Compounding at 10%

advertisement

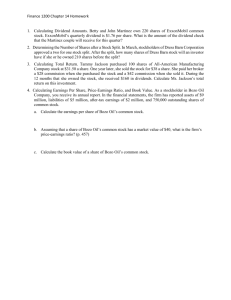

finan Chapter 3: Valuing Firm Output and Pricing Securities How do you assign values to investments and opportunities and how do you compare them? Valuation Issues 3-2 • Identifying the stream of future benefits • Valuing them at the owner’s opportunity cost. • Compounding interest to show future amounts at the opportunity cost. • Discounting future sums to present value using opportunity cost. • Discounting a single future period. • Discounting for a period several years removed • Discounting future streams - annuities • Application - valuing corporate bonds: Annuity plus a final payment • Valuing Perpetuities (stock) • Valuing earnings with growth • Valuing Projects • Determining the weighted cost of capital for a firm. • Determining Net Present Value using the cost of capital. Compounding at 10% 3-3 • Year 1:$1.00 x 1.1 = $1.10; • Year 2$1.10 x 1.1 = $1.21; • Year 3:$1.21 x 1.1 = $1.33; • Year 4:$1.33 x 1.1 = $1.46; • Year 5:$1.46 x 1.1 = $1.61. • • Formula: • V = s(1+r) • Where: • V = future value • s = a sum to be received at the end of a period • r = interest rate • Calculator: enter 1+r in memory • Enter sum; “x”, MR, =. Repeat as necessary for additional periods. Table 3-2 Future Values of $1.00 Invested Today, Compounded Annually • • • Number of Years, n • 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 15 • 20 • 25 • 30 • 35 • 40 • 50 Interest Rate, r_________________ 2% 4% 6% 8% 10% 1.0200 1.0404 1.0612 1.0824 1.1041 1.1262 1.1487 1.1717 1.1951 1.2190 1.3459 1.4859 1.6406 1.8114 1.9999 2.2080 2.6916 1.0400 1.0600 1.0800 1.1000 1.0816 1.1236 1.1664 1.2100 1.1249 1.1910 1.2597 1.3310 1.1699 1.2625 1.3605 1.4641 1.2167 1.3382 1.4693 1.6105 1.2653 1.4185 1.5869 1.7716 1.3159 1.5036 1.7138 1.9487 1.3686 1.5938 1.8509 2.1436 1.4233 1.6895 1.9990 2.3579 1.4802 1.7908 2.1589 2.5937 1.8009 2.3966 3.1722 4.1722 2.1911 3.2071 4.6610 6.7275 2.6658 4.2919 6.8485 10.8347 3.2434 5.7435 10.0627 17.4494 3.9461 7.6861 14.7853 28.1024 4.8010 10.2857 21.7245 45.2593 7.1067 18.4202 46.9016 117.3909 ____________________ 12% 14% 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 4.4736 9.6463 17.0001 29.9599 52.7996 93.0510 289.0022 1.1400 1.2996 1.4815 1.6890 1.9254 2.1950 2.5023 2.8526 3.2519 3.7072 7.1379 13.7435 26.4619 50.9502 98.1002 188.8835 700.2330 3-4 Quick Check Question 3.1 • How long will it take for your money to double at 8% • Use rule of 72 72 8 = 9 years Check Table 3-2: 8% column at 9 years = 1.999 3-5 Quick Check Question 3.1 • How long will it take for your money to double at 6% • Use rule of 72 72 6 = 12 years Check Table 3-2: 6% column at 12 years = 2.012 3-6 Quick Check Question 3.2 3- 7 • Franklin invests a penny at 6% in 1750. What is value in 2000? • Relevant Period: 250 years • Interest Rate: 6% • Formula: V = $0.01 (1 + .06)250 • Use Table 3-2 for 50 years @ 6% = $0.18422 • Calculation: V = $0.18422 • V = $0.01 ($0.18422)5 = $21,216. • • Alternative Means: • If your money doubles according to the Rule of 72s, at 6% interest, it will double every 12 years. • Thus, in 252 years it would double 21 times (252/12 = 21). • This can be expressed as 1(2)21 = $20,971. Compounding Quarterly vs. Annually • • • • • • • • • • • • • • • • Beginning Balance Quarter 1: Interest: .025 x $1,000 Ending Balance Quarter 2: Interest: .025 x $1,025.00 Ending Balance Quarter 3: Interest: .025 x $1,050.62 Ending Balance Quarter 4: Interest: 0.25 x $1,076.89 .1038 x $1,000.000 Ending Balance 3- 8 Quarterly Annual Compounding -10% Compounding -10.38% $1,000.00 $1,000.00 25.00 1,025.00 0.00 1,000.00 25.62 1,050.62 0.00 1,000.00 26.27 1,076.89 0.00 1,000.00 26.91 ________ $1,103.80 103.80 $1,103.80 Quick Check Question 3.3 3-9 • If interest is earned monthly what is your effective annual interest rate? • If interest compounds monthly, you earn 1/12 of 10%. • .10 = .0083, or .83% monthly 12 • • • • Effective annual rate = (1 + .10 )12 - 1 12 • • Effective annual rate of 10.46%. Thus: (1.0083)12 -1 = 1.104669 - 1 = $104.67 interest Basic Discounting to Present Value 3- 10 • PV = • • • • Sum_____ 1 + interest rate Where PV = present value, S = sum, and r = interest rate: PV = 1.00 1+r Thus, where the interest rate is 10%: PV = $1.00 = $0.909 1.10 To test: what would $0.909 be worth @ 10% in one year? $0.909 x 1 + r = $0.909 x 1.1 = $0.99999 • • • • To discount to one more year: • PV = $0.909 = $0.826 1.10 • Usually expressed as: PV = S Or more generally PV = S _ (1+r)2 (1+r)n • Where n = number of periods Table 3-4 Present Values of $1.00 • • • • • • • • • • • • • • • • • • Interest Rate, r Number of 2% 4% Years, n 1 0.9804 0.9615 2 0.9612 0.9246 3 0.9423 0.8890 4 0.9239 0.8548 5 0.9057 0.8219 6 0.8880 0.7903 7 0.8706 0.7599 8 0.8535 0.7307 9 0.8368 0.7026 10 0.8203 0.6756 15 0.7430 0.5553 20 0.6730 0.4564 30 0.5521 0.3083 35 0.5000 0.2534 40 0.4529 0.2083 50 0.3715 0.1407 3-11 _________________________________ 6% 8% 10% 12% 14% 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.4173 0.3118 0.1741 0.1301 0.0972 0.0543 0.9259 0.8573 0.7938 0.7350 0.6806 0.5835 0.5835 0.5403 0.5002 0.4632 0.3152 0.2145 0.0994 0.0676 0.0460 0.0213 0.9091 0.8929 0.8772 0.8264 0.7972 0.7695 0.7513 0.7118 0.6750 0.6830 0.6355 0.5921 0.62090.5674 0.5194 0.5645 0.5066 0.4556 0.5132 0.4523 0.3996 0.4665 0.4039 0.3506 0.4241 0.3606 0.3075 0.3855 0.3220 0.2697 0.2394 0.1827 0.1401 0.1486 0.1037 0.0728 0.0573 0.0334 0.0196 0.0356 0.0189 0.0102 0.0221 0.0107 0.0053 0.0085 0.0035 0.0014 Quick Check Question 3.4 3-12 • Brother gets a $10,000 bond maturing in 8 years and says he received $10,000. If the rate on 8 year government bonds is currently 7%. What is his bond really worth today? Quick Check Question 3.4 3-13 • Discounting a $10,000 savings bond due in 8 years @ 7% • Solution: PV = • • PV = $10,000 1.7181 $10,000 (1 + .07)8 = $5,820.3829 Quick Check Question 3.5 3-14 Law School receives a pledge of $1,000,000.00 bequest from a person with a 20 year life expectancy. How should it report the gift? Quick Check Question 3.5 Two choices $1,000,000 Or PV of $1M paid in 20 years. According to Table 3-4 at 7% value is $258,000 Which way should you report it? 3-15 Calculating the Discounted Present Value of a Bond 3-16 • $1,000 principle amount 10 year bond paying 10% interest a year. What is its current present value? Bond terminology: • Principle is the amount paid by the issuer to the holder at maturity. For bonds without original issue discount this is the same amount paid for the bond at issue. • Interest the payment made each year calculated as a percentage of the principle amount • Bond interest is usually paid semiannually but for simplicity we will assume annual. Interest payment date often called coupon date Calculating the Discounted Present Value of a Bond • • • • • • • • • • • • • Year 1: $100 ÷ 1.1000 Year 2: $100 ÷ 1.2100 Year 3: $100 ÷ 1.3310 Year 4: $100 ÷ 1.4641 Year 5: $100 ÷ 1.6105 Year 6: $100 ÷ 1.7716 Year 7: $100 ÷ 1.9487 Year 8: $100 ÷ 2.1436 9 years $100 ÷ 2.3579 10 years $100 ÷ 2.5937 Total of interest payments: Principal $1,000 ÷ 2.5937 Discounted Present Value = = = = = = = = = = $90.91 $82.64 $75.13 $68.30 $62.09 $56.45 $51.32 $46.65 $42.41 $38.55 614.45 385.55 $1,000.00 3-17 Table 3-5 Present Value of an Annuity • Present Value of an Annuity Payable at the End of Each Period for n Periods • • • • • • • • • • • • • • • • • 3- 18 No. Yrs. 2% 4% 1 0.9804 0.9615 2 1.9416 1.8861 3 2.8839 2.7751 4 3.8077 3.6299 5 4.7135 4.4518 6 5.6014 5.2421 7 6.4720 6.0021 8 7.3255 6.7327 9 8.1622 7.4353 10 8.9826 8.1109 15 12.8493 11.1184 20 16.3514 13.5903 30 22.3965 17.2920 35 24.9986 18.6646 40 27.3555 19.7928 50 31.4236 21.4822 Discount Rate, r 6% 8% 0.9434 0.9259 1.8834 1.7833 2.6730 2.5771 3.4651 3.3121 4.2124 3.9927 4.9173 4.6229 5.5824 5.2064 6.2098 5.7466 6.8017 6.2469 7.3601 6.7101 9.7122 8.5595 11.4699 9.8181 13.7648 11.2578 14.4982 11.6546 15.0463 11.9246 15.7619 12.2335 10% 12% 0.9091 0.8929 1.7355 1.6901 2.4869 2.4018 3.1699 3.0373 3.7908 3.6048 4.3553 4.1114 4.8684 4.5638 5.3349 4.9676 5.7590 5.3282 6.14465.6502 7.6061 6.8109 8.5136 7.4694 9.4269 8.0552 9.6442 8.1755 9.7791 8.2438 9.9148 8.3045 14% 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 6.1422 6.6231 7.0027 7.0700 7.1050 7.1327 Quick Check Question 3.6 3-19 • If the market rate on comparable bonds (10 year 10%) drops to 8% what is the present value fo the bond now? The bond pays $100 interest annually & $1,000 at maturity. Quick Check Question 3.6 3-20 • The bond pays $100 interest annually & $1,000 at maturity. • 10 annual payments of $100: • • Use the annuity table in Table 3-5: 10 years @ 8% = 6.7101 x $100 = $671.01 • The principal payment is a lump sum after 10 years, discounted at 8% in Table 3-3: • $1,000 x .4632 = $463.10 • $1,134.11 Value of the bond in today's market: Quick Check Question 3.6 3-21 • As interest rates fall prices (present value) on issued bonds go up • As interest rates rise prices (present value) falls. • Why? Value of a Perpetuity • Present Value of a Perpetuity = Payment = • Discount Rate PV = 1 .10 = $10.00 3-22 P r Valuing a Perpetuity Intended to be Sold 3-23 • Assume collection of dividend & sale at close of one year: • • PV of Dividend: = $1.00 = $1.00 = $0.909 1+r 1 + .10 • • Value of the sale:= $10.00 = $10.00 = $9.090 1+r 1 + .10 • Total: $9.99999 Valuing a Perpetuity Intended to be Sold • Thus if dividends held constant and discount rate constant stock prices would never change. • If dividends held constant price of stocks would be related to changes in doscount rate applied • In the real world both are variables. 3-24 Quick Check Question 3.7 3-25 • What is the value of a share of preferred stock carrying an $8.00 annual dividend, discounted at 7%, assuming it is neither redeemable by the company ("callable") nor subject to forced redemption by the holder? • Quick Check Question 3.7 Discount Rate of 7% PV = $8.00 = $114.29 .07 Discount rate of 8%, PV = $8.00 = $100.00 .08 Discount rate of 10% PV = $8.00 = $80.00 .10 3-26 Price – Earnings Multiples 3-27 • P-E multiples based on (1) current market price & (2) last 4 quarters’ net income • Regularly reported in financial press, e.g., Wall St. Journal: Price – Earnings Multiples YTD 52 Week Yld Vol Net Hi Lo Stock (Sym) Div % PE 100s 4.2 57.91 42.90 CocaCola KO .80 1.8 27 39470 (for Friday, Jan. 17, 2003) 3-28 Last 45.67 Price – Earnings Multiples 3-29 (for Friday, Jan. 17, 2003) Problems with P/E: • Uses historical earnings, not expected earnings & not cash flows • P/E ratio includes both cap rate and growth rate, bundled (described next) • Seems to assume same cap & growth rate will apply to all future periods (i.e. managers will continue to invest in projects that make the same rate of return). • Based on Net Income, not cash flows. Valuing Perpetuities with Constant Growth • The Value of a Perpetuity with Constant Growth is: • • PV = P r –g • Where g = constant growth rate 3-30 Valuing a Perpetuity with Constant Growth 3-31 • Assumptions: • • Earnings (A) • Capitalization Rate (r) • Growth Rate (g) • • Calculation: PV = $1.00 .10 -.04 • With no growth PV = $1.00 = .10 = = $1.00 per year = .10 = .04 per year $1.00 .06 $10.00 = $16.67 Valuing a Perpetuity with Initial Growth • Most companies do not sustain the same growth rate. There is usually a period of high growth until industry maturity when growth levels off and remains nearly constant. 3-32 Valuing a Perpetuity with Initial Growth 3-33 • Assume: Initial Earnings $1.00, growing at 4% for 5 years. • Stable earnings thereafter, discounted @ 10% • Year Dividend x Discount Factor = Present Value ( x 1.04) @ 10% (P / 1.1)n • 1 1.00 0.9091 $0.9091 • 2 1.04 0.8264 0.8595 • 3 1.0816 0.7513 0.8126 • 4 1.1249 0.6830 0.7683 • 5 1.17 0.6209 0.7264 • Subtotal: 4.0759 • 6 Perpetuity of $1.17 = $11.70 x 0.5645 = 6.6046 .10 • Total Present Value: $10.6805 Valuing Investments with Different Timing of Returns • • • • • Project A: End of Year 1 2 3 Total: Return $200,000 150,000 150,000 $500,000 Project B: End of Year 1 2 3 Total: 3-34 Return $100,000 100,000 325,000 $525,000 Discounted present values @ 10%, using Table 3-4: • Project A: • End of Return x NPV Year • 1 $200,000 x .9091 $181,920 • 2 150,000 x .8264 123,960 • 3 150,000 x .7513 112,695 • Totals: $418,575 Project B: End of Return x Year 1 $100,000 x .9091 2 100,000 x .8264 3 325,000 x .7513 NPV $90,910 82,640 244,172 $417,722 Net Present Value Defined • PV of Funds to be Received — PV of Funds Invested NPV of Project 3-35 Quick Check Question 3.8 3-36 A factory costs $400,000. You calculate that it will produce net cash after operating expenses of $100,000 in year 1, $200,000 in year 2, and $300,000 in year 3, after which it will shut down with zero salvage value. Calculate its Net present Value. Quick Check Question 3.8 Year Pymnt x Discnt Fctr @ 10% 1 $100,000 .909 2 200,000 .8264 3 300,000 . 7513 Prsnt Value $90,900 165,280 225,390 Total • Less: Cost of Capital: • Net Present Value: $481,570 (400,000) $81,570 3-37 Summary 3-38 1. Compounding of interest or returns. 2. Discounting future payments to present value. 3. Valuing Annuities (and bonds) 4. Valuing perpetuities. 5. Valuing perpetuities with growth. 6. Valuing perpetuities with changing growth. 6. Testing the present value of projects. Equations 3-39 • 1 .Compounding of interest or returns. • • 2. Discounting future payments to present value. V = P(1+r)n PV = P__ (1+r)n • • 3. Valuing Annuities • • 4. Valuing Perpetuities PV = • • 5. Valuing Perpetuities with Growth PV = PV = P r - P__ r (1 + r)n P r P r-g • 7. Net Present Value = PV (income) – PV (investments) Determining the Right Discount Rate 3-40 • So far we have assumed a discount or interest rate. Where does it come from? • It has two parts: Risk Free Rate and Compensation for Risk. • Risk Free Rate: Compensation for delaying other uses of the money. Inflation plus a risk free market rate of return. T-Bill 3.7% could be 3% inflation plus 0.7% return • Compensation for risk? Table 3-6. Returns to Asset Classes, 1926-1997 • Table 3-6 Returns to Asset Classes • Asset Class • • • • • • • • • • 3- 41 Nominal Return Short-term Treasury Bills 3.8% Intermediate-Term T- Bonds 5.3% Long-Term Treasury Bonds 5.2% Corporate Bonds 5.7% Large-Co. Stocks 11% Small-Co. Stocks 12.7% Std. Deviation Risk Premium Real of over Return Annual Returns T- Bills 0.7% 3.2% 0% 2.2% 5.7% 1.5% 2.1 2.6% 7.9% 9.6% 9.2% 8.7% 20.3% 33.9% 1.4% 1.9% 7.2% 8.9% Dow-Jones Average, May 2000 – 2005 3-42 The Coin Flipping Game • Outcome • Original Bet: $1.00 • $0 • $2.00 • Expected outcome: • Outcome • Original Bet: $25,000 • $0 • $50,000 • Expected outcome: Probability 3-43 Weighted Outcome 0.5 0.5 1.0 $0 $1.00 $1.00 Probability Weighted Outcome 0.5 0.5 1.0 $0 $25,000 $25,000 Figure 3-1 • Utility • 120 • 100 • 40 • 0 10,000 35,000 44 60,000 Wealth Percentage Gains & Losses in Figure 3-1 Money: Start: • Win • Lose • • $35,000 +25,000 = $60,000 - a 71% gain - 25,000 = $10,000 - a 71% loss Utility: • Start: • Win: • Lose 100 +20 = -60 = 120 40 - a 20% gain - a 60% loss 3- 45 Figure 3-2 • Utility • 160 • • 100 • 40 • 0 10,000 35,000 75,000 3-46 Wealth Percentage Gains & Losses in Figure 3-2 Money: Start: • Win • Lose • • $35,000 +40,000 = $75,000 - a 115% gain - 25,000 = $10,000 - a 71% loss Utility: • Start: • Win: • Lose 100 +60 = -60 = 160 40 - a 60% gain - a 60% loss 3- 47 Figure 3-3 – Outcome Probabilities • • • • • • • • • • • • • Firm A Probability 1.0 .9 .8 .7 .6 .5 .4 .3 .2 .1 0 50 3- 48 Firm B Probability 1.0 .9 .8 .7 .6 .5 .4 .3 .2 .1 100 150 200 250 Firm Value 0 50 100 150 200 250 Expected Values • • Firm A Outcome Probability Product • $0 $ 50 $100 $150 $200 Total 0 $5 $80 $15 0 $100 • • • • • 0 .1 .8 .1 0 3-49 Firm B Outcome Probability 0 $ 50 $100 $150 $200 Total .1 .2 .4 .2 .1 Product $ 0 $10 $40 $30 $20 $100 Table 3-7 • • Deviation • Outcome x Prob. from Mean • • • • • 0 50 100 150 Variance 0 .1 .8 .1 0 -50 0 +50 Firm A Deviation Squared 0 2,500 0 2,500 • Firm B • Deviation Deviation • Outcome x Prob. from Mean Squared • • • • • • 0 50 100 150 200 Variance .1 .2 .4 .2 .1 -100 -50 0 +50 +100 10,000 2,500 0 2,500 10,000 3-50 Probability times Deviation Squared 0 250 0 250 500 Probability times Deviation Squared 1,000 500 0 500 1,000 3,000 Table 3-7 Extended • • • Firm A Deviation Deviation Probability times Outcome x Probability from Mean Squared Deviation Squared 0 50 100 150 Variance 0 .1 .8 .1 0 -50 0 +50 0 2,500 0 2,500 0 250 0 250 500 Standard Deviation • • • • 3-51 Standard Deviation (sq. rt. variance) - 22.36 Firm B Deviation Deviation Outcome x Probability from Mean Squared 0 50 100 150 200 Variance .1 .2 .4 .2 .1 Standard Deviation -100 -50 0 +50 +100 10,000 2,500 0 2,500 10,000 Probability times Standard Deviation Deviation Squared (sq. rt. variance) 1,000 500 0 500 1,000 3,000 - 54.77 Returns to Diversification – Slide 1 • Returns to Umbrella Maker • Rainy Season $0.50 x .5 = $0.25 • Sunny Season ($0.25) x .5 = (0.125) • Expected Return $0.125 Returns to Beach Resort ($0.25) x .5 = ($0.125) $0.50 x .5 = $0.25 $0.125 52 Returns to Diversification – Slide 2 • Returns 1 • Umbrellas • 1 Rain 2 Resorts 2 Shine 3-53 Returns to Diversification 54 • Systemic Risk – General Market risk to whole economy. All investments are subject to it but to different extents. Beta represents the extent of the effect of systemic risk on a particular company’s stock. • Unsystemic Risk – Risk to a particular industry or investment. This can be eliminated by diversification Table 3-9 Effects of Increasing Diversification on Volatility Number of Stocks in Portfolio • • (1) 1 2 4 6 8 10 20 30 40 50 100 200 300 400 500 1,000 3-55 Average Volatility of Ratio of Portfolio Volatility Annual Portfolio Returns To Volatility of a Single Stock (2) (3)____________ 49.24% 1.00 37.36 0.76 29.69 0.60 26.64 0.54 24.98 0.51 23.93 0.49 21.68 0.44 20.87 0.42 20.46 0.42 20.20 0.41 19.69 0.40 19.42 0.39 19.34 0.39 19.29 0.39 19.27 0.39 19.21 0.39 - Market Risk Table 3-10 Return on Treasuries + Stocks 3-56 %Treasury Rate of Weighted % Common Rate of Weighted Total Bonds Return Return Stocks Return Return Return • 100 5% 5% 0 0% 0 5% • 75 5% 3.75% 25 10% 2.5% 6.25% • 50 5% 2.5% 50 10% 5% 7.5% • 25 5% 1.25% 75 10% 7.5% 8.75% • 0 5% 0% 100 10% 10% 10% • (Assuming 5% return on Treasuries & 10% on stocks) Table 3-11 Return to Stocks + Borrowing 57 Return on % Borrowed Interest Interest Net • %Stocks % Return Equity Funds Rate Expense Return • 100 10% 10% 0 5% 0 10% • 125 10% 12.5% 25% 5% 1.25% 11.25% • 150 10% 15% 50% 5% 2.5% 12.5% • 175 10% 17.5% 75% 5% 3.75% 13.75% • 200 10% 20% 100% 5% 5% 15% • (Assuming borrowing @ 5% & 10% return on stocks) Summary of Portfolio Choices and Results 3-58 • • % Stocks Weighted % T – Bonds Weighted % Borrowed Interest Return Return Expense • • • • • • • • • 0 25% 50% 75% 100% 125% 150% 175% 200% 0 100 2.5% 75 5% 50 7.5% 25 10% 0 12.5% 0 15% 0 17.5% 0 20% 0 5% 0 3.75% 0 2.5% 0 1.25% 0 0 0 0 25 0 50 0 75 0 100 Total Retun 0 5% 0 6.25% 0 7.5% 0 8.75% 0 10% 1.25% 11.25 2.5% 12.5% 3.75% 13.75% 5% 15% Two Different ways to get the same rate of return 3-59 Buy a single risky stock with expected 15% return – – 1. 2. Faces both systemic and non-systemic risk. Expected annual volatility of 49.21% rather than diversified portfolio volatility of 19.21% (Table 3-9) Market does not pay a premium for this high risk (volatility) because there are two less risky ways to get the same result. Buy a portfolio of stocks with a Beta of 2 (gets a 15% return (Figure 3-4) Buy a market portfolio with leverage 15% return (Table 311) Capital Asset Pricing Model Cap M 3-60 R = Return on investment S = Systemic Return U = Unsystemic Return R = S+U The Cap M theory holds that companies do not have to pay for unsystemic risk because that can be eliminated through portfolio diversification and/or leverage so U is fixed at 0 Different companies respond to Systemic Risk differently so S needs to be modified by this ratio called Beta Figure 3-4 Capital Market Line 3-61 Expected Return on Investment Market Rate (10%) Risk-Free Rate (5%) 0 .5 1.0 1.5 2.0 Risk (beta) Figure 3-4 Capital Market Line 3-62 Expected Return on Investment • Company A Market Rate (10%) • Company B Risk-Free Rate (5%) 0 .5 1.0 1.5 2.0 Risk (beta) Expected Cost of Capital under CAPM 3-63 • Risk Free Rate + (Equity Premium)(beta) • Assume Risk-Free Rate of 5% and Equity Premium of 5% (10% - 5%) • Assume a company with a beta of 1.5 • Risk-Free Rate: 5% • + Equity Premium: 5% x beta: 1.5 7.5% • Cost of Equity Capital 12.5% Leverage and Capital Structure 3-64 • Covered in more detail in next Chapter • Basic Example Firm A Debt Equity $300,000 $700,000 $1,000,000 Firm B Debt Equity $0 $1,000,000 $1,000,000 Because Beta is calculated based on market as a whole it is a function of average form of capital structure. It helps us calculate the cost of capital of the equity of the firm but capital structure can be changed so we may want the cost of capital of an unleveraged (all equity firm) Calculating an Unlevered Beta • • • • • • • • • • Unlevered beta = Levered beta/ [1+ (1-tax rate)(debt/equity)] Example: levered beta = 1.2 Tax rate: .4 Capital structure: 30% debt, 70% equity Unlevered beta = 1.2______ = 1.2_______ = 1+ (1-.40)( 30/70) 1 + (.60)(.42) = 1.2___ = .95 1.257 3-65 Calculating an Unlevered Beta • Beta goes down since leverage creates volatility. • When would you want to use this? • When you are buying an entire company and could redo the capital structure (mix of equity and debt). You are trying to figure out what to pay for the whole compnay. 3-66 Expected Cost of Capital under CAPM 3-67 • Risk Free Rate + (Equity Premium)(unleveraged beta) • Assume Risk-Free Rate of 5% and Equity Premium of 5% (10% - 5%) • Assume a company with a beta of .95 • Risk-Free Rate: 5% • + Equity Premium: 5% x beta: .95 4.75% • Cost of Equity Capital 9.75% Forms of ECMH 3-68 • Weak Form: Nothing in past stock prices predicts future prices. Based on the Random Walk Findings • Semi-Strong Form: Stock prices reflect all publicly available information. • Strong Form: Stock prices reflect all information. Necessary Conditions for ECMH 1. 3-69 Zero Transaction Costs in Securities (as commissions falla nd internet brokerage rises this is getting close) 2. All available information is costlessly available to all market participants. 3. Agreement on the implications of current information for stock prices. 4.Sufficient capital to engage in risky arbitrage? (this is necessary to cause the market adjustments to information) Mechanisms of Market Efficiency Efficient Markets Paradox (Grossman & Stiglitz): • Traders must believe that markets are inefficient. • Inefficiency creates opportunity to find bargains. • Bargains create opportunity to earn extraordinary returns. 3-70 Anomalies in ECMH • • • • • • • • • • • • • 3-71 Evidence: 1. Trend chasing can sometimes be profitable. 2. Low p/e (“value”) stocks outperform the market. 3. High risk stocks are overpriced 4. Convertible debt can sell below conversion value 5. Closed End Mutual Funds trade below asset value 6. Japanese bubble of 1980s 7. 1987 Crash of U.S. Market 8. Late 1990s bubble and 2001 U. S. Market Crash 9. January Effect Explanations: A. Irrational behavior by some investors swamps capacity of sophisticated investors to correct. • B. Small changes in expected interest & growth rates cause large changes in prices. can Nikkei 225: 1985 – 2005 3-72 Examples of Pricing Anomalies 3-73 • 3Com: (maker of modems, switches & computer components) • Mkt. Value of $19 billion in early 2000 • Owned 95% of Palm, Inc., with $332 Billion mkt. value. • • Healthdyne: (maker of infant monitors & medical devices) • Dec. 31, 1996 - stock traded at $8.88 • Early 1997 -rejected takeover bid of $15 • Nov. 1997 - sold for $24. • • Royal Dutch Shell - 60/40 sharing agreement Royal Dutch should be worth 150% of Shell • Early 1990s, Royal Dutch traded at 5-7% discount • Late 1990s, Royal Dutch traded at up to 20% premium Psychological Bases for Investor Errors 1. 3-74 Investors make a series of systematic calculation errors that prevent rational investment choices. a. Investors fear risk more than they value rewards. b. Investors suffer from an “anchoring bias” and calculate gains & losses from a reference point, rather than looking long-term. 2. Investors suffer from the “availability bias” in which they calculate based only on recent and easily recalled events rather than looking at a larger data set. a. Investors suffer from a “framing bias” in which their answer to a question depends on how it is framed. 3. Experimental economists have found an “endowment effect,” in which individuals will refuse to sell an item they own, where they would refuse to buy that item at that price. Challenges to ECMH and Responses 3-75 1. Arbitrage is risky, not risk-free. • There are particular explanations where arbitrage fails. e.g., insufficient public shares for short sales of Palm, Inc. 2. There may be insufficient funds to correct overall market bubbles. • Some market crashes can be explained by new information, e.g., interest rate changes. • It’s unrealistic to assume public trades foolishly, when 80% of trading is by informed professionals. 3. “Value” investing, that buys low p/e stocks, performs better than indexes over the long run. • “Value” stocks may be depressed for a reason, such as setbacks that make them riskier. • Many bargains don’t persist, but revert to mean returns. Wachter’s Reconciliation • 1. • 2. • 3. • 4. • 5. • 6. • 7. • 8. 3-76 Anomalies exist, and may persist for some time before correction. Grossman & Stiglitz’s “Efficient Market Paradox” – it takes inefficiencies to generate profits to motive searches for trading opportunities, and restore efficient pricing. Markets can be (relatively) efficient without always being correct – the only question then is how long it takes prices to be corrected. Fama & French: beta doesn’t capture all elements of risk; some are explained by other factors. These other factors mean that CAPM doesn’t necessarily capture the cost of equity capital accurately. Variations in growth rates of expected earnings can dramatically affect estimates of firm value. The risk premium on stocks appears to vary with the business cycle. No new theory has been offered; behavioralists test their theories against CAPM / ECMH. Implications for Lawyers 3-77 • How do you price an IPO? Google Dutch Auction. • Should managers be able to use takeover defenses if the markets are efficient? Why do takeovers occur?Inefficient? • Should short term drops in share prices be evidence of misrepresentation in securities offerings? • Should share prices movements after an IPO prove that unerwriter valuatiosn were fraudulent? 3-78 The Use of ECMH in the Courts and to Make Legal Arguments ECMH in the Courts 3-79 • Fraud on the Market assumes ECMH Semi Strong Form. All public information is reflected in price. Thus even if I don’t “know” the information it affects me in the price. West v. Prudential Securities, Inc. 3-80 • Facts: Hoffman, a Prudential broker, lied to his customers that Jerfferson was going to be taken over shortly. Those who bought shares during the 8 month period of the “lie” alledge they bought over priced shares as a result of his lie. Opinion assumes he told the customers it was “inside” information. Lie was never made public. • Judge: Easterbrook (law and economics school) West v. Prudential Securities, Inc. 3-81 • Issue: Can a class be certified? To do so P must show causation of loss. • Basic v. Levinson: Case involved false public announcements and a securities fraud claim. An issue is whether P has to show actual reliance on the false public information. “Fraud on the Market” theory accepted by 4 of the 6 Justices. Theory is that false public information affects all prices in the security due to ECMH. Does Basic apply to false private information? West v. Prudential Securities, Inc. 3-82 • Analysis: Since there was no public announcement and no evidence how the tips to the custoemrs here could have caused stock price rise there was no fraud on the market and hence no causation of the loss claimed. • P’s expert argued that purchases initiated by the false information drove up the price. (Almost a but for causation argument). He argues lie increased demand which increased price. West v. Prudential Securities, Inc. 3-83 • But Easterbrook says that demand in securities is elastic as so many fungible stocks (CAPM) so trades can only increase price to the extent trades convey information. • These retail customers could not convey information by trading (not professionals and volume too small) West v. Prudential Securities, Inc. • Which form of ECMH could have helped Plaintiffs? 3-84 West v. Prudential Securities, Inc. 3-85 • Which form of ECMH could have helped Plaintiffs? Strong Form: Prices reflect all even private information. This form is not accepted much any more. West v. Prudential Securities, Inc. 3-86 • QUESTION: Easterbrook presumes Jefferson’s stock is efficiently priced and suggests P bears the burden of proving it is not. Does Behavioral Economics suggest a different presumption? West v. Prudential Securities, Inc. 3-87 • Behavioral Economics would suggest that a large enough trading volume will cause irrational actors to follow the herd and drive prices up. How do you prove this with testimony in courts? • Q. Why did you (who are now suing Prudential and trying to prove an irrational herd following price change) buy Jefferson Stock? • A. I was following the herd. When is the market for a stock efficient? 3-88 • ECMH assumes public information is disseminated and understood. • Thus when a sufficient number of analysts follow a stock. • Information will be shared and multiple analysts will ensure agreement on significance. • Born out by fewer earnings surporises for well followed stocks. How many are enough? Time Warner Securities Litigation 3-89 • You may have read the Time Warner Paramount Case in Corporations. • It dealt with the issue of whether a board could just say no to an offer. • If company is not for sale are there Revlon duties? • This case arises later when TW tries to raise money for the cash tender offer and merger. • Doe sthe poor trading of TW prove the earlier decision wrong? Does it prove the board was wrong in their business judgment that it was better than the Paramount deal? Elements of a 10b-5 Claim • • • • • Material Misstatement or omission Scienter (knowing or reckless) In connection with sale of securities Relied on by P Caused damage 3-90 Elements of a 10b-5 Claim 3-91 Two issues in this case • Were there materialy misleading statements or omissions. • Was scienter pled sufficiently – one way to plead is motive and opportunity to commit fraud. • • • • Elements of a 10b-5 Claim 3-92 Is corp. responsible for statements in the press attributed to unnamed corporate personnel? Does corp. have duty to update optimistic predictions about a business plan when the prospects become dim? Does corp. have obligation to disclose a specific alternative to an announced plan when the alternative comes under active consideration Did Plaintiffs adequately plead scienter? Elements of a 10b-5 Claim • 3-93 Is corp. responsible for statements in the press attributed to unnamed corporate personnel? No. • Does corp. have duty to update optimistic predictions about a business plan when the prospects become dim? Not when projections were not specific. • Does corp. have obligation to disclose a specific alternative to an announced plan when the alternative comes under active consideration? Yes • Yes, Motive was lessening the dilution Did Plaintiffs adequately plead scienter? Time Warner 3-94 “A duty to disclose arises whenever secret information renders prior public statements materially misleading, not merely when that information completely negates the public statements.” “We do not hold that whenever a corporation speaks, it must disclose every piece of information in its possession that could affect the price of its stock.” “Rather, we hold that when a corporation is pursuing a specific business goal and announces that goal as well as an intended approach for reaching it, it may come under an obligation to disclose other approaches to reaching the goal when those approaches are under active and serious consideration.” Time Warner 3-95 Question of motive. “The unresolved issue is whether the effects of the artificial raising of the stock price by the combination of the glowing reports of potential strategic alliances and the nondisclosure of the active consideration of a rights offering could reasonably have been expected by the company not to have been completely dissipated by the announcement of the rights offering, thereby enabling the company to set the rights offering price somewhat higher than would have been possible without the misleading statements....” Time Warner 3-96 Question of motive. This statement implies markets may not fully react ot the correction of prior fraudulent statements. But ECMH says they should. This is Winter’s point in dissent. Time Warner 3-97 1. Does the majority suggest that all statements made must be updated when new information would make them no longer completely true? Time Warner 3-98 1. Not exactly. “It is important to appreciate the limits of our disagreement with the District Court. We do not hold that whenever a corporation speaks, it must disclose every piece of information in its possession that could affect the price of its stock. Rather, we hold that when a corporation is pursuing a specific business goal and announces that goal as well as an intended approach for reaching it, it may come under an obligation to disclose other approaches to reaching the goal when those approaches are under active and serious consideration.” 2. • Time Warner 3-99 Note that the Court concludes that consideration of a possible stock offering rather than strategic alliances would be material to investors. “An offering of new shares, in contrast [to a strategic alliance], would dilute the ownership rights of existing shareholders, likely decrease dividends, and drive down the price of the stock.” If you represented TimeWarner, what arguments could you make that this wasn’t so? Time Warner 2. 3-100 First, new equity investments will help reduce interest payments and will thus free up cash to pay dividends. This was a company with over $1.1 billion in interest expense in 1990, with net losses of $227 million. Losses per common share were over $13.00. No dividends were paid on the common in 1990. Second, notice that dilution of ownership rights, in terms of percentage ownership, always occurs when new shares are issued. As Winter’s dissent states, in a public corporation, “investors who do not care about control also do not care about dilution.” Thus dilution of ownership is not always bad. The question is whether you have positive net present value projects that will earn more than the cost of capital. Interest savings are a form of earnings. Third, Winter’s dissent points out that strategic partners would have diluted Time-Warner’s earnings - they would want a share of them in exchange for their investments. This isn’t to say that investors aren’t interested in whether the company is planning to issue more stock, or that it might not affect stock prices. Dilution 3-101 100 shares pre offer = original shareholders own 100% 200 shares post offer = original shareholders own 50% Dilution 3-102 Original company worth $100 so original shareholders own $100 After new money company becomes worth $300 so original shareholders own $150 of value Example of Real Dilution 3-103 Original company worth $100 so original shareholders own $100 After new money company becomes worth $150 so original shareholders own $75 of value where they owned $100 before. Dilution 3-104 Three theories on why new offerings drive down price: It dilutes share value by increasing total shares in issue: refuted above. It signals best time to sell so price is not going up so people sell. It conveys bad information (like in this case the alliances are off). Time Warner 3-105 3. Note the dilution example in footnote 5 of the majority’s opinion: “Presumably, announcement of a rights offering will tend to reduce a stock price by the extent to which the offering, if fully subscribed, dilutes the position of the original shareholders. Time Warner 3-106 For example, if a company, with 1,000 outstanding shares selling at $100 a share raises $100,000 of new capital by a rights offering that issues 2,000 shares at a price of $50 a share, the original shareholders will own onethird (1,000 shares of 3,000 outstanding) of a company that should be worth $200,000, and the share price after the rights offering should be $66.67 ($200,000/3,000).” Time Warner 3-107 3. Do you see any logical flaws in employing this example in TimeWarner? Time Warner 3-108 3. Why should a company be willing to sell new shares for $50? Time Warner 3-109 3. A. The new project to be financed is a negative net present value project. B. The offering reveals new information about the company - that it isn’t worth as much as investors previously thought. (The failure to find strategic partners may have meant that TimeWarner’s businesses weren’t worth what management thought, and as much as management’s asking price.) In this case, the harm isn’t issuance of new shares, but revelation that the company is worth less than investors previously believed. This could have resulted from the disappointment of hopes that strategic partnerships would create new value (i.e., be positive net present value projects) for TimeWarner. Time Warner 3-110 4. How does Judge Winter distinguish types of dilution compared to the majority’s approach? Time Warner 3-111 4. His characterization of the first rights offering is that it “created a disproportionate dilutive effect on non-exercising shareholders as a means of coercing shareholders to exercise the rights.” Time Warner 3-112 4. Why is it disproportionate and coercive? Rights weren’t transferable so shareholders were forced to exercise if they believed the purchase price would be below the fair value of the shares. (If the offering were under-priced, the rights, if marketable, would have traded for the amount of that bargain.) Time Warner 3-113 5. Is there anything in particular about the Time-Warner Rights Offering that might make the above example realistic? Time Warner 3-114 5. Rights Offer terms sent a negative message. Companies do not want to invest in TW at current valuations and lenders do not want to put in new debt. As Winter’s dissent says, “It thus indicated that the only source of capital available for the debt payments were the locked-in shareholders of Time Warner who might lose all if the company defaulted on the debt.” Time Warner 3-115 5. Rights offering seemed to be purposely dilutive so as to coerce acceptance (remember this was the only way to get money to pay off debt). Time Warner 3-116 6. Plaintiff’s scienter theory argued in part that management concealed plans for the rights offering because it didn’t want to scare off potential strategic partners. How does the court react to this argument? Time Warner 3-117 6. Trial Court Rejected and Majority Agrees. Winter suggests that it might even be favorable news for an investor (new source of capital). Time Warner 3-118 7. Plaintiff’s scienter theory argues that management was motivated to maintain an artificially high market price so the asking price in the rights offering could be higher. What assumptions underlie this argument? • Time Warner 3-119 7. That markets can be fooled and misprice a stock. Is that inconsistent with ECMH? No. It can happen when the information reflected in a stock price is false. But once the dilutive rights offering is announced, (true information is released) what happens to price? Time Warner 3-120 7. ECMH says markets should adjust rapidly to the new information, and correct for the misinformation. Time Warner 3-121 8. How does the court reconcile plaintiff’s theory with ECMH? Time Warner 3-122 8. “In such circumstances, we consider the pleading sufficient to survive dismissal because, however efficiently markets may be thought to work when disclosures are proper, it is not beyond doubt that they may not fully correct for prior misleading information once a necessary disclosure has been made. Though, in many circumstances, a truthful correction might be expected promptly to alert the market to errors in prior statements, ... it is possible, in some circumstances, that the embellishments of a deliberately false statement and the manner of its dissemination might leave its effects lingering in the market for some time, despite a correcting statement.” - page 152 Time Warner 3-123 8. The court’s real answer is that the issue is whether defendants believed in ECMH; if they didn’t, they might (naively) think the market might not correct sufficiently when the truth was revealed: “In a case like the pending one, however, the issue is not whether the misleading aspect of the prior statement in fact lingered; it is only whether the plaintiff can show that the defendants had a motive not to promptly correct the misleading aspect of the prior statement.” - page 152 Time Warner 3-124 8. “In a case like the pending one, however, the issue is not whether the misleading aspect of the prior statement in fact lingered; it is only whether the plaintiff can show that the defendants had a motive not to promptly correct the misleading aspect of the prior statement.” - page 152 Time Warner 3-125 9. Why does Judge Winter think the motive to artificially maintain the market price in advance of the rights offering is implausible? Time Warner 3-126 9. Because TW intended the offering to be below the pre-announcement market price, in order to coerce shareholders to exercise. 10.And management would have expected a negative reaction to the announcement of the coercive rights offering. • And because management knew that in their registration statement filing for the rights offering, management would have to disclose the failure of the strategic partners approach. Time Warner 3-127 • And because the notion that markets quickly reflect widely disseminated news is widely accepted by Securities Laws: – Texas-Gulf Sulpher – Basic v. Levinson – Securities Act waiting period for Registration Statements – Plaintiffs own pleading (to prove reliance) 3-128 Valuation Issues in the Courts Old Attitudes Toward Markets 3-129 • Chicago Corp. v. Munds, 172 A.2d 452, 455. (Del. Ch. 1934): • "When it is said that the appraisal which the market puts upon the value of the stock of an active corporation as evidenced by its daily quotations is an accurate, fair reflection of its intrinsic worth, no more than a moment's reflection is needed to refute it." • Smith v. Van Gorkom, 488 A.2d 858, 875-76 (1985): • "Using market price as a basis for concluding that the premium adequately reflected the true value of the Company was a clearly faulty, indeed fallacious, premise.... Most chief executives think that the market undervalues their companies' stock." Changing Attitudes Toward Markets? 3-130 • Appelbaum v. Avaya, 2002 Del. LEXIS 699: • “The corporation owes its cashed-out stockholders payment representing the “fair value” of their fractional interests. The cashed-out stockholders will receive fair value if Avaya compensates them with payment based on the price of Avaya stock averaged over a ten-day period preceding the Proposed Transaction. While market price is not employed in all valuation contexts, our jurisprudence recognizes that in many circumstances a property interest is best valued by the amount a buyer will pay for it. The Vice Chancellor correctly concluded that a well-informed, liquid trading market will provide a measure of fair value superior to any estimate the court could impose.” Del. Gen. Corp. L. § 262(h) • • 3-131 “(h) After determining the stockholders entitled to an appraisal, the Court shall appraise the shares, determining their fair value exclusive of any element of value arising from the accomplishment or expectation of the merger or consolidation, together with a fair rate of interest, if any, to be paid upon the amount determined to be the fair value. In determining such fair value, the Court shall take into account all relevant factors.” Cede & Co. v. Technicolor – Basic Facts • • • • • • • • • • • 3-132 June 30, 1978 - $7.75 June 30, 1979 - $10.33 June 30, 1980 - $24.67 (peak of silver bubble) July 7, 1981 - $18.63 (after announcement of 1-Hour Photo) 1981-82 – earnings drop June 30, 1982 - $10.37 June – Sept. 1982 Trading Range - $9.00 to $11.00 Negotiated buyout price - $23 MAF tender offer got all but 17.81% of shares Cinerama dissents from merger for its 4.4% Appraised value by Chancery Court: $21.60 Cede & Co. v. Technicolor – Basic Facts What is the Fair Value of Technicolor’s stock? 3-133 • Chancellor Allen decides $20.48, plus $1.12 adjustment for long-term debt = $21.60. Cede & Co. v. Technicolor – Basic Facts 3-134 There are three parts to a discounted cash flow valuation analysis: • An estimation of expected cash flows for the firm; • Determination of a residual or terminal value for periods beyond the cash flow projections; and • Selection of the appropriate discount rate. Methodology of Experts – Earnings Estimates 3- 135 • Technicolor: Alfred Rappaport (Northwestern) • Calculated an initial period of projected growing earnings (“Value Growth Duration” (“VGR”) during which earnings are in excess of cost of capital. • For a residual value thereafter, Rappaport assumed constant cash flows. (i.e. no equity value growth) • Cinerama: John Torkelson (Princeton Venture Research) • Also calculated cash flows for first five years. • Then assumed earnings continued to grow @ 5% in perpetuity. Cost of Capital • Rapaport: • Used beta of 1.7, based on December, 1982 beta for Technicolor • Added 4% small capitalization premium for 22.7% cost of capital • Torkelson: • Used average of two costs of capital: – MAF’s cost of 9.96% – Cost for all manufacturing companies of 15% – Average = 12.5% 3-136 Rappaport’s cost of capital without a small cap premium • Cost of capital • Small cap premium • Cost of capital 22.7% - 4% 18.7% 3-137 Technicolor Questions 3-138 1. What are the incentives of each expert in a case such as this? Technicolor Questions 3-139 1.What are the incentives of each expert in a case such as this? In fn. 17 Chancellor Allen describes them: “... the incentive of the contending parties is to arrive at estimates of value that are at the outer margins of plausibility – that essentially define a bargaining range.” “If one substitutes the higher discount rate used by respondent’s principal expert [Rappaport] for the lower rate used by petitioner’s expert [Torkelson] and makes no other adjustment to either DCF model the differences reduces from $49.61 a share to $20.86. Technicolor Questions 3-140 2. What are the three parts of discounted cash flow analysis described by the court? • An estimation of expected cash flows for the firm. • Determination of a residual or terminal value for periods beyond the cash flow projections. • Selection of the appropriate discount rate. Technicolor Questions 3-141 3. Why do you suppose experts focus on the first 5 - 7 years before calculating a terminal value? Technicolor Questions 3-142 3. Why do you suppose experts focus on the first 5 - 7 years before calculating a terminal value? • It’s customary to calculate expected cash flows out to a “valuation horizon” - chosen somewhat arbitrarily. • Beyond 5 years, it’s terribly difficult to project cash flows - too many variables will intrude. • As the court suggests, the assumption is that if a business is growing now, it will mature and growth either stop or slow down as competitors appear. • The terminal value assumes a no-growth state in most models - that earnings will be stable, and that the company will only earn its cost of capital on older businesses. Technicolor Questions 3-143 4. Why did the court prefer the September 1982 beta to the December 1982 beta? Technicolor Questions 3-144 4. Why did the court prefer the September 1982 beta to the December 1982 beta? • Recall that beta is the relationship between the variance of the company’s stock and the variance of the market. • When the takeover at a premium was announced, Technicolor’s stock price would have jumped relative to the overall market. This would increase the beta observed for that period. • Because that jump was temporary and caused by an unusual event, it wasn’t representative of the way the market normally valued Technicolor. Technicolor Questions 3-145 5. What do Rappaport’s calculations suggest about the cost of capital without a small cap premium? • His cost of capital (22.7%) included a 4% small cap premium, so the cost of capital would have been 18.7% Technicolor Questions 3-146 6. What is the small cap premium? What does the court think of applying it to Technicolor? Table 3-6. Returns to Asset Classes, 1926-1997 • Table 3-6 Returns to Asset Classes • Asset Class • • • • • • • • • • 3- 147 Short-term Treasury Bills Intermediate-Term T- Bonds Long-Term Treasury Bonds Corporate Bonds Large-Co. Stocks Small-Co. Stocks Nominal Return Std. Deviation Risk Premium Real of over Return Annual Returns T- Bills 3.8% 0.7% 3.2% 0% 5.3% 2.2% 5.7% 1.5% 5.2% 5.7% 11% 12.7% 2.1 2.6% 7.9% 9.6% 9.2% 8.7% 20.3% 33.9% 1.4% 1.9% 7.2% 8.9% Technicolor Questions 3-148 6. What is the small cap premium? What does the court think of applying it to Technicolor? • Although some think the phenomenon is observable there is no theory to explain its existence • In any event Technicolor as an industry leader is not a small cap company. Technicolor Questions 3-149 7. Why does the court use a lower cost of capital for One Hour Photo (14.13%) than for the rest of Technicolor (15.28%)? What would cause it to make such a decision? Technicolor Questions 3-150 7. Why does the court use a lower cost of capital for One Hour Photo (14.13%) than for the rest of Technicolor (15.28%)? What would cause it to make such a decision? • Presumably One Hour Photo is considered a lower risk business. • They may have identified similar businesses and used their betas. • This shows complexity in valuing conglomerates which have a blended beta of businesses and hence different costs of capital. Technicolor Questions 3-151 8. If experts determine the beta for Technicolor and then use CAPM to determine cost of capital, to what should they apply it? Technicolor Questions 3-152 8. “Professor Rappaport used the Capital Asset Pricing Model (CAPM) to estimate Technicolor's costs of capital as of January 24, 1983. That model estimates the cost of company debt (on an after tax basis for a company expected to be able to utilize the tax deductibility of interest payments) by estimating the expected future cost of borrowing; it estimates the future cost of equity through a multi-factor equation and then proportionately weighs and combines the cost of equity and the cost of debt to determine a cost of capital.” Technicolor Questions 3-153 8. Thus he used the unlevered cost of capital for the company, by estimating the cost of debt and, separately, using CAPM, the cost of equity capital. • If he uses a weighted average cost of capital reached this way, it’s lower than the cost of equity capital, because of the interest tax benefit of debt. • And the weighted average cost of capital will always be lower than the cost of equity. Technicolor Questions 3-154 8. He then uses this as a discount rate applied to his valuations of cash flow during the value growth period and the residual value to get a present value. • Note that this can reduce his valuation of the common stock of Technicolor because although he uses a lower discount rate he subtracts the value of debt from enterprise value. • • • • • • Technicolor Questions 3-155 If experts determine the beta for Technicolor and then use CAPM to determine cost of capital, to what should they apply it? “Professor Rappaport used the Capital Asset Pricing Model (CAPM) to estimate Technicolor's costs of capital as of January 24, 1983. That model estimates the cost of company debt (on an after tax basis for a company expected to be able to utilize the tax deductibility of interest payments) by estimating the expected future cost of borrowing; it estimates the future cost of equity through a multi-factor equation and then proportionately weighs and combines the cost of equity and the cost of debt to determine a cost of capital.” Thus he used the unlevered cost of capital for the company, by estimating the cost of debt and, separately, using CAPM, the cost of equity capital. If he uses a weighted average cost of capital reached this way, it’s lower than the cost of equity capital, because of the interest tax benefit of debt. And the weighted average cost of capital will always be lower than the cost of equity. Note that this can reduce his valuation of the common stock of Technicolor. Trial Court’s Valuation of New Boston Garden • Value • Market Value: $ 26.50 X • Earnings Value: $ 52.60 X • Net Asset Value: $103.16 X Weight 10% = 40% = 50% = 3- 156 Result $ 2.65 $ 21.04 $ 51.58 Total Value Per Share: $ 75.27 This is the Delaware Block Method supposedly discarded in Delaware by Weinberger Market Value of New Boston Garden • • • • • • 3- 157 Market Value What is it? Last trade before vote Average over some period Last Trade before deal effect What if no public market? What does ECMH have to say about this? Boston Garden’s Earnings Value – Slide 1 3-158 • Court accepted a 5 year average of past earnings $5.26 and then applied a multiplier of 10 to get $52.60 Boston Garden’s Earnings Value – Slide 2 3-159 1. What does the average earnings for the past 5 years tell us about expected future earnings? Would it make a difference if there was a trend, either up or down? Answer: Past predicts the future! Boston Garden’s Earnings Value 3-160 • Suppose average earnings are $5.26, determined as follows: • Year 1: $3.26 Year 2: 4.26 Year 3: 5.26 Year 4: 6.26 Year 5: 7.26 Total: $26.30 / 5 = $5.26 capitalized @ 10% = $52.60 • Growth Rate: • From year 1 to year 2: 30.7% growth rate ($1.00/$3.26) From year 2 to year 3: 23.5% growth rate ($1.00/4.26) From year 3 to year 4: 19% growth rate ($1.00/5.26) From year 4 to year 5: 16% growth rate ($1.00/6.26) From year 5 to year 6: 13.8% growth rate ($1.00/7.26) • Discounted Present value of $7.26 perpetuity @ 10% = $72.60 • (Note this assumes no further growth.) Boston Garden’s Earnings Value 3-161 • Suppose we use Rappaport’s CAPM Model of five years of growth plus terminal value times capitalization rate. Calculating Earnings with 5 Yrs Growth @ $1.00 • Going forward: • Earnings growing @ $1.00 per year: Year 1: $8.26 x 0.909 • Year 2: 9.26 x 0.826 • Year 3: 10.26 x 0.751 • Year 4: 11.26 x 0.683 • Year 5: 12.26 x 0.621 Total present value of growth era: = = = = = $7.51 7.65 7.71 7.69 7.61 38.17 • Terminal value: $12.26/ .10 = $122.60 • Discounted to PV after 6th year: $122.60 x 0.564 = • Alternative: a perpetuity with growth: • Assume present earnings of $7.26 .10 - .03 3-162 = $69.15 $107.32 $103.71 Calculating Earnings Value 3-163 2. When a court uses a multiple of earnings to determine earnings value, does this resemble any of the valuation techniques available in modern finance? If it differs, in what ways does it differ? Calculating Earnings Value 3-164 2. The multiplier is the reciprocal of dividing by the capitalization rate It’s the Price-Earnings Multiple from newspaper quotes. It masks the growth rate and the real cost of capital. It also ignores how different capital structures influence beta. Calculating Earnings Value 3-165 3. The trial court included income received from payments made by new teams admitted to the NHL in income. Why? Wasn’t this extraordinary income that should be excluded, as the court’s discussion of the Delaware approach suggests? Calculating Earnings Value 3-166 3. Why is extraordinary income excluded? • Extraordinary means non-recurring (present does not predict the future) and thus should not be multiplied. Calculating Earnings Value 3-167 3. In this case court concludes this income is not extraordinary. It ahd been received in the past and likely in the future. Calculating Asset Value 3-168 4. The trial court accepted the defendant’s expert’s valuation of $1,116,000 for the good will of the Boston Bruins, the “net player investment,” and the value of the AHL franchise as part of the asset valuation. Are these tangible assets? How does good will add value to a business? If you represent the defendant, how would you argue this to the court? Calculating Asset Value 3-169 4. These are intangibles. • Good will represents what you paid over fair market value of tangible assets for a business. • It only shows up on a balance sheet after an acquisition. Calculating Asset Value 3-170 4. Defendant Arguments: • As intangibles they are too speculative. This is why goodwill is not just put on a balance sheet. • Good wilI depends exclusively on the ability of the business to earn profits. • “Net player investment” has to be an intangible. Players aren’t chattels. • Value of the AHL franchise must also depend on profitability of team. Calculating Asset Value 3-171 5. The court held that it was not error to appraise the asset value of the concessions, while their earning power was already included in the calculation of earnings value. The concessions were valued at $4.2 million, roughly equal to the purchase price of the Boston Garden. Do you suppose they represented comparable tangible assets? If not, are they likely to duplicate the earnings valuation of the business? Calculating Asset Value 3-172 5. This shows the problem with valuing assets separate from their earning power. • What do you do with intangibles that exist solely based on their earning power? Calculating Asset Value 3-173 6. What is the court doing to determine the asset value of the Bruin’s franchise? Calculating Asset Value 3-174 6. There is reference to comparable sales, based on admission of new teams to the NHL, and the court indicates that the $9.6 million asset value seems low, but the court accepted the defendant’s expert opinion rather than the plaintiff’s $18,000,000 valuation. Not clear on what basis. Calculating Asset Value 3-175 7. If the company was valued more for its assets than its earnings because of tax reasons, why didn’t the market value it higher than the $26.50 price the court determined for market value? Calculating Asset Value 3-176 7. It is not clear sometimes the market doesn’t take into account tax benefits. • Is the company losing money for tax purposes, while producing a positive cash flow? • The company had $5 million in excess liquid assets. • If so, it’s worth more to a tax-paying business than investors. Calculating Asset Value 3-177 8. The court uses the net book value of the Boston Garden Arena as its asset value. Is this a useful approach? Calculating Asset Value 3-178 8. Because the arena was purchased in 1973, the year of the merger, ordinarily the book value would correspond to an arm’s length purchase price (market value). • The longer the passage of time between purchase and valuation, the less likely book value will correspond to market value. • But because the company had an extremely favorable lease on the property before the purchase, the purchase price for the asset was less than it would otherwise have been. • Because the trial judge didn’t explain how he handled this issue, it’s remanded for further findings. Calculating Asset Value 3-179 9. Why did the court say that in a family corporation earnings were of little significance? Calculating Asset Value 3-180 9. Court gives no explanation. • One theory is that controlling shareholders can extract through high salaries, good trips, and the psychic benefits of rubbing elbows with star athletes. • The other possibility is that ownership of valuable physical assets (Boston Garden Arena) is simply a real estate play, with the family holding the asset for appreciation. Calculating Asset Value 3-181 10. What is the significance of the court’s statement that Garden Arena had approximately $5 million in excess liquid assets? Calculating Asset Value 3-182 10.Tax Law likely has an answer. • The family doesn’t need dividend income, taxed at ordinary income rates (35%) (double taxation). • So it accumulates income and appreciating real estate assets for eventual sale at lower capital gains rates (15%). Calculating Asset Value 3-183 11. Can you discern a principled way in which courts can decide how much weight to assign to each valuation method? Calculating Asset Value 3-184 11. Case law does not disclose a rule or system of deciding this. It is one of the major problems with the block method. Calculating Asset Value 3-185 12. How can there be such large differences (from $26.50 to $103.16) in the valuation of the same company, depending on which valuation method is used? Calculating Asset Value 3-186 12. No real answer. • $26.50 represents a shallow market’s guess at future value streams of this business. Is this an efficient market? If not its price is not reliable? • Purchase Value of assets not necessarily prove their value to generate income streams. Calculating Asset Value 3-187 13. Is the dissenting shareholder getting what his minority interest is worth, or a pro rata share of the value of the entire business? NOTE minority interest discount is discussed in the next section. Calculating Asset Value 3-188 13. The attempt to value the whole business in valuing income and assets suggests a share of the whole; but giving some weight to market value suggests the value of a minority interest. • In Sarrouf v. New England Patriots Football Club, Inc., 397 Mass. 542, 492 N.E.2d 1122 (1986), the court suggested that the minority shareholder was entitled to the pro rata value of the entire enterprise, which suggests throwing out market value of shares and earnings value. Calculating Asset Value 3-189 14. If the company wasn’t being managed to produce earnings, what was it producing for shareholders? Calculating Asset Value 3-190 14. For the majority shareholders it may have produced high salaries that reduced net income. • This reduces taxable income for the corporation, and thus means no double taxation of the majority shareholders. • Note there was a mortgage of $3,437,065 on the arena even though the company had $5 million in excess liquid assets. The mortgage created interest expense that reduced taxable income. (This should be offset by interest income on the $5,000,000 in excess liquid assets, but perhaps not.) Calculating Asset Value 3-191 14. Majority shareholders get the psychic benefits of being owners of a major sports franchise. See Sarrouf v. New England Patriots Football Club, Inc., 397 Mass. 542, 492 N.E.2d 1122 (1986): • “[The trial judge] concluded that earnings or prospective earnings play little part in the valuation because ‘there exists a class of extremely wealthy individuals willing to purchase National Football League franchises at prices not directly related to the earnings or prospective earnings of the football team [in order to become] a member of an exclusive club - NFL Franchise-owners.’” Calculating Asset Value 3-192 15. If the company wasn’t being managed to produce earnings, and its asset value is twice its earnings value, why not rely exclusively on asset values? Calculating Asset Value 3-193 15. The court doesn’t address this. Most courts don’t wonder about the disparity. • This kind of disparity suggests the possible improvement in corporate values if this business were owned by someone else seeking to maximize profits. • From the shareholders’ perspective, failing to sell it looks like a breach of duty by the directors. • Or the difference in values represents the value of the current mismanagement, which might be the value of a derivative claim. • To weight these two values - earnings & market produces a value less than the enterprise could be worth. Control Premium and Minority Discount 3-194 • Control Premium: amount paid over the current market price for obtaining control of a company. • Minority Discount: Reduction fo a price for shares being a minority (lacking control) • Marketability or Illiquidity Discount: Reduction from price because no public market in which to sell • To what extent should any of these be used to determine “fair” value in an appraisal proceeding. Revised Model Bus. Corp. Act § 13.01(4) 3-195 • “(4) 'Fair Value,’ means the value of the corporation’s shares determined: – (i) immediately before the effectuation of the corporate action to which the shareholder objects; – (ii) using customary and current valuation concepts and techniques generally employed for similar businesses in the context of the transaction requiring appraisal; and – (iii) without discounting for lack of marketability or minority interest except, if appropriate, for amendments to the articles pursuant to section 13.02(a)(5).“ Commentary to RMBCA § 13.01(4) • 3-196 “Subsection (iii) of the definition of ‘fair value’ establishes that valuation discounts for lack of marketability or minority status are inappropriate in most appraisal actions, both because most transactions that trigger appraisal rights affect the corporation as a whole and because such discounts give the majority the opportunity to take advantage of minority shareholders who have been forced against their will to accept the appraisal-triggering transaction. Subsection (iii), in conjunction with the lead-in language to the definition, is also designed to adopt the more modern view that appraisal should generally award a shareholder his or her proportional interest in the corporation after valuing the corporation as a whole, rather than the value of the shareholder’s shares when valued alone.“ Summary of RMBCA § 13.02(b) 3-197 • (1) No appraisal rights for shares listed on exchange or NASDAQ or with 2,000 or more beneficial owners • (3) Unless shareholders receive anything other than exchange-listed or widely-traded shares • (4) (i) (A) Unless the transaction is caused by a person owning 20% or more of the company’s shares, except pursuant to a takeout merger following within one year of a tender offer at the same price & kind of consideration, or • (B) Unless the control person has had the power to control election of 25% of the directors, or • (ii) Unless the transaction is caused by a senior executive or director who will receive benefits not generally available to other shareholders. Comments to RMBCA § 13.02(b) • 3-198 “The premise of the market exception is that the market must be liquid and the valuation assigned to the relevant shares must be ‘reliable.’ Section 13.02(b)(1) is designed to assure liquidity. For purposes of these provisions, section 13.02(b)(4) is designed to assure reliability by recognizing that the market price of, or consideration for, shares of a corporation that proposes to engage in a section 13.02(a) transaction may be subject to influences where a corporation’s management, controlling shareholders or directors have conflicting interests that could, if not dealt with appropriately, adversely affect the consideration that otherwise could have been expected.“ Del. G.C.L. § 262(b) 3-199 • (b) Appraisal rights shall be available for the shares of any class or series of stock … in a merger…: • (1) Provided, however, that no appraisal rights under this section shall be available for the shares of any class or series of stock . . . Which … were either (i) listed on a national securities exchange … or (ii) held of record by more than 2,000 holders . . . . • (2) Notwithstanding paragraph (1) of this subsection, appraisal rights … shall be available for the shares of any class or series of stock . . . If the holders thereof are required . . . to accept for such stock anything except: • a. Shares of stock of the corporation surviving or resulting from such merger . . .; • b. Shares of stock of any other corporation [listed or traded in an equivalent manner]; • c. Cash in lieu of fractional shares . . . . Del. G.C.L. § 262(a) • 3-200 (a) Any stockholder of a corporation of this State who holds shares of stock on the date of the making of a demand pursuant to subsection (d) of this section with respect to such shares, who continuously holds such shares through the effective date of the merger or consolidation, who has otherwise complied with subsection (d) of this section and who has neither vote in favor of the merger or consolidation nor consented thereto in writing pursuant to § 228 of this title shall be entitled to an appraisal by the Court of Chancery of the fair value of his shares of stock under the circumstances described in subsections (b) and (c) of this section. * * * Harris v. Rapid-American – the Deal • Riklis • Controls • Kenton (new Rapid) • • • • • • • • 3-201 Controls AFC (1) bought 46.5% of which owns: Rapid 100% McCrory (2) (merger) 100% Schenley (3) $28 cash-out 100% McGregor Rapid Public Shareholders Harris v. Rapid-American 3-202 • Harris claimed that WMA’s valuation technique only compared the value of the subsidiaries with the market value of publicly traded shares, which are discounted because they are a minority interest. • Rapid argued that Cavalier prohibits adjustments to value, and that the addition of a control premium would reflect liquidation value, or a sale to a third party, which isn't involved here. • Rejected: Cavalier only prohibits adjustments in the shareholders’ valuation, not in the valuation of the company itself. • Tri-Continental Corp. v. Battye recognized that adjustments at the corporate level from market values of underlying assets were sometimes appropriate (as in the case of closed-end investment companies). • Cavalier, in approving of Tri-Continental, approved adjustments of value at the corporate level but not at the shareholder level. Harris v. Rapid-American 3-203 1.Why did both appraisers choose to value the subsidiaries rather than Rapid as a whole? Harris v. Rapid-American 3-204 • Rapid was a conglomorate. No two are alike so there are no comparables. • CAPM would suggest value earnings of each and then use the appropriate discount rate to value them. Harris v. Rapid-American 3-205 2. What did the Chancery Court mean when it criticized the SRC report as valuing Harris’ shares “as freely trading minority shareholders”? Harris v. Rapid-American 3-206 2. What did the Chancery Court mean when it criticized the SRC report as valuing Harris’ shares “as freely trading minority shareholders”? • That there is a “minority discount” from the value of the entire company in trading markets where small amounts are traded. Harris v. Rapid-American 3-207 3. What rationale supports WMA’s addition of a control premium to the values it found for Rapid-American’s subsidiaries? If Rapid had liquidated the subsidiaries and become the direct owner of their assets and businesses, does this mean the control premium would disappear? Harris v. Rapid-American 3-208 3. The rationale is that when the subsidiaries are valued by comparing them with the public market price of similar companies in their industries, the market price measure is simply a measure of the value of a small minority interest. • Simply multiplying that price by the number of shares outstanding doesn't produce the total value of the firm, because someone willing to purchase the entire firm would be willing to pay a control premium. • Similarly, if someone now controls the firm, that owner values the control block at a higher per share price, because control carries with it the ability to set the investment and distribution policies of the firm for the convenience of the controlling shareholder. • If Rapid were not a conglomerate, the same analysis would apply to Rapid as an operating firm, and the premium would be applied to value Rapid as a whole, under this reasoning. • Note that the result of this is to add a “control premium” value for each subsidiary to the “fair value” of Rapid, which, in effect, gives dissenting shareholders their pro rata share of the value of the entire firm. • In effect this eliminates the control premium that the majority shareholder may have paid for its interest in the company, or at least forces it to share that value (for which it may have paid) with the dissenters. Harris v. Rapid-American 3-209 4. If a control premium means that a controlling block of shares is worth more per share than a minority block, how can a 100% ownership carry a control premium? • A. Harris v. Rapid-American 3-210 4. In a real sense, it can't. But the measures of value that experts used all refer to markets, and in those markets only minority interests in firms are traded on a daily basis. Markets also produce information about the size of control premiums when firms are taken over, of course. Harris v. Rapid-American 3-211 5. Tri-Continental Corp. v. Battye, 74 A.2d 71 (Del. 1950), involved a discount of the asset value of a closed-end mutual fund. Closed-end mutual funds are organized like business corporations, in that they issue shares that are subsequently traded in markets, in contrast to open-end funds, which continuously redeem and reissue shares. Closed-end funds’ shares typically trade at prices that deviate from their “net asset value,” which is their pro rata share of the investments owned by the funds. Where the investments are publicly traded securities, determining net asset value is a simple task; one performed daily by openend funds. These deviations from net asset value for closed-end companies’ shares generally are discounts from net asset value. Thus the value of a closed-end fund’s assets in its hands is less than the value of the same assets in the market, and the Tri-Continental court recognized that this factor should be taken into account in an appraisal proceeding. How does this relate to a discussion of whether a shareholder in Rapid-American should be accorded a control premium? Harris v. Rapid-American 3-212 5. If Rapid had held a controlling but not 100% interest in its subsidiaries, the answer to this question would proceed as follows. • If the minority shares in each subsidiary were actively traded in efficient markets, determining market value of the subsidiaries would be easy: one would simply refer to the market value per share, and multiply by the number of shares. • This undervalues the company, because minority interests carry a discount reflecting the disadvantages under which minority shareholders operate. • The control block is simply worth more per share, because of its ability to control investment and distribution policies, and to hold out for a higher price should anyone else want to buy control of the firm. Harris v. Rapid-American 3-213 6. What does the court mean when it says that Harris was not claiming a control premium at the shareholder level? Harris v. Rapid-American 3-214 6. Harris is saying that the aggregate value of Rapid is worth more than the market value of Rapid shares, and that he is entitled to a pro rata share of its aggregate value. In that respect, he’s claiming a share of the control premium that previously belonged to Riklis, as if the company were being liquidated and its value being distributed pro rata. Harris v. Rapid-American 3-215 7. Bell v. Kirby Lumber Corp., 413 A.2d 137 (Del. 1980) involved a company where use of liquidation values was rejected by the Delaware Supreme Court, on the theory that the firm was to be valued as a going concern, with the expectation that it would consider, despite the fact that its liquidation value, according to asset appraisals, was over $600, while its value based on its income was approximately $150. Note that WMA’s valuation added a control premium, but the court stated that this didn’t involve a liquidation valuation, because WMA didn’t assume that an acquirer was going to liquidate Rapid-American. From the perspective of the present shareholders of Rapid-American, isn’t a sale of their entire interest to a new buyer equivalent to a liquidation? Harris v. Rapid-American 3-216 7. Kirby Lumber wasn't being liquidated, and neither is Rapid. In both cases, a majority shareholder simply froze out the minority investors. • In Bell v. Kirby Lumber the liquidation value was much higher than the previous market value of the minority interest, and higher than its value based on historic earnings (the Delaware Block was in effect). Harris v. Rapid-American 3-217 7. The higher liquidation value was based on what appraisers thought the company could obtain if it sold its assets (timber). In short, this was a “control premium.” Its huge size must have meant that Kirby Lumber had not been harvesting lumber at the optimal rate. • From the perspective of minority shareholders in Rapid, the analysis is exactly the same. Inclusion of a control premium at the subsidiary level is the same as inclusion of a control premium for Rapid itself. Control premiums, of course, only occur when control is sold. In short, the control premium appears to be identical to liquidation value, despite the language in Cavalier Oil Corp. v. Harnett that the firm be viewed as a “going concern.“