Financial Engineering vs. Reporting Standards: Is

advertisement

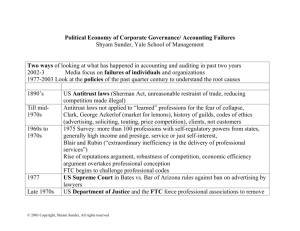

Equilibrating Corporate Financial Engineering and Reporting Shyam Sunder Yale University 20th Anniversary Conference on Financial Economics and Accounting, Rutgers University November 14, 2009 An Overview • Let us look at accounting and finance from a social science perspective • Objective in corporate financial engineering: to design transactions to optimize from the point of view of the organization, e.g., increase assessed creditworthiness and lower risk based on facts and appearances of its financial reports • Objective of financial reporting: to provide information useful for investment and other decisions by various agents in the economy • Does the interplay of these two objectives lead to a stable equilibrium? • If yes, what is the equilibrium? • If not, what are the consequences and what, if anything should be done about it? Sunder: Financial Engineering and Reporting 2 Accounting and Finance as Aspect of Social Sciences • These disciplines have been seen from several points of view • One of them is to think of their topics of substantive interest (e.g., corporate finance and reporting, investments, and auditing) as social phenomena • Social phenomena are characterized by multiple levels of analysis, e.g., macroeconomic, organizational, and individual • At each level, and across the levels, social phenomena exhibit interaction among agents (individuals, organizations, and government), learning by them, feedback effects, and consequently, pervasive endogeneity • These features of a social science make it more difficult to identify laws or relationships which are stable relative to their discovery and characterization (e.g., small firm effect) • In these few minutes, I would like to discuss one aspect of such interactions between financial reporting and engineering, and share some preliminary thoughts about their consequences Sunder: Financial Engineering and Reporting 3 Objectives in Financial Engineering • “The Financial Engineering Concentration encompasses the design, analysis, and construction of financial contracts to meet the needs of enterprises.” (Cornell’s ORIE M.S. concentration in financial engineering) • What are these needs? In at least some cases, these needs consist of finding ways of – Reducing indebtedness on the balance sheet, or – Reducing expense on income statement, or – Increasing revenue on income statement, or – Increasing deductions on tax returns Sunder: Financial Engineering and Reporting 4 Securitization according to International Finance Corporation • A form of off-balance sheet financing which involves the pooling of financial assets • Risk transfer mechanism that allows loan originators to optimize balance sheet management • Allows highly rated securities to be created from less credit worthy assets • Can be in local or foreign currency, depending on client needs • A rapidly growing asset class with proven benefit for emerging market borrowers • For summaries of prior deals, please visit www.ifc.org/structuredfinance Sunder: Financial Engineering and Reporting 5 Financial Reporting Standards as Constraints on Financial Optimization • In such optimization, standards of financial reporting are treated as constraints • Most optimization problems have hard constraints—their violation brings well-specified penalties (dual prices) • With optimization confined by the production possibilities set and other such physical limitations, external constraints make a real difference to the final actions • What kind of constraints do accounting standards offer? • I am going to argue that these standards offer softer constraints because the forms of contracts, transactions, as well as organizational forms that businessmen can devise and use are beyond the scope of accounting standards Sunder: Financial Engineering and Reporting 6 Redesigning Contracts • A manufacturer needs to buy a machine for the factory • Borrowing is an option, but the manufacturer does not want more debt on its balance sheet • The leasing subsidiary of a bank buys the machine and gives it to the manufacturer on a long term lease— machine is in the factory but no debt on balance sheet! • FASB writes Standard 13: leases >90%V and >75%T must be treated as capital leases (debt is back on BS) • The bank revises the lease to levels below the thresholds specified in the standard (debt is off the BS) • FASB goes back to work, and so on … until the rulebook grows to over a 1,000 pages Sunder: Financial Engineering and Reporting 7 Redesigning Transactions • Depending on the current standards of financial reporting, transactions can be redesigned to achieve the desired consequences for revenues, expenses and taxes Sunder: Financial Engineering and Reporting 8 Redesigning the Organization • When design of contracts and transactions is not sufficient, organizations themselves can be redesigned, or new ones created in order to have the desired consequences for balance sheets, income statements and tax returns • Special purpose entities (SPEs and SPVs) are examples of organizations created for this purpose (see Klee and Butler 2002 and Gorton and Souleles 2005) • “Hundreds of respected U.S. companies are ferreting away trillions of dollars in debt in off-balance sheet subsidiaries, partnerships, and assorted obligations” (Henry et al. 2002) Sunder: Financial Engineering and Reporting 9 Asymmetric Game • Note that financial reporting standards neither have, nor can have, any say in any of these “business” decisions of the management • The role of the accountant and auditor is limited to preparing financial reports given all these decisions • While these decisions clearly consider what the accounting standards are, accountants have little freedom to take into account how and why these decisions were taken in the first place • There is great asymmetry between the freedom available to the business decision makers and constraints on the accountant who must abide by relatively rigid written standards Sunder: Financial Engineering and Reporting 10 The Net Effect • The decision to write an accounting standard is a matter of social policy that calls for a deliberative due process; it typically takes years to determine which rules might best serve investors and others. Inevitably, these standards are written on the assumption that the current forms of contracts, transactions, and organizations will continue to be used in the future when these standards are applied • The decision to change contracts, transactions and organization is an individual decision that may be taken within days if not hours. Further, the scope of these decisions is virtually unbounded (except by the imagination of the businessmen). Soon after the standards are issued, the environment to which they are applied changes relative to the what the standards were written for • The net effect: Financial reporting standards serve as relatively weak constraints (if at all) on what businesses can do Sunder: Financial Engineering and Reporting 11 Three Major Classes of Derivatives • Futures/Forwards are contracts to buy or sell an asset on or before a future date at a price specified today. • Options are contracts that give the owner the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an asset. The price at which the sale takes place is known as the strike price, and is specified at the time the parties enter into the option ( European vs. American options) • Swaps are contracts to exchange cash (flows) on or before a specified future date based on the underlying value of currencies/exchange rates, bonds/interest rates, commodities, stocks or other assets. Sunder: Financial Engineering and Reporting 12 Six Types of Underlying Assets • • • • • • Interest rate derivatives (the largest) Foreign Exchange derivatives Credit Derivatives Equity derivatives Commodity derivatives Weather derivatives Sunder: Financial Engineering and Reporting 13 Over-the-Counter Derivatives • • • • • • • • • • • Traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary (e.g., swaps, forward rate agreements, and exotic options) This largest of the derivatives market is largely unregulated with respect to disclosure of information between the parties (banks and hedge funds etc.) Reporting of OTC amounts are difficult because trades can occur in private, without activity being visible on any exchange. According to the Bank for International Settlements: The total outstanding notional amount is $684 trillion (as of June 2008)[4]. 67% are interest rate contracts, 8% are credit default swaps (CDS), 9% are foreign exchange contracts, 2% are commodity contracts, 1% are equity contracts, and 12% are others Sunder: Financial Engineering and Reporting 14 Exchange-traded derivatives • A derivatives exchange acts as an intermediary to all related transactions, and takes Initial margin from both sides of the trade to act as a guarantee. • The world's largest derivatives exchanges (by number of transactions): Korea Exchange, Eurex, and CME Group (made up of the Chicago Mercantile Exchange, the Chicago Board of Trade and the New York Mercantile Exchange. • According to BIS, the combined turnover in the world's derivatives exchanges totaled USD 344 trillion during Q4 2005. • Some types of derivative instruments also may trade on traditional exchanges (convertible bonds and/or convertible preferred, warrants, Performance Rights, Cash xPRTs and various other instruments that essentially consist of a complex set of options bundled into a simple package) Sunder: Financial Engineering and Reporting 15 Sunder: Financial Engineering and Reporting 16 Why Is It So Difficult to Write Standards for Derivatives Accounting? • Some derivatives are designed to get around the intent (provision of information) of the extant financial reporting standards • How does one write standards for these instruments? • Is it possible to have an equilibrium between design of such instruments and standards for reporting them? • The problem seems to have gone largely unnoticed in the flurry of proposals on financial reforms now on the table • The question is: Are the optimization in financial engineering (relative to prevailing reporting standards), and search for standards that provide useful information to investors mutually consistent goals? Sunder: Financial Engineering and Reporting 17 Social Norms of Accounting and Finance • I personally doubt that a non-cooperative game between financial engineers and accountants has led us to a socially efficient outcome • Accountants have, over the past eight decades, increasingly come to rely on written rules as opposed to their judgment and social norms of their profession • Financial engineers, on the other hand consider it their own professional duty to design whatever instruments/transactions/organizations will best serve the immediate interests of their clients under the prevailing written standards of financial reporting • Social norms play a diminishing, if any, role on either side • Is it possible that some part of the blame for the systemic failures of the recent years may be linked to this diminishing role? Sunder: Financial Engineering and Reporting 18 Ethics and Moral Code in Business Programs • Shiller: “Many schools now offer a course in business ethics, and some even try to integrate business ethics into their other courses. But nowhere is ethics seen as the centerpiece or even integral part of the curriculum. And even when business students do take an ethics course, the theoretical framework of the core courses tends to be so devoid of any moral content that the discussion of ethics must seem like some side order of overcooked vegetable”. • If the role of ethics in curriculum is minimal, what is the role of ethics (i.e., social consequences of our work) in choosing the substantive topics of our research • Identifying mispricing of securities, for example, may help move prices to more efficient levels • What about identifying a way of redesigning a transaction so a financial obligation will not show up on the balance sheet under the prevailing reporting standards? Sunder: Financial Engineering and Reporting 19 Ethics and Moral Code in Research Programs • In some recent theoretical and experimental work, we find that the constraints imposed by financial and social institutions (e.g., bankruptcy laws, commercial code, accounting) can help resolve otherwise mathematically intractable problem of multiplicity of equilibria in economy. Could this also apply to interaction between financial engineering and reporting? • Which one of us would refuse to work on either an optimal transaction design or accounting standardization problem on ethical (social consequences) grounds? • If I were a locksmith, and published the locking codes for the university doors, I might bear some moral culpability • Is, or should, there be any moral culpability associated with devising a way around a standard of financial reporting intended to provide better information? • When, and where, should we raise such issues? Sunder: Financial Engineering and Reporting 20 Some Fundamental Issues • Role of social ethical norms in accounting and financial institutions • Reflexivity of markets and of financial reporting (Keynes, Sunder) • Rationality can serve as an anchor, not a description; irrationality offers no explanation • Fractal structure of knowledge (try for yourself, e.g., http://www.coolmath.com/fractals/fractalgenera tors/generator1/index.html) Sunder: Financial Engineering and Reporting 21 Roles of Accounting and Finance Research • Progressive “micronization” of research • Progressive shift in research attention to better explanatory power through additional variables • This process is understandable, but does not create a micro-macro issues balance • Discarding of details, standing back, to allow a big picture to emerge is just as important • What is the big picture of corporate financial reporting and engineering today? Sunder: Financial Engineering and Reporting 22 In Summary • Accounting and finance originated as a single discipline have increasingly diverged in the recent decades • Interaction of financial reporting standards on one hand and financial engineering on the other has created a newer kind of interaction between them with its own special consequences • What, if any thing, should we, and can we do about this? • Are there some alternatives to bringing in a sense of social responsibility for the consequences of our research agendas? If so, let us explore them. Sunder: Financial Engineering and Reporting 23 References • • • • • • • • • • • Hans J. Blommestein, “The Financial Crisis as a symbol of failure of academic finance (a methodological digression), The Journal of Financial Transformation, Fall 2009. G. Gorton and N. Souleles, “Special Purpose Vehicles and Securitization,” FRB Philadelphia Working Paper, 2005. Henry, David, Heather Timmons, Steve Rosenbush, and Michael Arndt (2002), “Who else is hiding debt?,” Business Week (January 28), 36-37. J. Huber, M. Shubik, and S. Sunder, “Default penalty as disciplinary and selection mechanism in presence of multiple equilibria,” Cowles Foundation Working Paper 1730, October 2009. K. Klee and B. Butler, “Asset-Backed Securitization, Special Purpose Vehicles and Other Securitization Issues,” Uniform Commercial Code Law Journal 35 (2002), 23-67. J. Mason, E. Higgins and A. Mordel, “Asset Sales, Recourse, and Investor Reactions to Initial Securitizations: Evidence Why Off-balance Sheet Accounting Treatment Does not Remove Onbalance Sheet Financial Risk” LSU Working Paper, 2009. Robert J. Shiller, “How Wall Street learns to look the other way,” The New York Times, Feb. 8, 2005. Shyam Sunder. Theory of Accounting and Control. Southwestern Publishing, 1997. Shyam Sunder, “Determinants of Economic Interaction: Behavior or Structure.” Journal of Economic Interaction and Coordination 1, no. 1 (May 2006): 21-32. Shyam Sunder, “’True and Fair’ as the Moral Compass of Financial Reporting,” in Cynthia Jeffrey, ed., Research in Professional Responsibility and Ethics in Accounting (Forthcoming 2009). Sunder: Financial Engineering and Reporting 24 Thank You. Shyam.sunder@yale.edu www.som.yale.edu/faculty/sunder