Exersize

advertisement

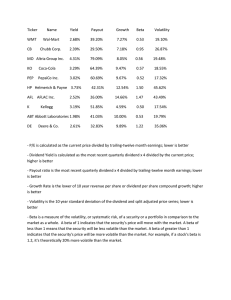

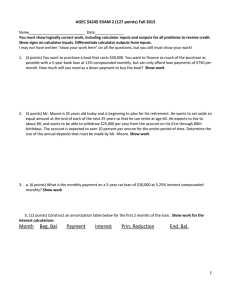

Exercise You bought a 20-year bond paying 8 percent interest today. Your required rate of return is 10 percent. Right after you bought it the interest rate changes so the your required rate changes to 12 percent. What is your dollar gains or losses? What is your percentage gain of losses ? Face value = $1,000 You bought a 15-year bond paying 10 percent interest. The yield to maturity of this bond is 12 percent. Right after you bought the bond interest rate changes causing you to reinvest your coupon payments at 14 percent per year. This rate stays the same over the next four years. After four years you sell your bond. What is your total dollar gain or losses in this transaction? What is your annualized rate of return in this investment? Face value = $1000 Risk free rate is 6 percent the return on TASI is 12 percent. The stock has a beta of 1.4. What is the rate of return implied by CAMP? Plot the SML in a risk-return space. XYZ firm just paid $3 per share in dividend. This dividend is expected to grow by 7 percent per year forever. Risk free rate is 4 percent and return on TASI is 10 percent. XYZ stock carries a beta of 1.5. a. What is the maximum price you pay for each share of XYZ? b. What is the expected price in year 2? Suppose you bought 1000- shares of this stock at a price equal to the price found in “a” above. After one year and after you collect the dividend you sell your shares at $58. What is your annual rate of return? ABC company just paid a dividend per share of $2. This dividend is going to increase by 6 percent per year forever. ABC stock is selling at $26.5. Risk free rate is 4 percent and the return on a market index is 11 percent. The Beta of ABC is 1.2. Is this stock under priced or over priced based on CAPM model? By how much? Plot the information in risk-return space. How much the price should go up or down to reaches the equilibrium price suggested by CAPM?