FREE Sample Here

advertisement

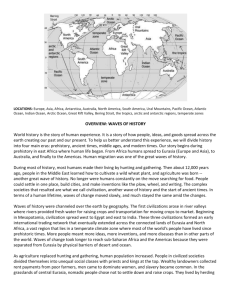

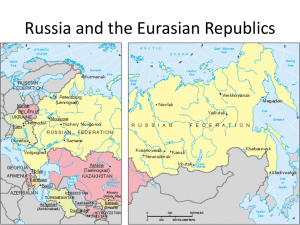

INTEGRATIVE CASE 2 TELIASONERA: A NORDIC INVESTOR IN EURASIA OVERVIEW Nordic telecom provider TeliaSonera grew from being a local telecom provider in the Nordic region to a trend-setting international player in Eurasia markets. It’s 150-million strong customer base spans across the Nordic and Baltic countries to the Himalayas. TeliaSonera’s operations in Eurasia, where the institutional frameworks are either in transition from planned to market economy or relatively weak compared to Europe, grew thanks to the technical know-how and deep customer understanding of the company, and its infrastructure investments in the region. The highly technological and better quality network investments provided TeliaSonera a leading edge in the region compared to local competitors. CASE DISCUSSION QUESTIONS 1. How would you characterize the competitive intensity and attractiveness of the telecom industry in Eurasia by using Porter`s Five Forces? Analyzing the telecom industry in Eurasia by using Porter`s Five Forces, one of the pertinent points of the telecom industry in Eurasia is that the institutional frameworks are either in transition from planned to market economy or relatively weak compared to Europe. TeliaSonera had fewer competitors in the Eurasian market as mobile penetration in these markets is lower than that in Europe. Its technological knowledge and better quality network infrastructure investments provided TeliaSonera a leading edge in the region compared to local competitors, and may have formed an effective entry barrier to minimize the threat of new entrants into the market. The threats of substitutes were in Eurasia were lower in the case of TeliaSonera, as high investment in infrastructure led to the development of a larger and more satisfied customer base, upgrading TeliaSonera into the leading positions in most countries. One of the most promising features of Eurasia is its customer base which has a larger young population with an increased trend of using mobile data services. 2. Many multinational companies fail in their expansion in emerging economies. What are the main capabilities and resources that drive TeliaSonera`s successful growth in Eurasia markets? When TeliaSonera began operations in Eurasia, the institutional frameworks were either in transition from planned to market economy or relatively weak compared to Europe. TeliaSonera’s main capabilities and resources were its experience and expertise in the field of telecommunications, its readiness to enter into partnerships and alliances with companies in the region, and its strong customer understanding. TeliaSonera leveraged its decades of telecom expertise developed in Nordic countries in the developing countries of the Eurasia region. The technical know-how and deep customer understanding of the company enabled operations in difficult areas to be smoother and less problematic. TeliaSonera faced certain challenges due to weak institutional settings, especially in former Soviet Union countries in Eurasia. TeliaSonera’s success in its Eurasia expansion lay in utilization of strong business and government ties that were developed in decades throughout the company’s history in the region. The market conditions in Eurasia countries present many opportunities for technology companies. Mobile network penetration is lower in Eurasia than in TeliaSonera’s mature markets, offering a great deal of potential for TeliaSonera’s mobile operations. Another significant aspect of market conditions is that there is a larger and younger population that is the number one customer group of new technologies and telecom services in Eurasia countries. This provided a huge sales opportunity for TeliaSonera’s telecom services in the region. TeliaSonera 14 also made savvy use of alliances and acquisitions in Eurasia appeared to be a key. Its alliances and acquisitions throughout Eurasia resulted in enviable performance in many host countries, often commanding either the number one or number two positions. 3. Given the institutional differences between European and Eurasian markets, what are the main challenges faced by TeliaSonera in its international expansion strategy? Which strategies enable TeliaSonera to minimize the risks of these challenges? Although each country of Eurasia is in a different phase of transition to market economy, the economic, legal, and regulatory systems are still highly bureaucratic and risky. TeliaSonera’s operations in Eurasia, where the institutional frameworks are either in transition from planned to market economy or relatively weak compared to Europe, utilized its know-how specifically in communications infrastructure investments. TeliaSonera was able to circumvent the liabilities of its foreignness by heavy infrastructure investment, providing local job opportunities and even increasing the number of base stations from 300 to 1500 in three years, in the case of Nepal. Other than employing 25 expatriates, Ncell created 500 solid jobs for locals in a variety of positions. Moreover, the technology expertise reflected in infrastructure investments expedited the government relations and related bureaucratic issues. TeliaSonera faced certain challenges due to weak institutional settings, especially in former Soviet Union countries in Eurasia. The ambiguity in the institutional frameworks brings additional risks for businesses, significantly increasing the costs of investments. The telecom industry has further liabilities in terms of infrastructure spending and related fixed costs. TeliaSonera’s success in its Eurasia expansion lay in utilization of strong business and government ties that were developed in decades throughout the company’s history in the region. Again, in the case of Nepal, there was an ongoing political and security crisis involving terrorist attacks and union strikes, which negatively affected multinationals. TeliaSonera contributed to the efforts to overcome such host country difficulties by offering world-class technologies to this country traditionally suffering from poor telecommunications and also by generating local jobs and employment opportunities. Finally, the politically risky and institutionally ambiguous Eurasia was overcome by utilizing strategic alliances and acquisitions. TeliaSonera’s operations in Eurasia helped it to be the trendsetter in these highly dynamic and low penetration markets. 4. How does TeliaSonera differentiate itself from its competitors in Eurasia market? As a result of its previous experience in Nordic countries, TeliaSonera had significant technical know-how and customer understanding as it entered Eurasia. The company’s expertise led it to make useful infrastructure investments in the region. The highly technological and better quality network investments provided TeliaSonera a leading edge in the region compared to local competitors. This high investment cost turned into a larger and more satisfied customer base, upgrading TeliaSonera into the leading positions in most countries. TeliaSonera had previously developed strong business and government ties in the region, and could capitalize on these while the institutional frameworks in Eurasian countries were still unstable. The company was able to tap in to the communication void caused by weakly developed fixed networks in Eurasian countries. TeliaSonera also made strategic partnerships and acquisitions in Eurasia which helped the company achieve an overall brand image. For example, its alliance with a local player, Kcell, was the first company to launch GPRS technologies that provided Kazakhstan access to Mobile Internet, WAP, and MMS services. Operating in such a broad geographic area, TeliaSonera refined its branding strategy to identify its operations under one brand image in 2009. Eighteen brands of TeliaSonera from Nordics to Nepal began to use the same brand image to convey the customers the message of unity under a strong, multinational brand. The most interesting aspect of this change was that the new branding strategy was first tested in the Eurasia markets in Kcell (Kazakhstan), Geocell (Georgia), Ncell (Nepal), Tcell (Tajikistan), Azercell (Azerbaijan), Moldcell (Moldova), and lastly in Ucell (Uzbekistan). The new 15 brand identity united the local companies under the same umbrella and turned out to be a success in the region that helped the companies protect their leading market positions. This harmonization in branding enabled TeliaSonera to further spread and better defend its extensive telecommunication technology in risky but high opportunity markets and differentiate its product from other competitors. 16