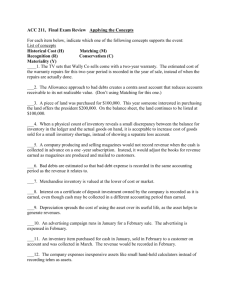

Study Guides, All Chapters

advertisement

Chapter 1 - Introduction to Financial Statements Page 4 5 7 8 9 11 12 13 13 14 15 17 18 26 42 Topic Forms of Business-Discussed last week by Dr. G Users of Financial Statements (Internal and External) Ethics- Enron, etc. Fraudulent Financial Reporting Solving an Ethical Dilemma Business Activities- Financing, Investing, Operating Communication with users – 4 Financial Statements Income Statement- Better one in Basic Training Retained Earnings Statement Basic Accounting Equation A = L + SE Balance Sheet- Better one in Basic Training Statement of Cash Flows- Not emphasizing yet Interrelationships of Statements- Study this Do it! YES Comprehensive Do It! Study problem and solution A Look at IFRS (Need for one set of financial statements) Appendix Tootsie Roll Annual Report and Financial Statements 1 Chapter 2 - A Further Look at Financial Statements Page 49 54 56 59 60 61 62 64 64 65 66-67 69-70 75 96 Topic A classified balance sheet - commit this to memory- even better than the one in Basic Training due to additional classifications. Ratio Analysis- Profitability ratios, Liquidity ratios, and Solvency ratios Earnings per Share (a profitability ratio) Working Capital and Current Ratio (liquidity ratios) Debt to Total Asset Ratio (a solvency ratio) When Debt is Good Free Cash Flow (a liquidity ratio) Financial Reporting Concepts- The standard- setting environment- GAAP. The SEC, FASB, IASB The Korean Discount! Characteristics of Useful Info- Relevant, Reliable, Comparable, Consistent Assumptions and Principles- Similar to those found in Basic Training- Monetary Unit Assumption, Entity assumption, Time Period assumption, Going Concern, Cost principle, Full disclosure Constraints in Accounting- Materiality, Conservatism Comprehensive Do it! Circuit City Income Statement and Balance Sheet A Look at IFRS (The Classified Balance Sheet) Chapter 3 -The Accounting Information System Page 103 104 104109 111 111 116 116 118 120126 127129 133 159 Topic The Accounting Equation (again) The Accounting Equation with details on Stockholders’ Equity Transaction Analysis for Sierra Corporation- like done with New Co. problem Study summary of transactions on page 110 T account Transactions in cash in tabular form and account form Rules of Debit and Credit- Very, very important Rules of Dr. & Cr. Summarized in T accounts Steps in the Recording Process- Analyze transaction, record transaction in journal, post from journal to ledger Three journal entries recorded Individual transactions presented in both transaction spreadsheet and T accounts Summary of entire chapter- entries recorded in the general journal, posted to T accounts, account balances determined, and trial balance prepared for Sierra Corporation Comprehensive Do It! A Look at IFRS (Recording transactions) Chapter 4- Accrual Accounting Concepts Page 164165 166 167 168 171 173 173 174 175 177 177 177 168 181 182 183 184185 187 Topic Time period assumption (periodicity), revenue recognition, expense recognition, matching principle, accrual accounting Accrual accounting vs. cash basis of accounting Basics of adjusting entries- start with trial balance, adjust accounts to match revenues and expenses, usually affect a balance sheet account and income statement account Prepaid expenses- rent, insurance, supplies Depreciation- Allocate an asset’s cost, not valuing an asset Debit Depreciation Expense and credit Accumulated Depreciation Straight-line depreciation = (cost – salvage) / years Unearned revenue- Balance in Unearned Revenue account (a liability). Adjust by debiting Unearned Revenue and crediting revenue by amount earned this period Accrue revenue or expense means to record it this period. Accruals are UNRECORDED revenues or expenses that must be recorded. Defer revenue or expense means to put it off to a later period. Deferrals have been recorded but must be adjusted Turning Gift Cards into Revenue Accrued revenue- Debit AR and credit Revenue Accrued expense- Debit appropriate Expense and credit appropriate Liability Examples of accrued expenses include accrued interest, accrued salaries, accrued taxes, etc. Calculate interest – Principal x Rate x Time in terms of 1 year Trial Balance for Siera Corp. Adjusting entries for Siera Corp. Ledger for Siera after adjustments are posted Adjusted Trial Balance for Siera Financial statements for Siera Closing entries: 1) Close Revenues to Income Summary 2) Close all Expenses to Income Summary 3) Close Income Summary to Retained Earnings 187 188 191 196 224 4) Close Dividends to Retained Earnings Temporary accounts and permanent accounts Closing entries for Siera Corp. Post Closing Trial Balance For Siera Corp. Quality of Earnings Worksheet for Siera Corp. (Very Important!) A Look at IFRS (Recognition of Revenues and Expenses) Chapter 5 – Merchandising Operations and the Multiple-Step Income Statement Page 228 229 240 243 245 245247 247 248 231235 231 233 234 234 235 236239 236 237 238 239 251 254 276 Topic We’re switching our studies from a service company to a merchandising company Periodic vs perpetual inventory systems. Text emphasizes perpetual. Single-Step Income Statement for Wal-Mart Multiple-Step Income Statement for PW Audio- Please commit this to memory Calculation of cost of goods sold under periodic inventory system Profitability ratios- Gross Profit Ratio (gross profit/net sales) Profit Margin Ratio (net income/net sales) (aka, return on sales) Quality of Earnings (cash from operating activities/net income) Journal entries involving the purchase of merchandise Purchase merchandise on credit Freight costs on merchandise purchased Purchase returns and allowances Purchase discounts Summary of purchase transactions Recording sale of merchandise Sale on account and related cost of goods sold Sales returns and allowances- reversing prior two entries Sales discounts Sales transactions – Do it! Periodic Inventory System-You are not responsible for this Comprehensive Do it! Put a star on this!! A Look at IFRS (Entries for merchandise and format of the Income Statement) Chapter 10 – Reporting and Analyzing Liabilities (Long-term liabilities, pages 512-531 and 533-539) Page 512 513 513514 515521 522 524525 526527 527 531533 533 535 535 536 537 537 Topic Current liabilities (pages 506-511) will be discussed later in the course Types of bonds- secured and unsecured, convertible, callable Terms-bond certificate, face value, maturity date, contractual (stated) interest rate, effective interest rate Value of a bond- pv of $ plus pv of A Accounting for bond issues- entries to issue, pay or accrue interest, amortize premium or discount, retire Balance sheet presentation Ratios- current ratio, debt to total assets, times interest earned Off balance sheet financing- contingent liabilities (record if probable and reasonable estimate can be made. If possibly, a footnote disclosure may be appropriate. If remote possibility, ignore. Enron Leasing- operating lease vs. capital lease SKIP THIS SECTION Appendix 10A- Straight-line amortization of bond premium or discount. We will use effective-interest method Appendix 10B- Effective-interest amortization. Straight-line and effective interest methods yield the same amount of interest expense over the life of the bond but the amount reported each year differs Schedule for Bond Discount Amortization Journal entries for recording bond interest expense and bond discount amortization Schedule for Bond Premium Amortization Journal entries for recording bond interest expense and bond premium amortization Effective interest rate= (interest paid – premium amortization) / carrying value of bond or (interest paid + discount amortization) / carrying value of 537 538 564 bond Accounting for long-term notes payable Mortgage installment payment schedule and journal entries A Look at IFRS (Accounting for Liabilities) Chapter 11 – Reporting and Analyzing Stockholders’ Equity Page 570573 575 575 575 577 578581 581 582 582 584 585 586 587 589 591 Topic Characteristics of a Corp. Advantages- separate legal existence (sue, be sued, ownership, enter into contracts), limited liability (personal assets of owners not at risk), transferability of ownership (sell shares), ability to acquire capital (stock and bonds), unlimited life, professional management (due to size) Disadvantages – government regulations, additional taxes, management decisions that favor management rather than the corporation Rights of Common Stockholders Right to vote, share profits (receive dividends), preemptive right, share assets upon liquidation Rights of Preferred Stockholders Same as above but no right to vote, and no preemptive right Preference to dividends and sharing assets upon liquidation Authorized (in charter), Issued (actually sold), and outstanding shares (issued minus treasury stock) Franklin Life Insurance stock certificate Par value, no-par stock, no-par with a stated value Journal entries for common stockSale of common stock at par, sale at a premium, treasury stock Stockholders’ equity on the balance sheet Journal entries for preferred stock Similar to entries for common stock Dividends on preferred stock- cumulative and noncumulative Dividends in arrears Cash dividends prerequisites- available cash, adequate retained earnings, declaration by board of directors Entries for cash dividend (date of declaration, date of record, date of payment) Stock dividends (dividend paid in shares of co’s stock rather than cash) Stock splits Retained earnings and restrictions (Amazon balance sheet ) Stockholders’ equity on balance sheet- Graber, Inc. 593 594 594 619 Payout Ratio = cash dividends / net income Return on common stockholders’ equity = (net income – preferred stock dividends)/ average number of common shares outstanding Illustration 11-23 Finance by issue of stock vs. issue of bonds A Look at IFRS (Accounting for Stockholders’ Equity) Chapter 7 – Fraud, Internal Control, and Cash Page Topic 335 Minding the Money in Moose Jaw- Stephanie probably has good control over food, supplies, and equipment. Read this section carefully after reading the rest of the chapter and note the internal control weaknesses over cash. 336 Fraud-A dishonest act by an employee that results in a personal benefit to the employee at a cost to the employer- bookkeeper diverts cash from his employer to his personal bank account; shipping clerk ships merchandise to himself; computer operator embezzles cash; church treasurer “borrows” church funds. Chapter tends to stress the theft of assets (employee fraud), but fraudulent reporting (management fraud) is also significant. 337 Fraud Triangle- Incentive (financial pressure), Opportunity, Rationalization (attitude). Our Internal Control system attempts to minimize opportunity (cost/benefit considerations) 337 Sarbanes-Oxley Act of 2002 (SOX). Auditors must now audit both the financial statements and the system of internal controls. 337 Internal Control- Methods and measures adopted to safeguard assets, enhance reliability of accounting records, increase efficiency of operations, and ensure compliance with laws and regulations. 337- Principles of Internal Control- Establish responsibility; segregation 338 of duties; documentation procedures; physical controls; independent internal verification (audits); human resource control. INTERNAL CONTROL FEATURES (see link on accounting assignment sheet) SEPARATION OF DUTIES-AUTHORIZATION, ACCOUNTING, & 1 CUSTODY 2 COMPETENT, HONEST EMPLOYEES 3 BOND EMPLOYEES 4 EXTENDED VACATION, ROTATION OF JOBS 5 PROCEDURES MANUALS 6 ASSIGN AUTHORITY AND RESPONSIBILITY 7 PHYSICAL CONTROL OF ASSETS 8 PHYSICAL CONTROL OF ACCOUNTING RECORDS 9 GOOD ACCOUNTING SYSTEM AND FINANCIAL STATEMENTS 10 AUDIT-INTERNAL AND EXTERNAL 11 12 13 UNANNOUNCED PHYSICAL COUNTS REASONABLENESS TESTS (ratio analysis) PERFORMANCE EVALUATIONS 340 Anatomy of a Fraud Lawrence Fairbanks- purchased items for self- missing control was segregation of duties Angela Bauer- issued company checks to herself—missing control was segregation of duties Multiple employees submitted vouchers for reimbursement for same trip- missing control was documentation procedures Alex Parviz received commissions for sales he didn’t makemissing control was physical control over mailroom and insurance applications Bobbi Jean filed expense reimbursement reports for purchase of her own clothes- missing control- segregation of duties and independent verification Ellen and Josephine never took vacations. Embezzled funds by keeping cash paid by hotel guests- missing control was human resource control as Ellen had been fired by previous employer for same scheme Limitations on Internal Control- reasonable assurance, not absolute assurance Internal Controls over Cash INTERNAL CONTROL OVER CASH (see same link on accounting assignment sheet) ALL OF ABOVE FEATURES APPLY CHECKING ACCOUNT BANK RECONCILIATION PETTY CASH FUND Must consider control over cash receipts and controls over cash disbursements Journal entry for cash sale where there is a shortage or overage (Cash Short or Over) Use of the Voucher System- Verify purchase order, purchase invoice, and receiving report- attach all three to voucher. Responsible individual then authorizes payment. Petty Cash Fund (Journal entries illustrated in Appendix- page 367368) 340 340 341 342 343 344 345 346 1 2 3 4 346 348 349 351 351 352 353 355356 357 357 360361 363 367368 393 Proper use of a checking account is a good control over cash Illustration of Laird Company Bank Statement from the National Bank & Trust Bank Reconciliation procedure Laird Company’s Bank Reconciliation and required journal entries Cash account, bank reconciliation, and Cash balance on Balance Sheet should all agree- Laird Company, $12,204.85 Madoff’s Ponzi Scheme Principles of good Cash Management1. Increase speed of cash collections (offer cash discount) 2. Keep inventory levels low (Just-in-Time Inventory system) 3. Delay payment of liabilities (take advantage of cash discounts but pay on last day to receive discount, e.g., 2/10, n/30) 4. Plan the timing of major expenses (Capital Budget) 5. Invest idle cash (Prepare cash budget to determine funds available to invest or funds needed to borrow. Cash Budget for Hayes Company Journal entries for Petty Cash (establish the fund, replenish it, and enlarge fund) A Look at IFRS (Internal Control) Chapter 8 – Reporting and Analyzing Receivables Page 398 400 400 401 402 402 402 403 404 405 407 408 409 410 412 Topic Types of Receivables- Name those that we have used previously Note entry for accrued interest earned. Valuing Accounts Receivable- we won’t collect all that is owed to us Direct write-off method. Simple and useful if there are few bad debts (aka, uncollectible accounts). However, it doesn’t provide a good matching of revenues and expenses. You are not responsible for this Allowance method- provides a good matching of revenues and expenses by estimating bad debts at the end of a period. How do we estimate bad debts? Look at past experience. Apply a percentage of net sales or percentage of receivables that occurred in the past. Better yet, age the accounts receivable. Adjusting entry to record estimated bad debts Entry to actually write off a bad debt in the following period Entries to collect an account that had been previously written off Aging Schedule, Journal entry, and T account presentationSTUDY THIS! Notes Receivable. Illustration of a promissory note Computing interest- we’ve been doing this since Basic Training Recognizing notes receivable- loan money and receive a note; make a sale and receive a note; receive a note as an extension of a past due account receivable. Journal entries for the collection of a note and another entry to accrue interest on a note at the end of the period. Managing Receivables: 1. Determine to whom to extend credit 2. Establish a payment period (COD, n/20, 2/10, n/30) 3. Monitor collections 4. Evaluate the liquidity of receivables (aging schedule) 415 423 444 5. Accelerate cash receipts when possible Ratios for evaluating receivables 1) Receivables turnover ratio (net sales/average receivables) (Some use net credit sales/average receivables) 2) Average collection period (aka, days in receivables) 365 / Receivables Turnover Ratio We’ll compute similar ratios to evaluate inventory in the next chapter Review the “Comprehensive Do It!” A Look at IFRS (Receivables) Chapter 6 – Reporting and Analyzing Inventory Page 282 283 284 286291 315 291 292 292 293 295 295 296 297 299 330 Topic Classifying inventory- For a merchandising firm, we refer to items for resale as “inventory” or “merchandise inventory.” For a manufacturing firm, inventory is classified as raw materials, work in process, and finished goods. Valuing inventory- 1) determine inventory quantities, 2) price the inventory Determining ownership- goods in transit, consigned goods Inventory costing methods- 1) Specific identification, 2) First-in, first-out (FIFO), Last-in, first-out (LIFO), and Average Cost (aka, weighted average) Use text problem (E6-5) to illustrate calculations Goods Available – Ending Inventory = Cost of Goods Sold $12,000 - $5,400 = $6,600 Effects of inventory methods on income statement (cost of goods sold and income tax expense), balance sheet (inventory, taxes payable, retained earnings) Use of Inventory methods in US (FIFO=44%) Effects on taxes this year and next year Effects on cash due to taxes paid Consistency required once a method is chosen Mention the Lower-of-Cost-or-Market method- Very conservative Inventory Turnover Ratio – Cost of Goods Sold / Average Inventory Days in Inventory – 365 / Inventory Turnover Ratio These are similar to the Receivables Turnover Ratios Mention the use of the LIFO Reserve – the difference between the ending inventory using LIFO and FIFO. Required footnote disclosure for companies using LIFO. A Look at IFRS (Accounting for Inventory) Chapter 10 – Reporting and Analyzing Liabilities (Current Liabilities pages 504-512) Page 506 507 508 508 509 510-511 Topic Long-term liabilities were covered earlier- Long-term notes payable and bonds payable. Our discussion today focuses on current liabilities. A current liability is one that is paid out of current assets (usually cash) or creation of other current liability (AP converted into NP), and paid within one year or the company’s operating cycle (the longer). Most operating cycles are for far less than one year. Entries for Notes Payable and Interest Payable Entry for Sales Tax Payable Entry for Unearned Revenue Current maturity of long-term debt Payroll Taxes Payable- entry to record the payroll and entry to record the employer’s payroll tax expense Chapter 9 – Reporting and Analyzing Long-Lived Assets Page 448 448 449 450 450 450 451 451 452 453 Topic Plant assets (Property, Plant, & Equipment) – Determining cost of a plant asset Accounting for PP&E including depreciation and disposal Analyzing plant assets (ratios) Intangible assets (no physical characteristics) Types of intangible assets Accounting for intangible assets Financial statement presentation Determining the cost of a plant asset- Cost includes all expenditures necessary to acquire the asset and get it ready for use Land cost includes purchase price, realtor, attorney, and other fees associated with the acquisition, removal of old building, etc. We do not depreciate the land. Land improvements- driveways, parking lots, fences, outside lighting, sprinkling systems. Depreciate land improvements over their useful life. Buildings- Capitalize the purchase price, closing cost, remodeling, renovations (everything it costs to get the asset in place and ready to use. Trucks, Autos - Cost includes cash price, sales tax, painting & lettering, special additions to asset Equipment – Cost includes cash price, sales tax, insurance during shipping, installation and testing. To buy or lease? Considerations include obsolescence, down payment, tax considerations, affect on financial statements Operating lease not reported as an asset nor is a liability reported- Debit Rent Expense; Credit Cash Capital lease- Record leased asset at present value of lease payments and credit an account called Obligations under Capital Lease. Depreciation- A process of allocating to expense the cost of a plant asset over its useful life in a rational and systematic manner. 454 455 455 456 457 458 458 462 463 Depreciation is a cost allocation process, not an asset valuation process (i.e., emphasis on getting a good matching on the income statement rather than a proper value for the asset on the balance sheet. Factors needed to compute depreciation: 1. Cost – As discussed on pages 436-437 2. Estimated Useful life – not physical life 3. Salvage Value (aka, scrap value, residual value) Pie chart indicates that straight-line method is used 83% of the time. Straight-line = (Cost – Salvage) / Estimated useful life Look at Depreciation schedule (Illustration 9-9) Double Declining-Balance = (Cost – Accumulated Depreciation) x Twice the Straight-line Rate See Appendix, page 461 for illustration. You are responsible for this! Straight-line rate for a five year life is 1/5, so we’ll use a rate of 2/5 for the Double Declining-Balance method Look at Depreciation schedule (Illustration 9-10) Units-of-Activity = (Cost – Salvage) / Estimated units in life. Look at Depreciation schedule (Illustration 9-11) See Appendix, page 476 for illustration. You are responsible for this! Illustration 9-12- Comparison of methods. Notice that total depreciation is the same over the five year life. What differs is that SL writes asset off evenly, DDB writes a large amount of the asset off in the early years Unit-of-activity methods depreciation differs due to usage (physical wear and tear) Repair Expense increases as asset ages, so total depreciation under DDB + repair expense might be similar over the years of the asset use For tax purposes, taxpayers must choose between straightline and Modified Accelerated Cost Recovery System (MACRS). But this isn’t tax class! Disposal of plant asset – scrap, sell, or trade-in Notice journal entries to record depreciation and sale of asset: Record cash received, eliminate Accumulated 464 465 466 466 462 468 468 476 500 Depreciation account, eliminate asset account, and show balance as a gain or loss. If the cash received is greater than the asset’s book value, you have a gain (credit Gain on Sale). If the cash received is less than the asset’s book value, you have a loss (debit Loss on Sale) Analyzing Plant Assets Return on Assets (ROA) = Net Income / Average Total Assets Asset Turnover Ratio = Net Sales / Average Total Assets Profit Margin Ratio = Net Income / Net Sales ROA = Profit Margin Ratio x Asset Turnover Ratio Accounting for Intangible Assets – Patents, Copyrights, Franchises, Trademarks, Trade Names, Goodwill, Research and Development costs. Amortization is the process of writing off an intangible asset. We depreciate tangible assets and amortize intangibles. Goodwill is capitalized but not amortized (subject to an annual impairment test) R & D is expensed and never capitalized Compute amortization on a patent- straight-line method used. International Accounting Standards differ from US GAAP Research is expensed but Development is capitalized. Appendix 9A. Other Depreciation Methods Double Declining Balance- Illustration 9A-2 Unit of Activity- Illustration 9A-4 A Look at IFRS (Property, Plant, and Equipment) Chapter 12 – Statement of Cash Flows Page 624 625 627 628 630 629-630 638 Topic We briefly looked at the Statement of Cash Flows in Basic Training and in Chapter 1. We know the three sections: Cash from Operating Activities, Financing Activities, and Investing Activities. We know that we are looking at sources and uses of CASH. This statement is necessary because the other three statements use accrual accounting and don’t necessarily stress cash. By looking at comparative Balance Sheets, we can see the beginning and ending cash for the current year, but can’t explain the changes to cash. Usefulness of Statement of Cash Flows: Company’s ability to generate future cash (usefulness in valuation models in Finance) Company’s ability to pay debt and dividends Opportunity to evaluate differences between net income and cash from operating activities Concise list of cash investing activities and financing activities Noncash financing and investing activities: Issuance of stock for assets Issuance of long-term debt for assets Conversion of long-term debt for stock Exchange of plant assets (e.g., land for building) Format of the Statement of Cash Flows Corporate and Product Life Cycle- Introductory, Growth, Maturity, and Decline. A Statement of Cash Flows can provide insight as to the stage of a company’s life cycle. Usage of Methods – 99% use the indirect method Information needed to prepare statement the statement of cash flows– Comparative Balance Sheets, Income Statement, Other Information STATEMENT OF CASH FLOWS Cash from Operating Activities Start with Net Income Assign Sheet 670 639 642 643 652 680 Make conversions needed to change from accrual basis to cash basis. This statement follows the Indirect Method. Cash from Investing Activities Purchase and Sale of Long-term Assets (Investments and PP&E) Cash from Financing Activities Changes in Common Stock, Preferred Stock, Dividends, LT Debt, Bonds Payable Combine OA, IA, and FA to determine change in cash for period Add Cash at beginning of period to change in cash to get Cash at end of period. Report Noncash Investing and Financing Activities Examine the Study Aid provided on the Assignment Sheet Complete P12-9A (Lemere Corp.) together in class Ratios: Free Cash Flow = Cash from Operating ActivitiesCapital Expenditures – Cash Dividends Current Cash Debt Coverage Ratio – Cash from Operations / Average Current Liabilities A measure of liquidity Cash Debt Coverage Ratio – Cash from Operations / Average Total Liabilities A measure of Solvency Statement of Cash Flows – Direct Method You are not responsible for the Direct Method but look at it to see similarities and differences with Indirect Method A Look at IFRS (Statement of Cash Flows) Chapter 13 – Financial Analysis: The Big Picture Page 686 687 687 689 690 690 692 693 695 695 697 698 699 700 700 701703 Topic Sustainable Income- most likely level of income to be obtained. That is, income before discontinued operations, extraordinary items, and other comprehensive income (all net of tax). Discontinued operations-division, product line Extraordinary items- event that is unusual and infrequent such as a flood or fire, expropriation (takeover) be foreign government, condemnation Ordinary items- natural casualty, not uncommon in area, write down of inventory, loss due to labor strike, sale of PPE Changes in Accounting Principle (Inventory, depreciation)For consistency, apply new principle to current and prior period. Comprehensive income- Gains and losses that are reported in stockholders’ equity rather than on the income statement such as gain or loss on sale of available-for-sale securities. Report on Income Statement after Net Income. Illustration 13-7- Complete Income Statement including irregular items. Comparative Analysis- intracompany (compare current to prior year), intercompany (compare to competition), industry averages. Horizontal analysis of Chicago Cereal 08 & 09 Balance Sheets Horizontal analysis of Chicago Cereal 08 & 09 Income Statements Vertical analysis of Chicago Cereal 08 & 09 Balance Sheets Vertical analysis of Chicago Cereal 08 & 09 Income Statements Ratio Analysis- We’ve seen them in prior chapters Liquidity Ratios Solvency Ratios Profitability Ratios These ratios are reported on the inside of the back cover of your text. This page will be photocopied and included on your final exam so you don’t have to memorize the ratios for the 708 743 exam. Appendix 13A- Comprehensive Illustration of Chicago Cereal A Look at IFRS (Financial Analysis and Irregular Items)