Unit 6 Midterm

advertisement

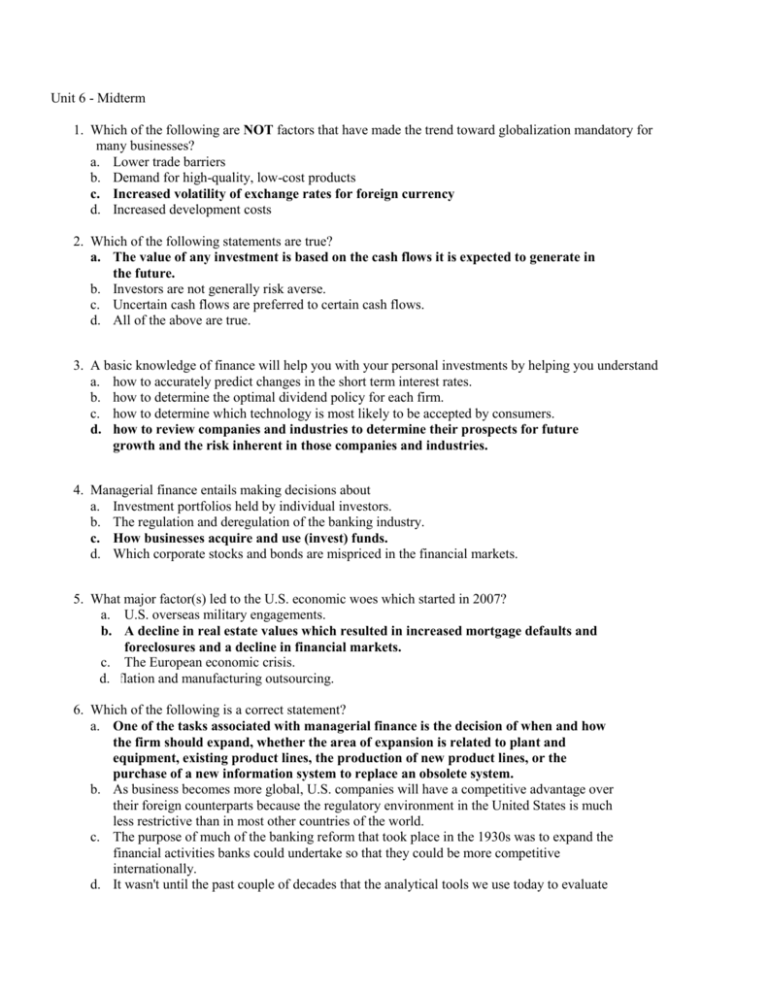

Unit 6 - Midterm 1. Which of the following are NOT factors that have made the trend toward globalization mandatory for many businesses? a. Lower trade barriers b. Demand for high-quality, low-cost products c. Increased volatility of exchange rates for foreign currency d. Increased development costs 2. Which of the following statements are true? a. The value of any investment is based on the cash flows it is expected to generate in the future. b. Investors are not generally risk averse. c. Uncertain cash flows are preferred to certain cash flows. d. All of the above are true. 3. A basic knowledge of finance will help you with your personal investments by helping you understand a. how to accurately predict changes in the short term interest rates. b. how to determine the optimal dividend policy for each firm. c. how to determine which technology is most likely to be accepted by consumers. d. how to review companies and industries to determine their prospects for future growth and the risk inherent in those companies and industries. 4. Managerial finance entails making decisions about a. Investment portfolios held by individual investors. b. The regulation and deregulation of the banking industry. c. How businesses acquire and use (invest) funds. d. Which corporate stocks and bonds are mispriced in the financial markets. 5. What major factor(s) led to the U.S. economic woes which started in 2007? a. U.S. overseas military engagements. b. A decline in real estate values which resulted in increased mortgage defaults and foreclosures and a decline in financial markets. c. The European economic crisis. 7. 6. d.Inflation and manufacturing outsourcing. 6. Which of the following is a correct statement? a. One of the tasks associated with managerial finance is the decision of when and how the firm should expand, whether the area of expansion is related to plant and equipment, existing product lines, the production of new product lines, or the purchase of a new information system to replace an obsolete system. b. As business becomes more global, U.S. companies will have a competitive advantage over their foreign counterparts because the regulatory environment in the United States is much less restrictive than in most other countries of the world. c. The purpose of much of the banking reform that took place in the 1930s was to expand the financial activities banks could undertake so that they could be more competitive internationally. d. It wasn't until the past couple of decades that the analytical tools we use today to evaluate investments were developed. Prior to the development of such tools, the concept that earnings and dividends are related to stock prices was unknown. 7. Which of the following is NOT an example of a firm becoming more of a "lean thinker" in its operations? a. simplifying financial reporting to avoid providing redundant or useless information b. developing products in the most efficient manner c. reducing scrap material being generated in the production process d. all of the above are examples of "lean thinking" 8. Which of the following is consistent with maximizing the value of a firm? a. increasing the amount and complexity of financial data reported by the firm b. increasing the riskiness of firm c. spending large amounts of money perquisites for the managers d. following sound sustainable business practices 9. Bond ratings of ____ and higher are considered investment grade. a. AAA b. AA c. A d. BBB 10. Which of the following is not an advantage of a term loan over public debt offerings? a. speed b. low issuance costs c. significantly lower interest rates d. flexibility 11. Which of the following is NOT a type of debt? a. commercial paper b. certificate of deposit c. term loan d. preferred stock 12. Which of the following is NOT an example of a financial asset? a. convertible bond b. certificate of deposit c. preferred stock d. inventory 13. A protective feature on preferred stock that requires preferred dividends previously not paid to be disbursed before any common stock dividends can be paid is called what? a. cumulative dividends b. callable dividends c. putable dividends d. historical dividends 14. An investor purchased a call option that allows her to purchase 100 shares of Dell Computer common stock for $45 per share any time during the next six months. The price she paid for the option was $2.50 per share, or $250 total, and the current market price of Dell's stock is $42.50. If the price of Dell increases to $44.50 and the investor decides to exercise it, what will be the gain or loss that results from the option position that was held? Ignore taxes and commissions. a. $200 gain b. $300 loss c. $50 loss d. $450 loss 15. Rollincoast Incorporated issued BBB bonds two years ago that provided a yield to maturity of 11.5 percent. Long-term risk-free government bonds were yielding 8.7 percent at that time. The current risk premium on BBB bonds versus government bonds is half what it was two years ago. If the risk-free long-term governments are currently yielding 7.8 percent, then at what rate should Rollincoast expect to issue new bonds? a. 7.8% b. 8.7% c. 9.2% d. 10.2% 16. Other things held constant, which of the following will not affect the quick ratio? (Assume that current assets equal current liabilities.) a. Fixed assets are sold for cash. b. Cash is used to purchase inventories. c. Cash is used to pay off accounts payable. d. Accounts receivable are collected. 17. Stock dividends a. Have the same effects on financial statements as cash dividends. b. Are similar to stock splits in that they do not change the fundamental position of current shareholders. c. Must be accompanied by cash dividends. d. Are viewed unfavorably by investors and thus should not be used. 18. Which of the following statements is correct? a. The annual report contains four basic financial statements: the income statement; balance sheet; statement of cash flows; and statement of changes in long-term financing. b. Although the annual report is geared toward the average stockholder, it represents financial analysts' most complete source of financial information about the firm. c. The key importance of annual report information is that it is used by investors when they form their expectations about the firm's future earnings and dividends and the riskiness of those cash flows. d. The annual report provides no relevant information for use by financial analysts or by the investing public. 19. As a short-term creditor concerned with a company's ability to meet its financial obligation to you, which one of the following combinations of ratios would you most likely prefer? Current ratio a. 0.5 b. 1.0 c. 1.5 d. 2.0 TIE 0.5 1.0 1.5 1.0 Debt ratio 0.33 0.50 0.50 0.67 20. Tapley Dental Supply Company has the following data: Net income: $240 Debt ratio: 75% Sales: $10,000 TIE ratio: 2.0 Total assets: $6,000 Current ratio: 1.2 If Tapley could streamline operations, cut operating costs, and raise net income to $300, without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase? a. 3.00% b. 3.50% c. 4.00% d. 4.25% 21. A firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA? a. 8.4% b. 10.9% c. 12.0% d. 13.3% 22. A fire has destroyed a large percentage of the financial records of the Carter Company. You have the task of piecing together information in order to release a financial report. You have found the return on equity to be 18 percent. If sales were $4 million, the debt ratio was 0.40, and total liabilities were $2 million, what was the return on assets (ROA)? a. 10.8% b. 0.8% c. 1.25% d. 12.6% 23. The Amer Company has the following characteristics: Sales: Total Assets: Total Debt/Total Assets: EBIT: Tax rate: Interest rate on total debt: $1,000 $1,000 35% $200 40% 4.57% What is Amer's ROE? a. 11.04% b. 12.31% c. 16.99% d. 28.31% 24. A(n) ____ is a bond that pays no annual interest but is sold at a discount below par, thus providing compensation to investors in the form of capital appreciation. a. coupon bond b. income bond c. convertible bond d. zero coupon bond 25. Which of the following is NOT a source of equity on a firm's balance sheet? a. additional paid-in capital b. retained earnings c. common stock d. property, plant, and equipment