DOC000000930

advertisement

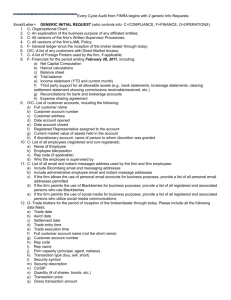

2013 Annual Compliance Meeting & AML Training 2013 Annual Compliance Meeting • • • • • • • USA Patriot Act & AML Policy Communications with the Public Investment Advisory Business Suitability Determination & Document Completion Dealing with clients who may have diminished mental capacity or elder abuse Social Media Compliance Reminders 2 USA PATRIOT Act and Anti-Money Laundering 3 Definition of Money Laundering • Money Laundering is the process of concealing the existence, illegal source, or application of income derived from criminal activity, and the subsequent disguising of the source of that income to make it appear legitimate. • Three Stages: – Placement – Introducing money into the financial system – Layering – Conversion of funds into another form – Integration – Placing funds back into the economy as clean dollars 4 Increased AML Issues • Questions: – Is AML still an issue? • Yes! – Are you seeing any new trends? • Penny stocks, insider trading, identity theft – Why do we still have to take AML Training? • Regulatory and firm requirement to receive AML training at least annually. 5 Vital to our AML program: KYC & CIP • Know Your Customer (KYC) – As Representatives meet with customers they are required to know the customers financial and suitability needs as well as where the assets come from to fund an account. • Customer Identification Program (CIP) – Obtain customer identifying information PRIOR to opening an account, verify this information, then document the information. 6 Customer Identification Program (CIP) • How well do you know your clients? • Do you compare the data provided on the NAF? • Do you physically view the ID? 7 Verification of Identity - Identity must be verified on all NEW customers – What constitutes a NEW customer? • Customer does not have an “existing” account with ProEquities • Even if you have personally known this person for several years, if there is no existing ProEquities account then they are NEW to ProEquities • Even if customer was with you at a previous firm, they are NEW to ProEquities and require ID verification – Identity must be obtained and verified prior to the opening of the account – Record information on the New Account Form 8 Verification of Identity – Identification Concerns • Customer Refuses to Provide Identification Documents or Documents Look Unusual • Customer Exhibits an Unusually or Excessively Nervous Demeanor • Customer Expresses Concern or Unusual Questions About Compliance Procedures with Government Reporting or AML Policies • Customer’s Address is Outside Your Normal Geographic Area of Coverage • Waterfront / Border States Call Your OSJ or AML Compliance Officer Immediately If You Become Suspicious of a Prospective Customer! 9 Suspicious Activities & Red Flags • • • YOU are responsible for detecting and reporting suspicious activities and red flags. KYC very crucial! – To detect suspicion you must know your customer, their needs and what are normal transactions for them. – If activities fall outside of the normal transaction type this is a red flag. Examples: – Refusal to provide an acceptable ID – Frequent trading in penny stocks – Withdrawing deposited funds as soon as they are deposited – Funds in/out of the account do not match the stated income levels for the client 10 Penny Stock Transactions • Increased AML Issues: – Shares deposited or ACAT received – Sell shares in large blocks or limit shares traded daily – Client is often an insider for the stock • What are our risks? – Insider Trading, Theft, Market Manipulation 11 Penny Stock Red Flags • • • • • • • • • • Client deposits large volumes of penny stocks via stock certificates Client provides a legal opinion to remove restrictive legends. Client has received shares from consulting work performed. There is no verifiable or legitimate physical place of business. There are multiple press releases on the company in one day. There is a history of company name changes, symbol changes, or reverse splits. The company’s employees are immediately dumping the stock received via a compensation program. Company changes their business’ products entirely. There are NO recent Edgar filings with the SEC. The stock has more than 4 characters in the ticker symbol. If the 5th letter is an “E”, it is not registered with the SEC and if it is a “Q”, the company is in bankruptcy. 12 New AML Trends Observed • Identity Theft and Phishing Emails – ProEquities has had an influx of fraudulent emails sent from a client’s email address to the registered rep. – The emails request account information, balances, and subsequently request that securities be liquidated and wired to a 3rd party or foreign bank account. 13 Identity Theft (Continued) • Tips – Be wary of emails requesting account balance, wire instructions, or account information. – Be cautious about an email from a client that would not normally contact you via email. – Be on alert if you receive an email requesting this type of information when the client is elderly or retirement age. 14 Identity Theft (Continued) • If you receive this type of email: – DO NOT provide account information – DO NOT provide account balances. – Respond requesting that he or she contact you directly to conduct the transaction – CONTACT the client to verify accuracy and/or instruct the client to change their email passwords immediately. – Contact the AML Compliance Officer or a member of Compliance immediately!!! 15 Other Helpful Tips • Always know the purpose of third party checks and third party wires. • Pay careful attention to any clients referred to you by clients. Develop an understanding of the referred client’s relationship with the existing client, especially if the existing client is relatively new. • Be wary of a client telling you at account opening or soon after account opening that they want to “dump” or “liquidate” stock and close the account. 16 Clients Circumvent Reps • Increase of Clients avoiding the Rep – Customer Service and Trading has received an increase in calls from clients wanting to reopen closed accounts and/or deposit stock and liquidate • How do we prevent this? – When closing an account request a ‘BLOCK’ on the account so it may not be reopened. 17 Accepting Customer Funds • Cashiering responsibilities play a vital part in the deterrence of money laundering. When accepting funds from customers ensure you follow the firm’s policies. – Checks must be made payable to ProEquities or Pershing. You may not accept checks made payable to you or your DBA/company name – Do not accept cash, money orders, or travelers checks – Do not accept third party checks (double endorsements) – Do not accept bank starter checks or counter checks – Do not accept cashier or official checks for any amount less than $10,000 in non-qualified accounts 18 Willful Blindness • We all have a responsibility for recognizing and reporting suspicious activities. • Failure to report a red flag can be viewed as “willful blindness”. • Willful blindness subjects the firm and YOU to significant civil liability and possible criminal penalties. • Willful blindness is one of the most significant aspects of AML laws. 19 Type of Suspicious Activities source: FinCEN Suspicious Activity Report Form 20 What should you do? • Suspicious activities should be directed to Compliance immediately. • If you have notified Compliance of suspicious activities you should NOT inform the OSJ, Representative, or Client. • Let Compliance handle it! 21 Civil and Criminal Penalties • USA Patriot Act – Fines up to $500,000 or twice the value of the property involved and 20 years in prison • Money Laundering Abatement Act – Fines up to $1,000,000 or twice the value of the property involved • Bank Secrecy Act – Fines up to $500,000 and/or 10 years in prison 22 Training and Audits • All Registered Reps, Investment Advisor Reps, OSJ’s, and Home Office Employees Must Receive Training on the Act • ProEquities Will Be Audited For Compliance With the Act • ALERT - Some Insurance Companies Have Started Requiring that Agents/Reps, Licensed with Them, Complete Their Company Specific Training – Insurance Company(s) AML Training Does not Provide Exemption from ProEquities Required Training – ProEquities Required AML Training May not Provide Exemption from Insurance Companies Requirement 23 Communications With The Public 24 Communications With The Public FINRA Regulatory Notice 12-29 • Communication categories have been reduced from six to three. -The new categories are: 1. Institutional Communications 2. Retail Communications 3. Correspondence 25 Communications With The Public • Institutional communication includes any written communications that are distributed or made available only to institutional investors • Retail communications include any written communication that is distributed or made available to more than 25 retail investors within any 30 calendar-day period. “Retail Investor” includes any person other than an institutional investor, regardless of whether the person has an account with the firm. Retail communications must be PRE-APPROVED by compliance prior to being sent. • Correspondence includes any written communication that is distributed or made available to 25 or fewer retail investors within any 30 calendar day period. 26 Communications With The Public Content Standards under NASD rule 2210 have not been affected by this new rule. NASD rule 2210 states communications must: – Not be misleading or untrue – Not lack material facts – Not contain exaggerated, unwarranted, or unfounded information – Not contain predictions or promises – Take into consideration the audience it is directed toward – Be balanced – showing risk as well as reward – Must be approved by principal and Home Office 27 Retail Communications • All retail communications must obtain PRIOR approval from Compliance – Submit all retail communications via AdTrax – FINRA review does not equal Pre-Approval by Compliance – Emerald and Forefield materials are not Pre-Approved • Appropriate disclosures are required • Retail Communications may include: – Newspaper/Magazine ads – Billboards – TV/Radio commercials/interviews – Websites 28 Investment Advisory Business 29 Third Party Money Managers • Suitability of selected portfolio – initially and ongoing • Appropriateness of IAR fees • Required paperwork • New Account Form (non-brokerage) fully completed • Investment Advisory Agreement • All paperwork from the third party manager or required to open the TPAM account 30 Wrap Fee Accounts • • Wrap Fee Accounts are: – Targeted to a more affluent investor – Charge monthly fees vs. “per investment” commissions – Provides a variety of services including: • Investment advice; • Investment research; and • Brokerage services Advisors must: – Provide continuous, hands-on management – Be acutely aware of clients’ assets, trading habits and any other financial services to be provided – Advisory business is NOT like traditional commission/brokerage business – Advisory business is NOT merely an alternate means of compensation 31 Wrap Fee Account Suitability • You must have a reasonable basis to believe the recommendation of a wrap fee account is appropriate based on these and other factors: – Financial status; – Investment objectives; – Trading history; – Size of portfolio; – Nature of securities held – Account Diversification 32 Wrap Fee Account Suitability • Once the client’s investment profile is established, you must determine: – The projected cost to the customer; – Alternative fee structures; and – The client’s fee structure preferences • You must disclose all material components of the program including the fee structure, services provided, and that the program may cost more than purchasing the investments separately or through a traditional brokerage/commission arrangement 33 Wrap Fee Accounts • When “not” to use: – Client wants to “buy and hold” investments – Client does not understand the fee structure – No intent to provide continual service • No servicing, no advisory services provided – Low assets and no anticipation to add further assets for management – Transfer assets, liquidate, then invest in commissioned products (VA’s, REITs, etc.) 34 Wrap Fee Accounts • Meet with the client at least annually to review investments, performance, investment goals, time horizon, and fees – Best Practice: Quarterly reviews/contacts, with one of those in person – Document calls and/or meetings with clients – Document account reviews (statement, performance reports, etc.) » CRM systems with auto date/time stamp » Makes notes of the advice given during discussions, including specific “no change” advice 35 Wrap Fee Accounts • Best practices (continued) • Documentation – Make notes of other services provided such as mortgage review, cash flow analysis, budget preparation, estate planning, etc. that are part of the overall advisory services provided and which are covered by the wrap fee – Follow-up letter or email to client regarding items covered in review/meeting 36 Wrap Fee Accounts • Sample follow-up letter/email Dear John, It was a pleasure meeting with you and Susan yesterday. I hope little Johnny does well in lacrosse this season. As we discussed in our meeting, your portfolio seems to be on target; therefore I do not recommend making changes at this time. In addition to reviewing your securities accounts, we also looked at your estate plan. I will review this and call you in the next two weeks to discuss or schedule an appointment. As always, I appreciate the trust you have placed in <DBA Investments>. Please do not hesitate to contact me or my staff if we can assist you in any way. 37 Wrap Fee Accounts • Examples of “best practice” documentation – Detailed notes regarding calls, meetings, etc. with the client • Especially those calls/discussions of other financial matters where the IAR was not specifically compensated for the services, but are covered under the wrap fee » Discussions regarding power bills, mortgage, estate planning, private business, etc. 38 Wrap Fee Accounts • Documentation not adequate – Meeting held in 2008, but no further meetings, calls, etc. noted in file, even if they occurred – No documentation in file – Computer/CRM system not backed up, therefore data lost 39 Frequently Noted Exceptions • Frequently-noted exceptions in advisory paperwork – New account form incomplete – Fee schedule not complete – Client and/or IAR did not sign agreement – Lack of NAF or IA agreement – Arbitration agreement or other terms altered in NAF/IA agreement 40 Rep-Managed Wrap Accounts • CAM/ProTrade accounts – State licensing requirements • You are executing transactions, which requires the appropriate state securities licensing – For incoming transfers - what holdings are being transferred in? – What are the plans for mutual fund holdings? – Did the rep sell/earn a commission on those funds? 41 Allowable Assets CAM/ProTrade • Policy regarding share classes – No-load and load waived mutual funds – A shares • Allowed to be transferred in where not sold by the rep within previous 2 years or where sold at NAV • Allowed to be purchased in wrap fee accounts at load waived/NAV at any time 42 Allowable Assets (continued) • Policies… – B shares • Allowed to be transferred in where not sold by the rep within previous 2 years (whether at ProEquities or prior broker/dealer) • Allowed as concession to customer to avoid “forced” surrender charge or taxable event • Where liquidated (not in-family exchange), subsequent purchase must be made in no-load fund, load-waived A share or other non-commissionable product 43 Allowable Assets – (Continued) • Policies… – C shares • Allowed to be transferred in as concession to customer to avoid “forced” taxable event to customer • Once liquidated, MUST purchase no-load or load-waived A share, or other non-commissionable product • Only allowed to be transferred in where not sold by rep in previous 2 years, whether at ProEquities or prior broker/dealer 44 Allowable Assets – (Continued) • Money market funds – Accounts invested mostly or solely in money market only for an extended period of time • Potentially brings into question active management • No penny stocks – Firm policy requires that penny stocks be conducted on unsolicited basis only 45 Allowable Assets CAM/ProTrade • Variable annuities – Only those intended for advisory arrangements, i.e., no load or low load – Must be processed through Pershing “Subscribe” system to be included on CAM/ProTrade statement 46 Allowable Assets CAM/ProTrade • Options – Must meet suitability requirements established by ProEquities and be approved for options trading by Home Office Registered Options Principal • Strategies must be suitable for the client • Client must have the capability to understand the strategy, on at least a basic level 47 Financial Planning/Advice • Agreements – Financial Planning Agreement – Financial Advice Agreement • IAR and/or customer revisions to agreement language not acceptable, unless specifically approved in advance by RIA and/or BD CCO • Allowable fees – If over $5,000, requires IA compliance preapproval 48 Disclosure Brochures • Deliver to all new advisory clients – Wrap Fee Program Brochures for Private Access, Defined Solutions, or CAM/ProTrade/5PR accounts – Part 2A (TPAM accounts, Financial Planning or Financial Advice agreements – Ensure that the required brochure is being provided to ALL NEW advisory clients – ProEquities will provide the annual update or material event update to all advisory clients 49 Form ADV Part 2B • Required effective 7/31/2011 for all IARs who are providing investment advice to clients – Personal brochure regarding the IAR – Provide to all new clients • Update as needed and send to clients – Disclosures (complaints, financial, etc.) – Outside business activities – IAR is responsible for mailing to customers for updates. 50 Personal Trading • New IARs – Must provide statements or a manually prepared “initial holdings report” • Required under Section 204 of Advisers Act • Ongoing monitoring – Representatives Must notify ProEquities of all ProEquities and/or outside brokerage accounts – Violation of Code of Ethics for maintenance of account without notice and duplicate records to ProEquities • Violations of the Code of Ethics will be included in annual report to management • Subject to disciplinary action, including letter of caution/warning, fine, etc. 51 Other RIA/Compliance Issues • Advertising – Testimonials prohibited • SEC rules not ProEquities – Use of partial client list allowed in limited circumstances, as long as certain criteria are met » No cherry picking » Clients to whom the list is provided » Partial client list and selection method pre-approved by ProEquities – As with any other advertising materials, all IA-related advertising must be pre-approved 52 Other RIA/Compliance Issues • Political Contributions – Investment Advisors Act Rule 206 (4)-5 – “Pay to Play Rule” – Applies to IARs only – ProEquities Policy issued March, 2011 • Pre-approval required for all contributions over $100 per individual contribution to any candidate for public office or political party or multiple contributions to the same candidate or party, which together exceed $150 • Any candidate or political party – not limited to state/local office or those for whom the IAR is entitled to vote – includes all federal offices • Submit the “Political Contribution Request Form” available on Advisor Portal 53 Other RIA/Compliance Issues • Customer complaints – As with all other complaints, must be promptly reported to ProEquities • Complaint defined as “any written grievance” – Client is unhappy and they put their unhappiness in writing – Regardless of product type, must be reported to ProEquities • Reporting Requirements – Statistical reporting – Form U-4/Form U-5, where applicable – IAR’s Part 2B, if reportable on Form U-4 – Late filing penalties (up to $1500) and possible disciplinary action to ProEquities for routine late filings 54 Suitability Determination & Document Completion 55 Suitability Determination KYC – Obtain information to know the client Suitability rule 2111 Recommendations: 1. Must be suitable to the client’s investment objectives, risk tolerance, time horizon and overall financial need. 2. Must be documented whether the client makes the purchase or not. 56 Variable Annuity Recommendations • FINRA Rule 2330 requires – The customer to be informed of material features of the proposed VA such as: • • • • • • • Potential surrender period Potential surrender charges Tax penalties (if redeemed/sold prior to 59 1/2) M&E charges Charges for riders and enhancements Insurance and investment components Market risk – The Rep to ensure the customer would benefit from the features of the proposed VA such as: • Tax-deferred growth (if not purchased in a qualified account) • Annuitization • Death or living benefit 57 Variable Product Compliance Guidelines • Surrender charge on old contract greater than 5% of contract value, or $2000 • Replacement products held less than 5 years and originally sold by the same rep • Replacements with decreased living or death benefits • Transfers where penalty free withdrawal is taken and invested in another contract • Transactions for customers under age 50 and over the age of 65 • Transactions exceeding $250,000 • Transactions which exceed 40% of client’s net worth 58 Required ASF for 1035 Exchanges • ALL fields MUST be completed on the Annuity Switch Form (ASF) – Blank boxes, “N/A” and “Per Prospectus” will be rejected • Use the Morningstar Annuity Intelligence tool located on Advisor Portal OR Contact carriers to ensure surrender charges, death benefits, riders, etc. are accurately stated on the ASF. 59 VA Transaction Requirements • Submit ALL Variable Annuity transactions to your OSJ for REVIEW and PRE-APPROVAL PRIOR to submitting to the product sponsor, including: – New money purchases – Additions to existing policies – 1035 exchanges **All transactions require pre-approval by your OSJ ***Group Variable Annuities must be processed through ProEquities. 60 VA Training – ProEquities requires annual training on Variable Annuities in compliance with the training requirements of Rule 2330 – All reps who sell Variable Annuities MUST complete the training 61 EIA - Outside Business Activity • Disclose EIA sales activities on Outside Business Activity Form – Separate from Insurance activities – Detail under “Other Outside Business Activity” – Disclose companies you sell EIA’s with, number of hours per month you spend working on EIA business, and total compensation for previous year • Trade Blotter Requirements – Maintain EIA Trade Blotter for all transactions 62 EIA Guidelines & Parameters • Allowable EIA Activities: – Sales commission 10% or less – Surrender period 10 years or less – Unregistered EIA’s may not be marketed primarily as investments – Ensure customer is fully informed • Product Features • Suitability • Expenses and Costs • Annuity Switch Form(ASF) requirement – If securities sold to purchase EIA or other insurance product or EIA sold to purchase a security, then an ASF is required 63 Failure to Follow EIA Procedures First Instance: Written notice of violation Second Instance: Letter of Caution & $250 fine Third Instance: Letter of Warning & $500 fine Fourth Instance: Ask for resignation 64 Mutual Fund Suitability & Breakpoints • Suitability – Share Class – front end load, back end load, ongoing load – Time horizon and Age • Breakpoints – Household accounts to obtain total holdings for breakpoint – Understand breakpoint availability per prospectus – Letter of Intent/Rights of Accumulation – 90 Day Reinstatement 65 Mutual Fund Documents • MFIAF (Mutual Fund Investor Acknowledgement Form) – “Per Prospectus” not acceptable. Complete ALL blanks. • USL (Universal Switch Letter) – Required for all switches – Document fees, charges, etc. • Other Required Documents – MF Analyzer, Letter of Intent, B Share Worksheet Failure to submit required paperwork may result in a commission hold 66 Mutual Fund B Share Policy • B Share Mutual Fund Policy – New Purchase Documents (excluding systematics) • B Share Worksheet • Mutual Fund Investor Acknowledgement Form • Mutual Fund Analyzer comparing share classes (recommended) • Large B Share Purchases – – – – $100,000+ must receive pre-approval from Compliance Mutual Fund Analyzer required – OSJ & Compliance must approve Letter of Consent with client signature Failure to obtain pre-approval, trade will be cancelled and corrected to A Shares at the expense of the Representative • Pershing or Fund Direct - Same Policy Applies for both 67 Mutual Fund C Share Issues • Large C share purchases where the client may have received a breakpoint in A shares. • C share purchases for clients who have a long time horizon where it may be more cost effective to place the client in A shares over the long term due to lower internal fees and expenses on the A share vs. the C share. The FINRA mutual fund analyzer is a great free tool that can be utilized to show clients the effects that different share class loads and their corresponding internal expenses may have on their investments over the life of the investment. 68 Unit Investment Trusts (UIT) • What is a UIT? 1. Investment Company Securities issued in units 2. Sponsor assembles a portfolio, deposits securities in a trust, and sell the units in a public offering 3. Securities are redeemable and issued for a specific term or series. 69 Unit Investment Trust • • • • NASD NTM 04-26 Breakpoints-UIT breakpoints generally function as a sliding reduction in the sales charge percentage available for purchases beginning at specified dollar amounts, such as $25,000 or $50,000 (or the corresponding number of units). Generally, investors may aggregate same-day purchases from a sponsor in their own and related accounts to reach a breakpoint. Rollovers-After an investor redeems trust units through a sale or mandatory redemption, UIT sponsors will allow him or her to reinvest the proceeds into another UIT(s) usually within 30 days, at a reduced sales charge. Please see the trust’s prospectus for specific policies. Exchange discounts: Certain UIT sponsors permit exchange discounts for purchases made with the proceeds from a UIT holding of another sponsor 70 Leverage and Inverse ETFs • FINRA Regulatory Notice 09-31 • Leverage ETFs seek to deliver multiples of the performance of the index or benchmark they track. • Inverse ETFs, also called “short” funds seek to deliver the opposite of the performance of the index or benchmark they track. 71 Leveraged and Inverse ETFs • • • • Most leveraged and inverse ETFs “reset” daily, meaning that they are designed to achieve their stated objectives on a daily basis. Their performance over longer periods of time can differ significantly from the performance of their underlying index. Due to this daily “reset” a leverage or inverse ETFs performance can quickly diverge from the underlying index or benchmark which could lead to significant losses even if the long term performance of the index showed a gain. Leveraged and Inverse ETFs may be more costly than traditional ETFs and you should use the FINRA Fund Analyzer to estimate the impact of fees and expenses on the investment. Leverage and Inverse ETFs may be less tax efficient than traditional ETFs, in part because daily resets can cause the ETF to realize significant short-term capital gains that may not be offset by a loss. 72 Direct Investments Products (DI) There are many types of Direct Investment Products available through ProEquities: (i.e.) • Real Estate Investment Trusts (REITs) • Business Development Companies (BDCs) • Limited Partnership / LLC programs (LPs/LLCs) • Private Real Estate Programs • Private Oil & Gas /Royalty Interest Programs • 1031 / 1033 exchange programs (1031s) • Private Land Development and Equity Programs • Equipment Leasing (usually publicly registered/non-traded) 73 Direct Investments- Compliance Perspectives • ProEquities Home Office Compliance wants to help you and your Representatives. • We are all in this together! • Regulations continue to increase for Alternatives. • Striving to keep you and your Representatives compliant without reinventing the wheel. • Many firms are being fined for not following their current procedures and for not adhering to prospectus rules regarding a specific state. 74 DI Product Industry Regs. • Representatives selling Direct Investments (DI) must be appropriately registered to be able to solicit DI products. • If a Rep does not have a Series 7, 22 or 62 license, he/she cannot be the rep of record for a client or solicit DI products until properly licensed. The representative must contact the Licensing Department to submit a request to become Series 7, 22 or 62 licensed. Also, if a representative is not registered in the client’s state of residence, the rep must add this State to his Registrations prior to soliciting to a client. All new documentation must be provided to client for completion after the effective date of this registration. . 75 DI Guidelines • • • Limitations/Guidelines: For REITs, LPs, LLCs or Private RE Offerings: No more than 10% of the client’s investable assets may be in any one program**** • For BDCs: These offerings require an investor to have a investable net worth of $350,000 or more, regardless of income. For clients with a net worth of $350,000 to $499,000 – no more than 5% should be invested into any one BDC, 10% overall; for clients with a net worth of $500,000 or more – no more than 10% should be invested into any one BDC, 20% overall. • The total DI Investments should not exceed 30% of the client’s overall investable assets • Requests for an exception to these guidelines should be sent in writing to the DI Compliance Principal prior to presenting to a client, and must have written approval prior to submitting to OSJ. • If using Joint Net Worth to meet product suitability, you should use Joint Net Worth for overall concentration of DI Investments. ****Certain states have implemented more restrictive guidelines and you should consult the prospectus for the product in order to determine client suitability. These state guidelines supersede ProEquities guidelines. 76 DI – Regulatory Requests • FINRA Arbitrations are now asking for more information not just from representatives but also from the supervisor/principal approving the transactions. • FINRA also requests that we furnish not only the firm’s due diligence file, but the representative’s due diligence file on the product. This file should be kept in a product file not a client file or with current offered prospectus information and can be electronic records. 77 DI Product Training • • • Representatives who obtain their licenses and registrations in order to sell DI products must also take the DI Product training provided by the ProEquities Due Diligence Department. This will classify the representative as a “DI Advisor” and place his or her name in the roster for any upcoming meetings, calls or conferences concerning DI products. This training program is called “DI Certify” and the link to begin this training can be found on Advisor Portal, Sales Support and Marketing/Due Diligence Product Services and click on “DI Certify”. Once under this tab a representative should see “Product Training” and should take each product type tests. Once complete, he/she should click on the name of product to be sold to certify the specific product they wish to sell. It is also recommended that the representative contact the sponsor to obtain a sales kit and check on attending a Rep focus meeting. 78 DI Product Training Continued • ProEquities Due Diligence Department performs an extensive review of the sponsor and each of their products; however, while ProEquities may have approved this product to be sold on our platform, it would have been approved for “some investors” and may or may not be suitable for your specific client. This can only be determined by you as the representative and the client as each situation and client is different. Please ensure that you are doing your own research and not just depending on ProEquities due diligence alone. Regulations require representatives to explain how a representative determined the suitability of client’s transaction. 79 Key Items on DI Transactions to Maintain • Documentation of client meetings, times, phone calls; • A product file with information such as brochures, prospectus, continued quarterly reports and ProEquities initial product report that would support you performed your own due diligence and did not rely on just the wholesaler information. • Your rationale in detail about the suitability of the transaction. 80 Client Suitability Continued Points to consider: - Age of client, physical and mental health - Long Term effects on the Heirs - Client’s required time horizon and current tax bracket - Income and Net Worth Qualification by Product – (Particularly whether or not this investment will meet the client’s State of Residence requirement as stated in prospectus. - Are the Risk Tolerance and Investment Objectives of Client in line with Product being offered? - Illiquidity of Product offered and client’s overall % of illiquid investments. (i.e., if client owns 50% private Real Estate and they are buying REITs then you need to take that into account. - Does client’s income appear to be sufficient prior to this investment? 81 Client Suitability Continued • Income potential needs of client – Not all DI products generate income for investors nor can they guarantee total return of principal. Have you explained these risks to the client? • Does the client thoroughly understand the product being offered and how the product is structured • Does the client understand how the investment can be affected in a downturn of the economy. Do clients understand the product income can be suspended and the value of asset can go up or down in certain situations. • Risk factors and fees associated with product should be reviewed with client upfront prior to sale. 82 Client Suitability Continued • Review the transaction as if you have to go on the defensive the next day; • Always keep notes on the transaction. • When making suitability determinations for DI products, if you have any questions on suitability or need assistance, please contact your OSJ/DP or the DI Compliance Principal or Due Diligence Department at ProEquities. 83 DI Advertising • DI Advertising submitted should follow FINRA guidelines for Advertising at all times. Product disclosures could be required in addition to standard representative disclosures and some could require FINRA review. • NASD Rule 2210(c)(2) requires a firm to file advertisements and sales literature concerning public direct participation programs within 10 business days of first use or publication Pieces submitted for review should include any FINRA reviewed letters from sponsor if applicable. If a slide presentation is submitted, it should have a separate introductory slide that should have Representative name and appropriate rep disclosure and product disclosure to be viewed at beginning of program or as a handout as clients enter a meeting. • • Products that fall under Regulation D requiring Accredited Investors cannot be sold by means of a general solicitation. Discussions of these products can only take place with clients with whom the representative has a pre-existing relationship PRIOR to the offering of this product on ProEquities platform. Any discussion of these products will require PES Home Office Compliance approval prior to the invitation being sent. 84 DI Workflow • DI paperwork can be submitted electronically through either STP or Onboard for OSJ/DP approval. Once approved the originals can be forwarded to the Sponsor or Custodian by the representative. • The originals generally do not go to ProEquities Home Office unless a check needs to be attached to subscription document prior to sending to sponsor if non-qualified or if purchasing within a Pershing IRA brokerage account purchase although not required. No DI purchases are allowed within fee-based IRA’s, 403-b accounts or brokerage accounts where Pershing is not the custodian such as cash accounts. 85 DI Workflow Continued • If Pershing is the custodian, there is a Transmittal Sheet that can be attached to the Pershing IRA original subscription document and Private Investment Form that enables the rep to overnight to Pershing directly as long as the client’s account is funded and the funds are clear of any 4-day check hold. This form can be found on Advisor Portal under “T” for transmittal sheet. Just remember that Pershing has a 48-72 hour turnaround. The Private Investment Form must be attached and completed, including full name of investment description. 86 DI Workflow Notes Things to remember: • REITs generally do not require a “wet” principal signature on the subscription documents. • LPs/LLCs, some BDCs and Private DI programs usually require a physical “wet” signature of the principal approval. Most will accept a fax copy of the OSJ/principal signature, but representative should contact sponsor to be sure. • Most sponsors do not accept third party checks endorsed by a client payable to sponsor. In any review of a transaction the OSJ/DP should also review client’s check for client name or authority to sign the check provided. Counter checks should not be used. • Generally, most sponsors require original subscription documents be provided to process the transaction. Representatives need to make sure once OSJ/DP has approved they are then allowed to send out the original. 87 DI Product Tips • • • Volume Discounts are available for some DI products – (This is usually for the REITs and can be found in the Plan of Distribution section of the prospectus). Some sponsors will automatically apply once received but representatives should examine this section of prospectus and be familiar with the levels provided. IRA accounts are subject to Unrelated Business Taxable Income (UBTI or UBIT) tax from some alternative products, usually from an LP or leasing program. IRA’s are not exempt and a client can be charged interest owed and be subject to a significant tax preparation fee from the custodian. Representatives must always present clients with a Prospectus, either physically or electronically if available for review prior to submitting any paperwork for processing. Most sponsors give instructions in the kit that a client must have at least five (5) days prior to purchase. If a representative is providing a prospectus to a client it is always a solicited trade, unless that client brings in the prospectus to that rep. In that situation, unless the rep’s broker dealer has a selling agreement with that product, the rep cannot assist client. 88 DI and Due Diligence Product Hubs • Access to Due Diligence Department Reports* *These reports are for Broker/Dealer Use Only. • DI Alerts and News on Products, Paperwork, Closings, etc., will generally be sent out as a blast email but could also be placed on Advisor Portal Alerts or News. • Sponsor Name, Telephone Number • DI Department and DD Department contacts 89 Dealing with clients who may have diminished mental capacity or elder abuse 90 Diminished Capacity Diminished Capacity may sometimes be difficult to identify. Common Signs of Diminished Capacity are listed below. • Memory Loss-is the client repeating him/herself • Disorientation- Is the client confused over time, place or simple concepts • Changes in personality • Poor Judgment • Difficulty conveying simple instructions 91 Diminished Capacity If your client is showing signs of diminished capacity you should • Check to see if a trading authorization/POA is on file. If so contact them. • Suggest that the client bring a close family member or friend to your next meeting 92 Elder Abuse Financial Elder Abuse occurs when someone exploits or influences an elderly person to gain access to that person’s assets. • Misusing or stealing an elders money or possessions • Coercing or deceiving an elder into signing documents such as POAs or wills • Elder abuse could be conducted by a relative, caretaker, friend or stranger who gains the elderly persons trust or who uses scare tactics to unduly influence the elderly person. 93 Elder Abuse Elder Abuse Red Flags • Atypical or unexplained withdrawals • Abrupt changes in wills, trusts, or POAs • Changes in beneficiaries on insurance policies, qualified accounts, or TODs • Fear of eviction or nursing home placement if money is not provided 94 Elder Abuse If elder abuse is suspected please notify the compliance department. Some States require elder abuse to be reported to the appropriate state agency(s). For additional info please review FINRA Regulatory Notice 07-43 95 Social Media 96 Social Media – Allowable forms of social media include: 97 Approval & Review Process • OSJ Approval to Begin • Complete Brainshark training prior to being approved for social media • Sign agreement acknowledging that they understand and will adhere to the ProEquities policies while utilizing social media to conduct securities business • Email address registered with FMG and Smarsh • Pre-approval of personalized landing page and other material used • Feed from sites to Smarsh which requires OSJ to review and monitor 98 Compliance Reminders 99 Handling of Customer Funds • ProEquities operates pursuant to the (k)(2)(ii) exemptive provision and must transmit customer funds AND securities by noon of the next business day following receipt. • There are NO exceptions to this provision. It also applies to the home office. Therefore you may not hold any checks or securities past noon of the next business day following receipt. • It is imperative that you log all checks and securities that you receive on the respective blotter and send them on to either the home office or product sponsor no later than noon the following business day 100 Variable Annuity Policy Delivery • Be sure to maintain evidence that the policy was delivered to the client • Some companies no longer send delivery receipts such as JNL in which case you will need to use the ProEquities delivery receipt which can be accessed on advisor portal under the forms section of the ops and compliance tab. 101 Outside Business Activities • FINRA Rule 3270 – Outside Business Activities of Registered Persons – Outside Business Activities (OBA) form must completed and approved by Compliance PRIOR to engaging in the activity • Spouse activities must be disclosed as well – Fully complete the OBA Questionnaire and make any changes as needed – Annual attestation required for each OBA – Potential conflict of interest 102 Customer Correspondence • Letterhead with proper disclosures • Includes all outgoing and incoming securities-related correspondence • E-mail is considered written correspondence – Reminder that text messages and instant messages are prohibited under ProEquities’ policies as these constitute written correspondence but cannot be captured and maintained as required. • Do not use securities letterhead for personal or non-client purposes • All correspondence is required to be reviewed by your OSJ • Correspondence can be submitted via AdTrax 103 Outside Brokerage Accounts • NYSE Rule 407/NASD Rule 3040 • Prior notification to ProEquities of any securities account held outside of the firm. • Firm opening the account should require written authorization from ProEquities before opening the account. • ProEquities must receive duplicate statements and confirmations. • Includes personal accounts of Registered person and immediate family. 104 Customer Complaints • ALL complaints (including insurance and other non securities complaints), oral and written, must be sent to your OSJ and the Compliance Department immediately upon receiving – Complaint simply defined is a client’s putting their unhappiness or dissatisfaction in writing! • If you are unsure a complaint is received contact the Compliance Department • Clients may contact ProEquities directly for any matter including filing a complaint • Representatives may NOT settle directly with a customer under any circumstances • Settlement agreements are required in most cases • Copies of complaints and all supporting documents should be maintained in the Complaint File indefinitely • Compliance notifies E&O carrier of all claims in order to preserve the notice provision of the E&O policy • Contact Michelle Smith in Compliance with any complaint questions 105 Regulatory Issues • Notify your OSJ and Compliance if: You have a regulatory issue (arbitration, lawsuits, arrests, indictments, etc., whether securities related or fixed, non-security product related) You are being audited by a regulatory agency or have received an inquiry from a regulatory agency • Provide Compliance with copy of regulatory agency audit reports and correspondence 106 Form U-4 Reporting • Securities Regulators, both federal and state, require that you and ProEquities maintain an accurate and complete Form U-4 at all times. You are required to notify ProEquities immediately of any of the following items: Address Change (home or business) Customer Complaints – whether securities or insurance related Civil Judgment – report to ProEquities at both issuance of judgment and final judgment if appealed. Compromise with a creditor Liens Bankruptcy – report to ProEquities at the filing and discharge Arrest Litigation Regulatory Action (including state insurance regulators) • • Failure to maintain an accurate and complete Form U-4 is a violation of securities regulations and is a slam-dunk finding for an examiner and potential penalty to you and ProEquities! If you are not certain if an item is reportable on Form U-4, call Compliance 107 Form U-4 Reporting Requirements • Where these events are reportable on the representative's U-4, the U-4 is required to be filed (i.e., drafted, signed by the representative and filed by ProEquities) within 30 calendar days from the event date. • Each event is assessed a $110 disclosure review fee by FINRA • Late filing penalties - currently assessed at $100 for the first day and $25 for each additional day up to a maximum of 60 days. This increases the maximum amount of the late disclosure fee from $300 to $1,575. Please see FINRA regulatory notice 1232 for additional info. • The filing fees and late filing penalties will be charged to the representative. 108 Non-Cash Comp Reimbursement • Request approval PRIOR to engaging in activity 1. Invitation to attend a product sponsor’s training event. 2. Receiving reimbursement from a product sponsor for an event YOU hold. - Ensure activity meets the policy standards - Maintain all appropriate receipts, invoices, etc. - Sponsor reimbursement must be in check made payable to ProEquities, Inc. from the sponsor’s checking account *No personal checks from wholesalers or other product sponsor employees will be accepted. 109 Private Securities Transactions (PST) • Private securities transactions must be requested in writing from the representative and approved by Compliance in writing PRIOR to any such investment. • Examples: – Selling securities to public investors on behalf of another party without the participation of the employing firm – Purchasing securities for your own account away from the firm – Referring an individual to a company who eventually purchases an interest in the company directly from the company • Concerns and Conflicts: – Potential for “selling away” – Confusion to investors – Legal and regulatory exposure for the firm 110 Books and Records • Maintain 6 years – Client account must be kept 6 years after account closed • Maintain 3 years – Correspondence, Advertising, Checks and Securities Blotters, Trade Blotters, Statements, Audits • Maintain Permanently – Rep contracts and files, Complaints, Log of closed client accounts 111 Questions? 112