Procedures for Direct Method SCF

advertisement

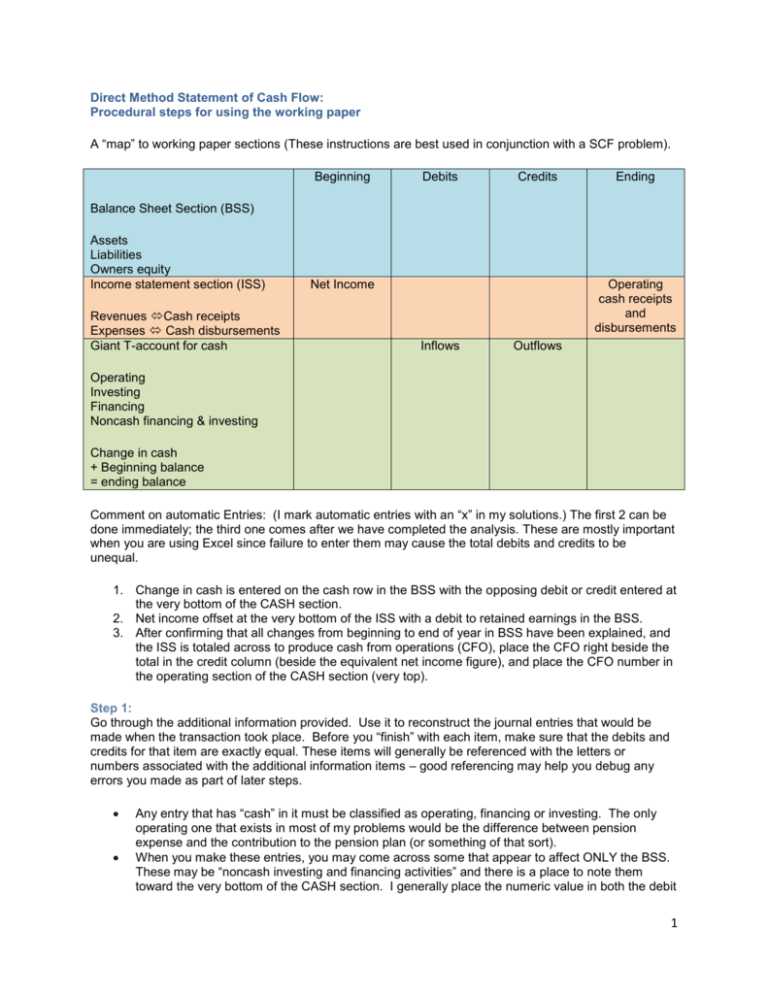

Direct Method Statement of Cash Flow: Procedural steps for using the working paper A “map” to working paper sections (These instructions are best used in conjunction with a SCF problem). Beginning Debits Credits Ending Balance Sheet Section (BSS) Assets Liabilities Owners equity Income statement section (ISS) Revenues Cash receipts Expenses Cash disbursements Giant T-account for cash Net Income Operating cash receipts and disbursements Inflows Outflows Operating Investing Financing Noncash financing & investing Change in cash + Beginning balance = ending balance Comment on automatic Entries: (I mark automatic entries with an “x” in my solutions.) The first 2 can be done immediately; the third one comes after we have completed the analysis. These are mostly important when you are using Excel since failure to enter them may cause the total debits and credits to be unequal. 1. Change in cash is entered on the cash row in the BSS with the opposing debit or credit entered at the very bottom of the CASH section. 2. Net income offset at the very bottom of the ISS with a debit to retained earnings in the BSS. 3. After confirming that all changes from beginning to end of year in BSS have been explained, and the ISS is totaled across to produce cash from operations (CFO), place the CFO right beside the total in the credit column (beside the equivalent net income figure), and place the CFO number in the operating section of the CASH section (very top). Step 1: Go through the additional information provided. Use it to reconstruct the journal entries that would be made when the transaction took place. Before you “finish” with each item, make sure that the debits and credits for that item are exactly equal. These items will generally be referenced with the letters or numbers associated with the additional information items – good referencing may help you debug any errors you made as part of later steps. Any entry that has “cash” in it must be classified as operating, financing or investing. The only operating one that exists in most of my problems would be the difference between pension expense and the contribution to the pension plan (or something of that sort). When you make these entries, you may come across some that appear to affect ONLY the BSS. These may be “noncash investing and financing activities” and there is a place to note them toward the very bottom of the CASH section. I generally place the numeric value in both the debit 1 and credit columns to keep the totals in balance. At a minimum, note the item and its reference so you can write up the additional required disclosures when you prepare the formal statement. Step 2: This step is optional. I call it “picking the low hanging fruit.” I know that depreciation expense, amortization of intangibles, accretion expense and bad debt expense are NOT cash flow of any type and therefore must be zero in the far column of the ISS. I also look for things like income from equity method investees (which was not received in cash) or remaining gains and losses (a gain or loss indicates there was some sort of investing or financing activity). Step 3: Start at the top of the BSS. The first row (Cash and cash equivalents) is an automatic entry (see above) since we have created an entire section to contain the numerous changes in cash. However, every other account must be “explained.” Check to see if the beginning balance + debits – credits = ending balance. If so, check it off. (If using Excel, you can write a formula so that you’ll know it has been explained if the check figure is zero.) The unexplained items will mostly be working capital accounts related to operating activities. Remember: working capital = current assets – current liabilities. Not all WC accounts are related to operations (dividends payable, short-term investments, short-term bank loans, etc.) However most WC accounts are related to operations and include account receivable, allowance for doubtful accounts, Inventory, prepaid expenses, accounts payable, other accruals like salaries payable, interest payable, etc. Each of these accounts is logically associated with an account on the income statement. You will need a debit or a credit to balance the row in the BSS – then place the offsetting debit or credit on the appropriate row in the ISS. o Sales Accounts receivable in the ISS o Inventory and accounts payable cost of goods sold in the ISS o Salaries payable, prepaid expenses may have obviously related accounts but if not, you can associate these accounts with “other operating expenses” in the ISS o Interest payable, taxes payable should always have an ISS account. In addition, you may find other “unbalanced items” o Deferred taxes – take the change to the income taxes row in ISS o Dividends payable – may indicate you need to record dividends paid or it will be related to retained earnings o Premium or discount on bonds payable – take change to interest expense row in ISS o Asset retirement obligation – an increase is probably accretion expense (assuming additional information has been successfully entered and there are no new obligations that arose during the year). o If retained earnings remain unbalanced, you may need the automatic entry for net income (see instructions just below diagram). o Securities available for sale – check to make sure the related AOCI account has been taken care of (unrealized gains/losses are not reported on the income statement, they are “other comprehensive income.”) o You may also discover one or two investing or financing activities. For example, a longterm liability account may require a debit (cash outflow to repay) or credit (cash inflow from borrowing.) It is important to make no assumptions until and unless all the additional information has been taken into consideration! Step 4: Doing the addition Add across the ISS section (income statement amount + debit – credit = cash flow). Then add down the column. The total should be “cash provided by operations.” Total the investing items Total the financing items 2 Add operating, investing and financing to see if it equals the change in the cash account. If so, say Hooray! If not, try to find error. Step 5 – prepare the reconciliation schedule. The “correct” way would be to re-do everything you already did. However, instead of writing things on the relevant row in the ISS, you’d make the debit or credit in the reconciliation schedule (like adding back depreciation). However, this would take quite awhile to do, so here is a shortcut to use if you have already done the direct method CFO. If you end up unable to balance, and have lots of time, you could try a fresh working paper and do it all again but put NO entries in the income statement section. This would be the procedure illustrated in the textbook. 1. Write down “net income” as the first item in the reconciling schedule (easy point!) 2. Go through the ISS section and look for rows that “zero out” meaning that they are not cash flows. This would include all gains and losses, depreciation, amortization, etc. Take each of these amounts (same sign as in the ISS section) and write it under net income with the description. The only exception: DO not do bad debt expense (it gets taken into account with the change in the allowance for doubtful accounts). 3. Now, skip down several rows and write a heading” changes in working capital accounts.” Go up to the top of the BSS and pick up the “target figures” for all the working capital accounts associated with operations (A/R, A/P, prepaid expense, accrued expenses, etc.) The target figure is the net debit or a credit on the BSS row. This amount needs to be the OPPOSITE sign in the reconciliation schedule. 4. Check for other BSS accounts normally associated with operations and enter the changes in the “middle section” if they are not changes in WC accounts. Premium or discount on bonds payable interest expense row in ISS Deferred taxes income tax expense row in ISS Funded status of pension plan pension expense row in ISS Equity method investees – if unbalanced, check to make sure that dividends received from investee are included in cash inflows in the ISS section (you may add a row if one doesn’t exist). If a debit is needed, check to make sure that “share of investee earnings” row in the ISS has been taken care of since reporting our share of investee net income is NOT a cash flow. 5. If you still don’t balance, check through the items in the ISS to be sure none are missing (with the exception of skipping sales and bad debts). If you find a missing item, use the referring system to figure out what it was. Step 6 Prepare the formal statement of cash flows. For the direct method, we MUST present the reconciling schedule (between net income and cash provided by operations) and disclose noncash investing or financing activities. The most important part to do for an exam questions is the direct method SCF section which begins with Cash collected from customers. See other notes and examples for format. 3