VKA-PRS-Talk-by-Javern-Lim-5Oct-2012

advertisement

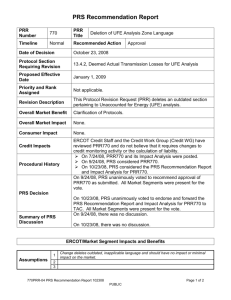

Public Behavior – Retirement Awareness Industrial Challenges Javern Lim CIM, AMTC, MBA, CFP, RFP, Shariah RFP Founder & Group Managing Director cum Licensed Financial Planner VKA Wealth Planner Sdn. Bhd. (A Financial Planning Firm Licensed By Securities Commission & Bank Negara Malaysia) website: www.vka.com.my email: javernlim@vka.com.my Public Behavior Retirement Awareness According to the date from credit counseling and debt management agency (AKPK) s High Medical Fee : Main causes of financial woes in Malaysia 根据信贷咨询与债务管理机构(AKPK)的数据显示,在前来寻求帮助的17万名大马人当中, 有24% 的人民因为医药费的支出而陷入财务困境,成为总数之冠。 Strictly for training purpose only Retirement Fear & Concerns Insufficient of retirement savings… Increasing Medical & Nursing Care Costs Fast growing aging population and as mortality rates declining, pension system have not been adjusted according. QUOTE OF THE DAY “ Having a private pension fund is a vital aspect of the agenda” 3 Main Reasons Why People Fail? Don’t know how much they need to save? No discipline in saving No Plan (flexible plan!) Regulators PRS Providers PRS Distributor PRS Members Effective intermediation for a high value-added and high-income economy Financial Sector Blueprint 2011 - 2020 Regulators SC is empowered by law to develop regulatory & supervision frame work for PRS industry & putting all in place. The challenges now are: To ensure the system to be implemented successfully. To build public trust toward PRS industry. Continuous of public finance education about PRS (Regulator or Providers’ duties?) Strictly for training purpose only Providers Huge initial investment but very profitable over long term. Economy of scale Changing PRSC mindset in dealing with PRS biz (conflict with existing agency model). Different Providers with different marketing strategies. PRS is a separate licensing under FIMM Strictly for training purpose only PRS Distributors Individual/Corporate/Institutional Distributor PRS framework will eventually changing the way consultants conduct their business by adopting holistic approach (lower front end fees but earning profits thru growing clients’ AUM). Is PRS a business opportunity or threat for me? Strictly for training purpose only Contributors (PRS Members) Trust EPF (Capital preservation with min guaranteed of 2.5% payout annually) PRS is a new toy in town (lack of awareness) “Wait & See” attitude Strictly for training purpose only Why PRS is an Ideal Solution for a Holistic Retirement Planning? Doing PRS Investment or Business Disclaimer This presentation was prepared byVKA Wealth Planners Sdn Bhd The information contained in this presentation has been obtained from public sources believed to be reliable and the opinions, analysis, forecast, projections and expectations (together “Opinions”) contained in this presentation are based on such information and are expressions of belief only. No representation or warranty, express or implied, is made that such information or Opinions is accurate, complete or verified and it should not be relied upon as such information and Opinions contained in this presentation are published for recipients' reference only, but are not to relied upon as authoritative or without the recipients' own independent verification or in substitution for the exercise of judgment by any recipient, and are subjected to change without notice. This presentation is not, and should not be construed as, an offer document or an offer or solicitation to buy or sell any investment. Website: www.vka.com.my Email: enquiry@vka.com.my