Intergovernmental Transfers

advertisement

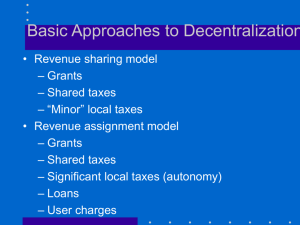

Intergovernmental Transfers: Theory and Practice Roy Bahl Dean, and Professor of Economics Georgia State University (rbahl@gsu.edu) Decentralization and Intergovernmental Fiscal Reform Sponsored by the Decentralization Thematic Group, PRMPS and WBI Washington, DC 29-31 March 2004 Basic Approaches to Decentralization Revenue-Sharing Model (Weak Decentralization) Grants Shared Taxes “Minor” Local Taxes Revenue Assignment Model (Strong Decentralization) Grants Shared Taxes Significant Local Taxes (Autonomy) Loans User Charges 2 Rules 8.Grants and shared taxes must play an important role in almost any decentralized fiscal system in a developing or transition country. Transfers may be designed as more centralized or more decentralized. 3 Justifications for Intergovernmental Transfers Close the “fiscal gap” Equalize fiscal capacity and need Adjust for spillovers Increase effectiveness of central expenditures Political reasons 4 Closing the Fiscal Gap Cause of “Fiscal Gap” Assigned more expenditures to local governments than revenues or too few revenues Local governments have “gone crazy” and are spending beyond their means Local governments are not making use of the revenue sources available to them Means to Close the Gap Change the revenue or expenditure mix among levels of government Introduce controls or restraints on local governments Enhance local fiscal effort 5 Equalizing Fiscal Capacity Equalize the position of governments, not people Allocate unconditional grants: give funds to government and let them spend as they choose Allocate conditional transfers: allocate funds for specified purpose Avoid “gap filling” 6 Adjusting for Spillovers Importance of spillovers Alternatives to transfers Getting public sector “prices” right Varying price with capacity 7 What is an Intergovernmental Transfer? Grants Shared Taxes 8 How Can Intergovernmental Transfers be Decentralizing Revenue adequacy Certainty Unconditional 9 How Can Intergovernmental Transfers be Centralizing No transparency in vertical sharing Ad hoc distributions Uncertainty and year-to-year changes Strict Conditions 10 How Should The Grant System Be Structured? Alternative Form of Intergovernmental Grant Programs Method of determining the total divisible pool Method of allocating The divisible pool Among eligible units Specified share of National or state Government tax Ad Hoc Decision Reimbursement Approved Expenditures Origin of collection to tax A NA NA Formula B F NA Total or partial reimbursement of costs C G K Ad Hoc D H NA 11 Appropriateness of Various Types of Grants Objective of National Government • Maintain control over local finances • Stimulate expenditures for a particular function/overall tax effort • Equalize services and fiscal capabilities among localities • Increase local tax effort 12 Appropriateness of Various Types of Grants Objective of Local Government • Maintain control over local finances • Plan efficient budget • Increase adequacy of local revenues Joint Objective • Minimize administrative costs 13 Natural Resource Revenue Sharing: The Case for More Centralization The Stability Argument The Disparities Argument The Local Capacity Argument The National Treasure Argument 14 Natural Resource Revenue Sharing: The Case for More Decentralization The Cost Reimbursement Argument The Heritage Argument The Conflict Resolution Argument 15 Revenue Sharing in Transition Countries Very Centralized Piggybacking Backdoor Approaches 16 Intergovernmental Grants: How Not To Do It! Deficit Grants Complicated Formulae No Transparency No Continuity Base It On The Amount Spent No Evaluation 17 Intergovernmental Grant Lessons Desired outcomes should drive design One grant/transfer instrument cannot accomplish multiple objectives. Expect changes in formula over time Is “distributable pool” a discretionary element in the central budget or an entitlement of local government? 18