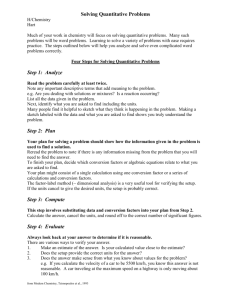

Quickbooks Ch. 12 Lesson Guide

advertisement

Name__________________________________ Date_______________________________ QuickBooks Accountant 2012 Chapter 12—Company File Setup and Maintenance Chapter 12 will teach you the 12-Step setup process for completing your QB company file so you can begin entering the accounting data. Term Definition Bookkeepers, accountants, software consultants, and CPAs who offer QuickBooksQuickBook related consulting services ProAdvisors Are those ProAdvisors who have completed a comprehensive training and testing QuickBooks Certified program ProAdvisors For more information about QuickBook ProAdvisors and Certified ProAdvisors, go to the Help Menu and select QuickBooks. Used to give more detail to your chart of accounts. Subaccounts must be the same account type (asset, liability, etc.) as the main account Subaccounts Fixed Assets Assets that you will own for more than one year. Choosing a Start Date-Step 1 Before you create you company file, select a start date for you company file. The start date is the day before you start using QB to track you daily transactions. The best start date for most companies is December 31, assuming you file taxes on a calendar year basis. If you file taxes on a fiscal year basis, choose the last day of your fiscal year as your start date. Don’t use January 2 or the first day of your fiscal period because doing so would cause the opening balances to affect your first year’s Profit & Loss Report. This will affect your taxes and distort the picture of the company’s financial history. You will need to enter all transactions between your start date and the day you perform the QB setup. This will have a big impact on how much work you will have entering company data the QB setup process. If you don’t want to go back to the end of the last year or fiscal period, choose a more recent date, such as the end of the last quarter or the end of the last month 1. For you records to be accurate, you should enter every __________________________(all checks, deposits, invoices, etc) _______________________________________________________________________. Creating the File-Step-2 2. Two way to create a file: 1) _____________________2) ________________________________________. 3. Express Start creates a file ____________________________________________________________ ________________________________________. Only experienced QB users should you this startup method. 4. Advanced Setup allows __________________________________________________________________ 1 Name__________________________________ Date_______________________________ ______________________________________________________. Express Start When you select Express Start, you only need to enter your Company and Contact information before creating a file. Once the file is created you can enter data in the centers and start using the file. QB chooses default Accounts and Preferences for your company based on the Industry you select. For paychecks to calculate automatically and forms to print properly, you must have a current Payroll service subscription. Intuit recommends connecting to their Website at least every 45 days to ensure that you’re using the latest tax tables. Advanced Setup 5. Advanced Setup is also called __________________________________________, allows you to enter your Company and Contact information; however you are asked to customize the common preferences and set a start date. 6. To start a new company, select _______________menu and then select _________________________. Click ______________________________________ to start the EasyStep Interview. You will be required to enter the company name, legal company name, Tax ID number, complete address, phone, email, website during the EasyStep Interview. Do the Computer Practice, Pages 368-376. Answer the questions below as you complete this computer practice. The first month of your fiscal period specifies the default date range for accounting reports such as the Profit & Loss and Balance Sheet. The first month in your tax year specifies the default date range for Income Tax Summary and Detail Reports. 7. Creating an Administrator Password is _______________________________________. The Administrator is the only person _________________________________________________________. Establishing an Administrator password restricts_______________________________________________ _____________________________________________________________. Need help during the EasyStep interview, click the Get answers link in the top right corner of the interview window. 8. List the types of company information customized in preferences: _________________________________ _______________________________________________________________________________________ _______________________________________________________________________________________ 2 Name__________________________________ The Chart of Accounts is also created in the interview setup. Date_______________________________ QB will suggest accounts based on the industry that you selected. At the end of the interview, click Go to Setup. Setting up the Chart of Accounts and Other Lists—Step 3 Open the Setup-12.QBW file in My QB Restored Files. You will use this file for the throughout the chapter. 9. The most important list in QB is the _____________________________________________________. 10. List the five basic account types: 1.)___________________________2.)___________________________ 3.)___________________________4.)_________________________5.)___________________________ QB does not require account numbers; however, if you prefer to use account number, they can be activated in the Accounting Company Preferences—Select Edit menu, then select preferences.. Do the Computer Practice, Pages 377-378. Adding Accounts Select Chart of Accounts icon on the Company section of the Home page. Do the Computer Practice, Pages 378-380. Adding Subaccounts 11. If you want more detail in you Chart of Accounts, use _______________________________________. The __________________________must be the same account type (asset, liability) as the ______________________________. You can add up to FIVE levels of subaccounts. Do the Computer Practice, Pages 380-381. Deleting Accounts—Option 1 Select the account in the Chart of Account List, select the Account menu at the bottom of the window and select Delete (or CTRL + D) Deactivating Accounts—Option 2 3 Name__________________________________ Date_______________________________ If you cannot delete the account because you used it in a record or transaction, you can deactivate it so it is hidden from the Chart of Accounts list. An X to the left of an account indicates that the account is inactive. You can click the X to toggle between active and inactive. Merging Accounts—Option 3 Combine two accounts into one account; QB will edit transactions post to the merged (combined) account Do the Computer Practice, Pages 384-385. Reordering Account Lists 12. To sort the Chart of Accounts: 1.)_________________________________________________________ and 2) _______________________________________________________________________. Accounts and items in lists can also be reordered by clicking the diamond to the left of the account, drag the account up or down to desired location in the list. Turning Off Account Numbers 13. Select __________________________menu and then select _________________________. Click the ___________________________ icon and then the ________________________________________ Setting Up Other Lists You can use the QuickBooks Quick Start to import Customers, Vendors, and Employees from contact lists in other formats, Setting Up Opening Balances—Step 4 Carefully read pages 388-392. Do all of the Computer Practice, Pages 392-410. Answer the questions below as you complete the remaining sections of the book. Recording Opening Balances Using a General Journal Entry 14. Select the __________________menu and then select ________________________________. 4 Name__________________________________ Date_______________________________ Understanding Opening Bal Equity As you enter opening account balances for assets and liabilities, QB automatically adds offsetting amounts in the Opening Bal Equity accounts. After you open enter all of the opening blaances, you’ll close Opening Bal Equity into Retained Earnings (or Owner’s Equity). Entering Open Items—Step 5 Entering Outstanding Checks and Deposits 15. Enter outstanding checks and deposits (these have not cleared the bank yet) in the ________Register. Entering Open Bills (Accounts Payable) 16. Click ____________________________on the Home page or select the ____________menu and then select Enter Bills. Enter Open Invoices (Accounts Receivable) 17. Click _______________________________Home Page or select _________________from the ______________________menu. Entering Purchase Orders, Estimates and Sales Orders Enter them just like you enter Bills, Bill Debits, Invoices, and Debit Memos. Entering Year-to-Date Income and Expenses—Step 6 Is your start date is not the end of the fiscal year, the year-to-date amounts for the Income and Expense accounts will need to be entered as a General Journal Entry. Adjusting Opening Balance for Sales Tax Payable—Step 7 Open the Sales Tax Payable register to view the amounts in the account from the invoices you entered; this tax is considered uncollected because it has not been paid yet. To adjust the Sales Tax Payable account, subtract the uncollected tax in the account from the Total Tax Due. Adjusting Inventory and Setting up Fixed Assets—Step 8 Setup Payroll and YTD Payroll Information—Step 9 Verify your Trial Balance—Step 10 18. To view the Trial Balance, select the _________________Menu, then select ________________________________, and select ________________________________. Closing Opening Bal Equity—Step 11 5 Name__________________________________ Date_______________________________ To transfer the balance of Opening Bal Equity, make a General Journal entry; debit Opening Bal Equity and Credit Retained Earnings (or Owner’s Equity if sole proprietorship). 6 Name__________________________________ Date_______________________________ Setting the closing Date—Backing up the File—Step 12 Backup your file with all you setup data; keep the file on a disk or other location so you always have a clean record of your setup transactions. After you begin entering transactions you should back up your file on a regular basis. Setting the Closing Date to Protect your Setup Balances—Covered in Chapter 13 Users and Passwords The administrator sets the QB privileges for each user of the company file for security and user tracking when several people use the same company file. 19. To setup passwords, select ________________________menu, select __________________________________________, and then select ____________________________________________. Multi-User and Single-User Modes Multi-User Mode—allows multiple users to access the file at the same time. Some features in cannot be performed in multi-user Mode and required you to switch to single-user mode. Single-user Mode—only one person can access the file at a time. Any user can use QB in single-user mode. To switch back and forth between modes, select the File menu 20. List some the features in QB that cannot be accessed in single-user mode: 1.)__________________________ 2.) ______________________ 3.) ______________________________ 7 Name__________________________________ Date_______________________________ Review Questions 1. If you’re setting up QuickBooks and plan to begin using it at the beginning of the next calendar year, the best start date for your company file setup is: A. The first day of the year (01/01/xx) B. The day you are starting to use QuickBooks, regardless of the fiscal period C. The last day of the previous year (12/31/xx) D. The first day of the quarter chosen for conversion 2. This chapter suggests that the best way to set up A/R and A/P balances in QuickBooks is to: A. Enter the total amount of A/R and A/P on a General Journal Entry date on your start date B. Enter the balance of each account by editing the accounts in the Chart of Accounts C. Use a special account called A/R Setup (or A/O Setup) to record the opening balances D. Enter a separate Invoice for each open invoice and enter a separate Bill for each unpaid bill 3. Setting up a company file does not include: A. Obtaining a business license B. Selecting the appropriate chart of accounts for your type of business C. Adding accounts to the chart of accounts D. Entering Invoices 4. A good example of a liability account is: A. Inventory B. Accounts Receivable C. Advertising D. Accounts Payable 5. To ensure the accuracy of the information entered during setup, it is important to: A. Know your Retained Earnings B. Verify that your Trial Balance matches the one provided by your accountant C. Start at the beginning of the fiscal period D. Know everything there is to know about accounting Complete the problem on pages 411-418. Type your name on all printouts before printing to earn credit for your work. Attach all printouts in problem order to this study guide. Printouts without names will not be accepted for credit. 8