Audit Failures: Why They Happened and What Can We Do?

advertisement

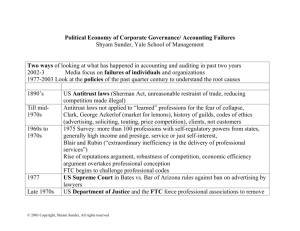

Audit Failures: Why and What Can We Do? Shyam Sunder Yale School of Management Ross Institute Forum on Auditor Independence May 10, 2004 (c) Copyright 2004 Shyam Sunder Serious Problems • We have seen serious problems in auditing, financial reporting, and corporate governance • New laws and institutions created to address the problems • I do not believe that we have correctly diagnosed the source of these problems • Issues are bigger and more fundamental, and call for structural changes, out-of-box thinking • Natural resistance: use veil of ignorance principle to prevent narrow self-interests from blocking wider, longerterm reform • Need leadership in thinking ahead (c) Copyright 2004 Shyam Sunder Three Questions • Why the failures? • What are the chances that the solutions proposed by Congress and others will work • What can and should be done? (c) Copyright 2004 Shyam Sunder Why the Auditing Breakdown • • • • • • • • • • Antitrust laws and professions – Unobservability of quality, restraint, Akerlof (market for lemons, Nobel Prize) 1960-70s: the cult of competition, Stigler (robustness of competition), misapplication of economic theory 1977-78: Supreme Court (Bates vs. Arizona Bar) US D of Justice and FTC: new professional codes of ethics for doctors, lawyers, accountants etc. AICPA implements it in 1979 1980: sharp drop in audit prices begins, no profit, new business model (analytical review, consulting, internal transfer payments, and wage adjustments for recruits) Consequences played out for two decades (don’t have time for the details, see my book soon) Sharp drop in stock market exposes the accumulated skeletons in the closet None of the problems, especially the impossibility of attaining market equilibrium in a market where the quality of the service essentially unobservable to the customer has been addressed yet PCAOB has been handed an impossible task (c) Copyright 2004 Shyam Sunder Creation of FASB as a Full Time Rule Making Body • Generated the demand dynamics of accounting rules (why argue with the client and risk losing business, just call Norwalk to make the rules “clearer”) • FASB’s dependence on revenue from sale of publications generated incentives even worse than academic “publish or perish” • Every additional rules creates several new loopholes (Can-Spam law as a license to spam legally) (c) Copyright 2004 Shyam Sunder Chances of Success of Recent Reforms and Proposals • I am pessimistic • None of the fundamental problems have been addressed • Nothing structural has been changed • PCAOB: With all due respect, a few years later, we shall be looking for the person who can be blamed for inventing the idea that a few hundred, or thousand, people can figure out if auditors are doing their job right – Can we reduce the number of bank robberies by appointing watchmen to watch the guards? • Let me move to what can be done (c) Copyright 2004 Shyam Sunder What Can We Do? • Solutions need to fundamental, structural and robust • One is already on the table: Prof. Ronen – Integrate insurance and audit – Firm decides how much, if any, financial fraud insurance to buy – Insurance firm decides on audit and the premium to charge (insurance and premium are made public) – No need for government oversight, except an accounting court (Leonard Spacek’s idea from more than four decades ago) • I shall present a second idea of my own (c) Copyright 2004 Shyam Sunder Tax and Financial Reporting • Ninety years of drift between financial and tax reporting • Separate optimization: minimize taxes, temptation to boost performance reported to shareholders • Increasing audit burden on IRS • Increased incentives to lobby Congress for corporate tax breaks • Falling effective tax rates for corporations • Push, push, push for lower taxes, even as IRS budgets get tighter (c) Copyright 2004 Shyam Sunder Financial Reporting on the Other Hand • Push, push, push for better quarterly performance driven by high powered compensation contracts • Financial reporting and governance failures • Difficulties of auditors faced with managers who might lose millions because the auditor says no • Rock bottom audit fees driven by competition do not allow much resources for substantive testing, so “analytical review” would have to do • Auditor incentives and independence problems (c) Copyright 2004 Shyam Sunder Management Plays Two Games • One to the IRS, who must spend resources it does not have to get the revenue the exchequer deserves • The other to the shareholders to persuade them what a great job they have done to deserve a pat on the back and a tidy bonus (stock options) • Integrate two games into one • Congress could see this in 1947 (LIFO) – Gave that up in the seventies (c) Copyright 2004 Shyam Sunder Tax Return = Income Statement • Tax returns of public corporations are public • Financial reports = tax return + balance sheet + cash flow statement + management discussion + footnotes • Could the two bookends of tax and financial reporting lean on each other to yield outcome which are better? • What would happen? (c) Copyright 2004 Shyam Sunder Consequences • By managerial choice – Tax returns would be less aggressive – Financial reports would be less aggressive • Save on significant auditing costs – By IRS – By independent auditors • Less Government regulation in financial reporting • Less corporate lobbying on the Hill • Scaling down of FASB and SEC Chief Accountant’s Office • A smaller auditing profession (c) Copyright 2004 Shyam Sunder Critique Welcome. Thank You Shyam.sunder@yale.edu http://www.som.yale.edu/faculty/ sunder/research (c) Copyright 2004 Shyam Sunder (c) Copyright 2004 Shyam Sunder