Name Unit 5: Financial Sector Module 29: The Market for Loanable

advertisement

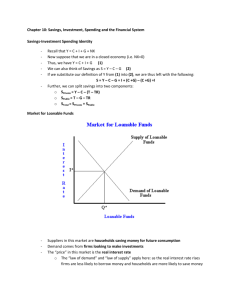

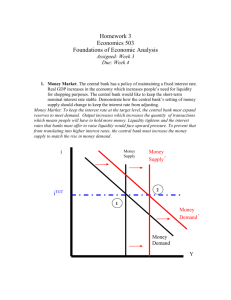

Name _______________________ Unit 5: Financial Sector Module 29: The Market for Loanable Funds Lecture Notes The purpose of this module is to develop a model that shows how the real interest rate is determined. The market for loanable funds is predicated on the interaction of savers who supply funds to earn interest income, and borrowers who demand the funds for capital investment. This model is required in later modules to show the impact of budget deficits or surpluses and the impact of foreign trade on real interest rates. Student learning objectives: How the loanable funds market matches savers and investors. The determinants of supply and demand in the loanable funds market. How the two models of interest rates can be reconciled. Key Economic Concepts For This Module: When savers put their savings in financial markets, they are essentially lenders because those funds are lent to borrowers for investments through the banking system. So the dollars saved/lent are equal to the dollars invested/borrowed. The demand for loanable funds comes from borrowers looking to make capital investments. If the real interest rate falls, more investment projects become profitable, so more funds will be demanded. The supply of loanable funds comes from savers looking to earn interest income. If the real interest rate rises, savers will forgo current consumption and save more money to the financial markets and more funds will be supplied. The key graph of this module is the loanable funds market as seen below. I. The Market for Loanable Funds (Note: It would be helpful to remember the savingsinvestment identity from earlier modules.) Closed economy: _________ Add the public sector (_______________): ____________________________________________________________ Add the foreign sector: ____________________________________________________________ It is through the _______________ _______________by which the funds of the savers are borrowed by _______________. M-29 Economists use the model of a market for _______________ _____________ to explain these interactions and determine the equilibrium real interest rate. (Note: .This model of loanable funds has been tested, in some measure, on each of the last several AP macro exams,) A. The Equilibrium Interest Rate Economists work with a simplified model in which they ____________ that there is just one market that brings together those who want to lend money (__________) and those who want to borrow (________ with investment spending projects). This hypothetical market is known as the _______________ ____________ _______________. The price that is determined in the loanable funds market is the _______________ _________, denoted by __. (Note: The interest rate on the ___________ axis represents the _________ interest rate, not the nominal. Recent scoring of the AP Macro free response questions require an accurate labeling of this vertical axis.) Savers and borrowers care about the ________ interest rate because that is what they earn or pay after _______________. _________ interest rate = ___________ interest rate – ___________ inflation If expected inflation = 0%, then: real rate ____ nominal rate. But, it’s also true that if _______________ inflation is constant, any change in the nominal rate will be reflected in an _______________ change in the real rate. This is why the graphs in the text are labeled “____________ interest rate for a given ____________ future inflation rate.” Note: For the reasons explained above, it is important, and accurate, to get in the habit of labeling this vertical axis as “________________________” or “___”. The Demand for Loanable Funds comes from borrowers. Demand is ____________ sloping for one very intuitive reason. Firms borrow to pay for capital investment projects. If the project has an expected rate of return that ____________ the real interest rate, the investment will be ____________, and the funds will be demanded. Rate of return (%) = 100*(____________ from project – _______ of project)/(Cost of project) 2 M-29 As the real rate _______, more projects become profitable, so the quantity of funds demanded will ____________. The Supply of Loanable Funds comes from savers. Supply is ____________ sloping. Savers can lend their money to borrowers, but in doing so must forgo ____________. In order to compensate for the forgone consumption, savers must receive ____________ income and as the real interest rate _______ the opportunity to earn more income _______, so more dollars will be _________. As the real rate _______, the quantity of funds supplied will ____________. Note: This market is like the others you have seen, equilibrium will occur at the intersection of demand and supply. The price (interest rate) will adjust to a ____________ or a ____________ in this market in the same way as with other markets Equilibrium in the Loanable Funds Market Here, the equilibrium interest rate is r*%, at which Q* dollars are lent and borrowed. Investment spending projects with a rate of return of r*% or more are _________; projects with a rate of return of less than r*% are _______. Correspondingly, only lenders who are willing to accept an interest rate of r*% or less will have their offers to lend funds accepted. B. Shifts of the Demand for Loanable Funds The factors that can cause the demand curve for loanable funds to shift include the following: Changes in perceived business ____________________: A change in beliefs about the rate of return on investment spending can ____________ or ____________ the amount of desired spending at any given interest rate. 3 M-29 If firms believe that the economy is ________ with profitable investment opportunities, the demand for loanable funds will ____________. If firms believe the economy is poised for a ____________ where profitable investment opportunities will be _______ and far between, the demand will ____________. Changes in the government’s ____________: Governments that run budget __________ are major sources of the demand for loanable funds. When the government runs a budget ____________, the Treasury must ____________ funds and acquire more ________. This ________________ the demand for loanable funds in the market. If the government were to run a budget ____________, _______ debt would be required and the demand for loanable funds would ____________. The fact that the real interest rate rises when the government ____________borrowing for debt provides us with a preview of the ____________ impact of debt. At higher interest rates, some investment will be “____________ _______” by government demand for loanable funds. C. Shifts of the Supply of Loanable Funds Among the factors that can cause the supply of loanable funds to shift are the following: Changes in private ____________ behavior: If households decide to ____________ more and _________ less, the supply of loanable funds will shift to the ________. Changes in capital ____________: For a variety of economic and political reasons, a nation may receive ________ capital inflow in a given year. 4 M-29 If a nation is perceived to have a ___________ government, a ___________ economy and is a good place to __________ money, foreign money will flow into that nation’s financial markets, _________________ the supply of loanable funds. D. Inflation and Interest Rates Anything that shifts either the supply of loanable funds curve or the demand for loanable funds curve changes the _________________ _________. We have seen in previous modules that unexpected inflation creates winners and losers, particularly among borrowers and lenders. Economists capture the effect of inflation on borrowers and lenders by distinguishing between the _________________ interest rate and the _______ interest rate, where the difference is as follows: _________ interest rate = _____________ interest rate — ___________ rate For _________________, the true cost of borrowing is the _______ interest rate, not the _________________ interest rate. For ______________, the true payoff to lending is the ______ interest rate, not the_______________interest rate. ______________ ___________ (after the American economist Irving Fisher, who proposed it in 1930): the expected real interest rate is unaffected by the change in expected future inflation. The Fisher effect says that an _________________ in expected future ______________ drives up ______________ interest rates, where each additional percentage point of expected future inflation drives up the nominal interest rate by 1 percentage point. The central point is that both lenders and borrowers base their decisions on the expected _______ interest rate. As long as the level of inflation is _________________, it does not affect the equilibrium quantity of loanable funds or the expected real interest rate; all it affects is the equilibrium ______________ interest rate. How does this work? (Note: The vertical axis on the loanable funds graph can be labeled “nominal interest rate for a given expected future inflation rate.”) 5 M-29 Step 1: Expected inflation is 0% so, real = nominal = 5% in equilibrium at point A. Loanable funds are equal to F1 dollars. Step 2: Borrowers and lenders all expect inflation to be 5% into the future. Nominal = 10%, real = 5%. The ______________ curve for funds shifts _____________ to D2: borrowers are now willing to borrow as much at a nominal interest rate of 10% as they were previously willing to borrow at 5%. That’s because with a 5% inflation rate, a 10% nominal interest rate corresponds to a 5% real interest rate. The ____________ curve of funds shifts __________ to S2: lenders require a nominal interest rate of 10% to persuade them to lend as much as they would previously have lent at 5%. The new equilibrium is at point ___. The result of an expected future inflation rate of 5% is that the equilibrium nominal interest rate rises from 5% to ____%. II. Reconciling the Two Interest Rate Models The short term interest rates are determined at the intersection of money _______________ and money ____________. In the loanable funds model, we see that the interest rate ______________ the quantity of loanable funds supplied by ____________ with the quantity of loanable funds demanded for investment _______________. 6 M-29 Let’s try to make sense of this. A. The Interest Rate in the Short Run Note: Refer to Figure 29-7 in the text. According to the liquidity preference model, a ______ in the interest rate leads to a _______ in investment spending, I, which then leads to a ______ in both real GDP and consumer spending, C. The _____ in real GDP leads to a rise in consumer spending and also leads to a ______ in savings: at each stage of the multiplier process, part of the_________________in disposable income is saved. How much do savings rise? o According to the savings–investment spending identity, total savings in the economy is always __________ to investment spending. Thus, a ________ in the interest rate leads to higher investment _______________, and the resulting ________________ in real GDP generates exactly enough additional savings to match the _______ in investment spending. After a ________ in the interest rate, the quantity of savings supplied ______ exactly enough to match the quantity of savings _________________. B. The Interest Rate in the Long Run In the short run an ______________ in the money supply leads to a ________ in the interest rate, and a decrease in the money supply leads to a _______ in the interest rate. In the long run, however, changes in the money supply ______ affect the interest rate. Why not? ________________________________________________________________________ ____________________________________________________ Note: Refer to Figure 29-8 in the text. Now suppose the money supply rises from M 1 to M 2. This initially _________________ the interest rate to r2. In the long run the aggregate price level will ________ by the same proportion as the _________________ in the money supply (due to the neutrality of money, a topic presented in detail in the next section). A ________ in the aggregate price level _________________ money demand in the same proportion. So in the long run the money demand curve shifts ______ to MD2, and the equilibrium interest rate _______ back to its original level, r1. What about the loanable funds market? o An increase in the money supply leads to a short - run _______ in real GDP and that this shifts the supply of loanable funds _________________ from S1 to S2. o In the long run, real GDP falls back to its original level as wages and other nominal prices ________. 7 M-29 As a result, the supply of loanable funds, S, which initially shifted from S1 to S2, shifts back to S1. In the long run, then, changes in the money supply ______ _____affect the interest rate. In the long run, the equilibrium interest rate ___________ the supply and demand for loanable funds that arise at potential output. Common Student Difficulties: At this point in the semester, students have seen so many macroeconomic models that they are probably experiencing model-fatigue. If you find yourself needing to motivate the learning, stress to them that the loanable funds market will play a significant role in the upcoming AP exam and it tells us some very useful things about how interest rates are determined. Emphasize to the students that many of the models are simply the model of supply and demand with labels specific to a new situation. Students don’t know why we have different models of the interest rate. You can impress upon them that there are short-term decisions and long-term decisions. The Fed determines the money supply, and this is related to the supply of loanable funds, but different. The Fed can put more money in the economy, but they can’t control whether it is made available for loans. People make those decisions based upon the interest rate, thus the difference between the vertical MS curve and the upward sloping supply of loanable funds curve. In the short term, we can assume virtually no inflation. In the money market, we are looking at short-term decisions like how much money I need in my pocket to go shopping. The nominal interest rate is really what I consider in making this decision. In the long term, there is likely to be inflation. In the loanable funds market, we are looking at long-term decisions like how much I need to save for a comfortable retirement. For such a longterm horizon, I must consider the real interest rate. Take the time to walk through the money market graph side-by-side with the loanable funds market graph. 8