pptx - James River District PTA

advertisement

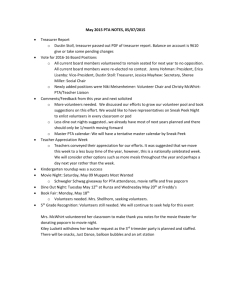

Session 102: Treasurers for NonTreasurers Jennifer Young, Treasurer Virginia PTA 2012 Annual Conference July 13, 2012 The ABC’s Audits, Budgets, Controls In this session we will: • Learn who does an audit and when. • Learn how to develop a budget. • What controls need to be in place to correctly maintain the PTA/PTSA’s funds. When do you Audit? • Before a new treasurer takes over • At the end on each fiscal year – Should be done within a month of year-end – Should be done right away if treasurer resigns Who completes the Audit? • An auditing committee of at least three – Can not be signers on the unit’s account(s) • Or an accountant or person with excellent working knowledge of PTA accounting procedures. What is Audited? • • • • • • • Treasurer’s reports Check book and register Bank statements Deposit slips Receipts Receipt book Previous audit report Audit Report • Present audit report at the general meeting. • Written audit report given to President, Secretary and Treasurer. • President calls for approval of the audit report. This is the actual acceptance of the monthly financial reports that had been put on file. – Auditor or auditing committee all sign and date the report at the time it is filled out Questions? Budget: Supply Line • Development – Look at actual income and expenses from last yr. – Look at what income is needed to achieve goals. – Decide what will be added or deleted. – Make sure to include money for training, advocacy, and leadership development. – Include start up funds for next year Budget: Getting it Approved • Present it to the full board • Make approved adjustments • Present it to the general membership for approval Live within the Approved Budget • Only approved expenses can be paid • If an expense is in the budget, it can’t be voted against as the budget has already been approved • Budget changes must be approved by 2/3 vote at a general meeting • Keep track of each line item’s income and expenses. The 3-to-1 Rule Are you using it to further your purpose/mission? For every fundraising activity, there should be at least three non-fundraising projects/programs aimed at helping parents or children or advocating for school improvements: Fundraiser Gift Wrap Catalog Sales Programs Take Dad to School Day Fall Carnival Reflections Program PTA Fundraising • You don’t need to have a fundraiser • Don’t raise funds, just to raise funds – you should have a purpose for the money • Plan what you want to do then plan how to raise funds to do it • No set amount that you can have, but if you have savings account, it should be earmarked for something Questions? 501(c)(3) Organization • Sales tax exempt - Income tax exempt • Donations by donors are treated as charitable contributions for tax purposes • Must be organized and operate according to the mission set forth in the bylaws: Advocate for the health, education and welfare of all children. • Non-sectarian • Non-commercial • Non-partisan --Cannot engage in political activity --CAN engage in insubstantial amount of lobbying • Resources cannot be used for private benefit IRS Form 990 All units must file 990, 990-EZ, or 990-N e-Postcard by the 15th of the 5th month after the end of fiscal year. Insurance • Check the renewal date of the policy • All treasurers (and officers) should be bonded • RV Nuccio offers insurance to PTAs or you can get insurance from any other company Banking • Have bank statements sent to school • Have a non-signer go over the bank statements (required by some insurance plans) • Reconcile statements in a timely manner To Protect the Association and the Officers: • • • • Never sign a blank check Never mix PTA money with school money Never open a credit card Never hold PTA money overnight Handling Money • Try to avoid cash if possible • Always have two people count the cash • Fill out and sign cash verification form • Treasurer counts cash with chair • Treasurer gives chair a receipt for cash and keeps a copy • Deposit slip filled out and deposit made Writing Checks • Have up-to-date signature cards on file at bank • Always have two signatures on checks – Married couples and family members should never be on the account together • Never sign a blank check • Get receipts before signing the check Financial Statements • Provided at each meeting – Balance from last meeting – Plus the itemized income – Less the itemized expenses – Current balance – Budget vs Actual Resources • • • • • • Money Matters from National PTA Financial section in VA PTA LURG State Treasurer Leadership Training Conference National PTA E-learning District Training Events For more information contact: Jennifer Young, Treasurer, Virginia PTA 804-852-3285 treasurer@vapta.org www.vapta.org