Tax Bases

Anderson: Structure of Taxes

What is Taxed? Defining the Tax Base

• The tax base reflects what is taxed,

• and therefore what is not taxed as well.

Copyright © by Houghton Mifflin Company. All rights reserved.

2

Haig-Simons Definition of Taxable Income

• Income during a particular period of time includes consumption plus the

change in a person’s net worth

• Consumption or change in potential future consumption

• Net measure, it requires that the costs of earning income be subtracted

• Blind to the source of income. It doesn’t matter whether income is due to

capital or labor

• Should include imputed income

• All accretion to wealth should be included, whether it is regular or

fluctuating, expected or unexpected, realized or unrealized.

• No consideration should be given to how the income is used, i.e. whether it

is saved or consumed

Copyright © by Houghton Mifflin Company. All rights reserved.

3

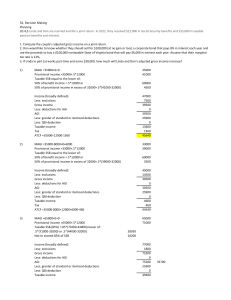

Basic Personal Income Tax Calculations

Jack has gross

income of $60,000,

from which he

subtracts some

deductions to get

adjusted gross

income (AGI). From

AGI, he subtracts his

family exemptions

and either the

standard deduction

or itemized

deductions (Jack

chooses the former),

yielding taxable

income. A tax

schedule is applied

to determine taxes

owed, and tax credits

are then subtracted

to arrive at the final

tax payment.

Structure of the Individual Income Tax in the United States

Computing the Tax Base

gross income The total of an

individual’s various sources of income.

adjusted gross income (AGI) An

individual’s gross income minus certain

deductions

Examples of Deductions between

Gross Income and Adjusted Gross Income

These adjustments have varied over time, but as of 2009 they include:

Contributions to retirement savings through IRAs or self-

employed pension plans.

Alimony paid to a former spouse.

Health insurance premiums paid by the self-employed.

One-half the payroll taxes paid by the self-employed.

Educator expenses.

Contributions to Health Savings Accounts.

Expenses for job-related moves.

Interest paid on student loans.

Structure of the Individual Income Tax in the

United States

Computing the Tax Base

exemption A fixed amount a

taxpayer can subtract from AGI for

each dependent member of the

household, as well as for the

taxpayer and the taxpayer’s spouse.

Structure of the Individual Income Tax in the

United States

Computing the Tax Base

There are two forms of deductions from which to choose:

standard deduction Fixed amount

that a taxpayer can deduct from

taxable income.

itemized deductions Alternative to

the standard deduction, whereby a

taxpayer deducts the total amount

of money spent on various

expenses, such as gifts to charity

and interest on home mortgages.

Structure of the Individual Income Tax in the

United States

Computing the Tax Base

Under the itemized deductions route, the taxpayer deducts from his or her

income the sum of amounts from several categories:

Medical and dental expenses exceeding 7.5% of AGI.

Other taxes paid, such as state or local income tax (or sales tax if the

state has no income tax), real estate tax, and personal property tax.

Interest the taxpayer pays on investments and home mortgages.

Gifts to charity.

Casualty and theft losses.

Unreimbursed employee expenses, such as union dues or expenses

incurred on job travel.

taxable income The amount of income left after subtracting

exemptions and deductions from adjusted gross income.

Structure of the Individual Income Tax in the

United States

Tax Rates and Taxes Paid

tax credits Amounts by which taxpayers are

allowed to reduce the taxes they owe to the

government through spending, for example,

on child care.

withholding The subtraction of estimated

taxes owed directly from a worker’s earnings.

refund The difference between the amount

withheld from a worker’s earnings and the

taxes owed if the former is higher.

Basic Personal Income Tax Calculations

Jack has gross

income of $60,000,

from which he

subtracts some

deductions to get

adjusted gross

income (AGI). From

AGI, he subtracts his

family exemptions

and either the

standard deduction

or itemized

deductions (Jack

chooses the former),

yielding taxable

income. A tax

schedule is applied

to determine taxes

owed, and tax credits

are then subtracted

to arrive at the final

tax payment.