FIN335 Fall 2010 Phase 3 Review

advertisement

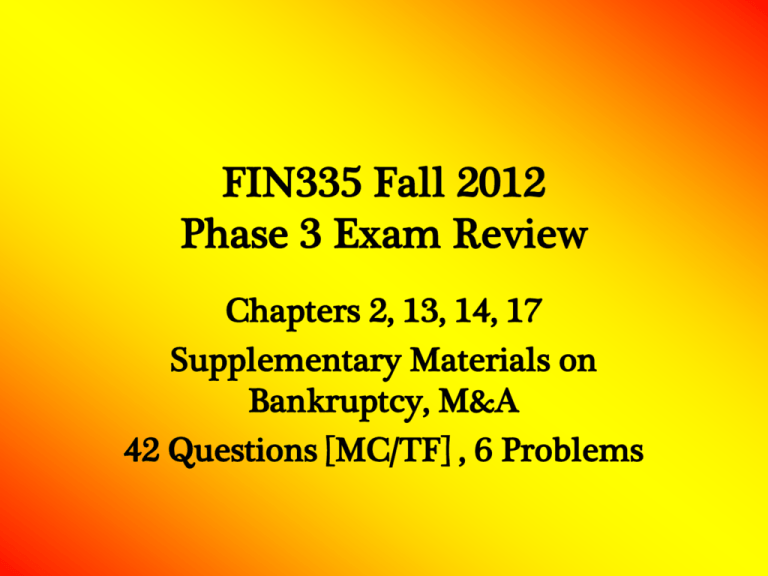

FIN335 Fall 2012 Phase 3 Exam Review Chapters 2, 13, 14, 17 Supplementary Materials on Bankruptcy, M&A 42 Questions [MC/TF] , 6 Problems Chapter 2 Financial Markets & Institutions 1. 2. 3. 4. 5. 6. 7. How do primary markets differ from secondary markets? How do stock splits affect post split prices (P) What effects do increases in debt use have on ROE? EPS? Why would a firm do a reverse split? How do Hedge funds differ from regular mutual funds? How do money markets differ from capital markets? What are derivatives? How are the valued? Chapter 13 Leverage and Capital Structure 1. What is the essence of Modigliani & Miller Proposition 1? 2. How do taxes affect the cost of debt? 3. How does financial leverage differ from operating leverage? 4. What is the breakeven point and how is it calculated? (P) 5. What is the objective of capital structure startegy? Chapter 14 Dividends and Dividend Policy 1. What are the 4 important dates regarding the payment of dividends? 2. What does it mean when a stock goes exdividend? (P) 3. How do stock splits affect shareholder wealth? (P) 4. How do dividends relate to stock prices? 5. What are dividend clienteles? Chapter 17 International Financial Management 1. How does a direct exchange differ from an indirect exchange? (P) 2. How can we compute a cross rate for a third given two cross rates? (P) 3. How does a spot trade differ from a forward? 4. How do floating rates differ from Managed rates? Which is more popular? 5. What are Eurodollar deposits? Supplementary Material 1. Bankruptcy and Reorganization (Supplementary Notes) a. b. c. What are the various definitions of financial distress? What does it mean to reorganize a firm in bankruptcy? How does the Rule of Absolute Priority work? Supplementary Material 1. Mergers and Acquisitions a. What is synergy in a merger/acquisition? b. What is an LBO? c. What is a white knight defense?