Meeting 9 - HawkTrade

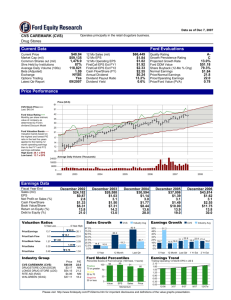

advertisement

THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an investor will make money, avoid losing capital, or indicate that the investment is risk-free. There are no absolute guarantees in investing. HAWKTRADE and its members do not bear any responsibility for losses or gains made by members trading on their personal accounts based on analysis from HAWKTRADE meetings. Announcements Hurricane Sandy Devastates Northeast Election Update October Jobs Report U.S. Earnings Baidu and China Outlook More Apple Trouble Stock markets closed on Mon., Tues. as storm hobbles New York Forced all U.S. Stock exchanges to close for first time in over 20 years due to natural disaster. Prompted discussion of having a back-up system of some kind/ moving the finance district to area like Arizona. Millions still without power/ thousands of homes destroyed. Estimated costs as high as $60 Billion! Flat for Week RCP Poll Average States Obama Romney Electoral Votes Colorad0 Florida Iowa Nevada 48.4% 47.7% 48.0% 50.0% 47.4% 49.1% 46.0% 47.3% 9 29 6 6 New Hampshire Ohio Virginia 49.2% 49.3% 47.6% 47.4% 46.4% 47.9% 4 18 13 Wisconsin 50.4% 45.0% 10 Prior Nonfarm Payrolls - M/M change 114,000 Consensus Consensus Range Actual 125,000 30,000 to 168,000 171,000 Unemployment Rate - Level 7.8 % 7.9% 7.8 % to 8.0 % 7.9% Average Hourly Earnings - M/M change 0.3 % 0.2 % 0.1 % to 0.3 % 0.0 % Av Workweek - All Employees 34.5 hrs 34.5 hrs 34.5 hrs to 34.5 hrs 34.4 hrs Private Payrolls - M/M change 104,000 120,000 104,000 to 167,000 184,000 Fri 23 Nov. 2 | 8:30 AM ET Santelli Argues over jobs numbers Reported earnings on Thursday Expected earnings: $6.31 Billion, $1.93 per share Q3 Profit: $6.1 Billion (down 15%) Q3 Revenue: $115.43 Billion (down 8.4%) 2.98 million barrels of oil and equivalents per day, down from 3.01 a year ago Expected Expected Q3 2011 EPS Revenue EPS Q3 2011 Revenue Q3 2012 EPS Q3 2012 Revenue $2.83 $61.3 Billion $2.69 $56 Billion $67 Billion $3.92 Reported earnings on Friday Production fell Sold oil and gas at lower prices August refinery fire hurt refining business Gulf of Mexico operations hurt from Hurricane Isaac Stock price falls on weak earnings Closed at 108.37 3.09(2.77%) 1 year % change: 3.66% Beat estimates of $1.95 EPS with earnings of $2.09, but down from 3Q 2011 Revenue beat forecasts, but down 8% from 3Q 2011 Stock closed on Thursday at $91.60 up $.43 Stock declined on Friday compared to Oil and Gas Industry Production: 3.96 million barrels day (down 7.5%) Movement of drilling equipment to areas of higher concentrations of oil, since it is more profitable Production should begin to increase Company: Revenue Net Income Chevron $230.56 Billion $26.63 Billion $13.43 8.07 Exxon $434.82 Billion $45.09 Billion 9.51 BP $376.60 Billion $17.26 Billion $5.38 7.9 Industry $120.95 Billion N/A 10.75 EPS $9.49 $2.53 P/E Sluggish global economy has cut demand. Revenue has decreased due to lower oil and natural gas prices, and lower production. Company E.P.S. Stock Reaction Visa Positive +3.77% MasterCard Positive +1.64% 3.34% Beat EPS estimate of $1.50 by $.04 or 2.67% Posted revenues of $2.73B against the $2.52B estimate Total processed transactions up 4.1 B cards, firmly ahead of MasterCard Beat EPS expectations of $5.92 by $.25 or 4.22% Posted revenue of $1.92B which missed expectations of $1.94B Increase in total Processed transactions Up to 1.9B cards 1.85% The Confidence Board index of confidence reached 72.2, the highest since February 2008. Up from 40.9 a year ago. Goal of 90 that is consistent with a healthy economy “We see extraordinary opportunity for growth in the payments industry.“ –MasterCard Management Reporting Company Ford Motor Co (F) General Motors Co (GM) Surprise Type Percent surprise Stock Reaction Positive 32.9% 8.01% Up Positive 55.8% 10.7 % Up October sales – best in 5 years Expects high sales level to continue into 2013 Dodge Ram and Caravan sales up big Surprisingly strong profit Expecting full year operating loss of $1.5 t0 $1.8 billion in Europe Targeting return to breakeven levels middecade Cutting jobs in Europe Reducing fixed costs – target of $500 million Good not great outlook Wed 31 Oct 12 | 07:51 AM ET GM Q3 Earnings Big Beat Profit trounced expectations +33% surprise in EPS Record high profit margins in North America Hurt in Europe Announced three plant closures First profit in Asia Pacific/Africa since second quarter 2011 Margins will decrease, but optimism remains The company had revenue of 994.6 million for the quarter, compare to the consensus estimate of 998.37 million. Baidu was downgrade by analysts at Citigroup from a buy rating to sell rating. Credit Suisse set Baidu price target at 82. Now traded at 106 5 YR. 156% Google acquired and merged more than a hundred companies, in which includes map analysis, advertising, mobile software, video, etc. Baidu mainly focus on search engine, which includes text search, domain search, music search, people search, etc. If Google can be unblocked? 18th National Congress of the Communist Party of China on Nov. 9, 2012 Unveil the policies and decisionmaking for the next 4 years China’s manufacturing industry enjoyed an improvement in trading conditions during October, with the latest HSBC Purchasing Managers’ Index™ coming in at 49.5 – up from 47.9 the previous month. The upward swing was in part thanks to a rise in new orders – the first increase for a year. Although the rate of contraction slowed in October, the figure of 49.5 still represents the 12thmonth in a row in which the industry has shrunk. Only 2 Meetings Left!! Guest Speaker Next Week Vote on Prizes for Investment. competetion