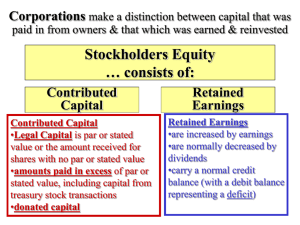

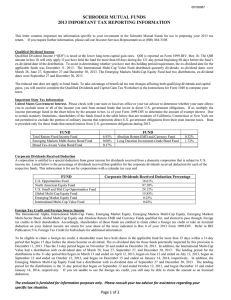

Chapter 11: Stockholders Equity

advertisement

FORMS OF BUSINESS ORGANIZATIONS LEGAL FORMS OF BUSINESS ORGANIZATION SOLE PROPRIETORSHIP ONE OWNER PARTNERSHIPS CORPORATIONS > ONE OWNER Can a partnership have 500 owners? Can a corporation have one owner? Does every business have a choice of legal form? Stockholders’ Equity • Corporate legal form – Advantages and disadvantages • Shareholder rights • Forming a corporation • Components of stockholders equity – Common stock – Treasury stock – Preferred stock • Dividends • Stock dividends and stock splits WHY LARGE BUSINESSES USE THE CORPORATE FORM CORPORATONS Advantages Limited Liability Transferability Ability to Raise Capital Disadvantages Double Taxation Shareholder rights • Share in dividends, if any • Share in liquidation…what’s left over • Preemptive right Shareholder rights • Elect board of directors – Make strategic decisions • Outside versus inside – M ajority voting: one vote per share. 51% elects all. – Cumulative voting: number of directors elected x shares = number of votes. Can vote all for one candidate – Stagger number of directors up for election • “Figure heads” – Hires management to implement strategic decisions Forming a corporation • Select state of incorporation – Any state • Organization costs – Attorney fees, filing fees, etc. – Amortized over five years • Amortization expense • Organization costs Components of stockholders equity • Capital stock – Authorized shares: number of shares company can issue • Generally a very large number – Issued: transferred to shareholders • IPOs: initial offering of stock to public – Expensive: fees of 6.6% of capital raised, for example – Pricing – Outstanding: still owned by shareholders Components of stockholders equity • Treasury stock – Stock issued but then repurchased • Mature or fast growing company??? • Impact on earnings per share • Impact on market price – Alternative to dividends – Tax treatment Components of stockholders equity • Treasury stock – Purchase • Treasury stock (negative owners’ equity) • Cash – Sale (at “gain”…) • Cash • Treasury stock • Paid in capital Components of stockholders equity • Preferred stock – Preference as to dividends • Cumulative versus noncumulative – Dividends in arrears – Preference in liquidation • Receive par value and any unpaid dividends before any distribution to common stockholders • Relationship to creditors Payment of dividends • Date of declaration (by board of directors) – Retained earnings – Dividends payable (now have liability) • Date of record (ex-dividend date) – Own stock on this date, get dividend – No entry required – Impact on stock price when stock goes ex-dividend • Date of payment – Dividends payable – Cash Stock dividends • Additional shares distributed to shareholders • Impact on stock price of a 10% stock dividend – Steak-N-Shake • Not taxable income • Investor still owns same percent of company Stock dividend • Entries – When stock dividend declared • Retained earnings (FMV of stock) • Common stock distributable (par value) • Paid in capital (excess) – When stock is distributed • Common stock distributable • Common stock Stock splits • Additional shares distributed to shareholders. 2 for 1 stock split – Impact on stock price of a 2 for 1 split • Signaling theory • Not taxable income • Investor still owns same percent of company • No journal entry required