Name - Gilbert Public Schools

advertisement

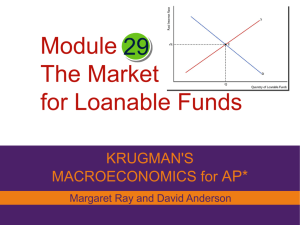

Name: _______________________ AP Macroeconomics Problem Set #4 Money, Banking and Monetary Policy A. Money, Banking and Financial Markets Define and give specific examples of each of the following: 1. Definition of financial assets: money, stock and bonds 2. Time Value of Money (present and future value). 3. Measures of Money Supply. 4. How banks create money. 5. Money Demand. 6. Money Market – Make sure to include a graph! 7. Loanable Funds Market – Make sure to include a graph! B. Central Bank and Control of the Money Supply Define and give specific examples of each of the following: 8. Tools of Central Bank Policy Make sure to provide a complete response here! 9. Quantity Theory of Money 10. Real vs. Nominal Interest Rates Practice Free Response Questions Complete the attached FRQs. Make sure to provide complete answers and label all graphs completely. FRQ #1: ( ____/7) FRQ #2: ( ____/8) FRQ #1 (a) Assume that businesses are granted a tax credit on spending for machinery. Using a correctly labeled graph of loanable funds market, show the effect of the business sector’s response on the real interest rate. (b) Now assume instead that the tax rate on interest income household savings is lowered and there is no change in government budget deficit. Using a second correctly labeled graph of loanable funds market, show the effect on the household’s response on the real interest rate. (c) Give your answer to part (b), explain what will happen to the country’s production possibilities curve in the long run. FRQ # 2 In Country Z, the required reserve ratio is 10%. Assume that the central bank sells $50 million in government securities on the open market. (a)Calculate each of the following (i) The total change in reserves in the banking system (ii) The maximum possible change in the money supply (b) Using a correctly labeled graph of the money market, show the impact of the central bank’s bond sale on the nominal interest rate. (c) What is the impact of the central’s bank bond sale on the equilibrium price level in the short run? (d) As a result of the price level in part ©, are people with fixed incomes better off, worse off, or unaffected? Explain. AP Macroeconomics Problem Set 4 Page 1