Industry Analyses Directions

advertisement

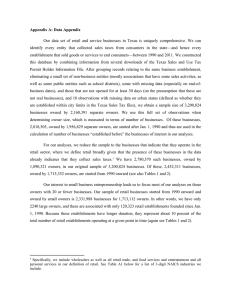

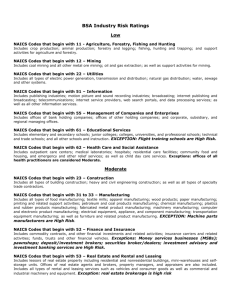

Industry Analyses Industry Analysis You will want to determine the size and trend of the industry in which you’ll be competing to assure that you have a large enough opportunity to satisfy your sales goals and to be able to gain from the leverage available in markets which are naturally increasing in sales volume which evidences increasing customer interest in that market. Information needs and input from published or online sources are listed below): Size of the industry in which your product/service will compete. Your industry is defined as the latest year’s retail sales of all of the brands that your business will compete. If you believe there are no products/services currently in your space, your industry is defined as how the consumer currently addresses the problem your product/service addresses. Industry size can be obtained from publications or online data bases by direct query; or you could add up the retail sales of each product/service that competes in your category. You may be able to short cut this research by identifying the NAICS number for one of your major competitors (the federal government assigns an NAICS number to each industry) then look up the retail sales of that industry via the NAICS number in the US Manufacturer’s Census (at uscensus.gov). It may also be helpful to know how many units of product were sold in your category, to calculate average price/unit for comparison to your proposed price. The trend of the industry in which your product/service will compete. You can easily determine the sales trend (in retail dollars or units or both) by duplicating the above steps for two earlier years. With three data points (latest year, plus two earlier years) you’ll be able to calculate the current and historical growth trends. Plus if you assume the industry will continue to grow at the historical growth rate, you can calculate what the industry sales will be in the future (ie: 3 or 5 years from now). Any other information about the industry which will help you achieve a competitive advantage. For example, you may discover articles which identify important to know activities which you can build into your business and marketing plans. Industry Information Sources For online sources go to the KU Libraries online data bases Go to KU Libraries online, Click on B under index to find business sources, Scroll to Business & Company Resource Center or Business Source Premier Click on selected data base and search for articles on your industry, competition, etc. Industry and Competitive Information Sources (continued): Other online resources you will want to consult include the following: o Bizstats.com (for cost and expense data, too) o o Entrepreneur Magazine o Inc. Magazine o o US Census.gov o Entrepreneur.com o Factiva (available online via KU Libraries) o o New York Public Library o Kauffman Foundation o (http://www.entrepreneurship.org/) o o Edward Lowe Foundation o (http://edwardlowe.org/index.elf) o NY Times.com (nytimes.com) Published sources: Many of the above, also the librarians at Anschutz can help you. Small Business Administration (http://archive.sba.gov/advo/research/) The Entrepreneurship Education Resource (http://library.businesschairs.com/entrepreneu rship-education-resource.html) Harvard Business School Working Knowledge (http://hbswk.hbs.edu/item/2100.html) Wall Street Journal.com (www.WSJ.com) Businessweek.com (www.businessweek.com) MIT Sloan Management Review (http://sloanreview.mit.edu/) Format Using a chart to graphically display the size and trend of the market is easiest and most communicative. Input the market size data from your search into an Excel spreadsheet and display using a bar chart format. Cut and paste the resulting table into your business plan, like the following: $ Sales (000) Industry Trends (for the Product/Service Marketing Area) 60 58 56 54 52 50 48 46 2004 2005 2006 2007 2008 Years 2009 2010 2011