4.2% 4.8% 65 to 69 years 8,055 8,785 10,228 2,173 27.0% 3.6% 3.9% 70 to 74 years 7,739 7,146 7,735 (4) (0.1%) 3.5% 3.1% 75 to 79 years 6,949 6,428 5,865 (1,084) (15.6%) 3.1% 2.8% 80 to 84 years 4,815 5,058 4,729 (86) (1.8%) 2.1% 2.2% 85 years and over Total 4,134 4,214 4,455 321 7.8% 1.8% 1.9% 224,176 226,945 228,479 4,303 1.9% 100.0% 100.0% Age Breakdown 15% 24 & Below 33% 27% 25-44 45-64 25% 65 & Above 5 Table 3: EGR-7 Educational Attainment for Population 25 and Above State of Indiana United States 2001 Population 2001 % of Total 2011 Population 2011 % of Total Change 2001-11 % Change 2001-11 7,287 5.04% 10,519 6.95% 3,232 44.35% 6.87% 33.13% 8.86% 27.67% 9th Grade to 12th Grade 19,069 13.20% 11,779 7.79% (7,290) (38.23%) 7.37% (30.87%) 6.59% (32.88%) High School Diploma 58,667 40.60% 58,297 38.53% (370) (0.63%) 35.86% 4.88% 28.48% 10.86% Some College 26,875 18.60% 32,378 21.40% 5,503 20.48% 20.53% 13.14% 20.93% 13.03% Associate's Degree 8,838 6.12% 12,203 8.07% 3,365 38.07% 7.29% 30.73% 7.45% 28.04% Bachelor's Degree 13,562 9.38% 14,770 9.76% 1,208 8.91% 14.19% 23.17% 17.47% 23.35% Graduate Degree and Higher 10,213 7.07% 11,353 7.50% 1,140 11.16% 7.88% 16.70% 10.22% 25.90% 144,512 100.00% 151,298 100.00% 6,786 4.70% 100.00% 8.67% 100.00% 12.28% Demographic Less Than 9th Grade Total 2011 % of Total % Change 2001-11 2011 % of Total % Change 2001-11 Over the past decade increases in attaining Some College or an Associate Degree for residents 25 and older in the Region exceeded that of the State and National Attainment. These efforts have provided for Economic Growth Region-7 to have a slight advantage over the State and National in regards to the percentages of adults completing High School, attending Some College and completing an Associate Degree, but the Region falls short on the percentage of residents with a Bachelor Degree, Graduate Degree or Higher. A portion of the decrease in the number of persons with a 9 th to 12th Grade Education across geographical regions can be attributed to better high school graduation rates and adult learners returning to school, but the 44-percent increase in population that do not acquire a 9th Grade education begs for a more thorough investigation into what might have precipitated this increase. EGR- 7 is home to five postsecondary educational institutions offering Bachelor or Higher Degrees including Indiana State University, Ball State University, DePauw University, Rose Hulman Institute of Technology and St. Mary-of-the-Woods College along with Ivy Tech Community College offering primarily Associate Degrees along with a limited number Bachelor Degree programs. Approximately one-third of all Indiana's four-year college students graduate on time and just over half graduate after six years. Only 4 percent of the state's two-year college students complete on time and 12 percent graduate within three years. 6 Economic Growth Region-7 has 13 public school corporations within its borders. Of the 2,540 students expected to graduate in 2011 from these school corporations, 2218 did graduate for an overall graduation rate of 87.3-percent. Statewide, Indiana’s high school graduation rate improved to 85.7 percent in the 2010-2011 school year, increasing 1.6 percent over the previous year and 4.3 percent over the 2009 rate. Overall the State’s graduation rate is broken down as follows: o 85.7 percent of students graduated within four years o 6.1 percent of students are reported dropouts or undetermined, which means they either moved out of state, dropped out or left school without formally withdrawing o 6.3 percent of students are still in school o 0.4 percent of students earned a General Education Development (GED) diploma o 1.2 percent of students earned a Special Education Certificate o 0.2 percent of students earned a non-diploma Course Completion Certificate While High School Graduation rates have improved across the state, Indiana’s Commission on Higher Education urges stronger engagement among the postsecondary and K-12 educational systems to ensure that postsecondary expectations for students are clear as 66-percent of Indiana’s high school graduates with a General Diploma require remedial education when they enter college and 38-percent of students receiving a Core-40 Diploma need remedial education. Table 4: EGR-7 High School Graduation Rates 2010 2009 Cohort Size Graduates Grad Rate Grad Rate Grad Rate Clay Community Schools 325 287 88.3% 91.2% 83.0% Southwest Parke Com School Corp 104 84 80.8% 80.2% 76.5% Corp ID County Corporation Name 1125 Clay 6260 Parke 2011 6300 Parke Rockville Community School Corp 58 53 91.4% 91.5% 90.1% 6310 Parke Turkey Run Community School Corp 51 46 90.2% 75.6% 90.0% 6705 Putnam South Putnam Community Schools 108 102 94.4% 83.5% 86.5% 6715 Putnam North Putnam Community Schools 127 112 88.2% 86.9% 86.6% 6750 Putnam Cloverdale Community Schools 107 79 73.8% 75.0% 73.3% 6755 Putnam Greencastle Community School Corp 147 127 86.4% 83.9% 81.3% 7645 Sullivan Northeast School Corp 102 87 85.3% 84.1% 87.0% 7715 Sullivan Southwest School Corp 144 122 84.7% 87.9% 85.9% 8010 Vermillion North Vermillion Com School Corp 64 59 92.2% 93.5% 83.5% 8020 Vermillion South Vermillion Com School Corp 134 115 85.8% 88.4% 77.5% 8030 Vigo Vigo County School Corp 1069 945 88.4% 84.8% 84.2% 7 The Region like the State and Nation saw a decrease in the overall percent of White, Non-Hispanic people represented in the area. While White, Hispanic is the cohort showing the largest gains nationally, the cohort ranks third for the Region with Black, NonHispanic retaining the number two spot. Together White, Non-Hispanic, Black, Non-Hispanic and White, Hispanic comprises 98.37% of the total population as compared to 91.73% on the National level and 97.16% at the State level. Table 5: EGR-7 Race/Ethnicity Breakdown Region Population Percent of Total Population 2001 2006 2011 Change 2001-11 White, Non-Hispanic 209,642 210,382 210,240 598 93.52% 92.02% 82.30% 64.24% Black, Non-Hispanic 9,159 10,139 10,728 1,569 4.09% 4.70% 9.22% 12.46% Demographic American Indian or Alaskan Native, Non-Hispanic Region 2001 Region 2011 State 2011 Nation 2011 671 661 629 (42) 0.30% 0.28% 0.22% 0.75% 1,809 2,059 2,337 528 0.81% 1.02% 1.66% 4.92% 56 61 36 (20) 0.02% 0.02% 0.03% 0.16% 108 151 195 87 0.05% 0.09% 0.19% 0.46% White, Hispanic 2,279 2,953 3,770 1,491 1.02% 1.65% 5.64% 15.03% Black, Hispanic 171 175 177 6 0.08% 0.08% 0.31% 0.78% American Indian or Alaskan Native, Hispanic 106 139 128 22 0.05% 0.06% 0.16% 0.50% 36 43 30 (6) 0.02% 0.01% 0.04% 0.17% Asian, Non-Hispanic Native Hawaiian or Pacific Islander, Non-Hispanic Two or More Races, Non-Hispanic Asian, Hispanic Native Hawaiian or Pacific Islander, Hispanic Two or More Races, Hispanic Total 32 33 11 (21) 0.01% 0.00% 0.03% 0.06% 108 151 197 89 0.05% 0.09% 0.20% 0.47% 224,176 226,945 228,479 4,303 100% 100% 100% 100% 8 Economic Overview Total Employment (jobs in EGR-7, EGR-7 Jobs 2001-2011 fourth quarter 2011) is 106,289, 111,000 representing a 3-percent decrease from 2001 employment 110,000 and a 3.6-percent decrease from peak employment of 110,236 in 109,000 2007. The chart shows a series of peaks 108,000 and valleys in Economic Growth Region-7’s employment base 107,000 over the past decade. 106,000 The Indiana Department of Workforce Development reports 105,000 that for the past three years, unemployment rates in January 104,000 were approximately 2-percent 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 higher than that of the National or State rate. Of Indiana’s 12 Economic Growth Regions, EGR-7 ranks number one in highest unemeployment rates. Jobs Table 6: EGR-7 Unemployment Rates Month EGR-7 Indiana U.S. January-12 11.2% 9.2% 8.8% January-11 11.0% 9.0% 9.1% January-10 11.8% 10.6% 9.7% Source: Indiana Department of Workforce Development 9 The North American Industry Classification System (NAICS) is a system used by the United States Government to classify industries by type. NAICS codes can be expressed at a 2 to 6-digit level with the higher number of digits providing a more detailed description of the industry type. Table 7: EGR - 7 Employment by Major Industry Sector Jobs Change NAICS Code Description 2001 2011 Number 11 Agriculture, Forestry, Fishing and Hunting 3,580 3,559 (21) 21 Mining, Quarrying, and Oil and Gas Extraction 656 1,116 22 Utilities 962 797 23 Construction 31-33 Manufacturing 42 Wholesale Trade 44-45 Retail Trade 48-49 Transportation and Warehousing 51 Location Quotients 2011 Earnings 2011 Percent 2011 State 2011 National Region Nation Establishments (1%) 1.64 1.72 $31,962 $26,453 77 460 70% 3.21 1.38 $68,265 $77,058 22 (165) (17%) 1.73 2.24 $110,651 $119,493 35 6,365 5,806 (559) (9%) 0.98 1.05 $42,023 $47,011 439 15,328 13,453 (1,875) (12%) 0.96 1.81 $59,893 $73,698 229 2,120 2,055 (65) (3%) 0.57 0.56 $44,732 $72,738 211 15,546 11,785 (3,761) (24%) 1.07 1.10 $21,960 $29,494 696 3,634 3,568 (66) (2%) 0.86 1.05 $42,619 $49,555 191 Information 1,365 972 (393) (29%) 0.74 0.50 $39,726 $81,339 56 52 Finance and Insurance 3,247 3,401 154 5% 0.78 0.59 $39,449 $77,402 284 53 Real Estate and Rental and Leasing 2,269 3,089 820 36% 0.77 0.65 $19,443 $25,651 144 54 Professional, Scientific, and Technical Services 2,643 2,763 120 5% 0.59 0.37 $35,973 $71,365 333 315 408 93 30% 0.49 0.33 $56,791 $114,099 22 4,186 5,816 1,630 39% 0.92 0.91 $20,509 $32,977 211 3,820 4,549 729 19% 2.03 1.77 $29,964 $35,383 39 55 61 Management of Companies and Enterprises Administrative and Support and Waste Management and Remediation Services Educational Services (Private) 62 Health Care and Social Assistance 10,714 12,013 1,299 12% 1.01 1.03 $45,829 $50,850 478 71 Arts, Entertainment, and Recreation 1,057 1,169 112 11% 0.58 0.52 $11,257 $26,471 61 72 Accommodation and Food Services 7,811 7,664 (147) (2%) 1.04 1.05 $13,989 $20,213 454 81 Other Services (except Public Administration) 90 Government 99 Unclassified Industry 56 Total 6,249 5,511 (738) (12%) 0.89 0.86 $19,782 $23,652 417 17,709 16,793 (916) (5%) 1.26 1.15 $47,067 $63,472 343 <10 <10 -- -- -- -- $10,552 $60,620 -- 109,577 106,289 (3,288) -3% $ 37,746 $ 49,851 4,740 10 At an aggregrate two-digit NAICS Code, the five largest indsutries by employment in EGR-7 are Government (NAICS 90), Manufacturing (NAICS 31-33), Health Care and Social Assistance (NAICS 62), Retail Trade (NAICS 44-45), and Accomodation and Food Services (NAICS 72). With the exception of Healthcare and Social Assistance(NAICS 62), all five of the top industry sectors declined within the time period indicated. Retail Trade (NAICS 44-45) demonstrated the most significant loss in actual numbers, 3,751, representing a 24-percent loss in jobs for this industry sector. Manufacturing (NAICS 31-33) was second in number of jobs lost, 1,875, at a rate of 12-percent. Administrative and Support and Waste Management and Remediation Services (NAICS 56) demonstrated the largest increase in actual number of jobs, 1,630, followed by the Health Care and Social Assistance (NAICS 62) Industry with 1,299 new jobs. Average Annual Earnings for a Hoosier male living in EGR-7 is $44,921 while a female makes an average of $29,799, both are approximately 75-peprcent of the National Average for their gender. Overall Average Earnings for a resident of EGR-7 is $37,746 which is 76-percent of the National Average of $49,851. The location quotient is a measure of relative concentration of an industry’s presence in a given geographical region compared to the United States. If the quotient is greater than one, the geography has a higher concentration (percentage of employment) of that industry than the Nation as a whole. The location quotient measures concentration rather than absolute size. Utilities (NAICS 22) has the highest location quotient with 2.24, followed by Manufacturing (NAICS 31-33) with a quotient of 1.81 and then Educational Services (NAICS 61) with a quotient of 1.77. In addition to having the highest National Location Quotient, the Utilities Industry (NAICS 22) also pays the highest annual earnings with $110,650 per worker followed by the related energy cluster industry of Mining, Quarrying, and Oil and Gas Extraction (NAICS 21) at $68,266 per worker. Drilling down to the four-digit NAICS level provides insight into which specific industries are growing or declining the fastest. In Tables 8 and 9 we review the Top 25 Fastest Growing and the Top 25 Fastest Declining Industries in Economic Growth Region-7. The Top 25 Fastest Growing Industries represented just over 15,200 jobs in 2001 and have grown by more than 50-percent during the last decade to represent more than 23,200 jobs in 2011 or 22-percent of the Region’s total employment. There are approximately 500 employers within these industries making up 10-percent of total business establishments in EGR-7. 11 Table 8: EGR - 7 Fastest Growing Industries Sorted by 4-Digit NAICS Codes Jobs NAICS Code 6241 Description Individual and Family Services 6214 Outpatient Care Centers 1120 Animal Production 5617 Services to Buildings and Dwellings 5311 Lessors of Real Estate 5613 Employment Services 5614 2001 275 Change Location Quotients 2011 Earnings 2011 2011 1,002 Number 727 Percent 264% 2011 State 1.50 2011 National 1.09 Region $29,437 Nation $27,426 Establishments 32 16 79 793 714 904% 2.23 2.03 $70,573 $64,304 870 1,460 590 68% 1.62 2.07 $33,053 $25,932 11 1,308 1,888 580 44% 0.94 0.87 $16,922 $20,899 118 832 1,374 542 65% 0.86 0.89 $20,040 $33,750 51 1,212 1,713 501 41% 0.72 0.96 $17,550 $35,197 19 Business Support Services 465 885 420 90% 1.71 1.30 $18,878 $35,419 16 6232 Residential Mental Retardation, Mental Health and Substance Abuse Facilities 317 640 323 102% 1.92 1.70 $21,810 $31,168 31 3346 Manufacturing and Reproducing Magnetic and Optical Media 1,058 1,377 319 30% 25.21 79.63 $59,073 $99,450 1 2121 Coal Mining 6113 Colleges, Universities, and Professional Schools (Private) 3362 6111 208 509 301 145% 5.11 9.14 $100,955 $95,322 3 3,201 3,498 297 9% 2.96 3.27 $32,128 $46,166 3 Motor Vehicle Body and Trailer Manufacturing 768 1,057 289 38% 1.33 15.11 $44,686 $59,480 2 Elementary and Secondary Schools (Private) 201 474 273 136% 1.20 0.79 $31,852 $35,088 6 5239 Other Financial Investment Activities 184 382 198 108% 0.57 0.26 $21,974 $59,536 15 5313 Activities Related to Real Estate 501 698 197 39% 0.65 0.51 $15,461 $20,911 28 4529 Other General Merchandise Stores 1,163 1,353 190 16% 0.87 1.46 $22,075 $27,367 44 6243 Vocational Rehabilitation Services 418 598 180 43% 1.35 2.64 $21,037 $28,740 7 3327 Machine Shops; Turned Product; and Screw, Nut, and Bolt Manufacturing 386 562 176 46% 1.31 2.59 $44,043 $58,657 24 4481 Clothing Stores 271 447 176 65% 0.81 0.61 $12,714 $20,973 33 1151 Support Activities for Crop Production 123 299 176 143% 2.00 1.03 $23,796 $26,052 5 3363 Motor Vehicle Parts Manufacturing 781 954 173 22% 0.68 3.59 $56,884 $72,814 8 5611 Office Administrative Services 6233 Community Care Facilities for the Elderly 3118 Bakeries and Tortilla Manufacturing 3391 Medical Equipment and Supplies Manufacturing Total 98 259 161 164% 1.22 0.58 $26,365 $55,887 6 233 389 156 67% 0.84 0.80 $29,555 $29,002 6 47 203 156 332% 0.90 1.14 $40,804 $42,079 3 240 395 155 65% 0.64 2.05 $52,913 $84,115 8 15,239 23,209 7,970 52.30% $37,746 $49,851 496 12 Individual and Family Services (NAICS 6241) and Outpatient Care Centers (NAICS 6214) led the Region in creating jobs with both adding more than 700 jobs. These two industries along with Residential Mental Retardation, Mental Health and Substance Abuse Facilities (NAICS 6232), Vocational Rehabilitation Services (NAICS 6243) and Community Care Facilities for the Elderly (NAICS 6233) demonstrate why the Health Care and Social Assistance industry sector had such strong growth over the past decade. Overall Manufacturing (NAICS 31-33) demonstrated a loss in employment during 2001-2011, but six sub-sectors are included within the top 25 Fastest Growing Industries and include Manufacturing and Reporducing Magnetic and Optical Media (NAICS 3346), Motor Vehicle Body and Trailer Manufacturing (NAICS 3362), Machine Shops; Turned Product and Screw, Nut and Bolt Manufacturing (NAICS 3327), Motor Vehicle Parts Manufacturing (NAICS 3363), Bakeries and Tortilla Manufacturing (NAICS 3113) and Medical Equipment and Supplies Manufacturing (NAICS 3391). While 25 Fastest Growing Industries added nearly 8,000 jobs to the economy between 2001 and 2011, the 25 Fastest Declining Industries reduced employment by 10,500 jobs during the same time period. Declining Industries represent more than 1,000 employers. Electronic Shopping and Mail Order Houses lost nearly 2,000 jobs between 2001 and 2011 resulting in the largest loss of jobs in the Retail Trade (NAICS 44-45) industry with additional losses reported in Department Stores (NAICS 4521), Gasoline Stations (NAICS 4471), Direct Selling Establishments (NAICS 4543) , Automobile Dealers (NAICS 4411), and Lawn and Garden Equipment and Supplies Stores(NIACS 4442). Industries that are declining should not be considered lost causes. The Plastic Products Manufacturing (NAICS 3261) lost over 1,000 jobs during the study period, but continues to have a strong presence in the Region with more than 2,700 jobs and a National Location Quotient of 8.71. Improvements in productivity and transition into new related markets might cause establishments to fluctuate in the number of employees within an industry sector. In Table 10: EGR-7 Occupations it is noted that more than one-third of the Region’s residents are employed within three occupations, Office and Administrative Support (SOC 43), Sales and Related (SOC 41) and Production (SOC 51). There are more than 5,000 occupational openings within the Region annually representing new job creation and openings produced by retirement and termination of employment. Average hourly wages for all Occupations across the Region is $16.27 per hour as compared to that of the State at $17.90 and the Nation at $19.92. 13 Table 9: EGR - 7 Declining Industries Sorted by 4-Digit NAICS Codes Jobs Change Location Quotients 2011 Earnings 2011 NAICS Code 4541 Description Electronic Shopping and Mail-Order Houses 2001 2,052 2011 134 Number (1,918) Percent (93%) 2011 State 0.59 2011 National 0.57 Region $13,688 Nation $43,926 Establishments 2 3261 Plastics Product Manufacturing 3,765 2,710 (1,055) (28%) 3.14 8.71 $60,237 $57,906 18 1110 Crop Production 2,366 1,553 (813) (34%) 1.56 1.80 $33,519 $26,044 39 9029 State Government, Excluding Education and Hospitals 2,765 2,045 (720) (26%) 2.21 1.47 $48,142 $65,976 90 6244 Child Day Care Services 1,219 680 (539) (44%) 0.79 0.65 $13,634 $17,024 74 4521 Department Stores 1,664 1,127 (537) (32%) 1.70 1.24 $22,195 $24,769 12 6221 General Medical and Surgical Hospitals (Private) 3,709 3,234 (475) (13%) 1.03 1.22 $57,301 $65,554 5 4471 Gasoline Stations 1,423 1,040 (383) (27%) 1.63 2.00 $17,954 $22,859 105 4543 Direct Selling Establishments 1,165 800 (365) (31%) 1.01 1.13 $7,290 $13,206 12 4411 Automobile Dealers 1,146 791 (355) (31%) 1.02 1.12 $36,976 $53,596 47 3323 Architectural and Structural Metals Manufacturing 449 97 (352) (78%) 0.30 0.48 $44,218 $57,184 8 3231 Printing and Related Support Activities 973 697 (276) (28%) 1.34 2.19 $42,730 $50,882 26 7221 2,879 2,605 (274) (10%) 0.91 0.94 $15,268 $19,836 138 951 686 (265) (28%) 1.00 1.04 $28,343 $39,353 59 3251 Full-Service Restaurants Foundation, Structure, and Building Exterior Contractors Basic Chemical Manufacturing 344 103 (241) (70%) 1.18 1.18 $92,339 $115,204 3 3254 Pharmaceutical and Medicine Manufacturing 779 548 (231) (30%) 1.13 3.22 $139,366 $133,835 3 3273 Cement and Concrete Product Manufacturing 432 201 (231) (53%) 1.99 1.95 $48,546 $59,410 10 2361 Residential Building Construction 1,011 788 (223) (22%) 1.07 1.09 $35,724 $41,278 111 8134 Civic and Social Organizations 618 396 (222) (36%) 0.92 1.57 $10,340 $19,223 55 9036 5,745 5,542 (203) (4%) 1.06 1.08 $47,235 $55,403 55 837 669 (168) (20%) 1.98 2.67 $115,145 $127,448 19 454 298 (156) (34%) 0.79 0.83 $30,364 $59,212 14 8123 Education and Hospitals (Local Government) Electric Power Generation, Transmission and Distribution Newspaper, Periodical, Book, and Directory Publishers Dry-cleaning and Laundry Services 358 204 (154) (43%) 1.04 1.02 $29,978 $29,251 19 2382 Building Equipment Contractors 1,576 1,430 (146) (9%) 1.03 1.13 $61,350 $56,175 93 4442 Lawn and Garden Equipment and Supplies Stores 1.40 1.76 $32,928 $32,110 20 $37,746 $49,851 1,037 2381 2211 5111 Total 304 158 (146) (48%) 38,984 28,536 -10,448 -26.8% 14 Table 10: EGR-7 Occupations SOC Code 11-0000 Jobs Change 2011 Annual Openings 2011 Average Hourly Wage/Worker Description Management Occupations 2001 7,414 2011 7,261 Number (153) Percent (2%) National LQ 1.01 EGR-7 278 National 558,350 EGR-7 $22.66 State $28.54 National $33.12 13-0000 Business and Financial Operations Occupations 2,771 3,012 241 9% 0.52 160 491,480 $25.13 $26.91 $30.34 15-0000 Computer and Mathematical Occupations 17-0000 Architecture and Engineering Occupations 19-0000 Life, Physical, and Social Science Occupations 21-0000 Community and Social Services Occupations 23-0000 958 855 (103) (11%) 0.37 33 158,455 $25.06 $29.61 $35.59 1,039 932 (107) (10%) 0.58 57 124,767 $29.66 $30.88 $34.94 715 681 (34) (5%) 0.58 49 122,529 $26.06 $26.60 $31.67 1,345 1,692 347 26% 1.14 117 119,058 $17.59 $18.83 $20.56 458 489 31 7% 0.55 25 55,976 $30.28 $34.62 $42.47 6,308 6,593 285 5% 1.17 274 424,710 $19.57 $20.09 $23.05 1,950 1,918 (32) (2%) 0.62 113 289,151 $16.45 $16.87 $19.93 4,912 5,364 452 9% 1.08 260 396,637 $30.03 $31.92 $34.86 2,090 2,362 272 13% 0.84 113 216,690 $11.88 $12.39 $12.72 31-0000 Legal Occupations Education, Training, and Library Occupations Arts, Design, Entertainment, Sports, and Media Healthcare Practitioners and Technical Occupations Healthcare Support Occupations 33-0000 Protective Service Occupations 3,117 2,785 (332) (11%) 1.41 139 171,811 $16.40 $17.07 $19.89 35-0000 Food Preparation and Serving Related Occupations 8,447 8,235 (212) (3%) 1.17 424 671,502 $9.05 $9.24 $10.04 37-0000 Building and Grounds Cleaning and Maintenance 3,983 4,333 350 9% 1.00 194 330,685 $10.16 $11.09 $11.42 39-0000 Personal Care and Service Occupations 41-0000 45-0000 Sales and Related Occupations Office and Administrative Support Occupations Farming, Fishing, and Forestry Occupations 47-0000 49-0000 25-0000 27-0000 29-0000 43-0000 51-0000 3,888 3,745 (143) (4%) 0.80 235 479,558 $9.69 $10.28 $10.65 13,407 12,796 (611) (5%) 0.92 609 1,207,274 $13.19 $15.45 $17.04 16,019 14,577 (1,442) (9%) 0.99 483 871,077 $13.58 $14.74 $15.93 461 599 138 30% 0.81 59 76,305 $12.82 $12.29 $11.28 Construction and Extraction Occupations 5,633 5,307 (326) (6%) 1.09 295 425,300 $17.49 $18.73 $18.39 Installation, Maintenance, and Repair Occupations 4,428 4,199 (229) (5%) 1.16 178 252,984 $17.50 $19.13 $19.24 10,736 9,795 (941) (9%) 1.74 539 433,953 $16.22 $16.51 $15.89 8,329 7,652 (677) (8%) 1.25 341 473,242 $14.27 $15.26 $15.71 783 715 (68) (9%) 0.57 32 83,656 $19.37 $19.72 $14.52 387 393 6 2% 0.82 23 34,618 $11.93 $12.75 $15.82 109,577 106,289 -3,288 -3% 5,032 8,469,769 $16.27 $17.90 $19.92 55-0000 Production Occupations Transportation and Material Moving Occupations Military Occupations 99-0000 Unclassified Occupation 53-0000 Total 15 16