China

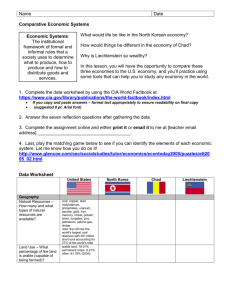

advertisement

I chose this topic because…… Economics is fun Heard and read stuff about financial crisis Wondering why was some better off than others? Outline Thesis China isofa Facts fast emerging • Statement: Brief Introduction of China country from the •recession of the world Crisis Financial of 2008 through Initial Conditions ofFinancial China (before Crisis) abiding its sets of agendasofand • Brief Explanation the proper Impact self-adjustments of Financial Crisis of 2008 on China both before an economic catastrophe and the aftermath of it. • China’s Reaction to Financial Crisis • Possible Outcomes (issues) and Solutions Facts of China• Largest Exporter China $1.506 trillion (2010 est.) #2 (behind EU) US $1.270 (2010 est.) #4 • Imports China $1.307 trillion (2010 est.) #3 US $1.903 trillion (2010 est.) #1 Reference: CIA World Factbook Export Import Facts of China• GDP (real growth rate) – China 10.30% (2010 est.) # 7 US 2.7% (2010 est.) # 138 Taiwan 10.50% (2010 est.) #6 European Union 1.8% (2010 est.) #154 • Debt - External China $406.6 billion (31 December 2010 est.) #23 US $13.98 trillion (30 June 2010) #1 Reference: CIA World Factbook GDP (real growth rate)(%) Initial Condition of China I. Highly administrative – Government controls the flow of loanable funds II. High interest rate – Higher saving Comparison of BRIC countries and world average savings rate (Share of total savings to Gross National Income (GNI)(%) 1990 2000 2001 2002 2003 2004 2005 2006 China 40 37 38 41 44 47 51 54 Brazil 19 14 14 15 16 19 17 18 India 22 26 26 27 29 32 33 34 Russia 30 37 33 29 30 31 32 31 World 22 22 21 20 20 21 21 22 Reference: ZHANG Xiaojing, TANG Duoduo, LIN Yueqin (Institute of Economics, Chinese Academy of Social Sciences) Initial Condition of China III. Limited exposure to external risks Economy Current account/GDP (Expected value of 2009)(%) Short-term external debts/Foreign exchange reserve (Expected value of 2009)(%) Bank loans/deposits Overall risk ranking South Korea 1.3 102 1.3 14 Brazil -1.5 22 1.36 10 Russia 1.5 28 1.51 9 India -2.4 9 0.74 4 Taiwan 7.9 26 0.87 3 Malaysia 11.3 15 0.72 2 China 5.2 7 0.68 1 Reference: ZHANG Xiaojing, TANG Duoduo, LIN Yueqin (Institute of Economics, Chinese Academy of Social Sciences) Impact of Financial Crisis of 2008 on China • Investment in the US • US Decreasing in Demand When world financial crisis strikes… Decrease demand for Chinese imports Chinese job losses Social and economical unrest Cuts in interest rate Encourage lending Tax cuts Increase willingness to consume Monetary stimulus $586 billion (roughly 4 trillion yuan) stimulus package Domestic investment increased Reference: ZHANG Xiaojing, TANG Duoduo, LIN Yueqin (Institute of Economics, Chinese Academy of Social Sciences), (Fan, The Jordan Times, 2011) China’s $586 Stimulus Package • Housing • Rural Infrastructure • Transportation • Health and Education • Environment • Industry • Disaster Rebuilding • Incomes • Taxes • Finance Reference: (Chiu, 2008) Possible Outcomes (issues) and Solutions • Hasty and wasteful projects • Increased government steerage • Appreciation of renminbi ====================================== • Upgrade industrial structure • Increase domestic market Reference: (NewYorkTimes, 2008), (Naughton, China Leadership Monitor, No. 29) C ONCLUSION 1. Highly Administrative System 2. High Interest Rate, Reserve Ration 3. Limited Exposure to External Risks 1. Lower down Interest Rate, Reserve Ration Increase spending 2. Tax Cuts Save exporting enterprises Save job lost 3. $586 Stimulus Package Numerous domestic investments projects (urbanization) Domestic Market vs. Export Oriented References: http://chinadigitaltimes.net/2008/12/2008-financial-crisis-and-china/ http://www.nytimes.com/2008/11/27/business/worldbusiness/27yua n.html http://www.jordantimes.com/?news=23852 http://chineseculture.about.com/od/thechinesegovernment/a/Chinas timulus.htm http://www.gees.org/files/documentation/doc_Documen-03520.pdf http://www.xiaojingzhang.com/pdf/economicrecovery.pdf http://epress.anu.edu.au/china_new_place/pdf/ch09.pdf http://www.imf.org/external/pubs/ft/wp/2009/wp09172.pdf References: http://www.bus.indiana.edu/riharbau/harbaugh-chuxu.pdf http://www.nytimes.com/2008/11/19/business/worldbusiness/19yua n.html http://www.china.org.cn/business/201007/01/content_20396527.htm http://www.cfr.org/india/financial-crisis-may-worsen-poverty-chinaindia/p17812 CIA Factbook